Success in the real estate business boils down to effective investment property analysis – you have to look at the numbers. One crucial return on investment (ROI) metric used to assess the profitability of a rental property is the cap rate (capitalization rate). If you want to find high cap rate properties that will cash flow, knowing how to find cap rate data is key.

In this article, we are going to go through the meaning of cap rate and where to find cap rate data for residential real estate.

What Is Capitalization Rate (Cap Rate)?

Cap rate is the ratio of a rental property’s net operating income to its purchase price/current market value. This is the ROI metric used by real estate investors to evaluate the returns of multiple comparable investment properties when purchased in all-cash. Most real estate professionals agree that a good cap rate for residential real estate ranges from 8% – 12%. However, technically, what is deemed as a good cap rate varies depending on a number of factors such as location, investment property type, and rental strategy.

Apart from showing how profitable a rental property will be relative to its cost, it’s also a measure of the level of risk a rental property carries. In theory, the higher the cap rate, the higher the risk. Properties with excessively high cap rates may not make good investments. This is why it’s a good idea to also look at other metrics like cash flow and appreciation along with cap rate.

Related: What Is a Good Cap Rate for Investing in Vacation Rentals?

Where to Find Cap Rate Data

Now that you understand what cap rate is, it’s time to learn where you can find cap rate data for your investment property analysis. Cap rate data used to be difficult to obtain in the past as it entailed lengthy and boring research and using tiresome spreadsheets. Fortunately, this is no longer the case. There is a faster and more efficient way to find reliable cap rate data for residential real estate in the US housing market – using Mashvisor.

Mashvisor is the best real estate investment software for real estate analytics. Using Mashvisor can turn 3 months of research into a few minutes. Here is a list of all the types of cap rate data that Mashvisor provides and how to access it:

1. Cap Rates for Cities

Location should be the number one factor you consider when conducting your investment property search since it will have the biggest impact on the rate of return. To choose a profitable investment location, you should begin by looking at city-level cap rates.

Mashvisor makes your real estate market research easier by providing cap rates by city (for markets in the United States). You can find this cap rate data on Mashvisor’s real estate blog. Mashvisor’s database has listings from a number of reliable sources such as the MLS, Zillow, and Airbnb. Cap rates for individual listings are estimated and market averages obtained to get the city-level cap rate data.

You can find the cap rate for a real estate market in the US by simply searching for its name on Mashvisor’s blog. A list of blogs with city data for that market will pop up. You can quickly analyze a real estate market even if you aren’t familiar with it.

Related: How to Research Real Estate Markets: The Beginner’s Guide

2. Neighborhood Cap Rates

While it’s good to have city-level cap rate data, it’s not enough to make a profitable investment decision. Based on the average cap rate, a city may seem profitable. However, you should keep in mind that the different neighborhoods in a city will typically have different investment potential. Searching for the most profitable investment property for sale in a whole city is also not a very easy task since you’ll be filtering through thousands of properties. Therefore, you need to narrow down your search further. You can do this by using Mashvisor to conduct a neighborhood analysis. This will help you locate the best-performing neighborhood in your city of choice based on cap rate data.

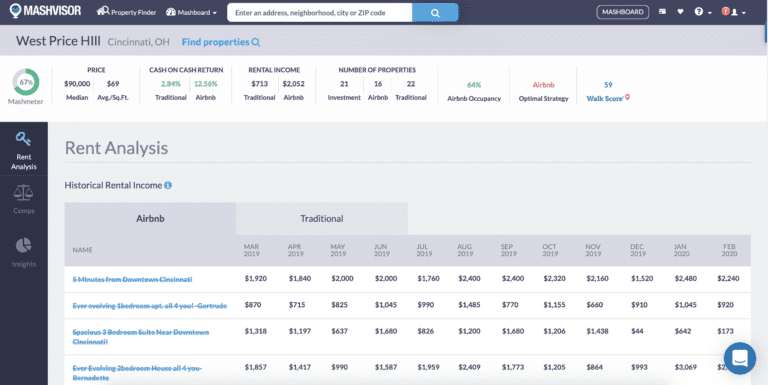

You can get neighborhood-level cap rate data by simply typing in any city of interest in the search engine and clicking on the name of a neighborhood. You’ll be taken to the Neighborhood Analytics Page where you’ll view all the neighborhood data. This includes cap rate data (traditional and Airbnb cap rate) and other key neighborhood stats like rental income, median price, Mashmeter score, etc.

Visit Mashvisor’s Neighborhood Analytics Page for the neighborhood of your choice and find the average cap rate (and much more!).

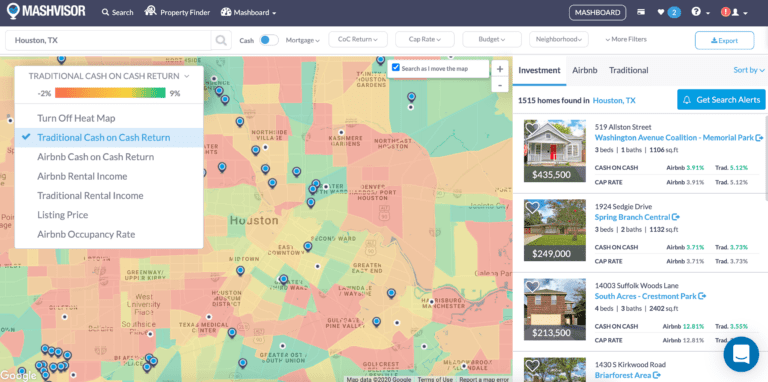

A quicker way of comparing cap rates for different neighborhoods is to use Mashvisor’s real estate heatmap. This real estate investment analysis tool uses visual cues to distinguish between low and high performing neighborhoods. You can filter your search using cash on cash return (Airbnb or traditional) since it’s the same as the cap rate. This is because the heatmap doesn’t factor in your financing method. You can select a top-performing neighborhood based on your preferred rental strategy.

Related: How to Do a Neighborhood Analysis in Real Estate Investing

3. Cap Rates for Investment Properties

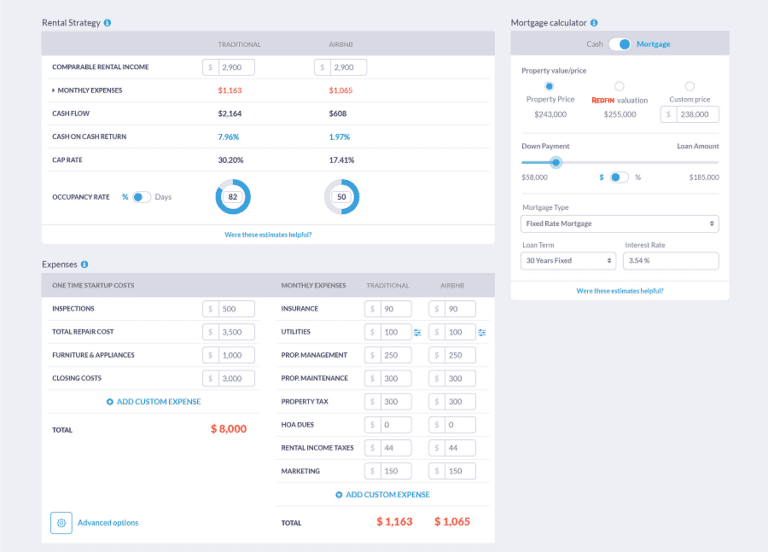

After identifying a profitable neighborhood, the last step is to find investment properties that match your criteria and compare the cap rates. You can easily search for top-performing investment properties for sale that fit your budget and investment criteria using our Property Finder. Once you’ve selected a few properties, you can use Mashvisor’s cap rate calculator to estimate the expected cap rate for any of them.

Apart from cap rate data, the calculator will show other key rental property data such as property price, rental expenses, rental income, cash flow, occupancy rate, and cash on cash return. The tool uses big data, predictive analytics, and machine-learning algorithms to quickly and accurately estimate cap rates for investment properties in the US housing market. And because our database includes a wide range of property types, you’ll find cap rates for single-family homes, cap rates for multifamily homes, and more.

Calculating cap rate manually or using a cap rate analysis spreadsheet can be time-consuming and is more prone to error, especially if you are comparing multiple properties. However, with our cap rate calculator, you can get accurate cap rates for investment properties in a matter of minutes.

To get access to our real estate investment tools, click here to sign up for Mashvisor today.

The Bottom Line

If you are looking for an investment property to purchase, the cap rate is an important metric for assessing profitability. However, the biggest obstacle to cap rate analysis is usually finding reliable cap rate data, especially for residential real estate. Mashvisor is the best real estate investment software for any property investor looking to optimize their cap rate analysis, gain a competitive advantage, and confidently make decisions. You can access cap rate data in a matter of minutes instead of taking days, weeks, or even months.