Investing in a multi family home can be a great way to make money in real estate. Whether it’s a duplex, triplex, or fourplex, this type of real estate property can help you realize a consistent stream of income and even achieve financial independence. However, this does not mean that you can just settle for any multi family home for sale. You need to make sure to find one that promises a positive cash flow. Having positive cash flow means having money left as a profit after paying all your property expenses using your collected rent.

So, how can you find positive cash flow multi family homes for sale? This is what we will show you in this article. Keep reading to find out all the steps involved as well as all the investment property search tools you’ll need.

1. Find a Good Real Estate Market for Multi Family Rentals

Before you can even start looking for positive cash flow multi family homes, you must first do some research in order to find a good real estate market for buying multi family homes. Although you might find it more convenient to buy an investment property in your local housing market, it is possible that where you live is not the best multi family market. So, take the time to research different markets regardless of their proximity to you.

Related: How to Research Real Estate Markets: The Beginner’s Guide

But, what makes for a good multi family market? Well, there are a number of characteristics that the best multi family markets usually have in common. First, affordability. It’s almost impossible to find positive cash flow multi family homes in a high-cost market, mainly due to the higher mortgage payments that come with buying expensive homes. So, if you want to find positive cash flow multi family homes, you should search for a market with affordable property prices, as this will lower your mortgage payments.

The second characteristic that the best real estate markets have in common is the demand for multi family homes. After all, you want tenants for your multi family home so you can secure a consistent rental income and cover your expenses. You should, therefore, look for a market where multi family homes are the most sought-after.

Other factors that point to a good real estate market for investing in multi family homes include population growth, economic growth, job growth, and low property taxes. You must, therefore, carefully do your research in order to find a market that has all those characteristics.

2. Identify the Best Neighborhood

Once you’ve picked your housing market of choice, you have to find the neighborhood which offers the best opportunities for cash flow investing. In fact, not all neighborhoods within a city make for good real estate investment locations. Property prices and rental income vary from neighborhood to neighborhood, and so does the rental property cash flow. So, in order to find positive cash flow multi family homes, you need to do a neighborhood analysis over the whole areas of the city and identify the best neighborhood for cash flow investment.

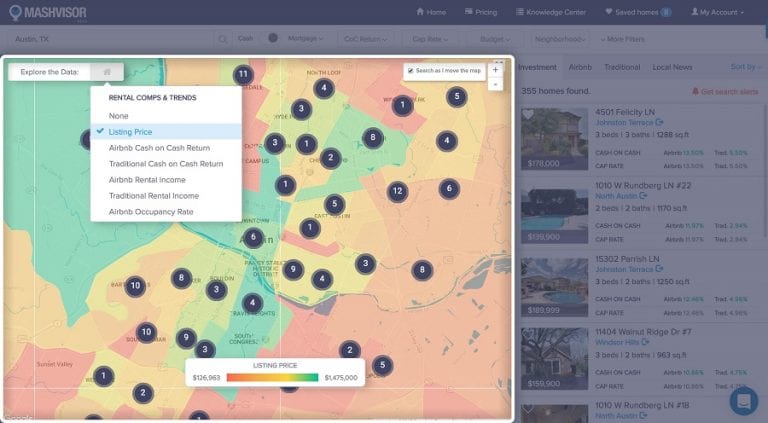

How do you do a neighborhood analysis quickly and efficiently? Use Mashvisor’s heatmap analysis tool. This is a real estate investor’s best friend when it comes to finding positive cash flow multi family homes. You simply have to type in the name of your desired city, and you will get an overview of all the neighborhoods there. Once you click the “Explore Data” button, you’ll see different filters that, once selected, will highlight the neighborhoods in different colors depending on their investment potential. Using the different filters that are available to you, you can then analyze the city’s neighborhoods in terms of the following metrics:

- Listing Price

- Traditional and Airbnb Rental Income

- Traditional and Airbnb Cash on Cash Return

- Airbnb Occupancy Rate

To locate the neighborhoods where you can find positive cash flow multi family homes, play around with the filters to see which areas on the map rank high (highlighted in green) and which ones rank low (highlighted in red). If you sign up for an Expert Plan with Mashvisor, you’ll also be able to set the multi family property search filter. That way, you will only see multi family homes for sale on the heatmap. You want to find an area with multi family homes for sale with a relatively low listing price and a high rental income, occupancy rate, and cash on cash return. This combination points to a neighborhood with positive cash flow multi family homes.

Related: Real Estate Heat Map: A Revolutionary Tool for Neighborhood Analysis

3. Narrow Down the Investment Properties

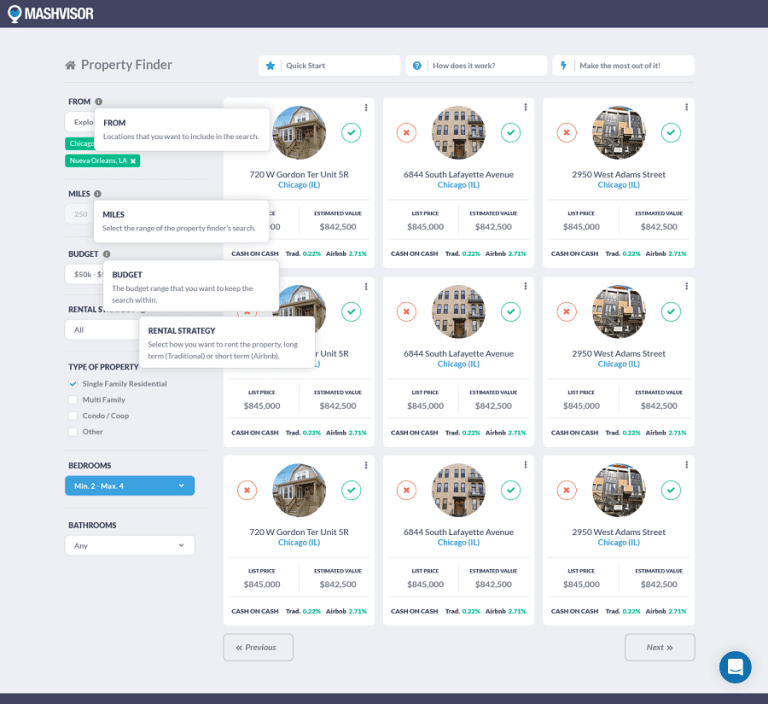

At this point, you’ve found a good neighborhood for cash flow investment, with possibly dozens of investment properties listed for sale. Now, your job as a real estate investor is to narrow down the properties to those that fit your property type (i.e. multi family real estate), your budget, and other important criteria. For this, you can use Mashvisor’s rental property finder tool.

This tool finds investment properties with a high ROI in your chosen location based on your search criteria. All you have to do is set your search criteria using the different filters available. These filters include the following:

- Property Type: By default, Mashvisor shows you all the types of investment properties it finds in your location of choice, from condos to townhouses to single family homes. To narrow things down, set the filter to multi family homes only.

- Budget: Set a range for your budget to keep your investment property search within. The tool will filter out any multi family homes that are too high above your target price.

- Rental Strategy: Select the rental strategy that you would like to adopt once you buy a multi family home: traditional (long-term) renting or Airbnb (short-term) renting.

- Bedrooms and Bathrooms: Specify the number of bedrooms and bathrooms that you would like your multi family home to have.

Once you set all these filters, the rental property finder will display a list of the best performing multi family investment properties that match your criteria.

Related: How to Use Mashvisor’s Investment Property Deal Finder

4. Analyze the Investment Properties

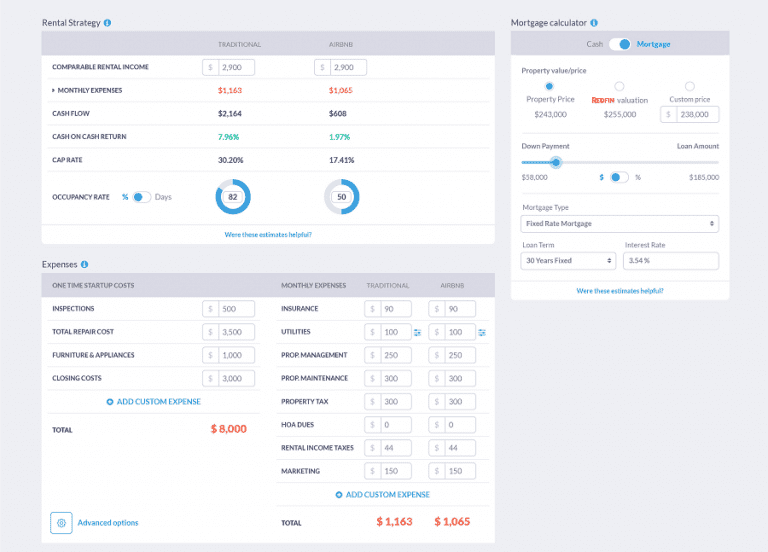

Your property search isn’t over yet. Finding a number of multi family homes that match your criteria isn’t a guarantee that you will end up with a positive real estate cash flow investment. You still need to do a multi family cash flow analysis to find the property that has the highest potential for profit. And to do this analysis, you need another one of Mashvisor’s tools: the multi family investment calculator.

The multi family investment calculator is probably the most important tool for finding positive cash flow multi family homes. It provides you with all the numbers you need to evaluate a multi family property’s profitability. To use it, click on a property listing you’re interested in, and you’ll be directly taken to Mashvisor’s calculator. Select your method of financing (cash or mortgage loan) and, if you’re using a loan, specify your loan details. Once you input this information, the calculator calculates the following values based on historical and predictive data from the local housing market:

- Rental Expenses: The calculator provides accurate estimates of all the monthly rental expenses associated with buying and renting out the multi family property, whether as a traditional rental or an Airbnb rental. These values are all customizable, meaning you can adjust them to fit the analysis to your particular situation.

- Rental Income: The investment calculator also provides an accurate projection of the monthly rental income that the multi family home is expected to bring, in the case of both long term renting and short term renting. Here also, the rental rate can be adjusted if you ever think you have a better estimate.

- Cash Flow: The calculator calculates the rental property’s cash flow by subtracting the rental expenses from the rental income. This is where you get to see if your target property is a good investment in terms of cash flow. Remember, the best cash flow investments are positive cash flow properties.

- Return on Investment: Lastly, the calculator provides an estimation of the rate of return that you can expect from the multi family home. The ROI metrics it calculates include traditional and Airbnb cash on cash return, traditional and Airbnb cap rate, and traditional and Airbnb occupancy rate.

You can then get this analysis on the other multi family homes for sale and eventually decide which one of them has the best potential for profit.

Related: How to Use an Investment Real Estate Calculator in 2020

There you have it, how to find positive cash flow multi family homes. Although it may seem challenging to find such properties, remember that these are the investment properties that will bring you money. If you follow the steps outlined above, you’ll eventually find the best multi family homes for sale to buy. Make sure to check out Mashvisor to get your hands on our tools and start your property search right away.

Start out your 7-day free trial with Mashvisor now.