Real estate investing is one of the best ways to improve your income and build wealth. For those willing to learn the ropes, real estate can offer some compelling benefits including steady cash flow, leverage, tax benefits, appreciation, and diversification of your investment portfolio. Moreover, you have several different types of real estate investments to choose from. However, not all types of real estate investments can assure a good return on investment.

For a beginner real estate investor, your first investment can determine your future in real estate investing. Therefore, it’s important that you only invest in the best types of real estate investments. But what’s the best way to invest in real estate?

If you are interested in real estate investing but are wondering where to begin, this blog is for you. So, let’s take a deep dive into the best way to start building your real estate empire.

Related: Is Real Estate a Good Investment for 2020?

What Are the Best Types of Real Estate Investments?

The best types of real estate investments are rental properties, but not just any rental property. There are several crucial factors to take into consideration when buying a rental property if you want a good return on investment. But the best way to make money in real estate is to capitalize on cash flow properties.

In real estate, cash flow is the amount of rental income that one is left with after accounting for all operating expenses.

Rental property cash flow is calculated as follows:

Cash Flow = Gross Rental Income – Total Rental Expenses

Positive cash flow means that all the operating expenses are covered by rental income and some amount of money is left as profit. In other words, you will be bringing in more money than you spend.

As a general rule, you should only invest in cash flow positive investment properties. You should never purchase a negative cash flow property unless your income is substantial enough to offset the deficit for a long period of time. With limited cash flow, you are likely to get stuck, and growing your portfolio will be hard.

Why Should You Invest In Cash Flow Properties?

Cash flow properties are the best types of real estate investments because of the following reasons:

-

Create Passive Income

For buy-and-hold real estate investors, positive cash flow is key to creating passive income. With a good property management system, positive cash flow properties can provide you with passive income. This means that you can earn a monthly income without working for hours as you would in a regular job.

-

Achieve Financial Freedom

If you build a portfolio of positive cash flow properties to a point where it can comfortably finance your lifestyle, you won’t have to work for a paycheck anymore. You will be able to spend more time with your family and friends. You will also be able to focus on other projects you are passionate about.

-

Cash Reserves for Unexpected Repairs

As a landlord, cash flow properties are the best types of real estate investments because they provide you with a safety net when unforeseen expenses arise.

The more the cash flow, the more cash reserves you’ll be able to set aside for unexpected future repairs. This way, it will be easier for you to sustain your real estate business expenses even during challenging economic times.

-

Reinvest in Other Opportunities

Real estate investors can also use cash flow from their investment properties to support their next rental investments and grow their portfolio. With good cash flow, you’ll be able to pay down your mortgage and generate equity as well as save enough money for a down payment. With time, you’ll be able to get even more cash flow and invest in bigger projects.

Related: What Makes for the Best Income Properties in the Real Estate Investing Business?

How to Find Cash Flow Properties

To harness the power of positive cash flow, you must know how to find cash flow properties. Follow these steps to find the best cash flow investments:

1. Find a Good Rental Market

Location plays a big role in determining the potential cash flow of an investment property. This is because it influences all aspects of an income property such as price, rental income, rental expenses, occupancy rate, optimal rental strategy, etc. Therefore, the first step to finding positive cash flow income properties is to find a good real estate market.

To find a profitable rental market, you need to conduct a thorough real estate market analysis. Ideally, you should find a rental market with a balance of the following features:

- Affordability

- Good price to rent ratio

- High demand for rental properties

- Growing job market

- High economic growth

- Population growth

- Low property taxes

Related: 10 Best Places to Invest in Real Estate in 2020

2. Find the Best Neighborhood in the Market

With a good real estate market in mind, the next step is to find the best neighborhood for rental investing. Rental properties in different neighborhoods within a city can have different income potential. To find the best neighborhood for positive cash flow properties, you need to conduct a neighborhood analysis.

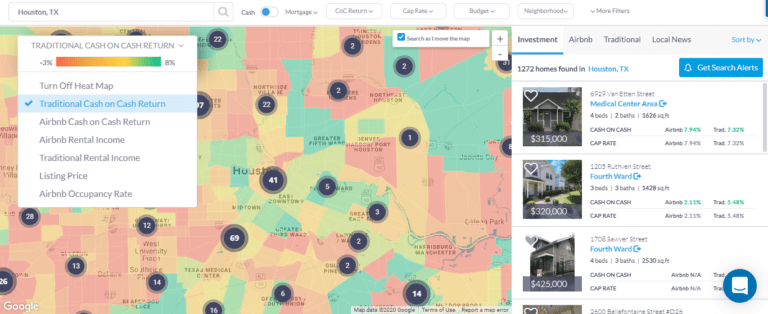

You can do a neighborhood analysis quickly and accurately using Mashvisor’s Heatmap Analysis Tool. This tool gives you an overview of the investment potential of neighborhoods in any city in the US housing market based on the following filters:

- Listing price

- Rental income (Traditional and Airbnb)

- Cash on cash return (Traditional and Airbnb)

- Airbnb occupancy rate

To find the best positive cash flow investments, focus on areas with a combination of a low listing price, high occupancy rate, and high rental income. Rental properties for sale in such neighborhoods are more likely to be cash flow positive.

To start looking for and analyzing the best neighborhoods in your housing market of choice for positive cash flow in real estate, click here.

Related: Finding Income Properties Using a Heatmap

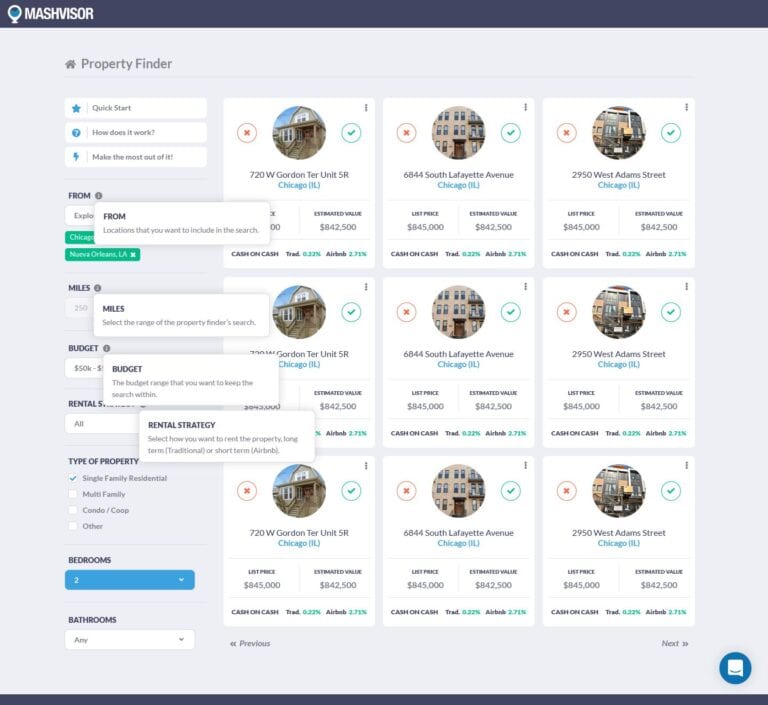

3. Do a Rental Property Search Using Mashvisor’s Property Finder

The most effective way to find the best types of real estate investments is to use Mashvisor’s Property Finder. You can search for rental properties for sale using filters such as location, budget, type of property, number of bedrooms, and number of bathrooms. You will get a list of potential positive cash flow income properties that match your criteria.

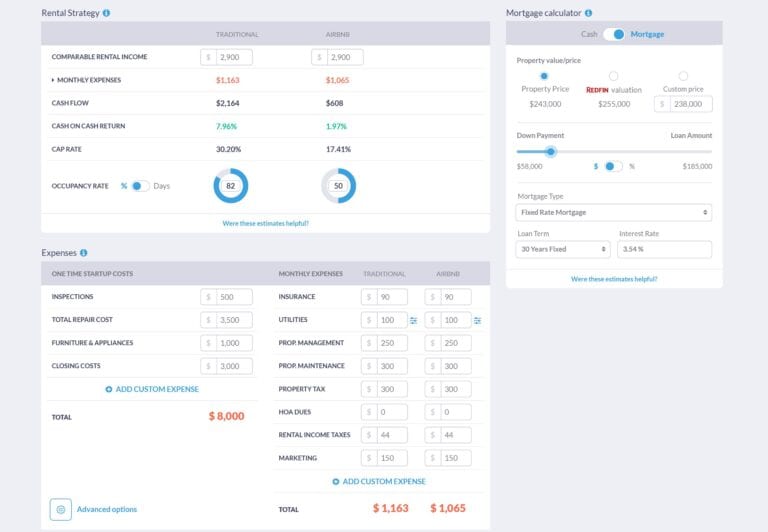

4. Analyze the Rental Properties for Sale

To find the best positive cash flow property among those in your list, you need to analyze each property. You can do a comprehensive rental property analysis using Mashvisor’s cash flow calculator. The calculator allows you to estimate not only the potential cash flow but also other key metrics such as cap rate, cash on cash return, and Airbnb occupancy rate.

The Bottom Line

When done right, real estate investing can be very lucrative. However, with many types of real estate investments to choose from, choosing an investment strategy can be quite overwhelming. But, you don’t have to complicate things. Generally, the best types of real estate investments to go for are cash flow properties. You should always focus on buying investment properties with positive cash flow.