Investing in a property (whether a rental, buy-and-hold, or fix-and-flip) is a great way to get yourself closer to financial freedom. However, it all starts with a good real estate deal. When people are just getting started with real estate investing, they’re often worried about making a mistake or buying a bad investment property. And, truth be told, that can happen. So the question on every first-time real estate investor’s mind is: How do I find an investment property that will be profitable? In a previous blog post, we laid down the ultimate guide to finding real estate deals for investment. But in order to figure out if the deal you’ve found has the potential for making money, you need to learn how to analyze it.

In other words, you need to know how to perform a real estate investment analysis. By calculating specific real estate numbers, this analysis tells an investor whether or not it’s smart to move forward with a certain deal. And don’t worry, you don’t need to be a genius or a master of numbers to analyze real estate deals. You just need to know the numbers you should calculate and the tools that’ll help in estimating your return on investment (ROI).

This is what we’ll help you with in this step-by-step guide! To learn how to confidently analyze the return potential of any real estate investment deal, keep reading.

Step 1: Analyze the Investment Location

First things first, real estate investing is (and will always be) about location, location, location. If you don’t think that’s true, keep in mind the fact that location impacts:

- Property prices

- The rents you can charge

- The tenants you’ll attract

- Any problems you may encounter

- The appreciation of your property in the future

So, needless to say, the location of your real estate investment affects how profitable it’s going to be. In fact, one of the biggest reasons new investors end up losing money has almost nothing to do with the property itself, but everything to do with its location. Hence, before you decide to purchase a property, make sure it’s in a good location for real estate investing first!

How can you tell if you’re in an ideal location for your next investment property purchase? Well, there are certain factors that you should look for that’ll give an indication of how the housing market is performing in your city/neighborhood of choice. Some of these factors are on the larger-scale such as market trends regarding:

- Population growth

- Job market growth

- Economic growth

- The price-to-rent ratio of the area

Others are small-scale factors that affect the local (micro) market such as:

- Walkability

- Safety and crime rates

- School ratings

- Access to public transportation

- Taxes

- Local laws

You can, then, use all of this information and data to perform a real estate market analysis and evaluate the strength of your location. You want to find real estate deals in locations where the economics benefit you and your end customer. This allows real estate investors to ask the highest rents or prices, enjoy the lowest vacancy rates, and increase prices over time. In other words, these locations allow you to make the most profits from your investment property.

For more details, read this post to learn exactly How to Identify the Best Places to Invest in Real Estate.

Step 2: Gather the Necessary Data

Real estate investing is a numbers game. Meaning, there is data and information out there that you will find on each and every property for sale. And, as you can expect, a real estate investment analysis is made up of taking such data and numbers that relate to the property and using them in your calculations to ultimately find out what type of ROI it’ll make. If you’re missing a number or if the data you’re getting is inaccurate, this will lead to a false estimation of your projected returns. You might end up moving forward with a real estate deal thinking it’s a profitable one when, in fact, it’ll cost more than it makes and you’ll be hit with a negative return on investment.

As such, collecting and analyzing property data is key for investors to find the financial value of potential investment properties and make profitable purchases. It might take a little digging to find these numbers, but it’ll be worth it when you get a more accurate estimate when analyzing real estate deals.

So, what are the numbers or property data that you need to look for? Depending on the type of property you’re planning to buy, the real estate numbers needed for running an investment property analysis may include:

- Property Characteristics

- Listing Price

- Taxes

- Insurance

- Utilities

- HOA/Condo Fees

- Capital Expenditures

- Vacancy Rate

- Rental Rate

- Down Payment

- Interest Rate

- Mortgage Term

You can get ahold of these numbers by speaking with the seller or by calling a few local real estate agents. A more efficient way to find such data is by using Mashvisor. We provide real estate investors with reliable property data which includes the above and more! Using Mashvisor, you will obtain data on both long-term and short-term (Airbnb) property listings. You’ll also get access to each property’s sales history, owner info, a breakdown of the expenses, recent sales of similar properties in the area, neighborhood-level data, and much more.

To learn more about us and how we make real estate deal analysis easy, book a demo!

Step 3: Calculate Monthly Cash Flow

After analyzing the location and gathering the needed numbers, the time has come to start evaluating the real estate deal. The first thing investors calculate in their analysis is the investment property’s monthly cash flow. In real estate investing, cash flow is the byproduct of owning a rental property and leasing it to tenants. Naturally, a profitable rental property should make positive cash flow every month. This allows real estate investors to reap extra income from renting their property after discounting all expenses – i.e. the income that you can keep in your pocket. And, of course, the higher the NET cash flow, the better the ROI. So, how do investors run a cash flow analysis on real estate deals?

#1. Calculate Rental Income

Estimating the potential cash flow of a rental property is fairly simple – all you have to do is deduct rental costs and expenses from the rental income. The catch, though, is knowing how to estimate the potential rental income that the investment property will generate. There is a number of ways to go about this. The simplest is by following the 2% rule of thumb. This rule states that the rental property should rent for 2% of the purchase price in order to get enough rent to cover expenses and produce cash flow. So if, for example, you are thinking of buying a rental property with a total upfront cost of $100,000, it should rent for at least $2,000 per month.

For more detailed examples, read this post: Real Estate Investing 101: How to Calculate Rental Income

#2. Subtract Expenses

The second part of the equation is calculating the expenses of real estate deals. These are simply the costs necessary to run and maintain real estate investments. Some of these expenses include mortgage payments, property taxes, insurance, management fees, repairs, vacancy rate, and other property-specific expenses that you need to also include in your calculation. As mentioned, you can get this information from the seller, a real estate agent, and by minding due diligence. If an expense comes only at an annual rate, divide it by 12 to get the monthly rate.

Finally, add up all the expenses and subtract them from the rental income to find your monthly cash flow. Going back to the previous example, say the total cost of owning this $100,000 investment property is $1,500 every month. In this case, the property will generate a monthly positive cash flow of $500. Is this considered a good monthly return? It really depends on a number of factors like your personal and investment goals, where you’re investing, and your real estate investment strategy. Plus, getting cash flow is not the goal of all investors and there are other (more important) metrics to find the best real estate deals – which are covered in the next step.

Step 4: Calculate Annual Return on Investment

And now comes the part that first-time real estate investors need to pay close attention to in order to find good deals – calculating the rate of return. Depending on how you’re investing in real estate, there are multiple ways to calculate your annual returns. In this section, we cover the most important ones that you need to know:

#1. Gross Rent Multiplier

If you’re comparing real estate investment deals, the simplest metric to narrow down your options is the gross rent multiplier (GRM). Gross rent means the total rent before subtracting expenses like taxes, insurance, or other deductions. The GRM compares the purchase price to the annual gross rent that the rental can generate. To calculate it, simply divide the property’s price by its potential gross annual income. For example, if you’re eyeing a real estate deal with a purchase price of $100,000 that rents for $24,000 a year, then your GRM would be 4 – as in, the purchase price is 4x the rent.

What does this number tell you? Basically, this is the number of years the income property would take to pay for itself in gross received rent. This also tells us how good a property is at producing income. For example, a property with a GRM of 12 is much better at producing income than a property with a GRM of 20 (at least on paper). Hence, the higher the gross rent multiplier, the less attractive real estate deals become. Still, keep in mind that GRM does not factor in operating expenses, market fluctuations, or loan amortization. So you shouldn’t make investment decisions based on GRM alone!

#2. Net Operating Income

Abbreviated as NOI, this real estate metric explains how much money the rental property will make after all operating expenses are paid. Essentially, the net operating income is the gross income minus expenses.

At first, you may think that this sounds exactly like the cash flow calculation, but there is a significant difference between the two metrics. The difference is that net operating income doesn’t include expenses related to property financing (like mortgage interest and mortgage payments) nor income taxes. On the other hand, these expenses are included in the cash flow calculation when analyzing real estate deals.

Therefore, NOI is the net cash a real estate investor earns before paying mortgage payments and income taxes. Calculating the net operating income has two main benefits:

- It shows how much cash you’ll have available to pay off your mortgage after paying all every-day operating expenses.

- It gives you a better understanding of the potential profitability of the property itself in relation to how much it costs, without factoring in expenses that are unique to every real estate investor.

For more details and comprehensive examples, read this Guide to the Net Operating Income Formula for Rental Properties.

#3. Capitalization Rate

Talking about real estate investing without the capitalization rate is next to impossible. Also known as cap rate, this estimates the investor’s potential returns on a property assuming the investment was made in cash. Meaning, it doesn’t take into account any financing you may have used to leverage your purchase. This allows you to easily compare one property’s return on investment to another.

To calculate the cap rate, simply divide the property’s net operating income by its market value or purchase price. Sticking to our example, if the $100,000 rental property has an NOI of $8,000, then it’ll have a cap rate of 8%.

This percentage indicates the annual rate of return on the investment property. Real estate investors use cap rates to compare the investment potential between two or more similar real estate deals. While the structure of the cap rate formula is simple, there are plenty of factors that affect cap rates including the property type, location, and interest rates. As a result, each investor has his/her own benchmark for what a good or an acceptable cap rate is. However, generally speaking, you want this number to be as high as possible.

#4. Cash on Cash Return

If you’re planning on financing the investment property with a loan, this means:

- You’re going to put less money out of your pocket

- But, you’ll have additional monthly expenses for your mortgage payments (often called debt services)

As a result, you’re going to need a metric to analyze the results of this leverage and assess how profitable it is for you. This metric is the cash on cash return and to calculate it, you divide the annual pre-tax cash flow by the total cash investment. Annual pre-tax cash flow is calculated simply by subtracting your annual mortgage payment from your NOI. As for the total cash investment, it includes your down payment, closing costs, rehab costs (if they apply) as well as other loan fees.

Let’s go back to our example, but instead of paying the entire purchase price in cash, you decided to put 20% down and take a 15-year fixed mortgage with a 3% interest rate. Say you also had a total of $5,000 in closing costs, meaning your total cash investment for the real estate deal is $25,000. Using a mortgage calculator, you find that your mortgage payments would be $715 per month ($8,580 annual debt service). Assume you have an NOI of $12,000 from which you’ll deduct the debt service and you’ll get $3,420 annual pre-tax cash flow. Divide that by the total investment and you’ll get a 13.6% cash on cash return.

Note: The rate of return on investment is higher when using loans to finance real estate deals because a general rule of real estate investing is: the less cash paid up-front, the greater the ROI.

Want to Make These Calculations Easier?

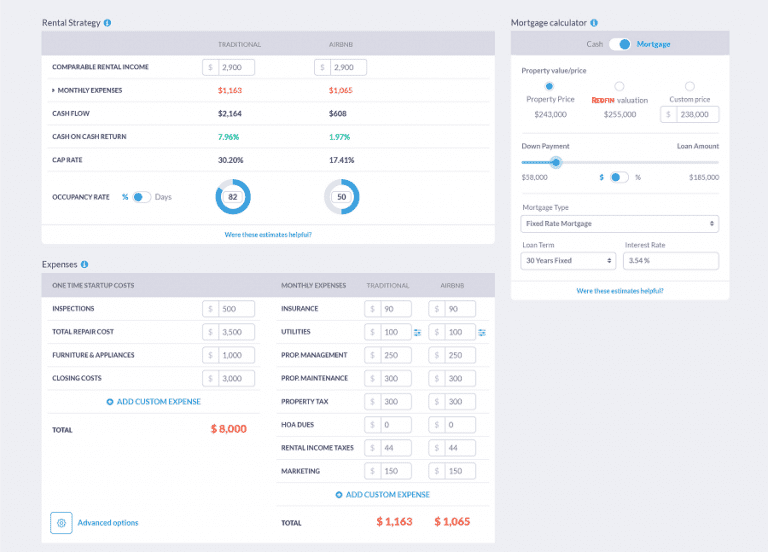

If all these formulas and calculations are stressing you out as a first-time real estate investor, don’t worry. With Mashvisor – a real estate analysis software – you can utilize our Investment Property Calculator to quickly and efficiently calculate all the important metrics in your real estate deal analysis. This is what this tool looks like:

As you can see, instead of creating spreadsheets, you can simply input the data you’ve collected in step 2 into the calculator. The tool then automatically gives you a purchase analysis after calculating the returns, including the rental income, cash flow, cap rate, cash on cash return, and traditional and Airbnb occupancy rate! Not only can you enter your own real estate numbers, but expenses (such as interest rate, property tax, maintenance, etc.) are also pre-calculated for you.

Furthermore, Mashvisor’s Airbnb calculator is unique as it gives you the expected return on investment on your rental property whether you want to rent it out traditionally (leasing to long-term tenants) or on Airbnb (hosting short-term guests). In just minutes, you’ll be able to see which rental strategy yields higher profits before you even purchase the property!

To start looking for and analyzing the best investment properties in your city/neighborhood of choice using this software, click here.

Step 5: Run a Comparative Market Analysis

The last step for analyzing real estate deals is the one that connects the pieces and gives you a final verdict. Say you’ve done all the above calculations and reached a decision that the property for sale which you’re eyeing has a good potential for investment. But how do you know that it’s priced at the fair market value? After all, no investor wants to overpay for a property and lower the chances of getting a high ROI. This is why you need to perform a comparative market analysis (CMA).

A CMA is part of the real estate investment valuation process. It deals more with the property as a whole in comparison to other similar properties that have recently sold in the desired location. These properties are called comparables (or rental comps for short) and they have to be similar in features including age, square footage, condition, and location, amongst others. It’s important to note that you should disregard short sales and foreclosures. This is because these represent “distressed” values and are not indicative of the market values.

Real estate investors can find real estate comps with the help of local agents, home appraisers, or property managers. You can also find them on your own by checking property listings on popular real estate sites. Mashvisor, for example, makes finding comparable listings effortless by providing you with a “Valuation Analysis” pre-prepared for every listing on the platform. Simply click on a property that interests you for real estate investing and you’ll get a list of comparable listings along with their data (both traditional and Airbnb).

For more details, read our complete guide on How to Do Comparative Market Analysis Step by Step.

After performing a comparative market analysis, real estate investors are able to estimate the property’s current value or the after repair value (ARV) – if they’re planning on flipping it. As mentioned, one benefit of the CMA is that it protects you from overpaying for an investment property. Another benefit is that it helps in finding cheap real estate and below market value properties (which can make for the best real estate deals). Plus, it also contributes to estimating what kind of rent rate you can get for the investment property. Finally, examining other property transactions helps you better understand how the housing market is performing and, in turn, ensures that you’re buying in the best locations to invest in real estate.

The Bottom Line

There’s a lot to consider when it comes to analyzing real estate investment deals, but if you mind your due diligence and have the right tools, then there’s no need to worry. Remember, you can make analyzing real estate deals much simpler and more efficient by using Mashvisor. Our real estate analysis software allows you to study any housing market through big data with access to the number of active and off-market real estate deals along with their investment performance. You’ll also get data on comparable rentals for both traditional and Airbnb listings and an Investment Property Calculator to estimate your ROI in a matter of minutes. If the math looks good, you can then make an offer and get the property under contract to strike the best real estate investments.

Start out your 7-day free trial with Mashvisor now and try it out for yourself!