Which is the best tool for finding properties with short term rental potential? Is it the AirDNA Rentalizer or the Mashvisor Airbnb Calculator?

Whether you are new to the Airbnb rental sector or have been in the business for years, you should know that the first hurdle you will face is finding a good rental home. The only way for you to do this is through due diligence.

Table of Contents

- What Is the AirDNA Rentalizer?

- What Is the Mashvisor Airbnb Calculator?

- Where Does the Airbnb Data Come From?

- What Types of Airbnb Analytics Do Investors Get?

- The Top 3 Websites for Short Term Rental Investors

- How Much Does It Cost to Use the AirDNA Calculator and the Mashvisor Airbnb Calculator?

- AirDNA vs Mashvisor: Is Mashvisor Better Than AirDNA?

First, you need to research cities that get a lot of visitors as a sign of high Airbnb demand. Then, you need to find which neighborhoods are ideal for tourists or business travelers. Next, you must look at the properties for sale in those areas.

Several years ago, this meant that you would drive to each area and make friends with realtors and investors to get the Airbnb data analysis you need. But now, various real estate websites have emerged with the mission of helping short term rental investors like you. As the number of these platforms increases, you have to choose which one to use.

In this article, we will compare the two top Airbnb tools in 2023. You will learn about the AirDNA Rentalizer and Mashvisor Airbnb Calculator, particularly:

- What these tools are, and who they cater to

- Where they get Airbnb data from

- What Airbnb analytics they provide

We will show you why the Mashvisor Airbnb data analytics platform is the superior choice for your investor needs.

What Is the AirDNA Rentalizer?

The AirDNA Calculator, known as the AirDNA Rentalizer, is an analytics tool that predicts the Airbnb earnings potential if you turn a home into a vacation rental. However, you have to enter an address. AirDNA does not let you search for properties on its platform. So, you must already know what house to look into, or you can use another platform to search for one.

First, the Rentalizer will ask you to type in a street address, as well as the number of bedrooms, bathrooms, and guest capacity. It then gathers a list of nearby properties and creates an index based on relevance. It also factors in market-wide metrics such as seasonality, rental demand, and revenue growth in its final calculations.

The AirDNA Rentalizer will then show the following metrics:

- Annual revenue

- Average daily rate

- Occupancy rate

- 12-month forecast

- Comparable Airbnb investment property analysis

Using the above data, the Airbnb income calculator makes assumptions about the earning potential of the property you are looking into. AirDNA also recently added a financial calculator that allows you to input your major expenses.

There are two types of AirDNA Rentalizer users:

- Those who are already hosting an Airbnb and want to compare their rental home to other hosts in their area

- Investors who are looking to expand their Airbnb business and want to determine the potential revenue of a property

Pros and Cons of the AirDNA Calculator

As one of the leading Airbnb data analytics tools in the US market, using the AirDNA platform comes with some major advantages. The main ones include:

- Access to Airbnb and Vrbo data (discussed briefly)

- Ability to analyze the investment potential of short term rentals to buy and those that you already own

- Possibility to maximize the performance of your vacation rentals through AirDNA Smart Rates

Meanwhile, the AirDNA Calculator also comes with a few limitations, namely:

- Lack of an investment property search option

- Need to enter some short term rental data manually to complete the analysis

- Lack of recurring expenses breakdown

- Absence of cash on cash return metric

- Limitation to vacation rental properties only

What Is the Mashvisor Airbnb Calculator?

Mashvisor provides data analysis to real estate investors who want to look into a property’s income potential before buying it.

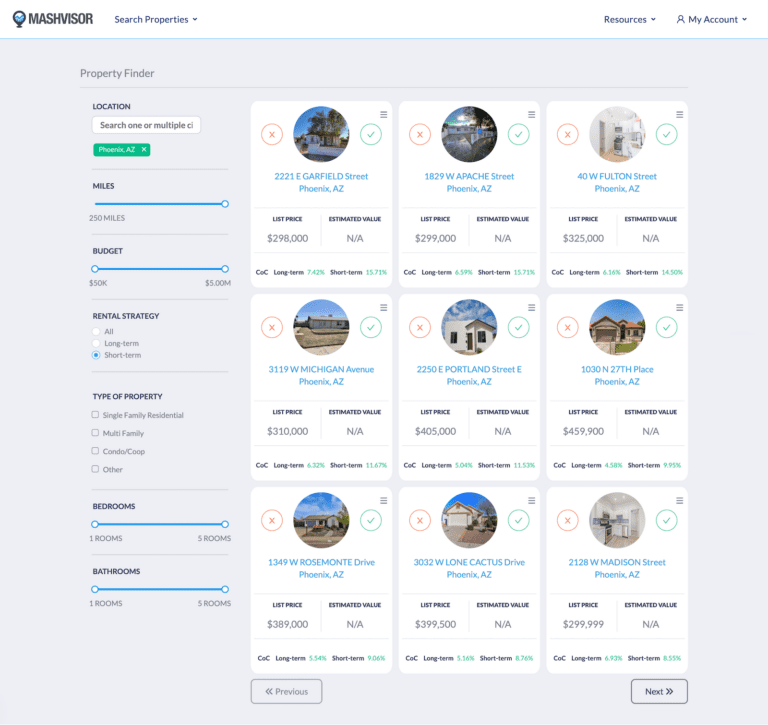

Unlike the AirDNA Rentalizer, you can start by looking for the best neighborhoods for vacation rentals using the Mashvisor real estate heatmap. Next, you can browse Airbnb properties for sale in any US market using Mashvisor’s investment property search or Property Finder.

When you find one that you like, click on a listing, and you will find the property’s details. On the same page, you will also find the Mashvisor Airbnb Profit Calculator.

Use Mashvisor’s Property Finder to identify profitable investments

The calculator helps you determine the revenue and investment potential of income properties for sale if you rent them out through Airbnb. The metrics displayed include the following:

- Airbnb income

- Expenses related to operating an Airbnb rental property

- Airbnb occupancy rate

- Airbnb cash flow

- Airbnb cash on cash return

- Airbnb cap rate

- Airbnb 10-year payback balance

Last but not least, you can use the Mashvisor Short Term Rental Regulations page to check out Airbnb laws by city. As you probably already know, many top US markets for this rental strategy have imposed strict regulations and even restrictions. Finding a market where you can legally operate a non-owned occupied short term rental is crucial.

Pros and Cons of the Mashvisor Short Term Rental Calculator

Just like with the AirDNA Calculator, there are advantages and disadvantages to using the Mashvisor real estate investing app.

The main benefits include:

- Ability to search for profitable areas for vacation rental property investments

- Ability to quickly locate the top markets for vacation rentals (through the Mashvisor Real Estate Investing Blog)

- Ability to check out the short term rental regulations in a market

- Ability to look for top-performing short term rentals for sale

- Function to conduct neighborhood real estate market analysis and rental property analysis

- Wide range of short term rental performance metrics

- Analysis based on active rental comps and access to them

- High accuracy of data and analytics

- Possibility to find and analyze long term rentals, too (in case you ever consider a switch in rental strategies)

- User-friendly, easy-to-navigate platform

Meanwhile, some limitations investors should consider are:

- Exclusive US coverage

- Focus on Airbnb statistics in specific (no Vrbo data)

Using the Mashvisor Airbnb Calculator

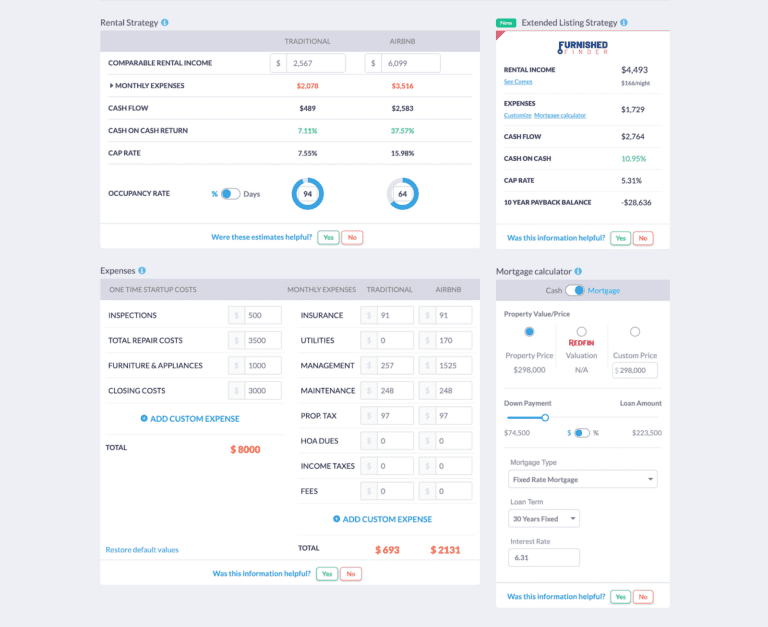

Use Mashvisor’s Airbnb calculator to estimate profits

The default data uses the short term rental comps performance from Airbnb, as well as national average costs. You can edit the following numbers on the Mashvisor calculator to get a more accurate estimate for your specific situation:

- Airbnb rental income

- Occupancy rate

- Toggle between cash payment or mortgage

- Mortgage details ( selling price, down payment, mortgage type, loan term, and interest rate)

- One-time initial costs (inspection, repairs, furnishing, and closing costs plus custom costs)

- Monthly running expenses (insurance, utilities, property management and maintenance, property and rental income taxes, HOA dues, and cleaning fees plus custom expenses)

As soon as you change any numbers, the calculator will reassess the cash flow, cash on cash return, and cap rate. It makes the investment property analysis provided by Mashvisor highly interactive and flexible.

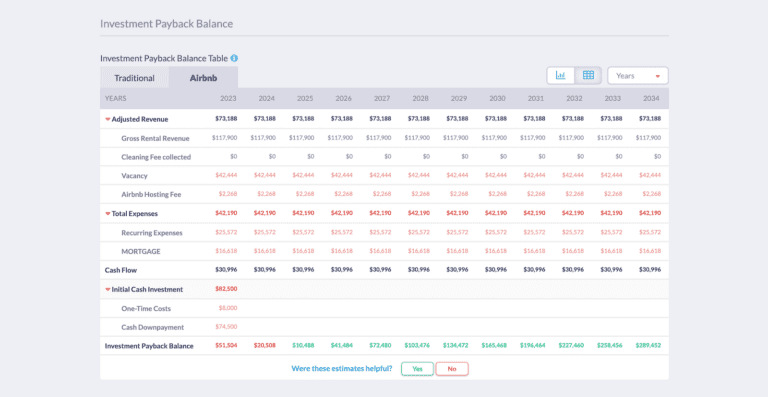

Meanwhile, if you scroll down the property analysis page, you can find a 10-year investment payback table. The table projects estimated accumulated earnings (or losses). They depend on the performance of comparable vacation rentals in the area and the numbers you entered.

In case you find that the property is not optimal for Airbnb, Mashvisor’s tools can help you determine if it is good as a long term rental instead. And in case you want to look for another area altogether, the platform also provides a comprehensive neighborhood analysis. It will help you know which markets offer high-income and ROI potential.

Mashvisor is the perfect investment property analysis platform for first-time investors looking where to start an Airbnb business. Experienced investors who want to expand their portfolio in other areas would find such features useful too.

To test the power of the Mashvisor Airbnb Calculator yourself, sign up for a 7-day free trial now.

Where Does the Airbnb Data Come From?

Both short term rental data analytics tools obtain most of their data directly from the Airbnb platform, though the AirDNA Rentalizer also collects data from Vrbo. The analyses on both platforms are based on the performance of actual vacation rental properties on Airbnb rather than guesswork and approximations.

Where AirDNA Gets Its Data

The data that AirDNA uses comes from public listings on Airbnb and Vrbo. However, data has not been independently verified. So, it is hard to know if the presented information is truly accurate and answer the question “Is AirDNA legitimate?” with 100% certainty. The platform bases analysis on the average occupancy and earnings of the market (rather than the medians).

Because the AirDNA Rentalizer looks at the mean, you should not take the calculations at face value without doing more research. Otherwise, you might risk losing a significant amount of potential revenue.

So, if you’re wondering, “How accurate is AirDNA?”, keep in mind that AirDNA reviews by hosts who have used the platform highlight overly optimistic revenue projections. The main reasons are using the mean values (rather than the medians, like Mashvisor does) and not factoring in taxes and other associated costs.

Some hosts recommend hacking methods to get a more accurate analysis, which may be fine in practice. However, it might raise some eyebrows since you would want the platform to provide an accurate report when you are paying for it.

AirDNA has recently added a financial calculator that lets you input your major expenses. So far, there is no feedback from users about this addition.

Also, the reported ranking data shown in the analysis is strictly based on what AirDNA has seen in that specific local market. Because the AirDNA Rentalizer gives you a broad overview of the local market based on the mean, it can be dangerous to take data at face value. It is due to the information presented getting skewed by top performers.

Where Mashvisor Gets Its Data

As mentioned above, the Mashvisor vacation rental data comes directly from Airbnb, so analytics are based on the actual performance of active rental comps. In addition, Mashvisor obtains data from the MLS and public records, allowing it to provide significantly more short term rental data points than AirDNA.

Moreover, instead of looking at the mean, the Mashvisor Airbnb Calculator looks at the median. The tool is a considerably more accurate, reliable, and robust approach since the median number eliminates outliers, which might skew and misinform the analysis. Thus, Mashvisor reviews are overwhelmingly positive.

The algorithms collect data only from verified Airbnb listings with three or more reviews on the vacation rental listing website. It means that Mashvisor uses exclusively the data of Airbnbs that have been actively rented out on the platform for a long time.

Mashvisor ignores properties and Airbnb hosts who are new to the website and are still trying it because they have a higher chance of discontinuing if things do not go well for them. It, alternatively, would mislead the short term rental property analysis.

What Types of Airbnb Analytics Do Investors Get?

While the AirDNA Calculator and the Mashvisor Airbnb Profit Calculator have a certain degree of overlap, there are significant differences in the Airbnb data points and analytics they provide.

What Airbnb Analytics Investors Get From the AirDNA Calculator

When using the AirDNA Rentalizer, you will see the following metrics:

- Annual revenue: This is the total revenue earned in one year. It includes the average price, as well as cleaning fees.

- Average daily rate: This is calculated by dividing the annual revenue by the number of booked nights in that same year.

- Occupancy rate: This is the total number of booked days divided by the sum of the total booked days and the total available days.

- 12-month demand forecast: This is the projected performance of the property in the next 12 months based on its rental comps performance in the last 12 months.

- Comparable property analysis: This is a summary of the property’s potential performance relative to its competitors.

The AirDNA Rentalizer also displays a score ranging from A to F, with A being the best and F being the worst. The scoring is based on the following factors:

- Vacation rental supply in the area by property type

- Rental rate for vacation rentals similar to the investigated property

- Average occupancy rates of comparable short term rental properties in the market

Each score is on a sliding scale relative to the available listings and average occupancy rates.

What Airbnb Analytics Investors Get From the Mashvisor Airbnb Calculator

When you click on a property listing on the Mashvisor platform or enter the address of an off market property, you will find the Airbnb Calculator on the property page. The tool displays the following data:

Property Details

Like listings on other real estate websites, the investment property page will display:

- Listing price

- Street address

- Number of bedrooms

- Number of bathrooms

- Price per square foot

- Property type

- Lot size

- Year built

- Number of parking spaces

- Number of days on the market

- Owner occupied status

The above details are usually the first criteria that you look into when searching for an investment property to rent out. Once you find a house that meets the basic features that you want, you can proceed to the next section of the property page. The next section is all about the Airbnb investment metrics.

Property Valuation Analytics

Mashvisor provides a quick summary of the investment potential of any property available on the real estate investing app. The score ranges from 1 to 5 stars, with 1 being the worst and 5 being the best. It is a Mashvisor-calculated evaluation of how well the property would perform as a rental.

Airbnb Rental Income

Similar to the AirDNA Rentalizer, the Mashvisor Airbnb Calculator estimates the home’s Airbnb rental revenue. It is done based on the daily rate and occupancy rates of comparable short term rental properties in the area. It helps you answer the burning question: “How much will my house make on Airbnb?”

The Airbnb income estimate helps you determine how much you could charge as the daily rate. It is also useful for computing your potential profit margins as the rental income is present in all real estate return on investment formulas.

Airbnb Occupancy Rate

Short term rentals typically face fluctuations in demand depending on the location and the season. Some towns get more tourists during summer or winter, while other cities tend to be popular year-round.

Obtaining Airbnb occupancy rate data in your desired area will have a huge impact on your revenue. Obviously, the more days you can book in one month, the more revenue your rental will generate.

Finding a property with a 100% occupancy rate is virtually impossible in the short term rental industry. So, experienced investors usually focus on listings that promise to bring at least 50% occupancy, as they have a good chance of providing strong profitability.

All in all, including the occupancy rate in the calculator helps you estimate your projected profits and avoid negative cash flow problems.

Airbnb Rental Costs

When you put your property up for short term rental, you will encounter costs and fees that will be deducted from your gross income. They are different and usually significantly higher than the operating expenses of a long term rental business. At the same time, estimating the exact costs is crucial to accurate rental property analysis before buying.

Mashvisor’s Airbnb calculator will give you estimates on one-time startup costs and running expenses that you likely have to pay for as part of your short term rental operations. It will help you plan for them, manage the expenses that you can lower or avoid outright, and determine profitability after deducting the said costs.

Even if the calculator has provided average numbers for each expense, you can modify the values if you already know how much you are spending on each category. You can also just play around with the numbers to see how the costs will affect your potential returns.

The calculator will reflect the estimated numbers on the profit projections in real time. You may not be able to do it on the AirDNA Rentalizer.

Airbnb Cash Flow

As a real estate investor, you are not starting your own Airbnb rental for fun. You are in the business to make money, and hopefully a lot of them. So, an ideal scenario for you is one where you make it out of each month with a positive cash flow instead of losing money.

Using your projected rental income and costs, the Mashvisor Airbnb Calculator will show you the estimates of your potential cash flow for each analyzed property.

Airbnb Cash on Cash Return

If you are planning to finance your purchase with a mortgage, the cash on cash (CoC) return is an important metric that you need to look into before committing to a purchase.

Cash on cash return is the rate of return that calculates the cash income you earned on the cash that you invested in the property. It measures the annual return on the property in relation to the amount of mortgage and other expenses you paid during the same year.

The CoC return metric calculates only the return for the current period, usually one year, rather than for the life span of your investment. You can also use the metric to forecast and set a target for your projected earnings and expenses. You would want a property to achieve an 8% cash on cash return, at the least. The more, the better.

Airbnb Cap Rate

Unlike cash on cash return, the cap rate is computed by dividing the net operating income by the property asset value, regardless of whether you paid for it in cash or with a mortgage. While the cap rate metric alone does not suffice to make profitable investment decisions, it complements the cash on cash return nicely.

You would want to buy a property with a cap rate between 8% and 12%. The upper limit is because the capitalization rate also measures risk in real estate investing, and you want to keep it in check, especially as a first-time vacation rental investor.

10-Year Investment Payback Balance

When you scroll down below the Mashvisor Airbnb Calculator, you will find the 10-year investment payback balance table. This section summarizes the property’s metrics based on the projected income and expenses available in the calculator.

It provides a detailed breakdown of your expenses and income, with the bottom showing your accumulated earnings.

What is great about the investment payback balance table is that it tells a more complete story about your investment. For example, if you are buying a property using financing, you might not be in the green until five years later.

If you want a straightforward way of visualizing your investment or need to pitch the property to your partner or prospective lender, you will have an easier time by showing them the table.

Mashvisor’s Airbnb calculator includes an investment payback balance table that projects your potential ROI on a property in the next 10 years.

Airbnb Rental Comps

When you analyze the investment potential of a short term rental, you do not look at the property alone. You need to put the property in context to be able to estimate the outcomes you can expect from it, especially if it’s never been rented out on a short term basis before.

The most effective way to do it is to observe the performance of comparable rentals in the local market. For this purpose, Mashvisor not only uses rental comps data in the automated investment property analysis but also provides investors with these comps. It allows them to look at the comps themselves and dig deeper into the rental property analysis.

The Top 3 Websites for Short Term Rental Investors

As a savvy investor, you probably do not want to be limited to the AirDNA Calculator and the Mashvisor Airbnb Calculator when choosing the best tool for analyzing vacation rentals. So, what are the top three short term rental investment platforms?

The best vacation rental data analytics platforms in the US market are Mashvisor, AirDNA, and BiggerPockets. We’ve already covered the first two in detail, so let’s talk about BiggerPockets.

The BiggerPockets Airbnb Calculator is powered by the AirDNA Rentalizer, so it’s basically the same tool. It means that short term rental property analysis conducted on BiggerPockets comes with the same pros and cons as on the AirDNA platform.

How Much Does It Cost to Use the AirDNA Rentalizer Calculator?

Before making a final decision on the best tool for investing in short term rentals in 2023, it’s important to look at the prices of the two competing calculators.

Wondering: “Is AirDNA free to use?”. Actually, investors get some access to the AirDNA platform for free. However, the available data is really limited and does not allow for conducting sufficient Airbnb market research and rental property analysis.

The AirDNA pricing model is based on location. That is, the monthly subscription price is based on the number of neighborhoods, cities, states, and countries that you want to analyze. It makes AirDNA pricing relatively affordable if you’d like to focus on just a couple of markets. However, the cost quickly become very high as you add more and more markets.

How Much Does It Cost to Use the Mashvisor Airbnb Calculator?

Meanwhile, the Mashvisor pricing model is based on the number of tools and functionalities you’d like to access and use. There are three levels of access – Lite, Standard, and Professional, with quarterly and annual subscriptions. Usually, a Standard plan is enough to cover the needs of most investors, while the Professional plan is good for serial investors and agents.

The said pricing structure makes the Mashvisor Airbnb Calculator considerably more affordable and cost-efficient than the AirDNA Calculator. For $49,99/month, with Mashvisor short term rental property investors get access to most tools and all US markets. At the same time, access to a single state costs $179/month with AirDNA.

AirDNA vs Mashvisor: Is Mashvisor Better Than AirDNA?

To find out more about the different capabilities of AirDNA and how its tools compare to Mashvisor’s, check out the video below:

Conclusion

The AirDNA Rentalizer and the Mashvisor Airbnb Calculator share certain similarities, being analytics tools that predict how much a property would earn if operated as a short term rental.

However, they also differ in the following ways:

- AirDNA requires you to type in an address, while Mashvisor lets you browse through MLS listings and off market properties anywhere in the US.

- With AirDNA, you can analyze the investment potential of certain markets, while Mashvisor also helps you look for the best rental markets.

- The AirDNA Calculator gets both verified and unverified data from Airbnb and Vrbo. Meanwhile, Mashvisor collects data from verified Airbnb listings with at least three reviews.

- AirDNA uses the mean values, while Mashvisor bases its calculations on the median.

- You will only get a 12-month forecast from AirDNA, but you will get a comprehensive 10-year investment payback balance with Mashvisor.

- AirDNA provides important information for making a profitable decision, but Mashvisor offers more data points.

- The AirDNA Calculator works exclusively with short term rental properties. The Mashvisor Airbnb investment property calculator analyzes the potential of long term rentals as well. It’s particularly useful if you are not absolutely sure that Airbnb is the right strategy for you.

- The AirDNA pricing model is relatively cheap for exploring a single neighborhood or city but becomes unaffordable if you’re interested in a few markets. At the same time, a subscription to Mashvisor provides access to all markets at a significantly lower cost.

Now that you know how both tools work, you should be able to decide on which one to use.

If you’d like to learn more about how the Mashvisor Airbnb Calculator can help you make profitable decisions, sign up for a free demo with our real estate experts.