If you’re interested in real estate investing, the first thing you should know is that it’s not a “get rich quick” scheme. While the real estate market offers many opportunities for making a profit, buying real estate investment properties is different from investing in a stock or mutual fund in several ways. For one thing, real estate has always been (and continues to be) a long term investment where short term selling doesn’t always make financial sense.

Yes, there are short term investment strategies where the real estate investor aims to sell the investment property ASAP like fix and flips and wholesale real estate. Nonetheless, many view long term investments as a more lucrative option – especially for those just starting out in the real estate business. In this article, we’ll introduce you to the best real estate long term investments and what to keep in mind to succeed. If you’re wondering where to invest money for the long term, these should be your first options.

1) Investing in Rental Properties

Rental properties are the most common form of real estate long term investment where, basically, you buy a property and rent it out to tenants for a long time (longer than 12 months). As an owner of a rental property, you’re the landlord and you make money from rental income and cash flow. There are many reasons why this is one of the best ways to invest in real estate: it provides steady income, can maximize your available capital through leverage, and many of your expenses are tax deductible. They also come in different shapes and sizes – there are:

- Single Family Homes

- Multi Family homes (Duplex/Triplex/Quads)

- Small Apartments (5-50 units)

- Large Apartments (complex buildings)

- Commercial Properties (leased to businesses)

Want to find a profitable rental property for sale in a matter of minutes? Click here to start looking for and analyzing the best properties in your city/neighborhood of choice using Mashvisor’s tools!

Keep in Mind…

The biggest difference between rental property investment and other types of long term investments is the amount of time and work investors have to put to maintain their investment. When you buy a stock, it simply sits in your brokerage account and, hopefully, increases in value. A rental property, however, is typically a hands-on investment – unless you choose to hire a property management company.

When you buy a rental property, you also acquire the responsibilities that come with being a landlord like paying the mortgage, insurance, taxes, and costs of maintaining the property. Your rent has to be enough to cover all of these costs with enough left over to make a monthly profit (positive cash flow). However, regardless of these responsibilities, landlords tend to invest in real estate for the long term. After all, once the mortgage has been paid on a long term investment property, the majority of the rental income becomes profit that goes back into your pocket!

For more details about this real estate investment strategy, read: Investing in Rental Properties in 2019: The Beginner’s Guide.

2) Investing in Buy and Hold Properties

This is perhaps the most basic (and maybe the easiest) form of real estate investing there is for beginner investors. The buy and hold strategy basically involves buying an investment property and holding it for a long period of time. Essentially, a real estate investor following this type of long term investment seeks to make money by renting the property out and collecting monthly rent or simply by holding the property until it can be sold for a profit sometime in the future.

As you can tell, among the reasons why this is one of the best long term investments is that it gives you two ways to make profits: rental income and real estate appreciation. The way this works is that during the time that you hold the investment property and rent it out, you can use the rental income to pay down your mortgage each month. In turn, this will decrease your principal balance and increase your equity in the investment property. At the same time, the property’s value grows thanks to natural appreciation and this provides a return on investment when the property is sold!

Keep in Mind…

Real estate appreciation is typically slow and steady. Some beginner investors think they can just buy a property and sit on it for two years, make some money and get out. These investors are forgetting that this is a long term investment! In order to reap the benefits of the buy and hold strategy, you need to hold the investment property for at least 7-10 years.

Furthermore, the key to making money when investing in buy and hold long term investments is to ensure that the properties you’re buying are positive cash flowing before making the purchase. Savvy real estate investors never buy investment properties that don’t make money, counting solely on appreciation. This is a losing strategy because appreciation is not always guaranteed. As a result, one of the most important things you need to understand as a buy and hold real estate investor is how to evaluate and analyze investment opportunities.

Related: How to Do Investment Property Analysis

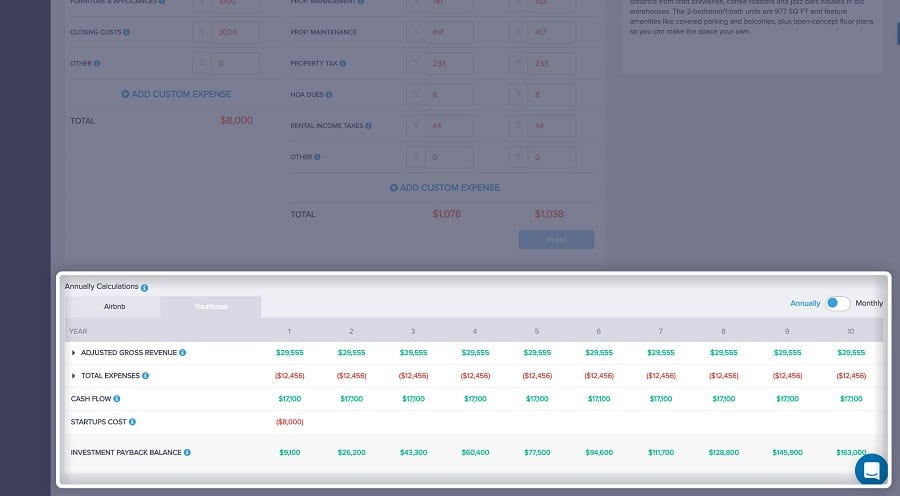

This is something we can help with! Mashvisor’s Investment Property Calculator allows you to calculate the monthly and annual gross revenue, total expenses, cash flow, and investment payback balance. This will help you see how your investment property will perform over the long term.

Interested in giving it a try? Start out your 14-day free trial with Mashvisor now!

Finally, in order to successfully carry out this type of long term investments, a real estate investor needs to understand the real estate market cycle. Essentially, buy and hold real estate investors buy properties when the market is at a low point (low prices, high inventory, and deals are plentiful). When the market becomes over-heated (prices are at an all-time high, inventory is down, and multiple offers are common), investors either sell for a profit or continue to hold their properties.

3) Investing in Real Estate Investment Trusts

In the most basic definition, a real estate investment trust is to a real estate property as a mutual fund is to stock. Essentially, it’s a corporation where a large number of real estate investors pool their funds together and purchase large real estate like shopping malls, apartment complexes, skyscrapers, or bulk amounts of single family homes. The REIT will distribute the profits to individual investors in the form of dividends. You can also buy shares in a REIT as a long term investment. The money you invested stays in the trust until it ends and the properties are sold. The proceeds are then distributed among the trust’s stakeholders.

What makes this different than the previous long term investments is that it’s a hands-off approach to investing in real estate. As an investor, you only invest your money in the REIT – managing, maintaining, and any other responsibilities fall on the trust itself and not you individually. This means REITs are a good alternative to direct property investment for investors who want regular passive income!

Related: The Best Passive Income Investments in Real Estate

Other benefits of long term investing in REITs include:

- They allow real estate investors into non-residential investments like malls or office buildings, which are generally not possible for individual investors to purchase directly

- Unlike traditional real estate properties, REITs are highly liquid because they are exchange-traded. Meaning, you can quickly sell your shares and cash out your investment without a realtor and a title transfer

- Beginner investors don’t need a lot of money to start investing in a REIT. Thus, this long term investment strategy gives you exposure to real estate investing with little money

- Real estate investors can easily create a diversified investment portfolio by adding REITs

Keep in mind…

As mentioned, investing in real estate investment trusts is great for those looking for hands-off long term investing. Having said that, do not expect the returns found in hands-on investing as owning an investment property is generally more profitable. Moreover, you must not forget that buying shares in a REIT does not make you a stock investor and there are potential long term investment risks to consider.

As mentioned earlier, real estate doesn’t always appreciate or go up in value. So, when choosing a REIT, consider the growth prospects of the industries, property types and locations that it’s targeting. Another thing to be aware of is that some (not all) REITs are highly correlated to the broader stock market. This means that prices for some REITs can go up and down with corporate stocks – regardless of whether the values of the properties within the REIT have changed. Finally, real estate investment trusts don’t have to pay taxes on profits. Real estate investors, however, will have to pay income tax on the annual dividend as though it’s personal income (not a capital gain) once it’s distributed.

The Bottom Line

Real estate investing is a long term relationship. We have looked at 3 types of long term investments which can be very lucrative investment strategies, especially if they are well thought out and planned. Now, it’s up to you to choose your investment strategy wisely and learn what it takes to make the most profits out of it in long term investing.

Remember, if you choose to go for rental properties or buy and hold investments, we’re here to help you find the most profitable properties for sale in your city and neighborhood of choice! Sign up to Mashvisor and start using real estate analytics to make faster and smarter investment decisions today.