Real estate investing is a great way to make money and secure your financial future. However, to ensure that you only buy profitable investment properties, you will need to look at the numbers. This means that you need to know how to calculate the rate of return on a rental property and other metrics. One important return on investment (ROI) metric you need to take into consideration is cap rate. In this article, we are going to go through what cap rate is and the right way to conduct a cap rate analysis.

What Is Capitalization Rate (Cap Rate)?

Cap rate refers to the ratio of the net operating income (NOI) of an investment property to its purchase price or fair market value. The cap rate analysis formula does not take into account leverage. It shows the expected profitability of a rental property when paid for fully in cash.

Here’s the cap rate formula:

Related: What Is a Cap Rate and How Do You Calculate It?

What Is a Good Cap Rate for Rental Property?

You now know how to calculate cap rate. But for you to effectively do your cap rate analysis, you ought to understand what the percentages you get actually mean. What is a good cap rate for rental property? Is a higher cap rate better?

Well, generally, anything between 8% and 12% could be a good cap rate. However, what is considered a good cap rate will vary slightly depending on different factors such as location, property type, and rental strategy.

A higher cap rate is not always better. You have to understand that, in theory, a higher cap rate means that the real estate investment is riskier. As a real estate investor, you should assess the level of risk you are willing to take on to avoid losing money. For instance, the cap rate for multi family homes within a housing market is typically lower because they are associated with a lower level of risk.

The best cap rate analysis is one that is used to compare very similar investment properties. Comparing the cap rates of properties in different real estate markets or different types of property is not very useful.

Related: What Is a Good Cap Rate for Rental Property in 2020?

So, how do you analyze a cap rate before buying a rental property? Let’s now look into how to do a cap rate analysis.

The Cap Rate Analysis Process

1. Find Cap Rates by City

The first step to finding a rental property with a good return on investment is to analyze the real estate market. Therefore, in our cap rate analysis process, we first have to assess the cap rates by city. In other words, you need to determine the best performing housing market in terms of cap rate.

The quickest and easiest way to find cap rates for cities in the US housing market is to check for city data on Mashvisor’s real estate investment blog. Mashvisor collects data on both Airbnb and traditional investment properties in US housing markets. Our database has listings taken from Zillow, MLS, Airbnb, and many other resources which makes our cap rate estimates by city more accurate. Cap rates of all individual listings in our database are obtained and a market average is calculated. You can know the cap rate for a real estate market by simply searching for its name on our blog. A list of blogs with city data and insights will likely pop up.

2. Conduct a Neighborhood Analysis Using the Heatmap Tool

After choosing a real estate market with a good average cap rate, the next step of your cap rate analysis is to narrow down your market search by finding the best neighborhood in the city in terms of cap rate.

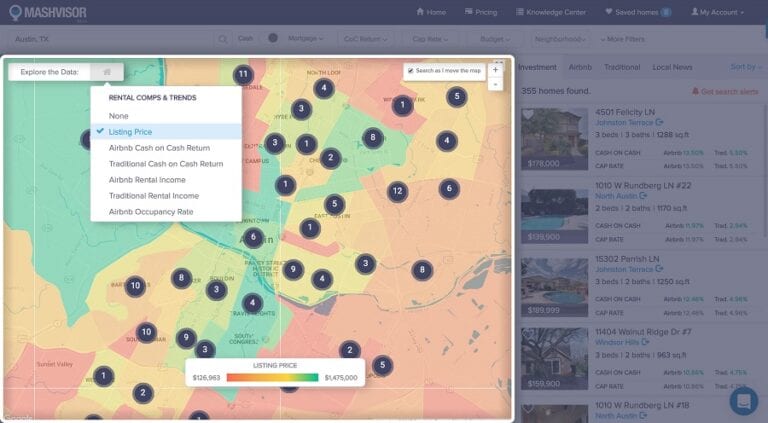

You may have already found a list of the best neighborhoods in your city of choice on our blog page. If you haven’t, you can access this information through our heatmap analysis tool. Mashvisor’s heatmap tool offers readily available data for each neighborhood.

But how do you use our heatmap analysis tool for your cap rate analysis? It’s very simple. You simply search for the city you wish to analyze further and set “cash on cash return” as your filter. Since the heatmap analysis tool doesn’t take into account your financing method (you can use other filters on the platform to account for this), the cap rate and cash on cash return for locations are equal.

The tool will then use different colors to display the projected data for the neighborhoods in the selected real estate market. The colors will show the performance of the neighborhoods in terms of cap rate, which will range from red to orange to green, with red showing low-cap rate areas and green showing high-cap rate areas. If you wish, you can use a number of other filters such as property price, rental income, and Airbnb occupancy rate, to further customize your results.

Related: Heatmap Analysis: The Secret to Successful Real Estate Investing

3. Use the Cap Rate Calculator

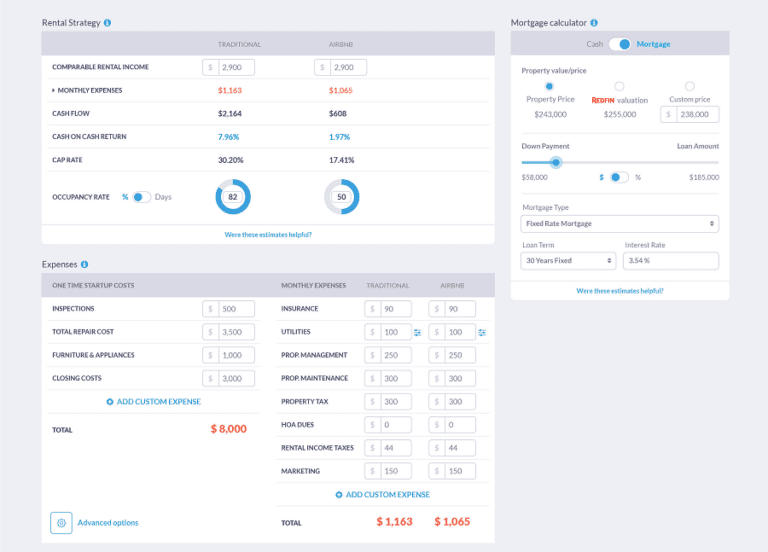

After selecting a profitable neighborhood, you can narrow down your cap rate analysis further to find high cap rate properties for sale in that neighborhood. While using the cap rate formula to calculate the cap rate of a single property may be easy, manually calculating the cap rates of multiple houses in a neighborhood can be overwhelming. Some people may use a basic cap rate analysis spreadsheet to calculate and compare cap rates for different properties. Well, an Excel spreadsheet may ease your cap rate analysis. However, it’s usually not very accurate and can be time-consuming. So, how can you calculate cap rate quickly and easily? Use our cap rate calculator!

Related: Why an Investment Property Calculator Is Better Than Spreadsheets

Our cap rate calculator, which also functions as an Airbnb calculator, uses big data and predictive analytics to provide you with reliable estimates of cap rates and other important metrics for investment properties for sale in a matter of minutes. It also allows you to check for real estate comps. The cap rate calculator is a must-have tool for any real estate investor looking to optimize their cap rate analysis.

The Bottom Line

The goal of every real estate investor is to get a good return on investment. Cap rate being one of the important ROI metrics used to analyze investment properties, you should know how to properly conduct a cap rate analysis. How you conduct your cap rate analysis will determine how good your investment decisions will be. Be sure to use Mashvisor’s real estate investment tools to make this process more efficient and accurate.

Start out your 7-day free trial with Mashvisor now.