Our investor blogs cover all aspects of the real estate business which first-time investors as well as experienced investors need to master in order to succeed in their property investments. From buying a positive cash flow property in a top location, through choosing the right financing method and rental strategy, to renting out to the right tenants and managing the property efficiently. You will find guides on the top real estate investment strategies, on the best markets to invest in traditional and Airbnbn rentals, on market and property analysis techniques and tools, on calculating return on investment, and on maintaining, repairing, renting out, and managing a property. Our investor blogs constitute a comprehensive knowledge center for all beginner and established real estate investors in the US housing market.

Are you planning on buying Airbnb property?

If so, you’ll probably want to figure out how to estimate Airbnb rental income. In fact, this is an essential step when investing in Airbnb. Without knowing exactly how much you will make, how can you determine if an Airbnb rental property is a good investment?

Airbnb hosts have a few different ways to predict revenue and estimate Airbnb income. In this article, we are going to break down the different options for estimating income to help you answer the question: how much money can you make on Airbnb?

3 Steps for Estimating Airbnb Rental Income

When trying to estimate revenue for an Airbnb property, you are faced with two different outlooks toward Airbnb investment analysis. One is the monthly revenue you bring in from your investment. The other perspective to consider is more long term, which is your overall return on investment. As a real estate investor, it is wise to look at both types of gains before making a decision.

Step 1: Calculate Cash Flow

To estimate Airbnb income over the short term, you are looking at your monthly cash flow. Cash flow is the money you bring in each month after subtracting your expenses from your rental income; this is known as your net profits.

Expenses can include Airbnb fees, property maintenance, property management, any software you use, utility bills, and mortgage payments. Your exact expenses will depend on circumstances specific to you and your Airbnb investment.

Related: Airbnb Property Management Fees Breakdown: Are They Worth It?

After adding all relevant monthly expenses, you’ll have to estimate your gross profits. This number is composed of what you’ll charge per booking and how often your Airbnb will be booked. It’s important to set your rates competitively so you can stay booked as much as possible.

You also want to set a rate that will provide you with positive cash flow. So based on the expenses and the goal of positive cash flow, you can come up with an estimate for Airbnb rental income.

We will talk about a better way how to find the average daily rate and Airbnb occupancy rate for a property later in this article. For now, we can use a general example.

Example of Calculating Cash Flow

In a perfect world, your Airbnb would be booked every day of the month. However, there will likely be times when your Airbnb won’t get booked, unfortunately. To find out how many days per month your Airbnb will be booked, you’ll need to multiply the average days in a month by your Airbnb occupancy rate.

For now, you can use the average Airbnb occupancy rate of the city where you plan on buying an Airbnb. Get this info here on Mashvisor’s blog. Let’s say you want to make a purchase in Abilene, TX. Mashvisor’s data shows that the average Airbnb occupancy rate for the city is 60%.

Days in a Month x Airbnb Occupancy Rate = Number of Days Your Airbnb Is Booked

30 days x 60% = 18 days

Next, to estimate Airbnb rental income, let’s add up your expenses. Let’s say you pay $500 a month for your mortgage and property taxes. You also pay an additional $500 for property maintenance.

Expenses = $500 + $500 = $1000 per month

Now, multiply the number of days your Airbnb will be booked by the daily rate you plan on charging – a rate that will provide you with positive cash flow after subtracting the $1000. Let’s set it at $150. Looking back at the average Airbnb daily rate for Abilene, TX from Mashvisor’s blog, it’s actually $153. So our estimate is roughly in line with market rates. Now, let’s check the math:

Airbnb Daily Rate (price per booking) x Number of Days Booked = Gross Rental Income

$150 x 18 = $2,700

Gross Rental Income – Rental Expenses = Cash Flow (Net Profits)

$2,700 – $1,000 = $1,700

In this example, your net income, or cash flow, is $1,700. Because the cash flow is positive and your other estimates for occupancy and daily rate match the market rates, your estimation of a monthly rental income of $2,700 makes sense.

See also: How to Find Positive Cash Flow Properties

Step 2: Use the Cap Rate Formula

Awesome! You’ve figured out that you can have a positive monthly cash flow. So, you’re good to purchase the investment property, right?

Not so fast! Short term profits are important, but so are long term gains. You want to make sure you are getting enough money out of your investment long term. To estimate Airbnb rental income this way, you must use the cap rate formula.

The cap rate tells you the rate of return on an investment over a period of time. It takes into consideration the full price of the property. In addition to giving investors insight into how valuable an investment is, the cap rate can be used to evaluate the risk of buying an Airbnb property.

To estimate Airbnb rental income with this method, you will need to use this formula:

Cap Rate = Net Operating Income (NOI) / Property Value where NOI = Gross Income – Operating Expenses

As you can imagine, there are a number of moving parts in this equation, and it typically requires a few other estimates and calculations before you will be ready to use this formula. With a cap rate estimate (you can once again use the average cap rate for a city, found here on Mashvisor’s blog), your estimate for expenses, and the value of the property you’re looking at, you can use this formula to find a rough rental income estimate.

Related: Learn How to Calculate Cap Rate for a Rental Property

So, you’ve got a few formulas to use in order to estimate Airbnb rental income. That’s great, but so far we have been using Airbnb data and metric estimates based on city averages. A more accurate method is to look at data for properties in the neighborhood. That’s where Airbnb market research comes into play.

Step 3: Conduct a Comparative Market Analysis

Conducting a CMA, or comparative market analysis, will give you most of the Airbnb data you need to make calculations. With this method, you are able to estimate Airbnb rental income based on Airbnb comps.

Rental comps are properties that are similar in size and other features to the property you are evaluating. They are also located in the same neighborhood. Due to these factors, they make a great benchmark for how valuable the property you’re considering purchasing is.

Airbnb comps give you estimates for the following:

- Property value

- Airbnb occupancy rate

- Average daily rate

Typically, real estate investors will search around for properties that fit the criteria for comparison to the property they want to purchase. Next, they will manually enter all of this information into Airbnb investment analysis spreadsheets and begin compiling estimates to use in their calculations. Finally, they will have to make all of the calculations longhand in order to estimate their Airbnb profit.

Is There a Faster Way to Estimate Airbnb Rental Income?

If all of this sounds like a lot of work, that’s because it is. Not only is it tedious to spend hours searching for and analyzing data, but investors run the risk of losing excellent properties in the meantime. The best investors make the fastest investment decisions because they know that good properties won’t stay on the market long.

Especially as we move into the new year, the US is experiencing a seller’s market with extremely low inventory. This means that if you don’t act fast, you aren’t likely to snag good rental properties. And all of the work you do to analyze properties will go to waste if you can’t make an offer quickly enough.

If you want the best shot at scoring good Airbnb properties, you might be asking: Is there a faster way for real estate investors to estimate Airbnb rental income?

The answer is yes! Luckily, there’s real estate investment software that can do all the work for you; from collecting data to analyzing it and even making complex calculations. The tool you are looking for is called an Airbnb calculator.

The Best Airbnb Calculator

Mashvisor’s Airbnb estimator tool is the best Airbnb calculator for investors. Our tool has everything you need to estimate Airbnb rental income quickly, efficiently, and accurately.

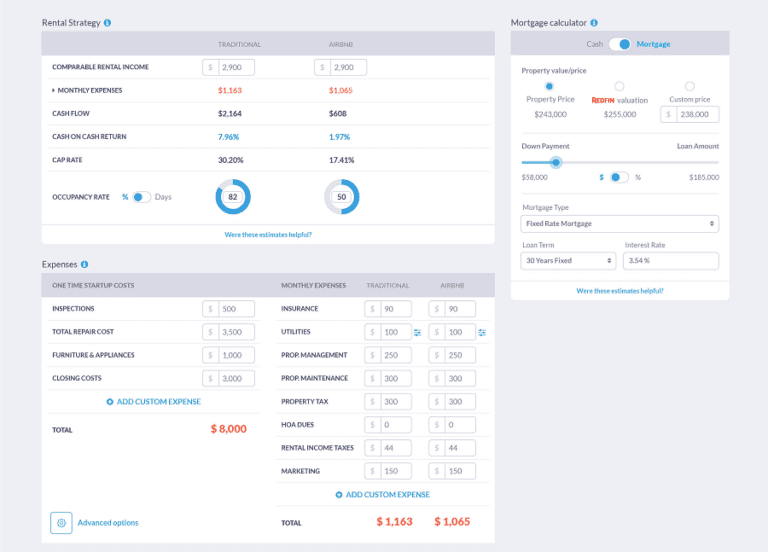

Easily estimate Airbnb rental income with Mashvisor’s calculator.

Not only will you get automatic Airbnb analytics for all of the properties you want to analyze, but you can search for the properties you want right on our platform. It is the best real estate investment tool on the market for Airbnb investors, because it uses highly accurate comps and data to estimate Airbnb rental income, and therefore provides better estimates than any investor could come up with on their own.

Mashvisor’s Airbnb calculator will instantly give you:

- Projected rental income

- Airbnb occupancy rate

- Estimated expenses

- Cash flow

- Cap rate

- Cash on cash return

- Airbnb comps

Our calculator will also determine which real estate investment strategy is best for the property you are analyzing. Some properties may perform better as short term rental properties, while others might actually make more money as traditional rentals.

After a quick search and a few minutes spent on Mashvisor’s software, you will be able to make faster, smarter decisions and beat the competition. Start out your 7-day free trial with Mashvisor now.