2021 is the year to learn all about investing in a distressed property. Why? Well, borrowers in the US housing market have been hit hard by the COVID-19 pandemic. Due to the high unemployment levels, millions of Americans are unable to keep up with their mortgage payments. Mortgage data from Black Knight reveals that 2.6 million property owners remain 90 or more days past due, though not yet in foreclosure. Homeowners with distressed finances are currently enjoying temporary relief from the eviction and foreclosure protections under the CARES Act. This law allows borrowers that have federally backed mortgages to request up to 180 days of relief when facing financial difficulties. Freddie Mac and Fannie Mae are even extending this foreclosure moratorium until December 31, 2020.

However, once the foreclosure forbearance protection is over, numerous distressed properties are likely to hit the real estate market. While this is bad news for many homeowners, it presents a great opportunity for real estate investors to make a handsome return on investment. So if you’re looking to jump on this real estate investment opportunity, this is the guide for you.

What Is Distressed Property?

Distressed property refers to real estate that has already been repossessed by the lender or is on the brink of foreclosure. Such properties are usually attractive to real estate investors because they are sold at prices below market value.

3 Types of Distressed Property

Distressed property falls into three main categories:

- Short sales – Many homeowners facing imminent foreclosure opt for a short sale. This is where the property is sold for less than what is owed on the mortgage, with all the proceeds going to the lender. The lender then gets a deficiency judgment against the borrower or forgives the difference.

- Foreclosures – When a homeowner continually defaults on mortgage payments, the lender will repossess the property and sell it via an auction or foreclosure sale.

Related: Short Sale vs Foreclosure: What’s the Difference?

- Bank owned or real estate owned (REO) properties – Properties become bank owned when they fail to sell through a foreclosure sale or auction. To avoid the responsibility of repairing or maintaining REO properties, lenders usually sell them at a discount.

The Risks

Before we talk about how to buy distressed property, let us consider some of the risks:

- High repair/maintenance cost – Distressed homes are usually sold ‘as is’, meaning that the buyer is responsible for any repairs or maintenance. Some of the problems that could cost a lot include leaky roofs, faulty wiring, bad plumbing, termites, water damage, and structural issues.

- Outstanding liens – Property owners that cannot pay their mortgage have probably defaulted on other payments like HOA dues or property taxes. If you buy the home, you will have to settle these costs if the lender has not already done so.

- Paying too much – If you don’t consider the repair costs involved, you might end up paying too much for a home. This is why you need to think about the acquisition cost and the after repair value (ARV).

- Difficult buying process – Buying a distressed home can be a very long and frustrating process. While it takes as little as 1-2 months to close on conventional investment property, it could take up to one year or more to close on a distressed property.

Related: How to Find Out If There Is a Lien on a Property

How to Find Distressed Properties for Sale

Here are some of the ways of how to find distressed properties for sale in 2021:

Government agencies

Government agencies such as the IRS and the HUD have repossessed and foreclosed properties to their names, usually due to unpaid mortgages or taxes. Others like the U.S. Marshals have properties as a result of ATF, DEA, or FBI-related seizures. Visit the relevant websites and look for distressed homes for sale.

Traditional drive-bys

Driving for dollars is an old fashioned, but effective strategy for finding a distressed investment property. As the name implies, this is simply driving around neighborhoods and looking for potential homes for sale. Broken windows, overgrown vegetation, uncollected mail, and overall poor maintenance are some of the signs of a distressed home. To succeed with this strategy, be sure to focus on up-and-coming neighborhoods where buyer demand is strong.

Probate, foreclosure, and family attorneys

Such attorneys are usually aware of up-and-coming probate income properties that will be in foreclosure soon. Networking with these professionals can therefore be a great way to find real estate deals that have little or no competition. You could also check sites like USProbateLeads.com or SuccessorsData.com for leads on foreclosure or probate sales.

Distressed property sites

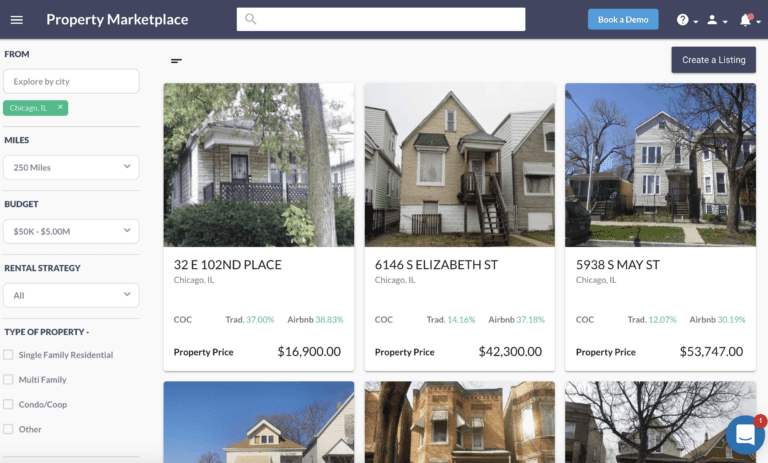

There are several sites that focus almost exclusively on distressed property listings. These include websites like HomePath, Foreclosure.com, HomeSteps, Hubzu, and Auction.com. Another great resource is the Mashvisor Property Marketplace. This tool helps you find distressed off market properties using filters like desired cap rate, cash on cash return, number of bathrooms/bedrooms, property type, location, miles, and budget.

Real estate wholesalers

Wholesalers spend a lot of time checking county records, visiting auctions, and even cold-pitching to homeowners to find potential deals for cash flow properties. Working with a wholesaler can therefore be a quick way of finding distressed property. To find a local wholesaler, look out for the ‘We buy houses for cash’ signs.

Financing a Distressed Property

Before you make a move on any investment property, you have to ensure your finances are in order. If you’re not using cash, then you need to know about the loan options available to you. These are the most common distressed property loans:

- Traditional mortgages – To acquire a conventional mortgage, you must have a low debt-to-income ratio, a good credit history, and a great credit score. You will also be required to make a significant down payment, usually 20-30% of the purchase price.

- Hard money loans – Also referred to as ‘fix-and-flip’ loans, these are short-term loans that borrowers must repay within about 3 years. Though the down payment and credit score requirements are not very strict, the interest rate is usually higher than that for traditional loans.

- Leveraging equity on a primary residence – If you have built up equity in your primary residence, you can tap into it with a Home Equity Line of Credit (HELOC) or cash-out refinancing.

Related: 6 Types of Investment Property Loans for 2021

A Few Final Tips

One of the best ways of mitigating risks when buying distressed property is by working with a real estate agent that specializes in this area. An experienced agent will help you find a great deal while avoiding potential pitfalls. To get an edge over the competition, be sure to get pre-approved for a mortgage before looking for a property. Finally, don’t forget to conduct a thorough inspection of the rental property before signing on the dotted line.