When you hear about condemned buildings, I bet the first thing that comes to mind is that these are buildings that need to be razed. And it’s true. Condemned buildings are buildings that local governments have deemed unfit to live in because they violate one or more building codes.

But they can be a good source of positive cash flow for you as a real estate investor looking to build your portfolio. That is if you can spend money and time to bring them back to code. Some of these buildings may already even have tenants who wouldn’t even have to move once work is completed.

What Does It Mean When a House Is Condemned?

Generally speaking, a condemned building is a building that fails to meet the local standards for livable housing and therefore must be vacated within a limited period of time, usually 30 to 60 days. If a house is condemned, it is either scheduled for repairs or, in severe cases, it is demolished. In order for a condemned property to be reoccupied, it must be repaired and inspected.

Why Would the Local Government Choose to Condemn a House?

There are a number of issues that can lead to a building being designated as condemned by the local government. Usually, these issues are concerned with the state of disrepair of the structure, the amenities available, and the ability to withstand natural disasters. Building condemnation can be carried out for several reasons. Some of these reasons are:

- Unsafe or unsanitary conditions such as pest infestation or mold

- Inadequate or nonfunctional utilities such as electricity, running water, gas, etc

- The structure has been abandoned/boarded up for more than 60 days

- The building has severely deteriorated to the point that it is a safety hazard

- The principles of eminent domain allow the government to condemn a perfectly safe house if it is in a location set aside for public projects

Pros of Buying Buildings With a Condemned Sign

For the big-picture real estate investor, condemned properties represent a profitable investment under a veneer of deterioration. A condemned building is usually available for purchase at a sizable discount, due to the fact that there is no competition for them.

A condemned structure might sell for little more than the value of the land. By putting enough time and effort into renovating the property, you can greatly increase its value and make a large profit when you sell it.

Buying Condemned Property – Disadvantages

Condemned buildings may be available at bargain prices but it is important to consider the cost of repairs and effort needed to make the structure market-ready. You should also consider whether you will be able to break even after all the necessary expenses. If the total cost of restoring the structure is much higher than its value, you risk running at a loss.

In certain cases where the condemned building is constituting a nuisance in the neighborhood due to pest infestation or slip and fall incidents, you will be liable and may have to pay compensation.

Also, it is important to note that with condemned properties, unlike other types of real estate, you’re buying from a bank or the government. Hence, the amount of bureaucratic red tape and paperwork you will have to wade through to buy a condemned building is usually considerable.

Should You Buy A Condemned Building?

When you put in the time and effort, a condemned property can be a great addition to your portfolio. It is important, however, to consider the property’s value and rehab costs when negotiating.

How to Buy Condemned Buildings

The process of buying a condemned property is much the same as purchasing any real estate investment. You find your target property, liaise with an agent, and try to make a deal working with a targeted offer.

The difference is that the very nature of condemned buildings means that you will be dealing with banks in the case of foreclosure or the government in the case of eminent domain.

You will have to identify the liens on the property and the specific violations that led to the condemnation. Liens like property taxes and other encumbrances will have to be cleared before moving forward. Ensure that the property is zoned for residential purposes.

Another major hurdle when buying condemned property is finding a lender who is willing to take the risk. Traditional lenders will only provide loans based on the value of the property in its current state. That is, factoring in the value of the land and the condemned property’s current value, without including the costs of rehab or demolition.

Buying a condemned property might require that you forego traditional lenders and go with a private lender who can provide loans based on the future value of the investment after building or rehab.

If you’re working with the existing property, you might need to clear your purchase with the local government using plans that show how you intend to rehabilitate the structure.

Finally, you can purchase the property and start bringing it up to code. You want to spend the barest minimum on repairs while still improving living conditions in the structure. Just enough and maybe a little more to guarantee a favorable return on investment when you hit the market.

How to Find Profitable Properties

Finding condemned properties can be as easy as driving around and looking for buildings with a condemned sign.

Once you find an abandoned building in a suitable location, you can decide to contact the owner about buying the property. You can acquire information about the owner of the home through your county tax assessor. Then, you can contact them with your offer and see their counter offer.

It is possible that your city or county keeps a list of properties that have been condemned. These lists are available online or in their offices.

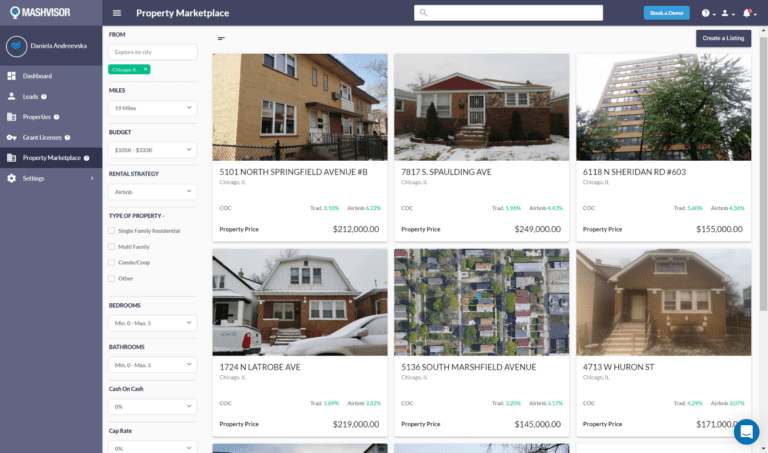

Mashvisor’s property marketplace can also help you find lucrative properties in the US housing market. By entering some basic search criteria, you can analyze possible offers in your chosen location and determine the best rental strategy.

Conclusion

A condemned property might appear to be a worthless investment at first glance but with time and due determination, you can transform the most dilapidated building into a solid cash flow rental.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.