Owning an Airbnb investment property can be a lot of work. At the same time, there are hundreds of thousands of Airbnb hosts around the world. Recent Airbnb statistics actually indicate that the US housing market has the most listings in the world as it’s home to around 660,000 Airbnb listings!

So there must be a reason why so many homeowners and real estate investors are entering the short-term rental market. Today, that reason is profit.

If you were wondering “Is owning an Airbnb profitable today?” the answer is yes. How do we know? Besides the fact that so many people are becoming Airbnb hosts, Mashvisor’s Airbnb data shows how much they are earning. Let’s take a look at the following Airbnb statistics for cities in the US real estate market:

- Median Property Price

- Number of Airbnb Listings

- Airbnb Occupancy Rate

- Airbnb Daily Rate

- Airbnb Rental Income

- Airbnb Cash on Cash Return

These values will show us that owning an Airbnb is profitable right now.

Mashvisor’s Airbnb Data by City

The following cities are those where:

- Airbnb is legal for non-owner occupied and owner-occupied rental properties.

- Airbnb cash on cash return is good for a short-term rental property.

What this means is that you won’t see Airbnb Los Angeles, Airbnb Las Vegas, or Airbnb NYC data on this list. That’s because it is not legal in these areas for real estate investors to buy investment property and rent out the whole unit unless they live on-site.

Related: House Hacking with Airbnb: How to Live for Free

It should also be noted that Mashvisor’s Airbnb data is collected from Airbnb and the MLS. We then conduct our own calculations and verify the results using data from real Airbnb hosts in the US housing market. So you can be sure it is reliable and will help you determine whether owning an Airbnb rental property is profitable or not.

| City | Median Property Price | # of Airbnb Listings | Airbnb Occupancy Rate | Airbnb Daily Rate | Airbnb Rental Income | Airbnb Cash on Cash Return |

| Auburn, AL | $349,857 | 159 | 37.31% | $334 | $3,829 | 7.12% |

| South Bend, IN | $183,526 | 327 | 39.99% | $283 | $2,163 | 6.67% |

| Abilene, TX | $254,935 | 253 | 55.63% | $146 | $2,976 | 6.15% |

| Columbus, GA | $253,133 | 572 | 66.89% | $109 | $2,543 | 5.84% |

| Seguin, TX | $433,462 | 42 | 46.27% | $351 | $4,143 | 5.75% |

| Hattiesburg, MS | $246,381 | 246 | 52.01% | $87 | $1,908 | 5.52% |

| Tuscaloosa, AL | $424,531 | 349 | 32.55% | $480 | $3,078 | 5.44% |

| Hampton, VA | $224,719 | 82 | 55.08% | $137 | $2,277 | 5.35% |

| Evansville, IN | $194,876 | 54 | 59.52% | $95 | $2,149 | 5.26% |

| Cumberland, MD | $153,724 | 132 | 41.68% | $125 | $1,860 | 5.25% |

| Dayton, OH | $154,496 | 1,309 | 59.56% | $149 | $1,769 | 4.66% |

| Gatlinburg, TN | $449,252 | 307 | 64.42% | $179 | $3,267 | 4.53% |

| Wilmington, DE | $325,887 | 173 | 61.32% | $235 | $2,683 | 4.47% |

| Fort Wayne, IN | $233,905 | 3,696 | 62.03% | $82 | $2,103 | 4.42% |

| Jasper, AL | $247,864 | 52 | 37.14% | $170 | $1,402 | 3.89% |

| Newburgh, NY | $291,513 | 69 | 49.50% | $199 | $2,617 | 3.71% |

| Harrisonburg, VA | $280,762 | 206 | 60.95% | $141 | $2,105 | 3.71% |

| Memphis, TN | $276,103 | 460 | 62.16% | $112 | $1,961 | 3.71% |

| Tempe, AZ | $367,463 | 4,913 | 55.82% | $152 | $2,774 | 3.66% |

| Tampa, FL | $419,335 | 3,963 | 56.45% | $131 | $2,756 | 3.64% |

| Youngstown, OH | $118,612 | 221 | 53.10% | $91 | $1,411 | 3.42% |

| Jonesboro, AR | $264,327 | 605 | 62.74% | $103 | $2,128 | 3.23% |

| Mesa, AZ | $345,627 | 3,234 | 55.80% | $129 | $ 2,349 | 3.13% |

This is, of course, a list of some of the best cities for Airbnb investment in the US. Does that mean owning an Airbnb investment anywhere in the US housing market will be profitable? Of course not. And there are also plenty of factors involved in running an Airbnb rental property that can affect your rental income and cash flow. So how can you ensure that owning an Airbnb is profitable for you?

How to Ensure That Your Airbnb Rental Property Is Profitable

At this time, the best way to ensure that owning an Airbnb investment property is a profitable venture is to use Airbnb analytics.

This means conducting in-depth Airbnb market research before you choose a location to buy Airbnb property. Then, you should use reliable property data to carry out Airbnb investment analysis on a few promising investment properties for sale. In this way, you significantly increase your chances of owning an Airbnb that will generate positive cash flow.

In fact, you no longer leave it up to chance. Rather, with basic knowledge of becoming an Airbnb host or, better yet, with the help of a professional Airbnb property manager, you’re sure to be making money with your Airbnb in no time.

Want to learn how to become an Airbnb host? Then check out our helpful guide on becoming an Airbnb host.

So, how do you get access to Airbnb analytics?

Using Airbnb Analytics to Find Profitable Short-Term Rental Properties

We’ve already introduced you to the fact that Mashvisor is an Airbnb database and that we can show you Airbnb data by city. But did you know you can get access to this kind of short-term rental data yourself? Mashvisor knows how important it is for the average real estate investor to be able to conduct Airbnb market research and investment analysis using property data.

That’s why, if you sign up for Mashvisor, you can use our Airbnb predictive analytics to conduct:

- Airbnb Neighborhood Analysis

- Airbnb Investment Property Analysis

- Comparative Market Analysis Using Airbnb Comps

Let’s take a brief look at how you can do each one using Mashvisor and how it will ensure you become the owner of a profitable Airbnb investment property.

Airbnb Neighborhood Analysis

Want to invest in Airbnb in your local housing market? Or maybe one of the best cities for Airbnb investment listed above has caught your eye? Either way, having a city in mind for buying an Airbnb rental property is only step #1. Next, you need to find the best neighborhood for Airbnb in that city- the one where owning an Airbnb investment will be profitable.

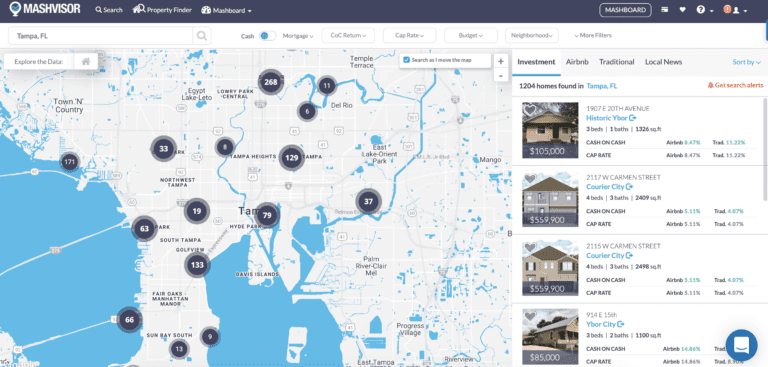

With Mashvisor’s Airbnb Heatmap Analysis Tool, you’ll find this location in a matter of minutes. Start by typing the name of the city where you wish to invest in Airbnb into Mashvisor’s investment property search engine. You’ll be taken to a map of the neighborhoods:

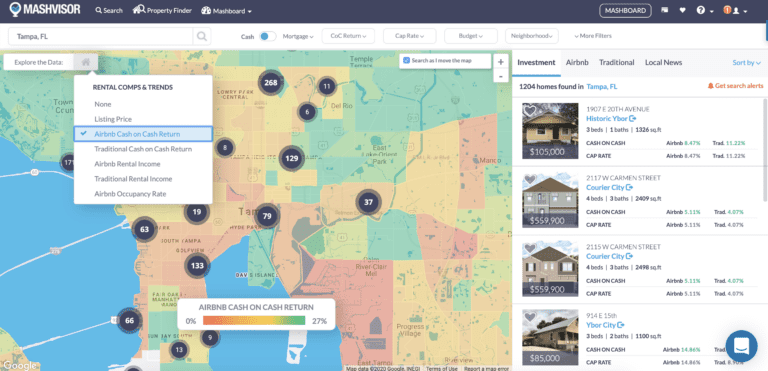

If you click on the Explore Data button, you’ll be able to use different analytical filters related to the Airbnb rental strategy:

- Listing Price

- Airbnb Rental Income

- Airbnb Cash on Cash Return

- Airbnb Occupancy Rate

These will help you see how the local neighborhoods perform. Since we’re interested in finding neighborhoods with profitable Airbnb for sale, you could start by setting the Airbnb cash on cash return filter. Neighborhoods that light up in green are those with the high return properties for sale. Be sure to set the other filters to find the best neighborhood for implementing your Airbnb investment strategy.

Start your own Airbnb neighborhood analysis now.

Related: Neighborhood Analysis in Real Estate Investing

Airbnb Investment Property Analysis

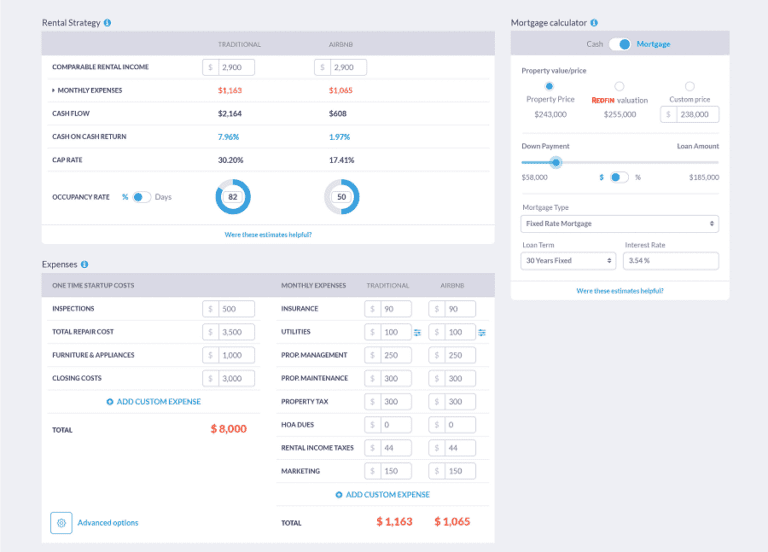

Once you find a good neighborhood or two, you can get a quick look at the Airbnb properties for sale. You’ll get an immediate idea of whether or not owning any of these Airbnbs will be profitable by looking at the Airbnb cash on cash return estimate. Select a few to conduct a thorough Airbnb investment analysis. For this, you should use Mashvisor’s Airbnb profit calculator.

The Airbnb profit calculator helps you estimate whether owning an Airbnb is profitable by showing you the following metrics for every rental property for sale:

- Airbnb Rental Income

- Airbnb Cash Flow

- Airbnb Costs and Fees

- Airbnb Cap Rate

- Airbnb Cash on Cash Return (which, if you take advantage of the integrated Mortgage Calculator, will factor in your investment property financing)

- Airbnb Occupancy Rate

Being able to look at all of these Airbnb calculations in one place makes it easier to find the best rental properties. And because it’s all pulled from Mashvisor’s Airbnb database, you don’t have to do any calculations yourself. But you can make adjustments to the figures as you see fit.

Start analyzing Airbnb properties for sale across the US housing market now.

Comparative Market Analysis Using Airbnb Comps

Owning an Airbnb investment property won’t be very profitable if you pay way too much for it and it’s unable to generate enough rental income to cover the financing costs. This is why you need Airbnb comps– sales comps and rental comps.

If you sign up for a Professional Plan with Mashvisor, you’ll get access to both sales comps and Airbnb rental comps. That way, you can conduct a comparative market analysis to ensure you’re paying a good price using the real estate sales comps. But you’ll also be able to compare profitability through metrics like Airbnb occupancy rate, nightly rate, and rental income using Airbnb rental comps.

Once you’ve completed this last analysis, you’ll be ready to buy an Airbnb rental property- one that you’re sure will make you money.

Start conducting your own Airbnb CMA now.

Find a Profitable Airbnb Rental Property Today

Yes, owning an Airbnb is profitable at this day and age. Many hosts are enjoying a high Airbnb profit margin across the US housing market. But the high Airbnb return on investment is not a guarantee that comes from simply buying a short-term rental property. Instead, it takes research and analysis (and the help of a reliable Airbnb estimator like Mashvisor’s!) to ensure that you find a good Airbnb investment.

Start your 7-day free trial with Mashvisor now and you too can become the owner of a profitable Airbnb investment in no time!