You’ve decided that Los Angeles real estate is a good investment for you and Mashvisor’s data on the Los Angeles housing market backs your decision:

- Median Property Price: $1,073,071

- Price per Square Foot: $609

- Price to Rent Ratio: 23

- Traditional Rental Income: $3,813

- Traditional Cap Rate: 1.5%

- Average Airbnb Daily Rate: $176

- Airbnb Rental Income: $4,041

- Airbnb Cap Rate: 1.4%

- Airbnb Occupancy Rate: 63%

And now you’re wondering where to invest in real estate in Los Angeles. Mashvisor conducted the neighborhood analysis for you and found the 10 best Los Angeles neighborhoods with good cap rates.

10 Best Neighborhoods in Los Angeles for Buying a Rental Property

The following neighborhoods are the best places to buy rental property in Los Angeles if you plan on implementing the traditional rental strategy. Although an Airbnb Los Angeles investment property is profitable, it has been illegal to rent out a whole property without living on site since 2019.

Learn more by reading: New Los Angeles Airbnb Laws Set for 2019. If you wish to house hack an Airbnb Los Angeles rental, read: The Ultimate Guide to House Hacking.

#1. Wilmington

- Median Property Price: $802,090

- Price per Square Foot: $371

- Price to Rent Ratio: 14

- Traditional Rental Income: $4,864

- Traditional Cap Rate: 2.6%

#2. Winnetka

- Median Property Price: $526,496

- Price per Square Foot: $379

- Price to Rent Ratio: 15

- Traditional Rental Income: $2,859

- Traditional Cap Rate: 2.3%

Not only is Winnetka the second-best neighborhood in Los Angeles based on the kind of return on investment you can get, but it is also the most affordable Los Angeles neighborhood on this list. Search for Los Angeles investment properties in this neighborhood now.

#3. North Hills

- Median Property Price: $650,293

- Price per Square Foot: $398

- Price to Rent Ratio: 17

- Traditional Rental Income: $3,105

- Traditional Cap Rate: 2.1%

#4. Boyle Heights

- Median Property Price: $729,631

- Price per Square Foot: $481

- Price to Rent Ratio: 18

- Traditional Rental Income: $3,359

- Traditional Cap Rate: 2.0%

#5. Lake Balboa

- Median Property Price: $704,466

- Price per Square Foot: $426

- Price to Rent Ratio: 19

- Traditional Rental Income: $3,158

- Traditional Cap Rate: 2.0%

#6. Canoga Park

- Median Property Price: $655,638

- Price per Square Foot: $409

- Price to Rent Ratio: 18

- Traditional Rental Income: $3,039

- Traditional Cap Rate: 2.0%

#7. Southeast Los Angeles

- Median Property Price: $589,583

- Price per Square Foot: $441

- Price to Rent Ratio: 17

- Traditional Rental Income: $2,834

- Traditional Cap Rate: 2.0%

#8. Northridge

- Median Property Price: $839,515

- Price per Square Foot: $361

- Price to Rent Ratio: 20

- Traditional Rental Income: $3,476

- Traditional Cap Rate: 1.7%

#9. Leimert Park

- Median Property Price: $843,019

- Price per Square Foot: $518

- Price to Rent Ratio: 23

- Traditional Rental Income: $3,089

- Traditional Cap Rate: 1.6%

#10. Valley Glen

- Median Property Price: $1,118,949

- Price per Square Foot: $503

- Price to Rent Ratio: 20

- Traditional Rental Income: $4,556

- Traditional Cap Rate: 1.6%

A Few Key Los Angeles Housing Market Trends to Know

You may have already made up your mind about buying a property in Los Angeles for investment. And now you know where exactly to start searching for rental properties for sale. Still, there are a few current trends that you should know before you try to navigate the Los Angeles housing market.

Los Angeles Home Prices Are High, But You Can Find More Affordable Properties

Mashvisor’s data shows that the median property price for the Los Angeles real estate market is $1,073,071. This isn’t really surprising as the California housing market as a whole is known for its high property prices. So if you are looking to get your hands on a profitable Los Angeles income property, you will either need to have a lot of money saved up to pay in cash or you will have to meet the minimum requirements for a mortgage loan.

Even so, not all Los Angeles homes for sale will cost you $1 million. The quickest way to find affordable properties when conducting your Los Angeles property search is to use online real estate investment tools. With Mashvisor’s tools, you have two great options. Take a look:

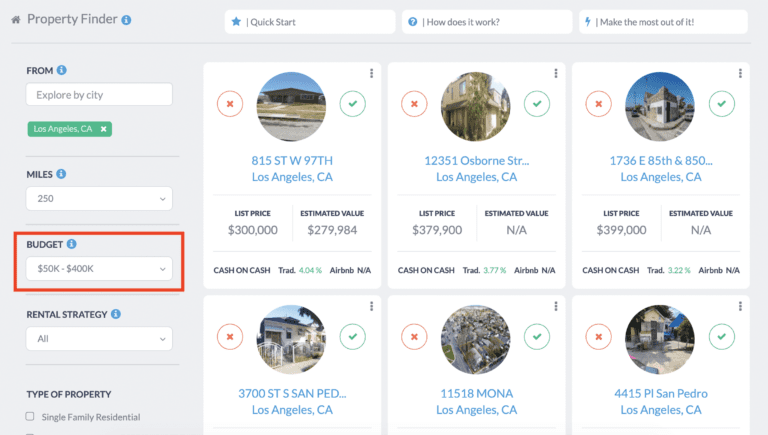

The Rental Property Finder

With this tool, we set the location to the Los Angeles housing market and our budget maximum to $400k. The rental property finder instantly shows us a list of high return properties for sale in Los Angeles that are relatively affordable for this market:

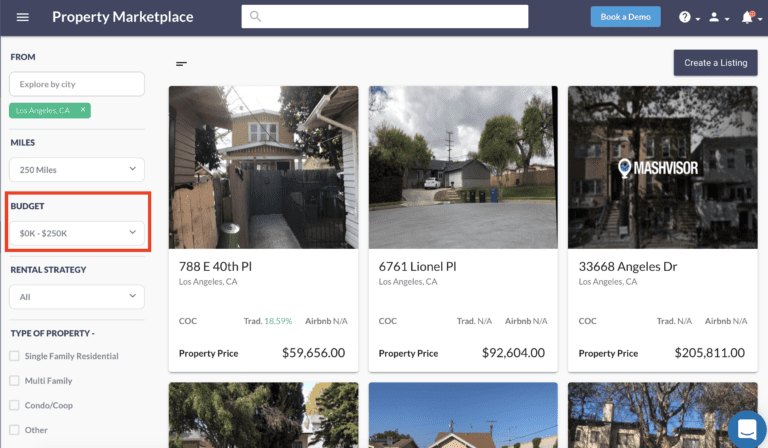

The Mashvisor Property Marketplace

A lot of the time, you can find more affordable properties if you look for foreclosures, bank owned homes, short sales, and auction homes. To conduct this kind of search in the Los Angeles housing market, turn to the Mashvisor Property Marketplace. With this tool, we can set the budget even lower (from $0k to $250k). Here are the current off market properties for sale in Los Angeles in this price range:

Try out these tools by signing up for Mashvisor now.

The Los Angeles Housing Market Is a Neutral Market

Zillow reports that, currently, the Los Angeles housing market is a neutral market. This means sellers don’t necessarily have the upper hand in negotiations.

At the same time, other sources show that you will face some competition in this neutral market. Los Angeles is the third most searched city on Mashvisor for 2020 (following the Orlando real estate market and the Austin real estate market). Real estate investors have continued to search for deals in LA on Mashvisor, even during the coronavirus. Redfin gives the Los Angeles real estate market a Compete Score of 70 (very competitive). The company reports that many homes for sale in Los Angeles receive multiple offers. Still, data shows that homes sell for about 1% below the listing price.

Historically, Los Angeles Real Estate Has Appreciated

From now through 2021, Zillow reports that Los Angeles real estate is likely to depreciate in value by 0.4%. Currently, most real estate markets are expecting a very small decline in value. This particular Los Angeles housing market forecast for 2020 – 2021 is likely due to the coronavirus.

However, you won’t have to worry too much about your Los Angeles real estate investment losing value and costing you money down the line. Historically, Los Angeles properties have appreciated greatly. NeighborhoodScout reports that, since Q1 2000, properties in the Los Angeles housing market have appreciated by a total of 210%, at an average annual rate of 5.82%. That timeframe includes the 2008 housing crisis. This provides a little insight into the fact that, once the COVID-19 crisis has passed, Los Angeles real estate will likely continue to appreciate as it has historically.

Related: How to Calculate Real Estate Appreciation

The Renter Population Is High in the Los Angeles Housing Market

Los Angeles real estate investors who buy into the local rental market enjoy high demand for their properties. Because homes for sale are so expensive, it’s not surprising that 64% of the population lives in a Los Angeles rental property, according to NeighborhoodScout. Homeownership in the Los Angeles housing market stands at 34%.

This is the main driver for the good rate of return rental properties generate as well as the high rental income. In fact, Los Angeles is one of the best cities for rental income in 2020 thanks to this trend.

The Coronavirus Has Hit the Los Angeles Real Estate Market

Finally, you cannot enter the Los Angeles real estate market in 2020 without examining how the coronavirus has impacted the local market. Is it a good time to buy a house in Los Angeles for investment? Well, it could be.

Related: Is Now a Good Time to Invest in Real Estate?

COVID-19 did create a pause in the US housing market as a whole. Many buyers and sellers were waiting on the sidelines, watching how the economy and real estate market would be affected. Many feared a housing market crash would come about or that the housing bubble in some markets would burst as a result.

However, as restrictions began to lift slowly, buyers and sellers both returned to the Los Angeles housing market. Recent data shows that although market activity has definitely slowed down during this time, it remains steady relative to previous years. The median sale price has dropped but this is likely due to the low inventory. It seems that the homes that were sold during this time were those that had been on the market for a long time and had motivated sellers who kept their listings active, even during COVID-19. Inventory remains low, but the summer real estate market will probably see an increase as more sellers return. As demand slowly recovers, it appears that the Los Angeles housing market remains strong. There is no crash in prices insight or any signs of a serious downturn. As long as you are in a good position financially to make a real estate investment, now is a good time to buy.

Just keep in mind that you need to keep yourself, any sellers, and your real estate agent safe during your hunt for a Los Angeles property. Practice safe social distancing and follow CDC guidelines. Real estate has been an essential business in California during this time and activity has been allowed to continue even during lockdowns, but be sure to stay safe.

Related: The Impact of the Coronavirus on the California Real Estate Market 2020

Start Investing in Los Angeles Real Estate Today

If you can afford it, Los Angeles real estate investing can be very profitable. Just be sure to select a good neighborhood and analyze any property for sale that interests you to ensure it will perform well as a rental property. Do all of this and more right here at Mashvisor. Start out your 7-day free trial with Mashvisor now.