One of the most important factors when determining the profitability of an investment property is the type of cash flow it generates. Naturally, real estate investors should always try to invest in properties that produce positive cash flow. Some beginner investors, however, fall for the mistake of buying a rental property and settling for negative cash flow in the hopes that it will appreciate rapidly. This is typically not a wise investment, especially as you can’t always guarantee long-term real estate appreciation in every housing market. Therefore, many agree that learning how to rent out a house for positive cash flow is key to successful real estate investing.

Related: 7 Things to Know Before Renting Out a House as an Investment Property

Here are some great tips to help you generate positive cash flow from rental properties, whether you already own one or are planning to buy.

#1 Know Your Market Value

While the market value of the real estate property (or its purchase price) is not a part of the cash flow calculations, it’s still an important factor that beginner investors often overlook. In order to rent out your investment property for profits, a common rule of thumb is that you need to buy at a discounted price. Think about it this way, if you buy an investment property that is $20,000 over the market value, then that’s $20,000 you have to make up if you want to profit from the investment.

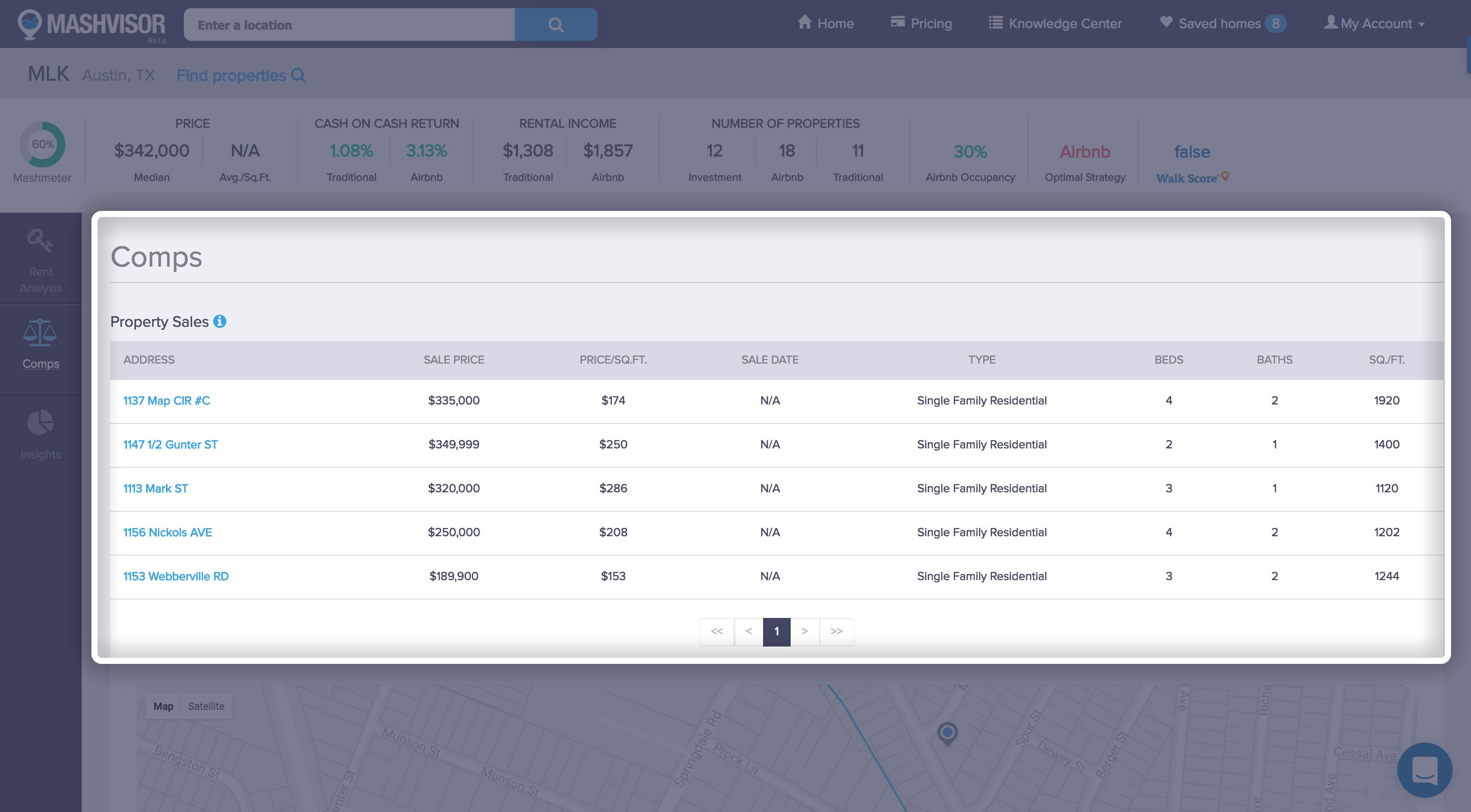

Therefore, property investors need to know the real market value of properties (not just the listing price) in order to assure paying a fair price. The best way to know the market value of a rental property is by conducting thorough research on other sales in the area – also known as a real estate market analysis.

#2 Set the Right Rental Price

Knowing the market value when learning how to rent out a house will further help you in setting the rental price that will generate positive cash flow. For example, if you underprice your investment property, you could lose out on hundreds of dollars a month that could have increased your cash flow. On the other hand, if you overprice your rental property, it could sit empty on the market for months, which will leave you with negative cash flow.

Another way for real estate investors to determine the best rental price is by looking at comparable listings (or real estate comps). These are similar properties that were recently sold in your area. By checking how much these properties are renting for, this helps you to set a competitive price to rent out the property right after it hits the market.

You can find real estate comps by checking newspaper ads, speaking to property management companies and real estate agents in the area. Alternatively, Mashvisor’s Investment Property Calculator provides you with lists of rental comps in the neighborhood where you’re interested in buying a rental property so you don’t have to do any work!

To start looking for and analyzing the best rental properties in your city and neighborhood of choice, click here.

#3 Reduce Your Operating Expenses

Since cash flow is the income you receive after collecting rent and paying off all expenses (rental income – rental expenses), an obvious solution to generate positive cash flow is by cutting down your expenses. Beginner real estate investors often underestimate these expenses and overestimate the expected rental income. This is one reason why they end up with negative cash flow rental properties. So, how to rent out a house requires landlords to first be aware of their operating expenses, and second to try reducing them for positive cash flow.

When owning an investment property, there are two types of expenses. First, there are fixed expenses (like mortgage payments, property insurance, and property taxes) which are somewhat easy to calculate. There are also unpredicted expenses (like repairs, unexpected vacancies, etc.) which can be tough to accurately estimate. A simple rule of thumb to follow is that total operating expenses for rental properties should fall at roughly 25% of the total gross rental income.

Wondering how to rent out a house and minimize these operating expenses? There are numerous things you can do. For example, you can:

- Manage the rental properties yourself instead of paying for professional property management

- Schedule maintenance checks on major appliances/systems

- Perform regular maintenance on all your appliances/systems

- Check for plumbing and water leaks frequently

For more ideas, read this: The Best Real Estate Investing Tips for Cutting Down on Your Expenses

Keeping a close eye on all rental expenses is important because, even if you’re not losing money and know how to rent out a house for positive cash flow, it doesn’t mean you couldn’t be making more!

#4 Consider Doing Some Renovations

Most real estate investors simply buy a rental property and rent it out to tenants. But a savvy investor would look for extra ways to create cash flow from the property by adding more value through renovations. Even minor renovations, like painting the kitchen, painting the bathroom, adding curb appeal or a security system/gate, can be worth the effort. It’s amazing what you can achieve with a couple hundred dollars on minor renovations if done correctly. You’ll increase the value of your rental property which allows you to charge more for rent.

You could also consider major renovations like adding an extra room, putting an extension on your rental property, or redoing the kitchen to a higher standard. Such major renovations could help you significantly increase the income above the money spent so that you can generate positive cash flow. However, you need to be really careful where you spend your money.

A smart thing to do for how to rent out a house for positive cash flow is simply asking your tenant what he/she would like. If you provide what is requested, your tenant will surely pay that extra rent.

#5 Know the Optimal Rental Strategy

In real estate investing, there are two main rental strategies: 1) renting out traditionally to long-term tenants or 2) renting out on Airbnb to short-term guests. How you choose to rent out your property will play a huge role in your rental yield and overall ROI. For example, if your investment property is located in a growing job market, then the optimal rental strategy is to rent out traditionally because this will give you a higher occupancy rate, and therefore a higher rental income. An Airbnb rental property in such a location could end up being poorly occupied (if it’s not a tourist destination). You’d end up with a negative cash flow investment property.

Therefore, if your property is not generating the rental yield you’re aiming for, it might be because you’ve chosen the wrong rental strategy. So, you need to determine the optimal rental strategy when learning how to rent out a house to successfully generate positive cash flow.

Related: Real Estate Investing: Traditional vs. Airbnb Investments.

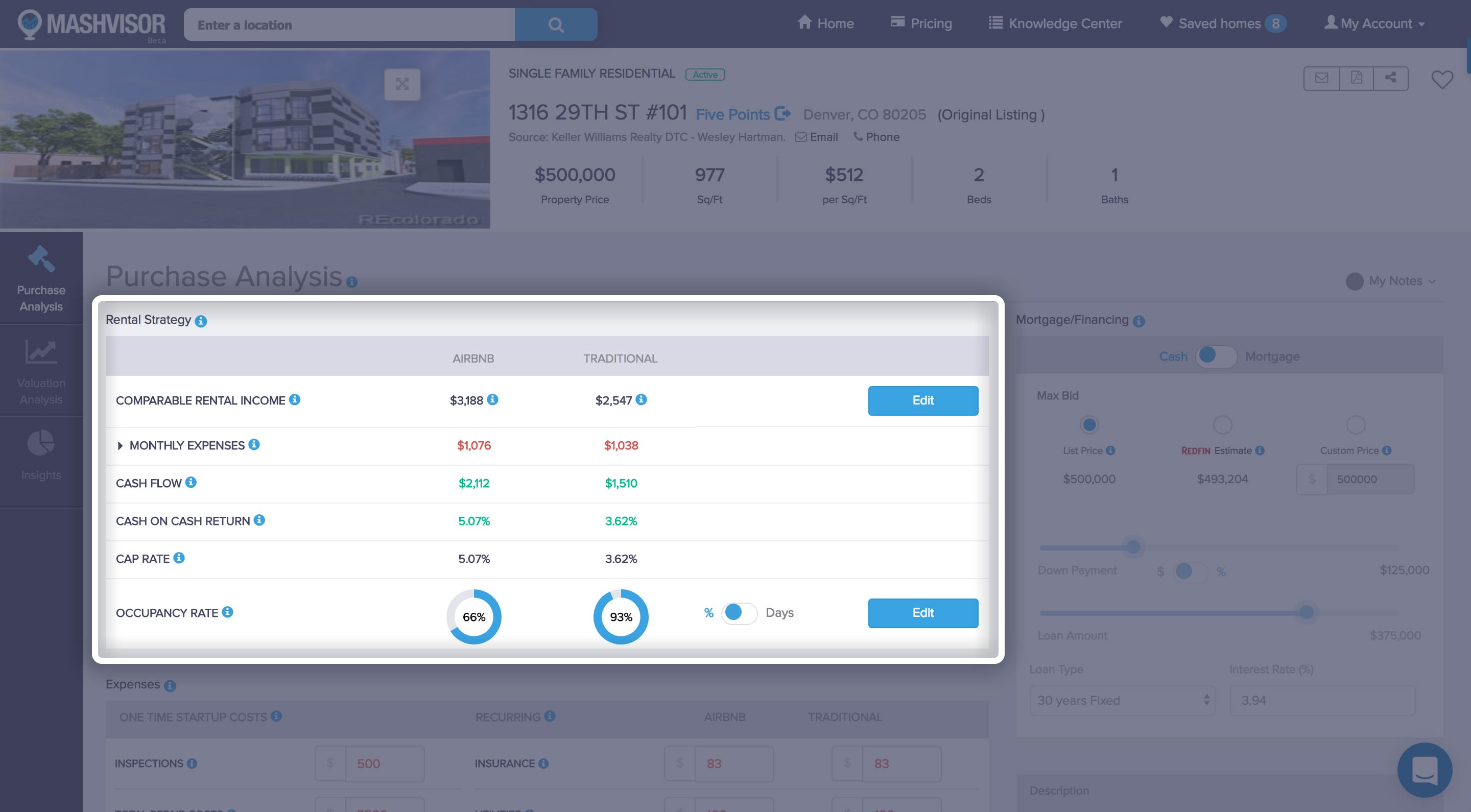

Interested in finding out if you’ve chosen the right rental strategy? Use Mashvisor’s Investment Property Calculator – it gives you all the calculations you need to analyze a property for real estate investing. With this investment tool, you will be able to learn the following about your rental property:

- Comparable Rental Income

- Monthly Expenses

- Cash Flow

- Cash on Cash Return

- Cap Rate

- Occupancy Rate

These metrics will be shown for both the traditional and Airbnb rental strategy! This allows you to make quick comparisons and determine which rental strategy is more favorable for each property you’re thinking of buying and renting out. Want to give it a try? Start out your 14-day free trial with Mashvisor now.

#6 Select the Right Tenant

The last tip we have for property investors on how to rent out a house for positive cash flow is to make sure the property is occupied by a good tenant. This is a general rule of thumb that successful landlords follow for increasing rental income. The right tenant is someone who you can count on to keep your investment property in good shape and pay the rent on time and in full.

To find this tenant, the real estate investor needs to perform a thorough background check that would reveal any red flags. For example, if a tenant has difficulty paying rent, he/she could potentially cost you hundreds (if not thousands) of dollars per month. Not only will your rental income dry up, but you could also be looking at costly court fees to evict the tenant, which can reduce your expected profits.

Do you have more tips you’d like to share on how to rent out a house for positive cash flow? Feel free to leave them in the comments section below!