Our investor blogs cover all aspects of the real estate business which first-time investors as well as experienced investors need to master in order to succeed in their property investments. From buying a positive cash flow property in a top location, through choosing the right financing method and rental strategy, to renting out to the right tenants and managing the property efficiently. You will find guides on the top real estate investment strategies, on the best markets to invest in traditional and Airbnbn rentals, on market and property analysis techniques and tools, on calculating return on investment, and on maintaining, repairing, renting out, and managing a property. Our investor blogs constitute a comprehensive knowledge center for all beginner and established real estate investors in the US housing market.

Deciding on an investment property can be tricky. The best way to determine if a rental property will be profitable is through data, specifically, the traditional cap rate.

Table of Contents

- What Is Traditional Cap Rate?

- What Cities Have the Best Traditional Cap Rate?

- How to Find Other Cities With Good Cap Rates

In this article, we will talk about what exactly a traditional cap rate is and why it is important in real estate investing. Then, we will look at the best traditional cap rate by city in 2022.

What Is Traditional Cap Rate?

Before we look into which cities have the best cap rate this year, we should discuss what it is. Cap rate, also known as capitalization rate, is a metric used in real estate investing to determine a property’s return on investment (ROI) or how profitable it will be. Traditional cap rate does not take into account any financing on the investment; it only expresses profit.

In investing, you want to ensure your property will generate a positive cash flow. It is why the cap rate is so essential. Don’t get it confused with cash on cash return, though. As the latter is also important, cash on cash return is something completely different from the real estate cap rate.

Cash on cash return describes the cash flow created by an investment relative to the cash initially invested into the property. The metric is presented in a percentage and is meant to show how much money a property can generate annually.

The overall difference between the two metrics is simple. Cap rate shows potential profit without the factor of how it was financed, while cash on cash return accounts for profit based on initial money invested.

Though both carry importance in the real estate investing world, this article will focus on the traditional cap rate.

Related: Understanding Cap Rate Real Estate: The Complete Investor’s Guide in 2022

How Is Cap Rate Used?

Cap rate real estate has a few different uses. To start, the traditional cap rate is used to predict how much yield of return your investment can generate. Typically, in investing, it is recommended to look for a cap rate of between 8% and 12%. It ensures you will generate a profit without the investment being too risky.

Additionally, the cap rate essentially corresponds with the risk involved in a rental property. So, the higher the cap rate on an investment, the higher the risk it is to invest in that particular property.

If you’re new to the investing world, you may want to stay clear of properties with very high traditional cap rates. For traditional rental properties, you should look for cap rates of 8%-12%. Anything higher can point towards a less-than-ideal neighborhood or an undesirable location.

Location plays a large factor in a property’s cap rate. For example, a traditional rental in a city with a lot of businesses, restaurants, and shops will always produce a lower cap rate than a rental home in the middle of nowhere. It is because more people are moving into that city and looking for a place to stay.

Later, we will look at some of the top traditional cap rates by city.

When to Use Cap Rate

Traditionally, investors like to use cap rates when comparing the risk between potential investment properties. The cap rate is an excellent resource when determining how risky your investment property may be, as well as how much yield of return it can generate.

The cap rate can also vary depending on the size of the market you are looking to invest in. An area with a more competitive real estate market will have a lower cap rate than any location with a smaller real estate market. It is because there is less overall risk involved with investing in the larger market, and with it, more opportunity to generate a profit.

Cap rates are helpful when used on rental properties for long-term use. If you’re looking to flip a house and sell it immediately, cap rates will not be helpful. Other real estate metrics such as cash on cash return would be a better metric to look at when flipping a property.

How to Calculate Cap Rate?

The cap rate formula is fairly simple. You just need to divide the net operating income (NOI) by the current market value of the property. Then, you just convert the calculated value to a percentage by multiplying it by 100. After these simple steps, you are left with your cap rate.

What Is a Good Cap Rate?

Though it can be debated what is a good cap rate for a rental property, typically, anything between 8% and 12% is a good one. You want to make sure your cap rate isn’t too high as it may mean it is a higher-risk property.

You also want to make sure your cap rate isn’t too low though, as it is less likely to generate a good return on investment. Remember cap rate accounts for both risk factors and potential profitability on a property. So, you should always aim to invest in rental properties with cap rates of 8%-12% for the best outcome.

What Cities Have the Best Traditional Cap Rate?

Now that we have looked in-depth at cap rate real estate, let’s look for the best place to buy rental property in the US. Below are the top places with traditional cap rate by city, according to the latest data from Mashvisor:

1. Alturas, CA

- Number of Listings for Sale: 13

- Median Property Price: $271,954

- Average Price per Square Foot: $166

- Number of Traditional Listings: 0

- Monthly Traditional Rental Income: $3,152

- Traditional Cash on Cash Return: 8.90%

- Traditional Cap Rate: 9.14%

- Price to Rent Ratio: 7

- Days on Market: 120

- Walk Score: 53

2. Sylacauga, AL

- Number of Listings for Sale: 8

- Median Property Price: $319,975

- Average Price per Square Foot: N/A

- Number of Traditional Listings: 0

- Monthly Traditional Rental Income: $1,414

- Traditional Cash on Cash Return: 8.47%

- Traditional Cap Rate: 8.98%

- Price to Rent Ratio: 19

- Days on Market: 136

- Walk Score: 60

3. Logan, AL

- Number of Listings for Sale: 6

- Median Property Price: $170,750

- Average Price per Square Foot: $160

- Number of Traditional Listings: 1

- Monthly Traditional Rental Income: $1,579

- Traditional Cash on Cash Return: 7.79%

- Traditional Cap Rate: 8.15%

- Price to Rent Ratio: 9

- Days on Market: 25

- Walk Score: 0

4. Zavalla, TX

- Number of Listings for Sale: 9

- Median Property Price: $321,878

- Average Price per Square Foot: $168

- Number of Traditional Listings: 0

- Monthly Traditional Rental Income: $1,250

- Traditional Cash on Cash Return: 7.04%

- Traditional Cap Rate: 7.48%

- Price to Rent Ratio: 21

- Days on Market: 87

- Walk Score: 20

Related: The Best Rental Markets in Texas: The 2022 Guide

5. Truman, AR

- Number of Listings for Sale: 16

- Median Property Price: $140,900

- Average Price per Square Foot: $121

- Number of Traditional Listings: 3

- Monthly Traditional Rental Income: $967

- Traditional Cash on Cash Return: 6.63%

- Traditional Cap Rate: 7.18%

- Price to Rent Ratio: 12

- Days on Market: 51

- Walk Score: 42

6. Gray, LA

- Number of Listings for Sale: 10

- Median Property Price: $220,975

- Average Price per Square Foot: N/A

- Number of Traditional Listings: 1

- Monthly Traditional Rental Income: $1,754

- Traditional Cash on Cash Return: 6.69%

- Traditional Cap Rate: 6.98%

- Price to Rent Ratio: 11

- Days on Market: 94

- Walk Score: 14

7. Dawson Springs, KY

- Number of Listings for Sale: 7

- Median Property Price: $134,000

- Average Price per Square Foot: $103

- Number of Traditional Listings: 0

- Monthly Traditional Rental Income: $969

- Traditional Cash on Cash Return: 6.06%

- Traditional Cap Rate: 6.65%

- Price to Rent Ratio: 12

- Days on Market: 81

- Walk Score: 15

8. Dunkirk, IN

- Number of Listings for Sale: 8

- Median Property Price: $138,613

- Average Price per Square Foot: $78

- Number of Traditional Listings: 0

- Monthly Traditional Rental Income: $979

- Traditional Cash on Cash Return: 5.90%

- Traditional Cap Rate: 6.32%

- Price to Rent Ratio: 12

- Days on Market: 67

- Walk Score: 34

9. Danville, WV

- Number of Listings for Sale: 5

- Median Property Price: $149,000

- Average Price per Square Foot: $107

- Number of Traditional Listings: 0

- Monthly Traditional Rental Income: $1,110

- Traditional Cash on Cash Return: 5.91%

- Traditional Cap Rate: 6.27%

- Price to Rent Ratio: 11

- Days on Market: 26

- Walk Score: 38

10. Greenbelt, MD

- Number of Listings for Sale: 14

- Median Property Price: $211,943

- Average Price per Square Foot: $201

- Number of Traditional Listings: 63

- Monthly Traditional Rental Income: $1,656

- Traditional Cash on Cash Return: 5.95%

- Traditional Cap Rate: 6.22%

- Price to Rent Ratio: 11

- Days on Market: 51

- Walk Score: 63

11. Nashville, MI

- Number of Listings for Sale: 5

- Median Property Price: $140,040

- Average Price per Square Foot: $119

- Number of Traditional Listings: 0

- Monthly Traditional Rental Income: $1,122

- Traditional Cash on Cash Return: 5.81%

- Traditional Cap Rate: 6.15%

- Price to Rent Ratio: 10

- Days on Market: 1

- Walk Score: 32

12. Adelphi, MD

- Number of Listings for Sale: 10

- Median Property Price: $322,080

- Average Price per Square Foot: $241

- Number of Traditional Listings: 1

- Monthly Traditional Rental Income: $2,151

- Traditional Cash on Cash Return: 5.80%

- Traditional Cap Rate: 6.03%

- Price to Rent Ratio: 12

- Days on Market: 54

- Walk Score: 63

Above is the highest traditional cap rate by city. The areas are sorted from highest cap rate to lowest.

How to Find Other Cities With Good Cap Rate

Though we’ve presented you with some of the best options for cap rate by city, you may want to explore other neighborhoods with potentially good cap rates. To do so, we recommend a few helpful tools from Mashvisor.

Real Estate Heatmap

Mashvisor’s Real Estate Heatmap tool lets you search through any city in the US to uncover the best places for an investment property. We conduct a neighborhood analysis of any location you are interested in to find the most profitable locations.

To determine a neighborhood’s profitability, we consider the cap rate, along with other metrics such as cash on cash return and monthly rental income. The data will help you find the best area to invest in.

Related: What Is a Good Cash on Cash Return on Rental Properties in 2022?

Investment Property Calculator

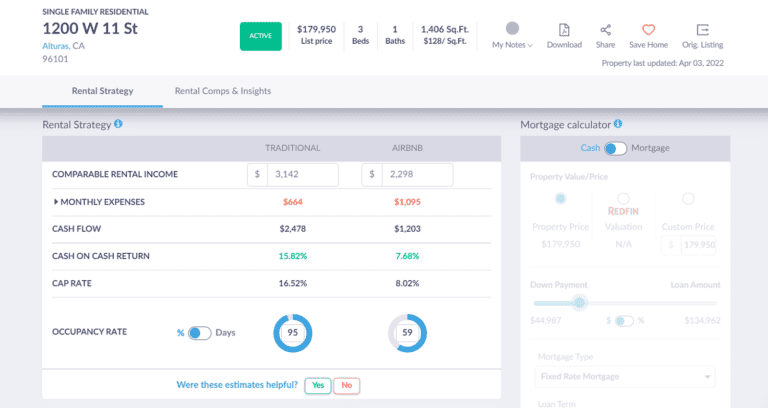

The next tool we offer for our investors is the Investment Property Calculator. The calculator is an excellent way to determine how profitable your rental property will be. We use the most up-to-date real estate data from trustworthy sites, such as the MLS, to run an analysis on your traditional rental property.

Our rental property calculator provides pre-calculated data for costs on your investment property like property tax, interest rates, and maintenance. Additionally, we offer a comprehensive rental strategy. It shows you how your property will perform as a traditional rental vs an Airbnb so you can make the best decisions regarding your rental strategy. Below are the metrics we use to compare the two:

- Rental Income

- Cash Flow

- Cap Rate

- Cash on Cash Return

- Occupancy Rate

Use Mashvisor’s Rental Property Calculator to compare the profitability of traditional rental vs Airbnb, based on rental income, cash flow, cash on cash return, and cap rate.

Recap

If you’re looking for new strategies as to how to invest in real estate, remember to keep the traditional cap rate in mind. Cap rate is a reliable metric that can be used to determine how much of a return on investment your long-term rental property will generate.

Always remember that the cap rate both helps to predict the return on investment and the risk factor involved in investing in that certain property. A very high cap rate can mean that neighborhood or real estate market has a high-risk potential. It is why you should always look for a traditional cap rate between 8% and 12%. It will provide you with the most profit with the least amount of risk.

If you’re considering investing in a traditional rental property, visit Mashvisor for the best tools for your real estate decisions. To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here. To learn how to use Mashvisor’s tools for your property investment needs, schedule a demo soon.