Every real estate investor has heard it before. “Here is the secret to successful real estate investing!” “The ONE thing every real estate investor needs, right here!” These are the kind of bold claims that turn out to be clickbait for real estate investors more times than we can count.

So, when we say we actually have the secret to successful real estate investing, we mean it. And we can back it up, too. The secret? Using heatmap analysis to find investment properties. Not just any investment properties, but the best real estate investment properties out there. Why is this the secret to successful real estate investing that trumps any other claim to the title?

- It is actually somewhat of a secret. Not many real estate investors utilize heatmap analysis to find investment properties.

- Heatmap analysis will actually lead to successful real estate investing- we’ll show you how.

What is Heatmap Analysis Anyway?

Because it happens to be the secret to successful real estate investing, you may not know exactly what heatmap analysis is, specifically when it comes to real estate investments. But you probably know what a heatmap is. A heatmap is a kind of tool that can be used in many different industries besides real estate investing. It’s essentially a colored map with different colors representing different forms of data and values.

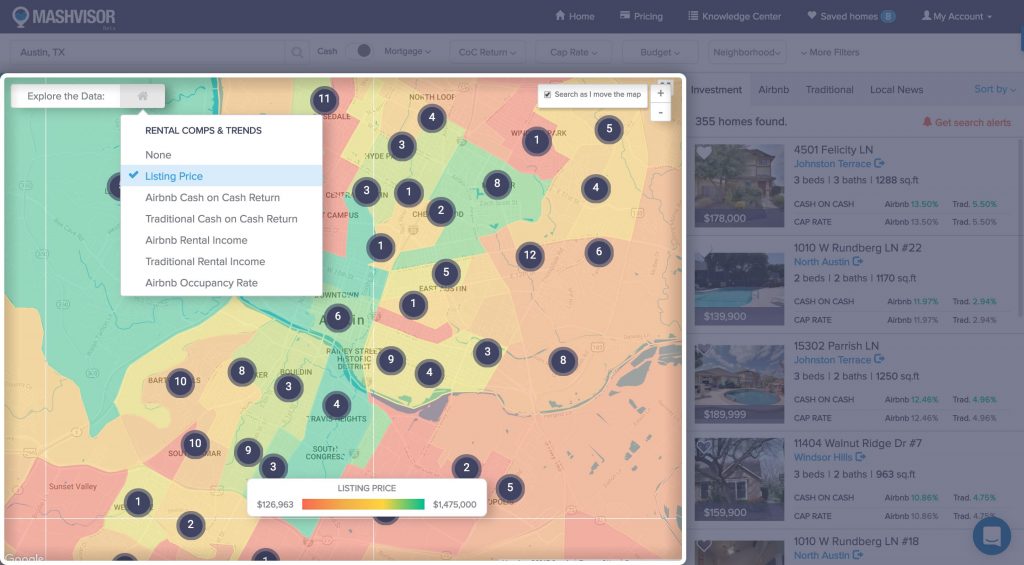

Never come across a heatmap for real estate investment properties, have you? Or maybe you have heard of heatmap analysis but never put it to good use. Well, heatmap analysis in real estate investing is looking at a heatmap that shows key real estate metrics and data in order to find the best real estate investments in the best real estate markets. These real estate metrics include average cash on cash return, rental income and median listing price for different real estate markets, right down to the neighborhoods. These are all essential to finding the best real estate investment properties to get the highest return on investment possible.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

All of this is done with the simplicity of looking at colors on your part as the real estate investor and the complexity of using traditional and predictive analytics on the part of the real estate investment tools that bring you heatmap analysis. What does this mean? This means rather than sifting through tons of data brought to you by traditional and predictive analytics, you get to simply look at different colors and find investment properties with heatmap analysis that make a lot of money!

Related: Finding Income Properties Using a Heatmap

Where Can You Find Real Estate Investment Tools to Perform Heatmap Analysis?

Every real estate investor wants the highest return on investment and you need heatmap analysis to find that in any real estate market. You need the real estate investment tools to do so, then. The only place that you can find these real estate investment tools that have been hiding the secret to successful real estate investing is Mashvisor. Big surprise, we know. But this isn’t just another real estate investing platform’s attempt to persuade you. This is the actual secret to successful real estate investing. Let’s take a look at how successful real estate investors use Mashvisor’s heatmap analysis to find investment properties (single family and multi family homes!).

How to Perform Heatmap Analysis to Find Investment Properties

What does a heatmap for real estate investing even look like?

The first thing you may notice is that heatmap analysis can be performed for both traditional and Airbnb investment properties. This means, even if a real estate investor hasn’t decided which real estate investment strategy to go with just yet, heatmap analysis can help with choosing the optimal rental strategy depending on the real estate market.

How? Let’s start at the beginning of heatmap analysis.

Choose a Real Estate Market

First, you have to decide what real estate market you want to invest in. This can be done with the same platform. Take a look at the return on investment metrics (cash on cash return, cap rate, median listing price, Airbnb occupancy rate, etc.) of different real estate markets and choose the best one for you.

Related: What Makes for the Best Place to Invest in Real Estate?

Listing Price of Investment Properties

Next, take a look at the heatmap for the real estate market of your choice. For Mashvisor’s heatmap, click explore data. This gives you the option to look at the different metrics. For example, in the image above, the heatmap analysis is focused on the listing price. The locations with the highest listing price for investment properties in Austin, TX are marked in green. The locations with the lowest listing price for investment properties are in red. In this way, heatmap analysis helps a real estate investor choose a location that will have an investment property that fits within his/her budget.

Cash on Cash Return

Cash on cash return is arguably one of the most important return on investment metrics for finding the best real estate investments. With heatmap analysis, you don’t have to worry about how to calculate cash on cash return, but let’s look at the cash on cash return formula anyway in case you’re new to real estate investing:

Cash on Cash Return = Annual Cash Flow/Cash Investment

If you haven’t already made up your mind whether you want to go with traditional or Airbnb investment properties, cash on cash return can help. Simply select the Airbnb cash on cash return, use the Airbnb calculator, and take a look at the kind of cash on cash return you can get in that real estate market. What kind of traditional cash on cash return can you get in those same neighborhoods? Heatmap analysis will let you see which rental strategy will bring the higher cash on cash return in the location, making the decision easier.

To start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.

Rental Income

Want to know how much money you’ll be making in real estate on a monthly basis? With heatmap analysis, you can know before you even invest in real estate. Select either the Airbnb rental income or the traditional rental income option. View the locations with the highest rental income (in green) and the highest traditional rental income.

Based on your choice of rental strategy, your budget, the cash on cash return, and the rental income, heatmap analysis has essentially led you to the exact place in the real estate market where you can get the highest return on investment.

Of course, successful real estate investors know that with Airbnb investment properties, you should also review the Airbnb occupancy rate.

Airbnb Occupancy Rate

The final part of heatmap analysis for Airbnb investment properties is looking at the different Airbnb occupancy rate for different neighborhoods. Again, the highest Airbnb occupancy rate is in green, the lowest in red.

For more information on how to use heatmap analysis tools, visit our help center.

Truly the Secret to Successful Real Estate Investing?

At this point, heatmap analysis would be complete and you’d have in front of you different investment properties to choose from (using a rental property calculator hopefully). In this way, you’ll have found the best real estate investment properties. Why are they truly the best? These investment properties will have:

- A listing price within your budget

- High cash on cash return

- High rental income

- High occupancy rate

If those four things don’t spell successful real estate investing, then we must speak different languages. Heatmap analysis is truly the secret to successful real estate investing. End of story.

Sign up with Mashvisor to start using heatmap analysis for real estate investing with a free trial. You won’t be sorry.

Related: How to Find the Best Investment Property Using a Heatmap