There are a lot of questions associated with starting out in real estate investing. For instance, how to find positive cash flow properties? Where to find positive cash flow properties? What rental strategy to use for a specific investment property? The best way to answer these questions (and many more) is to rely on real estate investment tools. By far, the ultimate investment tool is the cash flow calculator for rental property.

Related: Why Positive Cash Flow Is a Must with Income Properties

What Is a Cash Flow Calculator for Rental Property?

A cash flow calculator for rental property, also known as a real estate investment calculator, is one of the top real estate investment tools used by investors. The calculator performs multiple tasks. Some include calculating cash flow and return on investment, estimating rental property expenses, projecting long-term and short-term rental data, and analyzing a local housing market. The real estate investment calculator works by using traditional analytics and, if it is a good calculator like Mashvisor’s (which you can learn about by clicking here), predictive analytics.

Why Do Investors Need a Cash Flow Calculator for Rental Property?

The answer to this question is quite simple. All we need to do is compare a cash flow calculator for investment property to the alternative to showcase the calculator’s necessity. This alternative is an archaic one: spreadsheets. Generally, spreadsheets perform many of the same functions as a rental property calculator such as calculating return on investment. The primary difference is that using spreadsheets requires manual and tiresome analysis, while a calculator can be used at the click of a mouse in mere minutes.

Speed is not the only advantage of a cash flow calculator for rental property. It also provides accuracy. Spreadsheet analyses are done manually, without the aid of technology or real estate investment tools. This can magnify errors, which take a lot of time to resolve. Errors can also lead to inflated positive cash flow or negative cash flow. A calculator is also much more accessible than spreadsheets, allowing anyone to search for income properties. These three factors are why investors need to have an investment property calculator.

How Does a Cash Flow Calculator Help Find Income Properties?

This tackles two of the questions mentioned earlier in this blog: where and how to find positive cash flow properties. The answer, of course, is that the cash flow calculator for investment property conducts a real estate market analysis.

Related: Real Estate Investing 101: How to Find Positive Cash Flow Properties in the US Housing Market

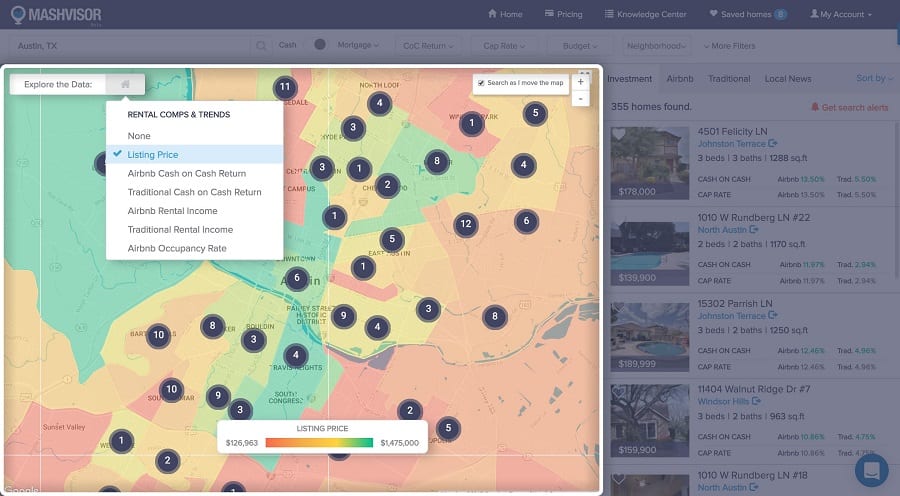

A real estate market analysis (specifically a neighborhood analysis) begins with searching for a city. The calculator allows investors to choose a city based on their preferred criterion. The Mashvisor’s rental property calculator, for instance, utilizes a heatmap analysis tool, which can display a market’s neighborhoods and help you choose the best one based on different data like the return on investment (cash on cash return), the Airbnb rental strategy, and more. That way you can easily spot which neighborhoods in a specific city will have positive cash flow properties.

How Does a Cash Flow Calculator Determine Investment Profitability?

After a real estate investor has found a location, he/she needs to find an investment property. In other words, the calculator must conduct an investment property analysis. The investment property analysis is what allows the calculator to determine potential investment profitability. This includes using data for calculating cash flow, estimating rental property management costs, and more.

-

Calculates Rental Income and Rental Expenses

Rental income is the bread and butter of an investment property’s profitability. That is why it is so vital for a cash flow calculator for rental property to compute it before anything else. Investment property calculators use the power of predictive analytics to provide the expected rental income for every income property in their database.

Rental property expenses are also very important when conducting an investment property analysis. There are various types of property expenses, further favoring the usage of a cash flow calculator for rental property over spreadsheets. The most common rental property expenses are mortgage payments, rental property management costs, property insurance, utilities, and association fees. Estimations are given for the property expenses based on reliable data but because the calculator is interactive, an investor can adjust the expenses any time. And with the help of a built-in mortgage calculator, an investor can enter in his/her mortgage information. The calculator crunches all of these numbers in a matter of seconds, saving the investor a lot of time and energy.

-

Calculates Return on Investment

Rental expenses and income are the basic components to all variants of return on investment, or ROI. ROI is the most accurate measure of property performance and it comes in three main forms: cash flow, cash on cash return, and cap rate- all of which are computed by a cash flow calculator for rental property.

Cash flow is defined as the difference between the rental income of an income property and its rental property expenses. Positive cash flow rental properties have a net positive difference or more income than expenses, while negative cash flow properties have a net negative difference or more expenses than income. Without a doubt, real estate investors should strive for positive cash flow rental properties.

Cap rate is a form of ROI that considers a property’s cash flow relative to its purchase price. Cash on cash return is the same as the cap rate, but with one important distinction. The difference is that it considers the financing method of the investment property in question. If the property is purchased through a mortgage, the total cash invested is in place of the purchase price.

You can learn more by reading Cap Rate vs Cash on Cash Return.

Where to Find the Best Cash Flow Calculator for Rental Property

Where can you find the best cash flow calculator for rental property? The answer is…right here! Mashvisor provides the best rental property calculator you can find, and here’s why!

Our calculator isn’t the typical investment calculator. Mashvisor’s cash flow calculator for investment property is frequently updated with the most accurate predictive analytics available. Its heatmap allows investors to scour for neighborhoods with the highest performing positive cash flow rental properties in any location within the US. The calculator also tells real estate investors which rental strategy, traditional or Airbnb, to follow for the most success by using long-term and short-term rental data. But perhaps the best way to know if Mashvisor’s cash flow calculator is for you is to try it out yourself. To start a 14-day free trial with Mashvisor and use all of our investment tools, click here!