So, you’ve decided to buy a rental property after learning how profitable this real estate investment is? Not so fast – one thing every beginner in this business needs to understand is that not just any property can make profits. And because we don’t want you to invest in real estate property that’s not worth your time or money, we’re here to teach you how to calculate annual rate of return for rental property. What is the rate of return, you’re asking?

The return on investment (ROI) is a popular metric that real estate investors use to analyze properties and evaluate their performance in the current housing market. Essentially, the rate of return measures how much money the property is expected to make compared to the cost of the investment (how much money you’ve invested). In other words, it gives you a percentage which indicates how lucrative this property is/will be compared to others in the market.

Now you see why it’s important for a real estate investor to know how to calculate annual rate of return. It gives you the assurance that investing your money in real estate will bring profits AND helps you identify the best investment property for sale. In addition, if you already own a rental property, calculating ROI is a great way to check up on how your investment is performing. If you don’t know how to calculate the expected rate of return for rental properties, just keep reading.

The ROI Formula for Rental Properties

The real estate return on investment is always expressed as a percentage or a ratio. To calculate it, you take the dollar amount of your annual return and divide it by the dollar amount of capital you paid for the investment. Your annual return is simply your monthly rental income multiplied by 12. So, the ROI formula for real estate investing is as follows:

Learn more: The Real Estate Investor’s Guide to the ROI Formula

Learn more: The Real Estate Investor’s Guide to the ROI Formula

For example, if you own a rental property that generates $10,000 annual return and it cost you $150,000 to acquire this property, your annual rate of return on investment is 6.6%. Pretty simple, right? However, this formula is only good when you’re doing a back-of-the-envelope calculation. Meaning, it’s a quick way to get a rough estimation of the expected rate of return.

Calculating an accurate ROI for an investment property can be challenging as you can include or exclude certain variables in the calculation. Furthermore, if you have the option of paying cash or taking out a mortgage on the property, the rate of return will vary (drastically). This is why real estate investors rely on two other methods to calculate the rate of return for rental properties – the cap rate method and cash on cash return method.

How to Calculate Annual Rate of Return for Cash Deals

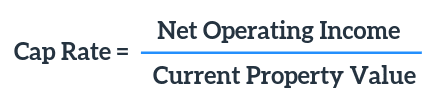

If you find an investment property for sale that you’re planning on buying fully with cash, you’ll have to use the cap rate method to analyze its profitability. Simply, it’s the ratio between the property’s sale price (its current market value) and it’s net operating income (annual return minus all operating expenses). So, the formula to calculate the cap rate is:

Here’s an example of how to calculate annual rate of return using the cap rate method. Say that you:

- Buy an investment property for $150,000 with cash

- Spend $12,000 on closing costs plus remodeling (total cost of investment = $162,000)

- Rent it out for $1,500 per month (annual return = $18,000)

- Deduct $3,000 from the annual return to cover operating expenses like property taxes, management, and repairs (NOI = $15,000)

- Cap rate = ($15,000/$162,000) = 9.2%

A great thing about the cap rate is that it’s a real estate metric an investor can use not only to analyze the profitability of his/her property but also to compare potential investments in the housing market. Many investors set a minimum cap rate to “accept” when investing in a real estate property. This will help them identify which properties would make good investments and which ones would not.

Use Mashvisor to find and compare the best investment properties for sale in the city or neighborhood of your choice based on the cap rate. Sign up to get started now!

How to Calculate Annual Rate of Return for Financed Deals

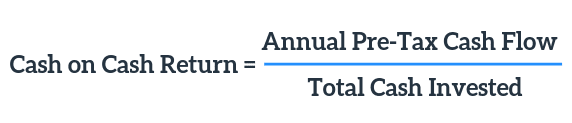

Since not every real estate investor (especially a beginner) has enough capital to buy rental properties with cash, many turn to other methods of financing. If this is how you plan to acquire your investment property, you can’t use the cap rate method to estimate the expected rate of return because you’re not paying the entire sale price. You should only analyze profitability based on the amount of money you’ve actually invested. To do so, real estate investors use the cash on cash return method. The formula for this metric is:

The annual pre-tax cash flow is the rental income minus operating expenses. However, what makes it different from the net operating income is that it includes mortgage and interest payments while the NOI does not. Here’s a simple example of how to calculate annual rate of return using the cash on cash return method. Say that you’ve bought the same property in the above example, but took out a mortgage loan with a 20% down payment. In this case, you:

- Buy the investment property with a $30,000 down payment ($150,000 x 20%)

- Spend $15,000 for remodeling and closing costs (they’re higher due to the mortgage). This makes your total cost of investment = $45,000

- Rent it out for $1,500 per month (annual return = $18,000)

- Deduct $3,000 from annual return to cover operating expenses and another $6,000 for mortgage payments (annual pre-tax cash flow = $9,000)

- Cash on cash return = ($9,000/$45,000) = 20%

As you can see, the rate of return on investment drastically changed when financing the rental property with a mortgage. That’s because a general rule in real estate investing is the less cash paid up-front, the greater your ROI. To learn more about these real estate metrics for calculating ROI, read Cap Rate vs. Cash on Cash Return.

This ROI Calculator Makes It Easier for Investors!

Tired of calculations and numbers? Use Mashvisor’s Investment Property Calculator to know a property’s ROI with a simple click of a button. This real estate investment tool allows you to analyze rental properties for sale that you find on our platform to quickly determine if they’re worth it. We have an entire article that explains how this tool works in details, but here’s a quick break down of what you need to know.

Our Airbnb investment calculator accounts for your financing method as well as both your start-up costs and ongoing expenses. When you plug in these numbers, you’ll get an analysis of what kind of rental income, cash flow, cap rate, and cash on cash return you can expect to receive from the real estate investment! What’s unique about our calculator is that it’ll show you the expected rate of return of the property whether it’s rented out traditionally (to a long-term tenant) or on Airbnb as a vacation rental (to short-term tenants). Meaning, our Investment Property Calculator allows you to see which rental strategy will yield higher profits and ensures success in real estate investing.

Read the full article here: Real Estate Investment Calculator: What It Is and How It Works

This is only one of the many real estate investment tools Mashvisor has to offer. Now that you’ve got a better understanding of how to calculate annual rate of return, start out your free trial and gain access to all our tools to quickly find and analyze the best properties in a matter of minutes!

Click here to start out your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after!