Looking for the best places to invest in real estate in 2021? Considering buying an investment property in the Dallas housing market in 2021?

Then you’ve come to the right place. In this article, you will learn about the most important Dallas real estate market trends and statistics to help you make the right investing decision.

Located in North Texas, Dallas is one of the most populous metropolitan areas in the US. Historically, the city was a very important hub for the cotton and oil industries due to its strategic location along numerous railroad lines. In recent years, Dallas has become one of the hottest destinations in the Texas real estate market.

Why investing in Dallas is a good idea in 2021

Here are some reasons why you should consider buying Dallas rental properties this year:

- Booming economy – Dominant sectors in the diverse economy of Dallas include information technology, financial services, defense, transportation, and telecommunications. The city is home to a number of Fortune 500 companies such as Southwest Airlines, Tenet Healthcare, Energy Transfer Equity, Holly Frontier, and Dean Foods. Though thousands of jobs were lost due to the Coronavirus pandemic, the normal annual job growth rate is about 2.70%. According to a recent report, the Dallas job market fared much better compared to other US cities during the pandemic, and this is a major determinant of the Dallas housing market forecast for 2021.

- Population growth – In terms of population, Dallas is one of the fastest growing metropolitan areas in the US. According to the World Population Review, the current population of Dallas is over 1.3 million, with an annual growth rate of 0.13%. A high population growth means an increased demand for rental property in the Dallas housing market.

- Low cost of living – A strong economy is characterized by high salaries and a low cost of living. As you might already know, there is no income tax in Texas. This is one of the main factors that keep the cost of living low in Dallas. According to PayScale, if someone moved from San Francisco to Dallas, the cost of living would be 43.5% lower and the cost of housing 68.3% lower. Due to the job opportunities and the low cost of living, the Dallas housing market continues to attract thousands of new residents each year, and this trend is expected to continue in 2021 when many tenants face economic pressure as a result of the ongoing pandemic.

- Growth of short-term rentals – Dallas is well-known for its vibrant music and art scene. It is also a place of historical significance, with attractions such as the John F. Kennedy Memorial Plaza. As a result, the city continues to attract thousands of tourists every year. This has led to an increased demand for vacation rentals in the Dallas housing market. According to Mashvisor’s real estate data analysis, the Airbnb occupancy rate in Dallas reached 57% this year.

The good news for real estate investors is that Dallas has no rules and regulations for Airbnb. This makes Dallas one of the most Airbnb friendly cities in the US.

Dallas real estate market trends 2021

What is the condition of the Dallas housing market at the moment? Here are three major real estate market trends to consider if you’re looking for the best location to invest in rental properties in this year:

1. Rising home values

According to Mashvisor’s real estate market analysis, the median home price in the Dallas housing market is $465,534 in 2021. Furthermore, Mashvisor’s analysis shows that the median price of homes for sale in Dallas, TX went up by 21% between January 2020 and October 2020, despite the pandemic. A report by the Real Wealth Network shows that from 2014 to 2020, the average house price in Dallas had gone up by 55%. This is much higher compared to the 36% average real estate appreciation in the US housing market. Real estate investors therefore have an opportunity to build equity much faster with these rising housing prices in Dallas than in other major US markets.

2. Increasing rental price

Real Wealth Network also reports that between 2014 and 2020, the median rent for traditional properties in Dallas increased by 25%. This is higher than the national increase of 23% during this period. With a growing population and a strong employment rate, Dallas housing market predictions 2021 show that rental prices will continue increasing in coming years. Based on Mashvisor’s real estate data, investors make an average of $2,811 per month with long-term Dallas rental properties.

3. Low inventory

According to DallasNews.com, home inventories in Northern Texas are at a record low. At the end of January 2021, only about 7,800 homes were listed by real estate agents, representing a 60% drop in inventory from the previous year. At the same time, there was a strong buyer demand for Dallas investment properties. This situation has fueled a significant increase in real estate prices and turned Dallas into a hot seller’s market.

Impact of the Coronavirus on Dallas housing market trends

Real estate listings and home sales dropped to different degrees across the US in 2020, at least temporarily, due to the expected real estate market crash as a result of the Coronavirus pandemic. However, the Dallas housing market begun to show signs of recovery as soon as July., and by October property prices had recovered and even gotten back on a growth path. In the third quarter of last year, there was an 18.4% year-over-year increase in homes sold in Texas including Dallas. In 2021 there is a great shortage of available homes for sale in the Dallas housing market 2021. Remaining a hot seller’s market is a leading Dallas housing market forecast.

Where to invest in Dallas in 2021

Here are the best neighborhoods for investing in the Dallas housing market in 2021

Looking for the hottest real estate markets in the Dallas housing market? Based on Mashvisor’s data, here are the best places to invest in Dallas income properties in 2021:

Best places to invest in a traditional rental property

#1. Cedar Crest

- Median Property Price: $216,413

- Price per Square Foot: $141

- Price to Rent Ratio: 15

- Monthly Traditional Rental Income: $1,234

- Traditional Cash on Cash Return: 3.94%

#2. Southeast Dallas

- Median Property Price: $200,565

- Price per Square Foot: $140

- Price to Rent Ratio: 13

- Monthly Traditional Rental Income: $1,250

- Traditional Cash on Cash Return: 3.62%

#3. Dells District

- Median Property Price: $269,805

- Price per Square Foot: $125

- Price to Rent Ratio: 14

- Monthly Traditional Rental Income: $1,611

- Traditional Cash on Cash Return: 3.53%

#4. Five Mile Creek

- Median Property Price: $234,269

- Price per Square Foot: $152

- Price to Rent Ratio: 16

- Monthly Traditional Rental Income: $1,257

- Traditional Cash on Cash Return: 2.92%

Best places to invest in an Airbnb Dallas property

#1. Southeast Dallas

- Median Property Price: $200,565

- Price per Square Foot: $140

- Average Airbnb Daily Rate: $192

- Monthly Airbnb Rental Income: $2,555

- Airbnb Cash on Cash Return: 7.20%

- Airbnb Occupancy Rate: 61%

#2. Five Mile Creek

- Median Property Price: $234,269

- Price per Square Foot: $152

- Average Airbnb Daily Rate: $127

- Monthly Airbnb Rental Income: $2,452

- Airbnb Cash on Cash Return: 5.52%

- Airbnb Occupancy Rate: 55%

#3. Northeast Dallas

- Median Property Price: $396,576

- Price per Square Foot: $214

- Average Airbnb Daily Rate: $137

- Monthly Airbnb Rental Income: $3,187

- Airbnb Cash on Cash Return: 4.19%

- Airbnb Occupancy Rate: 16%

#4. Urbandale-Parkdale

- Median Property Price: $305,615

- Price per Square Foot: $168

- Average Airbnb Daily Rate: $162

- Monthly Airbnb Rental Income: $2,287

- Airbnb Cash on Cash Return: 3.83%

- Airbnb Occupancy Rate: 62%

How to find the best Dallas investment property in 2021

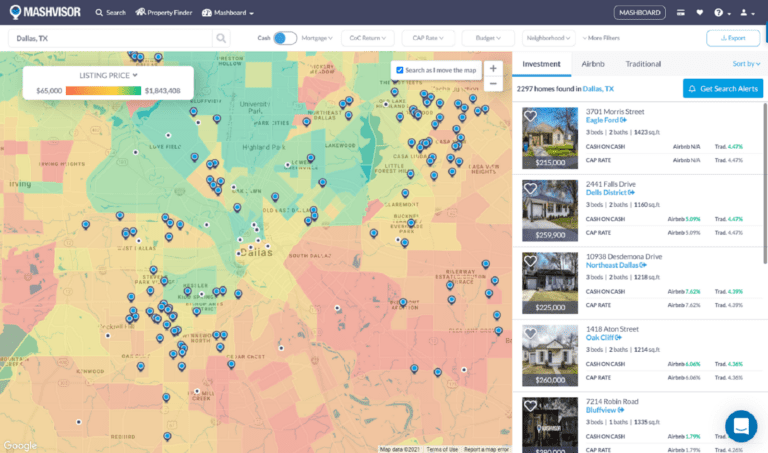

Finding the best Dallas, Texas houses for sale is easy with Mashvisor’s real estate investment tools. The real estate heatmap will help you find the best neighborhoods in the Dallas housing market 2021 for buying investment property. It works as a color-coded home values map which will highlight the neighborhoods within our budget. Moreover, it will show you which areas will generate the highest traditional or Airbnb Dallas rental income, traditional or Airbnb cash on cash return, and Airbnb occupancy rate, based on our Dallas forecast.

Mashvisor’s Heatmap: Listing Prices in the Dallas Housing Market

Once you’ve selected a few neighborhoods which match your investment criteria, you can search for the most lucrative long-term or short-term rental properties in them with a few clicks of a button. To find the most affordable off market properties in specific, check out the Mashvisor Property Marketplace.

Related: How to Find Off Market Properties for Investment in 2021: 5 Ways

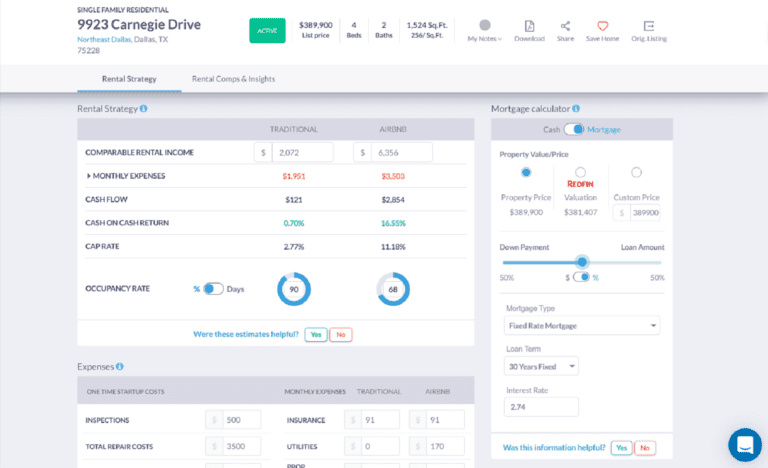

Finally, you can analyze the return potential of Dallas rental properties using the Mashvisor investment property calculator. This tool will provide you with estimated one-time start up costs and recurring monthly expenses, traditional and Airbnb rental income, occupancy rate, cash flow, cap rate, and cash on cash return. All these numbers are based on real estate comps and rental comps in the area, which makes them very reliable and trustworthy.

Mashvisor’s Investment Property Calculator: Analysis of a Dallas Rental Property

Conclusion

With the release of the Covid-19 vaccine, most Dallas housing market predictions 2021 show that the average house price will increase. This means you should start your market analysis and property search soon, before home values have gone too high. According to Mashvisor’s data analytics, if you are looking for a profitable investment in the 2021 US housing market, you cannot go wrong with Dallas, Texas.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today and enjoy 15% off for life.