Using Mashvisor’s latest data, we found the top 10 fastest growing rental markets in the US. Discover which cities made the list and why.

Purchasing a property in an area that is not growing economically would cause a negative impact on your investment. It can be difficult to determine if a specific location will be a profitable place to buy an investment property. A great way to help limit your location search is by looking at neighborhoods with an increase in population. Population growth is always one of the most reliable factors to look at when determining if an area will be a profitable location for an investment property.

This article will look at the fastest growing rental markets in the US this 2022. Continue reading to learn about the best places to buy rental property this year.

Where Should I Look for Investment Properties?

Though there are plenty of locations that could be profitable for your short-term rental property, Mashvisor has collected data from reliable sources such as Airbnb and Multiple Listing Services (MLS) to determine what areas will be the best place to invest in real estate in 2022. Below are some of the best rental markets to consider investing in:

Related: This Heatmap Will Show You Where to Invest in Real Estate

1. Charlotte, North Carolina

- Traditional Rental Income: $1,938

- Traditional Cash on Cash Return: 1.93%

- Median Property Price: $545,589

- Average Price per Square Foot: $318

- Price to Rent Ratio: 23

- Days on Market: 100

- Walkscore: 34.72

Charlotte, North Carolina can be an excellent place for an investment property as the cities population is steadily increasing and mortgage rates are staying low. This makes it convenient for investors looking for a property that is guaranteed to make a high return on investment. Many are in search of a property to stay at in Charlotte as it is becoming a desirable location to both live in and travel. Any style of investment property, such as a traditional house or an apartment-style rental would perform well in Charlotte.

2. Houston, Texas

- Traditional Rental Income: $1,998

- Traditional Cash on Cash Return: 2.08%

- Median Property Price: $589,578

- Average Price per Square Foot: $299

- Price to Rent Ratio: 25

- Days on Market: 128

- Walkscore: 39

Houston, Texas is one of the fastest growing rental markets in the US and is a great city for an investment property this 2022 as the city has extremely low-interest rates. This makes it fairly affordable to live in. If you plan to invest in real estate, purchasing a property in Houston and taking advantage of its low-interest rates can help contribute to a more profitable investment.

Related: The Best Rental Markets in Texas: The 2022 Guide

3. Sarasota, Florida

- Traditional Rental Income: $2,621

- Traditional Cash on Cash Return: 2.42%

- Median Property Price: $969,702

- Average Price per Square Foot: $479

- Price to Rent Ratio: 31

- Days on Market: 67

- Walkscore: 50

Consider investing in Sarasota, Florida if you are looking for a profitable location. Though there are not many homes available in Sarasota, if you can get your hands on one it can turn into an extremely profitable investment. People from all over are seeking properties to rent or purchase in Sarasota so finding a renter would not be an issue. Additionally, Sarasota is close to other desirable areas in Florida such as Tampa and Fort Myers.

Related: Sarasota Housing Market Forecast 2022: Should You Invest?

4. Orlando, Florida

- Traditional Rental Income: $1,699

- Traditional Cash on Cash Return: 2.72%

- Median Property Price: $426,921

- Average Price per Square Foot: $256

- Price to Rent Ratio: 21

- Days on Market: 72

- Walkscore: 43

Another one of the fastest growing rental markets in the US and a great location to buy an investment property in is Orlando, Florida. Its real estate is booming and experts predict that the properties will continue to appreciate in value. Plus, the beautiful weather and year-round sunshine have always attracted people who have been sick of living in colder regions to move to cities like Orlando.

5. Buckeye, Arizona

- Traditional Rental Income: $1,894

- Traditional Cash on Cash Return: 2.67%

- Median Property Price: $485,611

- Average Price per Square Foot: $251

- Price to Rent Ratio: 21

- Days on Market: 28

- Walkscore: 71

Buckeye, Arizona is becoming a very popular area this 2022. This suburb is only a 45-minute drive from Phoenix. This means people looking for a place to live who work in the city will be in search of a home here. Homes are selling quickly in Buckeye, only being on the market for an average of 28 days. If you are considering Buckeye for a real estate investment, you will have to move quickly to get your hands on a property.

6. Chico, Texas

- Traditional Rental Income: $1,123

- Traditional Cash on Cash Return: 2.32%

- Median Property Price: $299,044

- Average Price per Square Foot: $183

- Price to Rent Ratio: 22

- Days on Market: 1

- Walkscore: 24

Chico, Texas is another great location to buy an investment property. Though this town is fairly small, it is not a far drive away from Dallas and Fort Worth. This makes it an excellent location for travelers looking to visit the larger cities in Texas but want to stay somewhere quieter.

7. Floral City, Florida

- Traditional Rental Income: $1,253

- Traditional Cash on Cash Return: 2.53%

- Median Property Price: $345,688

- Average Price per Square Foot: $210

- Price to Rent Ratio: 23

- Days on Market: 71

- Walkscore: 44

One of the rapidly growing rental markets in the US is Florida. Consider looking into Floral City, Florida for an investment property this 2022. Floral City is a great location as the city offers a lot of historical attractions. Floral City is also near Tampa and Orlando, making it an ideal location for tourists in need of a place to stay when visiting the surrounding cities.

8. Hickory, North Carolina

- Traditional Rental Income: $1,266

- Traditional Cash on Cash Return: 2.82%

- Median Property Price: $341,716

- Average Price per Square Foot: $156

- Price to Rent Ratio: 23\

- Days on Market: 79

- Walkscore: 35

If you are an investor trying to find a profitable location for your investment, look at Hickory, North Carolina for buying rental property. The city is just a short drive away from Charlotte, making it one of the best locations to purchase an investment property. People intending to move to the area as well as visitors will be in search of a property. Hickory provides access to all the attractions in Charlotte without directly living in the city itself.

9. Colorado Springs, Colorado

- Traditional Rental Income: $1,677

- Traditional Cash on Cash Return: 2.56%

- Median Property Price: $507,230

- Average Price per Square Foot: $274

- Price to Rent Ratio: 25

- Days on Market: 48

- Walkscore: 28

Colorado Springs is located in the heart of Colorado, and just a short way away from Denver. Consider investing in Colorado Springs if you are looking for an investment property. Colorado Springs is home to many winter attractions such as larger ski mountains. This can attract tourists looking for a place to stay especially in the winter.

10. Palm Springs, California

- Traditional Rental Income: $3,446

- Traditional Cash on Cash Return: 2.91%

- Median Property Price: $974,224

- Average Price per Square Foot: $487

- Price to Rent Ratio: 24

- Days on Market: 80

- Walkscore: 59

The last city in our top 10 fastest growing rental markets in the US is Palm Springs, California. Palm Springs is a large tourist area right in between Los Angeles and San Diego. Many people are looking to visit Palm Springs and this can be a great area for investors in search of an investment property.

How Can I Find Properties in These Areas?

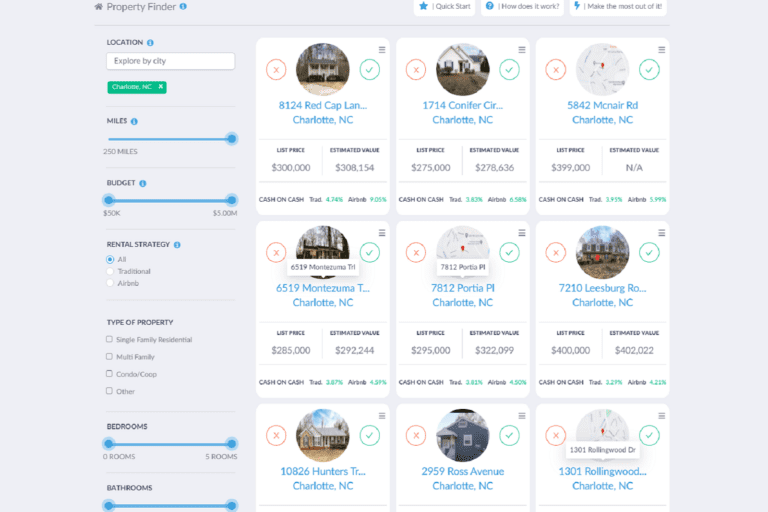

Now that we’ve looked at some of the fastest growing rental markets in the US, you might be interested in finding properties in these areas. Using Mashvisor’s Property Finder tool can help investors locate the best place to buy rental property. It is easy to use and lets investors to filter through properties in any location based on their specific wants and needs for an investment property. Some specific filters investors can change to find their perfect property are:

- Location

- Budget

- Property Type

- Rental Strategy ( Traditional vs Airbnb)

- Number of Bedrooms

- Number of Bathrooms

Mashvisor’s Property Finder is an excellent tool to use to buy investment properties in the fastest growing rental markets in the US.

Use Mashvisor’s Property Finder tool to search for and purchase investment properties in the fastest-growing rental markets across the US.

Strategies for Investing

Investing in real estate can be tricky. While finding properties in the fastest growing rental markets in the US can be difficult, there are many tips and tricks investors use to ensure they are making the best investment decisions. Below are some of the most useful investing tips:

BRRRR Strategy

The BRRR strategy refers to the buy, rehab, rent, refinance and repeat the method. This method is typically used when investors purchase a property to flip it, then rent it out, and then get a cash-out refinancing on the property. This strategy is popular in many of the fastest-growing rental markets in the US as it increases investment profits, which can be used to do the BRRRR method again.

Buy and Hold Real Estate Strategy

The buy and hold real estate strategy is a method used by investors where they purchase a property and hold that property for a long period of time. During this time they rent out the property until they feel ready to sell it again. Typically, investors wait until they can sell the property for much more than they purchased it for, and in the meantime, they rent it to generate a rental income. Investors will calculate cap rate when they are ready to sell the property to ensure they are making money on their investment. The buy and hold real estate strategy is another popular method practiced by investors in the fastest growing rental markets in the US.

How Can I Make Sure My Property Will Be Profitable?

Though you may think you have all of the information needed to make sure your property will generate an income, the best way to ensure your investment will be profitable is by using Mashvisor’s Investment Property Calculator. The investment property calculator lets investors use their own numbers to fine-tune the costs within their investment. This calculator provides investors with information such as calculated property tax, predicted maintenance, and interest rates to help them figure out a budget for their investment. It also functions as an Airbnb calculator for those interested in starting a short-term rental business.

Conclusion

In order to make money in real estate, it is essential to invest in one of the fastest growing rental markets in the US. investing in an area in which many people are leaving, or a location with no attractions to draw tourists will limit the amount of money you will make on your real estate investment. Finding an area with a growing population or many attractions will be the best decision to increase your investment. Though it can be difficult to locate profitable areas, Mashvisor offers tools to help guide investors through their investment journey. To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.