If you’re looking to invest in real estate in 2023, chances are you’re looking for the best ways to minimize the risk in today’s unstable market.

As 2022 comes to a close, beginners who want to invest in real estate in 2023 are told to be cautious or to wait until economists are more certain about the future of the economy.

Table of Contents

- Is It a Good Idea to Invest in Real Estate in 2023?

- 4 Simple Ways to Invest in Real Estate in 2023

- The Best Way to Find Lucrative Real Estate in 2023

However, if you’re learning how to invest in real estate for a profit, you probably want to start earning as soon as possible.

So, what are the best ways to invest in real estate in 2023 while avoiding the financial risks that might arise in the coming months?

In this article, we will briefly learn about the financial landscape of today’s economy and the real estate market to see if it’s a good idea to invest in real estate in 2023.

We will also tackle the best real estate investment strategies that beginners like you could utilize to reduce the risk and maximize your return on investment.

Finally, we will discuss how Mashvisor’s platform can help you circumvent the challenges and invest in real estate efficiently while also saving time and money.

Is It a Good Idea to Invest in Real Estate in 2023?

If you’re looking for how to make your first investment in real estate, then you’re probably facing the strong sense of hesitation that many beginner investors feel.

Especially now that we’re entering a new year when the financial indicators are not optimistic or certain about the future of the economy or the housing market.

However, if you’re looking to invest in real estate and you’re waiting for the perfect time to do so, it should be noted that there is no such thing as a perfect or a worse time to invest in real estate.

The fact is, there are always opportunities and ways to learn how to make money in real estate, regardless of where you are or where you want to invest.

What matters, however, is how affordable it is to enter the market as an investor.

So, for beginner investors, the question should instead be: where can I afford to invest in real estate in 2023?

How to Decide Where to Invest in 2023

Investing in real estate in 2023 is as good or as bad as the location that you choose to invest in.

As a beginner investor, your biggest concern should be to find a location where you can afford to buy a property and turn it into a profitable investment.

Luckily, nowadays it is easy for investors to obtain data about market prices across multiple locations in order to find affordable markets to invest in real estate.

However, the challenge arises when beginners neglect the step of figuring out their finances and how much they can afford to spend on their real estate investment.

Investors should learn how to assess their finances in terms of the amount of cash that they have access to, their credit score, and what types of loans or mortgages they qualify for.

So, it is very important for investors who want to invest in real estate in 2023 to learn how to sort out their finances based on the latest home prices and mortgage interest rates.

How to Invest Out of State: What Are Your Options?

Another aspect that investors need to make if they want to invest in real estate in 2023 is the method of investment that they want to use.

While buying and renting out a house can be fairly simple if you’re doing it in your own town or neighborhood, it gets more complicated the further away you want to invest.

This is mainly because most traditional real estate investment strategies require the investor to be hands-on when it comes to property and tenant management.

However, as we will discover in the next section, there are great methods and strategies for investing in real estate and making money without having to leave the comfort of your house.

In 2023, one of these methods is on the rise and is becoming very popular among beginner investors and young adults who can’t afford to buy a house.

Investing through REITs (Real Estate Investment Trusts) lets you enjoy the benefits of making money from real estate while minimizing your involvement.

However, with today’s technology, even traditional real estate investments can be done online.

So, regardless of the method you choose to invest in real estate in 2023, we have tips and strategies for you to learn about.

4 Ways to Invest in Real Estate in 2023

When looking for the best ways to invest in real estate in 2023, it is important to keep in mind that due to the uncertainty of the economy, it is best to avoid making risky investments.

For example, since property prices have gone up drastically in a short amount of time during the past couple of years, buying a property in order to sell it at a higher price later can be risky.

This is because although prices have been on an upwards trend, many experts and housing market forecasts predict that a crash will happen in the near future.

If a crash happens, the prices of real estate properties will fall back down rapidly, causing you to lose money instead of making a profit.

Instead, it is best to use safer investment strategies that can generate money and won’t be as affected by the volatility of the economy.

Here are four of the best ways to invest in real estate in 2023.

1. Investing in REITs (Real Estate Investment Trusts)

One of the best ways to invest in real estate in 2023 is to invest in REITs.

Beginner investors who want to invest in real estate and generate a passive income without the hassle of running and managing a rental property will often invest in REITs.

This allows beginner investors to have partial ownership of a real estate property without having to buy the property in the traditional sense.

Instead, real estate investment trusts build up a pool of money from the investors and use it to buy and operate investment properties, and the profits are then split among the investors.

Of course, there are different types of REITs that investors can invest their money in, and most of them trade on an online exchange that is similar to the stock market.

Beginner investors, however, are recommended to invest in publicly traded trusts that are known to be less risky and easier to buy and sell through brokerage firms.

Advantages of Investing in REITs

There are two main advantages for anyone who’s considering investing in real estate in 2023 through an investment trust.

Firstly, real estate investment trusts are an ideal form of real estate investment for those who are looking to diversify their investment portfolio.

Diversifying your portfolio means owning assets of different types in order to minimize the risk of losing your money due to market volatility, especially in 2023 and beyond.

REITs let you do that because you can invest a smaller amount of money to own parts of different types of real estate without having to actually buy these properties.

This brings me to the second biggest advantage of investing in real estate through REITs in 2023, and that is affordability.

Since property prices have increased significantly in the past few years, buying real estate properties in the traditional sense has become unrealistic for many people.

Most REITs will typically have a minimum amount that you will need to invest.

However, the amount needed to enter a REIT is usually very affordable, and can sometimes be in the three digits range.

This means beginner investors who do not have sufficient funds to buy a real estate property in a traditional manner can instead invest through a REIT using a small amount of money.

Luckily, investing in REITs can be done online.

There are many REITs that operate online, and their platforms let you invest directly, make the payment, and receive the profit online without much hassle.

So, make sure to search for the best online REITs and investment platforms that you can use online today.

2. Fix-and-Flip Real Estate Strategy

Another great strategy that beginner investors can take advantage of in 2023 is flipping houses.

Fixer-upper strategies are great for beginner investors who want to make a profit quickly instead of generating a passive income over a long period of time.

How to carry out this unique and lucrative strategy?

This strategy revolves around buying distressed properties that are cheap and require repairs or rehabilitation.

Although property rehabilitation can be costly, you make up for it by buying the property at a cheap price due to its inhabitable condition.

These properties can often be bought through bidding in auctions over foreclosed properties, or you can buy them directly from their owners if you have enough info.

Of course, when doing a fix-and-flip strategy, beginner investors need to make sure that they have sufficient money to purchase the property and pay for the rehabilitation costs.

Most importantly, they need to understand the market to know what price they can sell the property for after rehabilitation so that they would make a profit from it.

This means selling the property at a higher price than the total cost they had to pay for the purchase and the repairs combined.

Advantages of Fix-and-Flip Strategies in 2023

The biggest advantage of using a fixer-upper strategy to invest in real estate in 2023 is the abundance of foreclosures and the lack of housing inventory.

In recent years, and as a result of the COVID-19 lockdowns, the US housing market saw a drastic decrease in the development of new real estate properties.

Learn: 7 Ways COVID-19 Has Changed Real Estate

This led to a housing inventory shortage that still affects parts of the market today.

Additionally, as the COVID-19 relief programs for helping house owners come to an end, the number of properties that are going into foreclosure has been on the rise.

These two factors mean that the market currently has plenty of foreclosed properties that you can buy at a cheap price and not a lot of properties that primary homeowners can buy.

This presents an opportunity for beginner investors in 2023 to buy foreclosed and distressed homes, fix them, and sell them to primary homebuyers for a profit.

3. Long-Term Rental Strategy

The ideal way to invest in real estate in 2023 for any beginner investor is to buy and own a long-term rental property.

Rental properties are the most sought-out type of real estate investment among beginner and experienced investors.

This is because of all the great benefits that rental properties offer.

Generating a steady stream of rental income that can cover the costs of owning the property while also providing an extra amount of cash is the dream that many investors seek to achieve.

In 2023, although property prices are much higher than they used to be a few years ago, the demand for rental properties has been on the rise, which maintains the profitable nature of this type of investment.

While beginner investors might struggle to analyze markets and find the perfect property to invest in, there are tools that you can use in 2023 to help you.

If you’re looking for ways on how to invest with little or with no money down, you should consider borrowing money from private lenders such as friends or family and pay them back using your rental income.

Related: How To Find Good Investment Properties

Advantages of Investing in Rental Properties in 2023

The biggest advantage of investing in rental properties in 2023 is the ability to pay your mortgage and interest rate off of your rental income.

Rental properties are unique in that they can often generate enough monthly rental income to cover all costs related to owning them.

This means that as long as you can qualify for a mortgage and afford to purchase the property, you won’t have to worry that much about its running costs and fees.

If the property is generating enough money, you can hire professional property management to help you manage the property and take on the role of the landlord on your behalf.

Of course, in addition to the rental income that the property generates, you will also own the property and can resell it at any point in the future to make an extra profit from it.

All of these factors make rental properties the best way to invest in real estate in 2023 or any other year.

4. Short-Term Rental Strategy

While a long-term rental strategy relies on the whole property to generate a rental income, a short-term rental strategy only needs one room at a minimum.

If you’re looking for the most modern way to invest in real estate in 2023 while also making serious profits, then you should consider renting out a room on Airbnb.

Short-term rental strategies operate similarly to long-term rentals, except you will only be renting out a room in your own house or multiple rooms in a house that you own.

If you already own a house and you’re struggling to pay the bills, property taxes, or other recurring costs, you can make extra money from that house by renting out a room on Airbnb for a nightly rate.

Of course, as the name suggests, you will only be renting out the room for short periods of time that range from a couple of nights to a couple of weeks.

Since your guests will be paying per night, you can set and adjust your nightly rate based on the demand or the amount of profit that you hope to make.

This type of real estate investment has become very popular in the last decade through platforms like Airbnb, and it is one of the most lucrative ways for making money in real estate in 2023.

Advantages of Short-Term Renting in 2023

In recent years, short-term rentals have become increasingly more popular and can often have more demand than hotel rooms in their areas.

In the last year, in particular, demand for short-term rentals has increased sharply as the lockdowns are lifted and people want to travel and visit new places again.

Since travelers and tourists make up the bigger part of short-term renters, this increase will continue in 2023, and beginner investors can take advantage of it.

Unlike other strategies on this list, you don’t have to buy a new home or invest an extra amount of money to start making a profit from short-term renting.

As long as you own a home and you have a spare room that you can rent out, you can use this strategy.

Of course, you will need to make sure that your local laws and regulations allow you to rent out your property in this manner.

But when done correctly and when using modern online platforms and analytics to make your decisions and set your rates, short-term rentals can be more profitable than traditional rental properties.

Read: Beginner Investor’s Guide to the Airbnb Strategy

The Best Way to Find Lucrative Real Estate in 2023

Whether you decide to invest in real estate via a trust, buy a foreclosed property, or purchase a rental property and start making passive income, you will need a tool to help you.

Before you consider buying an investment property in 2023, it is important to take a look at the real estate landscape in terms of property prices, rental rates, and volume of sales.

Carrying out research about the different markets and analyzing them to find one that is affordable to you and which matches your investment criteria is the most important step in your investment journey.

To do that, you will need a real estate investment and analysis tool.

Luckily, there are many digital tools and platforms that you can use nowadays, ranging from search tools to calculators.

But the best tool to use in order to find and analyze markets and investment properties in 2023 is the tool that does it all: Mashvisor.

What Is Mashvisor?

Mashvisor is a real estate investment platform that lets beginner and experienced investors analyze markets, obtain data and analytics, and find the perfect property.

By gathering data from multiple reliable and up-to-date sources, including the MLS and Airbnb, Mashvisor’s analytics provide insights that can help you in every strategy.

Additionally, the platform offers a wide range of tools and features that can help you get analysis about markets and affordability or search for specific properties that match your criteria.

While Mashvisor doesn’t allow you to invest directly through the platform, it provides you with all the information that you need to make a decision and gain insights about the property that you want to buy.

The tool specializes in ways to analyze rental properties, and it provides data and analytics for both long-term and short-term rentals.

Additionally, if you want to invest through a REIT, you can use Mashvisor’s data to locate lucrative markets and invest in REITs in those markets to maximize your profits.

Gain Market Insights & Data

Whether you want to invest in or outside of your own state, Mashvisor can help you find the best city or neighborhood to invest in the market that you like.

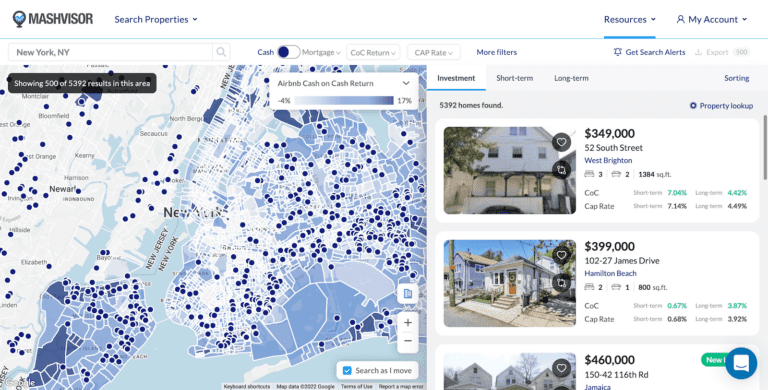

By using the platform’s search tool, you can enter the name of any state, city, neighborhood, or street address to start your search.

The map tool will show you a map of the area that you searched for, but you can zoom in or out freely using the mouse wheel or the user interface.

On the map, you will be presented with information in the form of icons with numbers in them.

These icons represent markets and the number of properties listed in that market.

By zooming in, the icon will break into smaller icons that represent smaller markets, and if you zoom in more you will eventually get to the neighborhood level.

On the neighborhood level, the icons will represent individual properties.

By hovering your mouse over any of the icons on the map, you will get more info that includes:

- The median price of properties in that area

- The average occupancy rate for short-term rentals

- Long-term and short-term rental cap rate and cash on cash return values

Additionally, you can use the several filters and features that the map tool offers to narrow down your search based on property prices, property types, rental rates, and much more.

Related: Estimate Rental Value In 6 Easy Steps

Finally, you can request exports for any market of your choice, which will provide you with an Excel sheet containing all the data that we have about that market.

To get access to our real estate investment tools, sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.

Invest in real estate and succeed by using Mashvisor’s property search and heat map tools to find a lucrative market that fits your investment strategy.

Find the Best Property for Your Investment Strategy

Mashvisor’s tools also allow you to search for properties that match your investment criteria in places that you wouldn’t have considered.

By utilizing the filters and features of the map tool, you can analyze places that have outstanding stats in terms of projected return on investment or rental rates.

Learning this info can help you decide on the best type of property that you can afford to generate the most return on investment with little time and effort.

For example, you can look at different types of properties such as multifamily and single-family homes in an area to see which one is more profitable.

While multifamily homes are usually more expensive, it is possible to find markets where multifamily properties are affordable and more lucrative.

Alternatively, if you have a preference for a multifamily home or a condo, for example, you can use Mashvisor’s Property Finder tool to search for properties of this specific type that have the best return on investment.

Mashvisor’s tools are designed to allow you to search and find properties that match your criteria, and to provide you with enough information and analytics to help you make your decision.

Want to take advantage of Mashvisor’s tools and analytics? Start your 7-day free trial now!

Conclusion

If you’re looking to learn how to invest in real estate in 2023, these four methods are your best options.

Whether you choose to invest in REIT, do a fix-and-flip, or rent out a room, you will need analytics to help you.

So, if you want to invest in real estate in 2023, make sure to start your journey with Mashvisor.

Mashvisor can help you analyze markets to find an affordable place where you can invest. With it, you’ll have all the analytics and insights you need to make your decision.

To learn more about Mashvisor’s tools and how to use them, book a time for a demo!