Since you’ve clearly shown an interest in investing in real estate, you must be looking for new data on mortgage rates.

Ambitions for investing can be diverse—it could be buying a house where you’ll spend your retirement, flipping a distressed home, or creating passive income as a landlord. And for all of the above, you need two things—financial stability and resources that’ll allow you to make this venture successful and profitable.

If we glance back at past experiences with banks, we can attest that investors and first-time homebuyers, in particular, have encountered numerous obstacles in obtaining funds. Luckily, today’s banking system offers more opportunities and benefits to those who want to invest in real estate.

One of the significant changes that directly contributed to the growing interest in investing is the faster and more accurate calculation of interest rates and repayment terms.

To stay up-to-date and make an informed decision, continue with this guide dedicated to real estate investors who want to attain high profits and handle mortgage rates wisely.

To learn about different mortgage loan types and how to choose the best one for you, check out our video below:

Brief Introduction to Mortgage Rates

The first thing we should focus on here is the general information on mortgages loans.

Mortgage rates are essentially rates of interest that are distributed and added to mortgages. The lender determines these rates, and they can be either:

- Fixed

- Variable

Just as lenders are in charge of determining rates, mortgages won’t be the same for all borrowers; ultimately, credit scores contribute the most. The rates could rise and fall, which directly impacts the market and investors’ strategy on how to invest in real estate.

How Do Mortgage Interest Rates Work?

With a mortgage, the lender funds your project up to some 80% of the property price.

Under this agreement, you, as the borrower, are obligated to repay a specific amount based on many factors.

You’re expected to return the money given to you—but this amount depends on something called the amortization rate, which is further calculated.

This amortization schedule determines the interest and principal for your repayment. And in essence, the longer the term on your mortgage, the longer it will take you to repay it in full.

However, mortgages are not the only factor you should be informed about here. In addition to mortgages, you should inquire about tax rates, insurance, and other costs that a lender may include when purchasing and closing the deal on your investment.

For example, the lender might require paying taxes and insurance on your new home at the previously established rates. That money goes to a separate account—which the lender takes care of.

It’s crucial to understand that these prices are not fixed and that there is a tendency for them to increase or decrease over time. Since the taxes and insurance rates added to this are not fixed (and can affect your mortgage rates), does the same apply to interest rates?

Yes. Current mortgage rates are subject to change in the open market.

Although these changes are common, they are nothing like those we saw several years ago, when rates changed five times in just one day.

Why is this important?

As home buyers and investors, you should know that the lender will never charge you with yesterday’s mortgage rates.

Mortgage Pre-Approval – A Necessity

Applying for a mortgage isn’t as straightforward as going to the bank. Investors and homebuyers must be granted mortgage pre-approval.

These approvals determine how qualified you are to buy a home and how much you can afford. This will ultimately help you get better terms on your loans.

The mortgage pre-approval document is valid for 90 days. Mortgage lenders take the time to review information regarding your income, credit score, and assets to make a decision.

Types of Mortgage Interest Rates

When applying for a mortgage, our humble advice is to gather information about the different types of interest rates and how they will affect your monthly repayments.

These are the basic types of mortgage rates available to those who want to buy investment properties.

Fixed Rates

First on the list—and the most common—are fixed rates. As the name suggests, the interest rates included in your mortgage do not change. They’ll remain the same throughout the deal, regardless of the market situation.

Fixed mortgage rates can be beneficial in protecting your budget and giving you peace of mind that things will not change. On the other hand, these rates could be higher than adjustable ones, bringing us to our next point.

Adjustable Rates

The second type is adjustable rates. Contrary to fixed rates, these tend to change and do not retain the original payment amount. Their variability is owed to constant changes in the real estate market.

With that in mind, you should learn to set aside a specific amount of funds so that you can pay off your obligations on time and avoid getting sucked into debt, which could jeopardize your investment property.

Investing in Real Estate With Current Mortgage Rates

Although investing in real estate and paying off a mortgage does not seem like the brightest business idea from a lender’s viewpoint, you could still achieve a regular cash flow—with the right way of financing, that is.

As for the current situation in the real estate market, the MLS database gives you an overview of all the homes currently for sale. However, lenders do not use this information or have access to it.

Perhaps the most posed question concerns whether you should invest in real estate property, considering the current rates.

The one thing investors must note is that interest rates will always be higher if you decide to invest in a residential and rental property.

Generally, you can expect an increase of 0.5 to 0.7%.

The reason for this jump is that most lenders believe that such investments are at a higher risk. So, to protect themselves, they will spike your interest rates.

Also, note that a lower down payment usually means a higher interest rate.

Should You Go for It?

The question of the day: “Is it a good time to refinance a mortgage?“

An investment or refinancing will only make sense if you reduce the rates by at least 0.75%. The closing costs will leave you some room for a profit with a similar reduction.

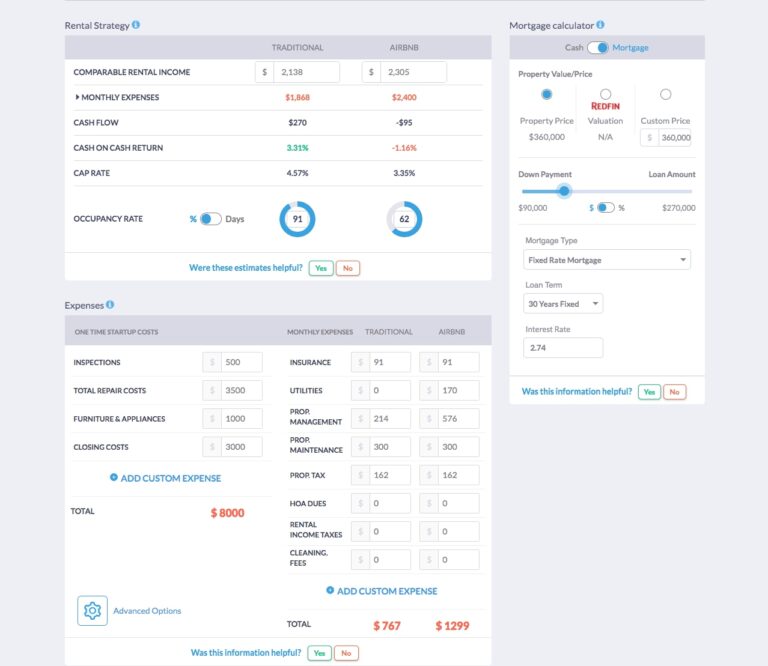

To be even more confident in your decisions, don’t miss the opportunity to request a helping hand from Mashvisor’s Rental Property Calculator.

Our rental property calculator helps real estate investors select the perfect location for their investment and allows them to calculate the expected profit.

Mashvisor’s rental property calculator is found in every listing on the platform. You can use it to incorporate your mortgage rates and other terms to estimate your potential income, expenses, cash flow, and more.

Indicators That You Are Ready to Invest

We’ve gone through the most essential parts. Now it’s time to look at things from a slightly broader angle and try to answer the following question:

When are you ready to invest in a rental property?

Of course, the first step involves a detailed rental analysis. To your luck, Mashvisor has vast experience in this area, assisting potential investors and helping them achieve this efficiently.

Here are some critical indicators that give you the green light:

Financial Stability

The first—and most important—indicator is that you are financially stable for such a venture. That’s because most lenders will require a minimum of 15% down payment for investment properties.

You also need additional savings, especially if you availed of an adjustable-rate mortgage.

ROI

A secure and regular cash flow ensures a high return on investment (ROI). And to calculate this, you must consider your annual net and operating income.

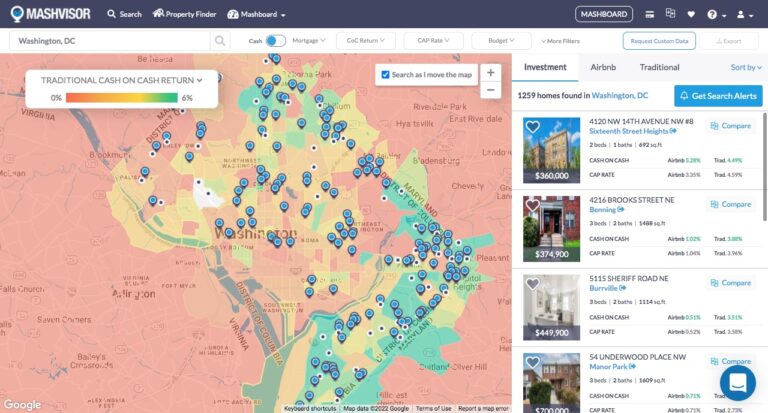

Mashvisor’s Rental Calculator can do that for you. You just need to focus on the real estate heatmap first—and explore the most lucrative areas.

Mashvisor’s real estate heatmap gives you a quick overview of the parts of a city with the highest and lowest cash on cash return, rental income, listing price, or occupancy rate.

Time

One thing is for sure—you need to have enough time to manage your rental property.

Investing is not a one-time job. On the contrary, after you finish the formal part with the bank, you must set aside time for advertising, interviewing tenants, looking over your top competitors, and making necessary repairs to your property.

Investing in a property is a one-time thing—but investing in its value is a long-term project.

Before you make the final call, you should be financially stable and use Mashvisor as your number-one consultant for real estate investing.

Choose the plan that suits your needs—and go from there.