Real estate investment is a numbers game. Unless you’re buying your retirement home, you want to know how much return on investment your investment property will give you. This is the only way to know whether your investment makes financial sense.

Calculating rental profits is important whether you’re going to follow the traditional long-term rental strategy or short–term rental strategy, such as Airbnb. This process basically involves coming up with the figure or rate that’s your property’s potential for generating income. The higher the number, the greater the potential of the property.

So, how do you actually calculate profit before investing in property?

Step One: Real Estate Market Analysis

Location is one of the core factors that determine your property’s income potential. If the property isn’t located in an area with a high demand for Airbnb, its income potential is low. Once you’ve identified a profitable market, you can then estimate the rental income for Airbnb property in that area.

Real estate market analysis helps you find out the following:

- How much money you’ll need to have to purchase the property

- How much you can set as your nightly rates

- What rate do the properties in that area appreciate by

- The rate at which Airbnb properties are in demand

Why is rental market analysis important when investing in Airbnb property? You need to realize that in some markets, the property might be suitable for traditional rentals but perform badly as a short-term rental. If you look at traditional rental statistics and use them to invest in Airbnb, the property won’t generate as much income as you’d expect.

During this process, you’ll also need to use predictive analytics. This is simply data that you use to predict how an investment property in a specific real estate market will perform in the future. In this process, you’ll have to utilize historical Airbnb data analytics and factor in trends to see how they’ll affect your rental income.

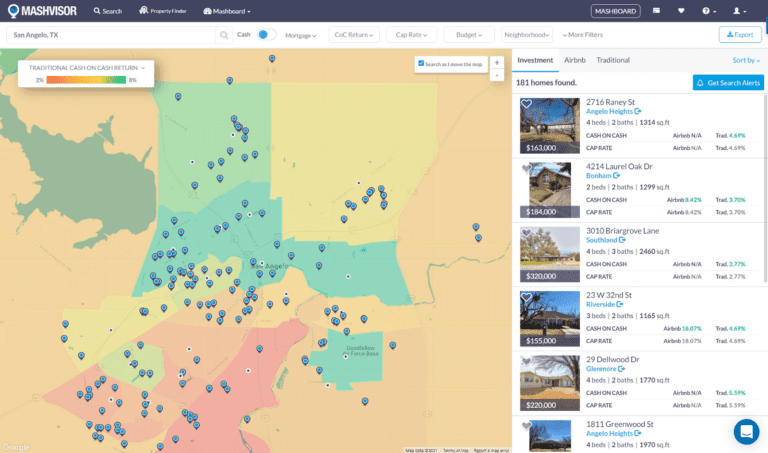

While this process may seem daunting, it doesn’t have to be. Luckily, you can use the Mashvisor Heatmap to carry out an in-depth real estate market analysis before investing in an Airbnb property.

Before using the Heatmap, you need to choose a city or town you think would be profitable for Airbnb investment. Once you’ve done that, use the Heatmap tool to check which of the neighborhoods in the city are the most profitable for investment property.

Using the Heatmap isn’t complicated. Other than numbers, it also uses a color-coding scheme to represent various key metrics. Green denotes high values for profitable neighborhoods while red indicates low values.

Once you run a thorough market analysis, you’ll have a rough estimate of how much income you can expect by investing in that location.

Step Two: Investment Property Analysis

While the neighborhood may be a good market to invest in, not all properties within that area would bring in a good average profit from Airbnb. A good rental property analysis will help you identify which properties have great income potential.

Once you have a list of some potential neighborhoods to invest in, it’s now time to look at a few investment properties and scrutinize them. Here are some metrics you’ll use to analyze Airbnb properties’ return on investment:

Cash Flow

Cash flow in real estate refers to the difference between gross Airbnb rental income and property expenses. If your property provides you with a positive cash flow, it means that the income can cater to the expenses and makes you attractive to lenders. Positive cash flow also means that the property is a low-risk investment and you’ll be able to build a diversified real estate portfolio easily and faster.

When computing Airbnb cash flow, it’s tempting to use a manual spreadsheet to get through the process fast. However, this will only make the work more laborious for you and make the data prone to human errors. We recommend you use a real estate cash flow calculator to make the work easier and end up with accurate data.

So, how much cash flow is good cash flow? It depends. Various factors, such as location, rental strategy, property type, and financing determine which amount of cash flow is good for your Airbnb investment property.

While these factors may change the amount that will be perceived as a great cash flow, always aim for a positive cash flow. The higher the cash flow, the higher the return on investment. If the cash flow is negative, your real estate business may fail. This may be discouraging especially if you’re a beginner.

Capitalization Rate

Capitalization rate, or cap rate, refers to the potential return on investment of a certain property. When calculating the cap rate, you’re looking for the return on investment by comparing the potential Airbnb income to the total investment amount on the property. In simpler terms, the capitalization rate is the rate of the Airbnb return relative to the property price.

Here is the Airbnb cap rate formula:

Cap Rate = Net Operating Income/Property Price

Net Operating Income refers to the difference between the gross rental income generated by the Airbnb property annually and the cost of maintaining, managing, and renting out the property. While it may look like a simple calculation, an accurate computation of the net operating income needs to factor in the vacancies as they directly affect Airbnb profit margin.

Let’s assume your Airbnb property generates $1,000 per month, and you take out $600 to pay for the mortgage, management fees, and insurance. This leaves you with a positive cash flow of $400. Using the above formula to get the cap rate, we’ll multiply $400 by 12 to get $4800 as the net operating income. If the property is selling for $160,000, the cap rate is 3%

What is a good cap rate? A good cap rate for Airbnb rentals should range between 8% and 12%. This rate provides a great balance between the property’s rate of return and the level of risk involved.

While it may make sense to aim for the highest cap rate possible, don’t forget that the cap rate also represents the level of risk involved when buying and owning an Airbnb property. This means that lower cap rates may be better when the investor is risk-averse.

Higher cap rates may also be a sign that the property is poorly managed. The cap rate may be too big because the property owner doesn’t spend enough money to maintain and repair the rental. If you buy such a property, you’ll spend a lot of money on major repairs in the future.

Cash on Cash Return

The final metric to measure Airbnb profit is cash on cash return. Airbnb’s cash on cash return is almost similar to the cap rate. The only difference is that instead of dividing the net operating income by the property price, we divide it by the amount of cash you invested into the property. We use the total money you paid from your pocket to consider the financing that goes into the property.

Why is it necessary to calculate the cash on cash return? The return on investment in real estate depends on how an investor can finance the investment. Some investors can fully pay for the property out of their pockets. Others can only afford a downpayment and obtain a mortgage loan to settle the difference.

Calculating the cash on cash return will let you know whether getting a mortgage loan is the best option for a high return on your investment. If you have a couple of options to access financing, the cash on cash metric allows you to calculate profit on Airbnb and the return on investment for all your options so that you can decide which is the best for your investment.

How do you calculate the cash on cash return? Here’s the formula:

CoC Return = Net Operating Income/Actual Cash Investment

Let’s assume you’re interested in a property going for $200,000. You can afford a downpayment of 20% and spend a further $5,000 into renovating the property and furnishing it to match Airbnb standards. This means that your actual cash investment is $45,000. Assuming the net operating income is $4,500, here’s how you’ll get the cash on cash return:

CoC Return = $4,500/ $45,000 * 100 = 10%

This is simplified cash on cash return calculation. You’ll also need to factor in rent lost due to vacancies, property taxes, utilities, and many other costs. This is why you need to use real estate investment software to calculate the cash on cash return.

Firstly, a cash on cash return calculator will give you more accurate results than when you’re calculating on paper. The calculator uses AI and big data to ensure you’re getting accurate results. Secondly, using the calculator makes you confident with the results. You make business decisions backed by data and stand out from your competitors. You also make the calculations instantly.

Step Three: Comparative Market Analysis

Now you know a few Airbnb profit metrics and how to calculate them. However, how do you find the Airbnb data to calculate it all? For example, where can you find the projected rental income or property prices? This needs a combination of Airbnb analytics and comparative market analysis.

A comparative market analysis (CMA) is a comprehensive report on a property’s current value that is prepared by analyzing other similar properties within the same market or neighborhood. The similar homes in the market are what we refer to as comparables.

As a real estate buyer, carrying out a comparative real estate market analysis is important so that you can ascertain the real value of a house before making an offer. This means that any smart and successful real estate investor will do a CMA before moving forward with any deal.

If you’re a beginner, don’t make the mistake of believing that a CMA is a home appraisal. CMAs and appraisals are different. Appraisals are usually required by banks and mortgage lending institutions so that they can lend you the right amount of money after you’ve made an offer.

Also, appraisals can only be carried out by certified real estate appraisers. Further, the appraiser needs to adhere to the Federal Housing Finance Agency guidelines. Unlike CMAs which factor in recent sales data, an appraisal only considers the home’s condition, location, features, and markets.

When performing a CMA, simply compile a list of Airbnb properties within the neighborhood that have the same features as the property you’re interested in. Check how much they rent their units per night and the Airbnb occupancy rates as well. This will give you a basis of what you can expect.

What are the benefits of carrying out comparative market analysis before investing in an Airbnb property? Here are the main advantages:

- List your property accurately– Once you buy the property and list it on Airbnb, you might be tempted to set low nightly rates to attract more guests. Of course, this price will not be your property’s worth. Remember you also have to take away some costs that come with maintaining and managing the property. Conversely, setting a price that’s too high will see you lose your target market to your competitors. A CMA allows you to set a reasonable nightly rate and also holds you back from overpaying for a property when buying a home for Airbnb profit.

- Understand the housing market– Taking your time to understand the housing market in the neighborhood will make you more educated while buying the property. As we’ve already said, location is key when it comes to real estate investing. Looking at and analyzing recent Airbnb transactions within that neighborhood will help you know whether your Airbnb business will perform well. This way, you can spot the best properties to buy and stay away from neighborhoods that don’t perform well.

Utilize Real Estate Investment Tools

So, does Airbnb make a profit? Conducting the average Airbnb property calculations will help you answer this question and understand how to maximize Airbnb profit.

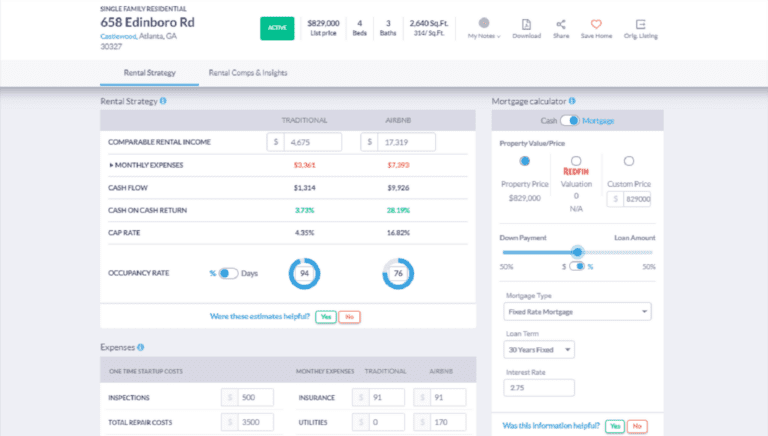

Doing all the calculations we’ve discussed above manually would be impossible. As a serious and wise investor, you need various tools to carry out such tasks. This is why we recommend you use the Mashvisor Airbnb Profit Calculator to help you calculate profit accurately.

The Airbnb property profit calculator stands out since it performs a Heatmap analysis of the neighborhood. It also displays the potential return on investment for both traditional and Airbnb rental strategies. Using this tool, you can decide whether Airbnb investment will be the best strategy and know how much income you can expect.

Sign up for Mashvisor now and get 15% off.