Find out what you need to know about how to buy a foreclosed home in Texas. This can help you save big on your next investment.

As a property investor, you always have to look for great deals to maximize your rental income. If you want to buy a house below market value, consider learning how to purchase a foreclosed home in Texas. Their prices are low because of one caveat: their condition may not be as nice as you would expect.

If you are a beginner, foreclosed homes are great opportunities for you to acquire your first property. But you might find the process of buying foreclosures to be confusing.

With patience, careful budgeting, and the right team and tools, you can find a foreclosed property worth investing in. Make sure to know about the requirements and qualifications you should meet to close on this type of transaction.

In this article, you will learn about buying a foreclosed home in Texas:

- What a foreclosure is

- The three stages of foreclosure in Texas

- A step-by-step guide on how to buy a foreclosure in Texas

What Is a Foreclosure?

If there is a word that homeowners dread but homebuyers (especially real estate investors) look for, it would be “foreclosure.”

Foreclosure is the act of repossessing the property because of loan default. In Texas, if a homeowner misses their home loan payments for at least 120 days, their respective lender can seize the property. They will then resell it to recoup their losses.

The homeowner can also try to short sell their home at a lower price so they can avoid having a foreclosure on their record. This penalty would bring down their credit score for up to seven years.

In Texas, foreclosures are mostly non-judicial, which means that the court was not involved in the filing. But you might still find foreclosed properties that were filed with a court and ordered by a judge. This only happens when the deed of trust does not include the power of sale clause.

Knowing how to buy a foreclosed home in Texas is the perfect way for beginner investors to start their real estate empire. But just because these houses are cheap does not automatically mean they are a great deal. If you are not careful, you might end up spending even more money on significant renovations. You need to have patience and do careful research and budgeting before setting out with your purchase.

3 Stages of Foreclosure in Texas

When thinking of buying foreclosed homes, most homebuyers think of public auctions. But you do not have to wait until this stage to find and purchase a foreclosed property. There are three stages of the foreclosure process in which you can make an offer:

Stage 1: Pre-foreclosure

When a homeowner has fallen behind on their mortgage payments, the lender sends them a breach letter to tell them that their loan is in default. The homeowner then has 60 to 120 days to catch up on their late payments.

If 120 days have passed without any action from the homeowner, then the lender will send a Notice of Default and Intent to Accelerate. Doing this will start the foreclosure process. This notice gives the homeowner a final 20 days to reinstate their loan, which is for them to pay the overdue amount plus other fees and costs.

During this 140-day period, you can swoop in and offer to buy the house at a price that is enough for the homeowner to pay off their debt. In this scenario, everybody wins:

- The homeowner avoids foreclosure;

- The lender gets back the money they are owed; and,

- You, the homebuyer, get a property that you paid for below market value.

Stage 2: Public Auction

If the homeowner fails to reinstate their loan or sell their property in time, then the lender will put up the property for sale through an auction. In Texas, the lender is required to announce the sale publicly and must open the auction to all bidders.

How to buy a foreclosed home in Texas via auction: first, you need to have cash in hand as well as proof of funds. You must also bring a cashier’s check to use as your down payment on the day of the sale. During the bidding, competition may be strong and the final price may end up higher than you would expect.

Buying a foreclosed property at an auction is risky as you may not have time to research the property. And usually, the lender does not allow interested bidders to visit the house for inspection. You will have to buy it as-is.

Stage 3: REO

If a foreclosed home does not get sold in the public auction, it becomes a bank-owned or real estate-owned (REO) property. In this stage, the lender is highly motivated to sell, but homebuyers will have to deal with a lot of regulations and paperwork, so expect the transaction to be slow. You might also have to pay a higher price for the property compared to when buying it during the previous two stages.

A Step-by-Step Guide on How to Buy a Foreclosed Home in Texas

Before setting out to buy a foreclosed property in Texas, it is best to know the steps first so you do not feel lost.

Step 1: Understand What Foreclosures Are Like and How They Go

Foreclosures in Texas are mostly non-judicial, meaning there was no court involved in the filing of the foreclosure. However, you may encounter foreclosed properties that were filed with a court and ordered by a judge. Non-judicial foreclosures are usually auctioned off on the first Tuesday of each month.

When you purchase a foreclosed property in Texas, you will be buying it as-is, meaning that you cannot negotiate for the owner to fix something before you buy the house. Additionally, the property you purchase may not be as high quality as you would expect. The state of these homes can vary; some may be ready for move-in while others may need substantial repairs.

Step 2: Search for Foreclosed Properties in Texas

There are several ways to find foreclosed properties for sale.

Check the Courthouse Lobby

When a lender files a Notice of Sale with the County clerk, it will also be posted on a bulletin board in the courthouse lobby 21 days before the sale. Look for a Notice of Trustee’s Sale or Notice of Substitute Trustee’s Sale. There, you will also find the property’s legal description, the debt owed, and the exact time and date of the sale.

Read Your Local Newspapers

The lender must also advertise the foreclosure sale in the local newspapers. Just like in the Notice of Sale at the courthouse, you will also find in these ads details about the property such as its description, debt owed, and when the sale will take place.

Go Online

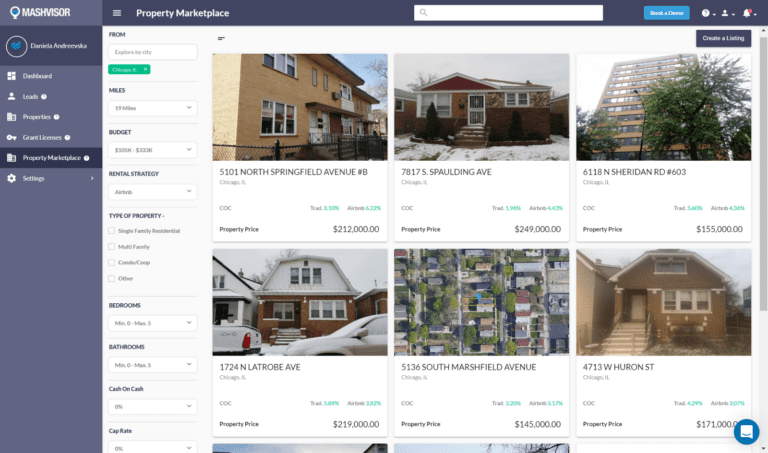

You can also search for foreclosed properties using an online tool like Mashvisor Property Marketplace. On this platform, use the filters to narrow down the listings to match your preferences.

Aside from the home’s description, each listing has an investment analysis on both the property and the neighborhood where it is located. Use this feature to determine what type of rental strategy is best for that particular home, how much you can expect to earn, and when you could earn back your investment.

Step 3: Do Your Due Diligence

Use whatever time you have before the auction to research the foreclosed property you wish to buy.

Check the title for liens

The first thing you should do is to look up its title and check for the balance of the main lien and other possible liens it could have. If you end up buying this property, you will be responsible for these, and the cost of clearing these liens can offset the equity in the home.

Should you find any liens on that property, consider hiring a real estate attorney to help you clear these without having to pay for them. But if the lawyer is not able to clear these liens, then you could move on to a different foreclosure.

Contact the trustee

Next, ask the trustee who is in charge of the sale for any additional information. Because you are getting the property as-is, ask if you could have it inspected before the auction so you know its condition before bidding on it. However, this is rarely allowed, especially when the previous homeowner is still living in the foreclosed home.

If you hire a real estate agent, though, they may be able to help you arrange for an inspection. They could also handle the entire transaction on your behalf, as buying a foreclosed home can be overwhelming for beginners.

In case you are not allowed to have the home inspected prior to the sale, you could instead ask for the lender to let you do this after they accept the contract. Make sure that you add an inspection contingency in the agreement so that you have the option to back out if you discover any issues that are too expensive for you to handle.

You could also ask the trustee for a copy of the purchase agreement. Review it carefully (or have your lawyer do it for you) and negotiate any changes and contingencies in advance.

Step 4: Get Prequalified

Before auction day, you might be required to get a pre-approval letter from your mortgage lender or have proof of funds to show that you can afford to buy the home. You may also need to bring a cashier’s check to pay for the down payment on the day of the sale. Note that these requirements may vary depending on the property, so make sure to ask the trustee for these details before attending the auction.

Step 5: Bid on the Property

On auction day, remember to bring your pre-approval letter or proof of funds, a cashier’s check, and your ID. Decide ahead of time on the maximum amount you are willing to bid, as competition may be rough and you would want to be ready in case of a bidding war. Because of high emotions and competitiveness, you could end up winning the property at a price that you cannot afford.

During the bidding, the auctioneer will increase the bid in increments of $100 and $1,000 depending on the property’s value. Take note of your competitors and keep bidding until you have reached your ceiling price or when everyone else has dropped out.

If you win the bid, you can complete the transaction following the terms set by the lender’s representative by signing the purchase agreement and giving them your deposit. Be prepared to close the deal within the required time period, which is usually only 30 days, unless you managed to negotiate for contingencies.

Start Building Your Real Estate Empire With a Foreclosed Property

Learning how to buy a foreclosed home in Texas can be intimidating for a first-time real estate investor. But think about this: if you are able to navigate the entire process even with the help of an expert, you will come out of this with experience that you can use on your next home purchase. You might even decide to only buy properties that are either in the pre-foreclosure stage or up for auction.

Whether you have decided to look into foreclosures or are open to buying other types of properties, you will have an easier time doing your research using a platform like Mashvisor. Here, you can search for homes in the US that are for sale, foreclosed, or off-market. When you click on a listing, not only will you find the property’s description and price, but you will also see an analysis of the property and the neighborhood. Use this to determine whether they have a great income potential for a traditional long-term lease or Airbnb rentals. Start your 7-day free trial with Mashvisor today.