If you’re looking to make some money in real estate, then having positive cash flow properties is your top priority. You could invest for appreciation, but positive cash flow is the most upfront and beneficial gain you could make. Having positive cash flow means paying all costs associated with your property using rent and still having profit. In other words, it’s having a net positive after paying expenses using your collected rent.

Understanding the necessity of positive cash flow properties is easy, but finding such properties isn’t always as smooth. When searching for properties, you will need to consider some vital factors that will influence the potential positive cash flow you could earn.

What Are Positive Cash Flow Properties in Real Estate?

What exactly are positive cash flow properties, also known as positive geared properties? They are properties that actually make money for real estate investors. If you’re a real estate investing beginner, you may be asking yourself, “Well, aren’t all investment properties meant to make money?”. The answer is yes (unless we’re talking about purposefully negative gearing properties, a topic for another day), but not all properties do make money. Some rental properties do the exact opposite; they spend more money than they make.

With these two concepts, making versus spending, in mind, we can arrive at a definition of positive cash flow. Positive cash flow is a situation in which an investment property makes more in rental income than it spends in rental expenses. Another way to phrase this is to say that positive geared properties have a net difference of income and expenses that is positive.

How to Calculate Positive Cash Flow?

Positive cash flow is calculated, according to the definition, as:

Positive Cash Flow = Rental Income – Rental Expenses = + $$$

This calculation is simple and innocent. It can help real estate investors know if they are making money or losing money on an investment property during a certain time period. While the cash flow calculation is certainly not beyond basic arithmetic, one part of the calculation can be tricky to obtain.

The part we are talking about, of course, is rental expenses. The reason summing expenses can be difficult is that there are so many of them to consider. Examples of only common expenses include but are definitely not limited to: management fees, repairs, property taxes, income tax, utilities, HOA fees, mortgage interest, and rental property insurance.

How can real estate investors tackle this problem? They could decide to manually, and tiresomely, approximate and sum up the costs. Or, they could use Mashvisor’s investment property calculator, which sums up and presents costs for them in a matter of seconds.

Why Are Positive Cash Flow Investment Properties Important?

Besides the fact that having positive geared properties means making money in real estate, positive cash flow has other importance as well. Positive cash flow is the essence of ROI, or return on investment, in real estate investing. The two most common ROI metrics, cash on cash return and cap rate, are strongly influenced by a rental property’s cash flow.

Positive cash flow, cash on cash return, and cap rate also serve another purpose when buying a rental property. These real estate metrics are used for property comparison in real estate market analysis. Beginning real estate investors may not know how to narrow down potential investment properties in terms of profitability when buying. Using a combination of positive cash flow, cash on cash return, and cap rate, however, will always point investors to the most profitable real estate investing deal.

How to Find Positive Cash Flow Properties for Investment

1. Find the Best Market to Invest in:

First thing’s first, pick a suitable location. The location you choose could be the key player in the positive cash flow you could earn. Location dictates almost everything, from tenant pools to legal restrictions of certain rental types, like Airbnb.

Although it is more convenient to choose an area that is close to you, you might have to look farther for positive cash flow properties. Find out what would make the area attractive for real estate. If the area is close to colleges and universities, then it will be a hotspot for college students. If the factories are moving into the area, then you could expect blue-collar workers to move in. Be aware of the area’s opportunities and the types of tenants you should expect.

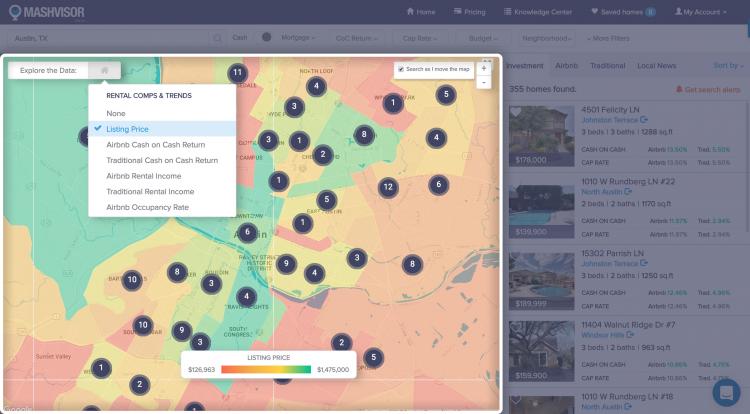

Luckily for you, finding areas with positive cash flow properties does not have to be difficult. By using Mashvisor, you’ll find high-producing properties within minutes. By entering your desired city in the search bar, the various areas of the city will be presented. Each area’s cash on cash return, cap rate, and median property price will be displayed. To determine which areas contain positive cash flow properties, play around with the real estate heatmap to see which properties rank high in features associated with positive cash flow. For instance, properties with high rental income and occupancy rates tend to have positive cash flow. You can adjust the heatmap for these features (and more) and the areas that are hot or cold for these features will appear.

Now that you’ve found a lucrative area, it’s time to find a property.

2. Begin the Investment Property Search Process

Once you have found a potentially cash flow positive real estate market, it is time to begin your investment property search. Your offline search could involve looking for ‘For Sale By Owner’ (FSBO) signs in the area you are targeting. As you drive or walk around, also check for signs of distressed or abandoned homes. This could be an indication that someone might want to sell their property for below market value. Don’t forget to check local newspapers and magazines for home sale advertisements.

When searching online, start by visiting sites with property listings and real estate data such as Mashvisor. Mashvisor’s Rental Property Finder allows you to search in up to 5 cities at once. You can set filters like your budget, property type of choice, preferred rental strategy, and more. The tool then returns the highest cash flow properties in those markets within seconds.

However, before you begin the search process, make sure your budget is ready. Decide the maximum price you can pay in order to cover your mortgage payments and still end up with a cash flow positive rental property. All the properties you shortlist should fall within your price range. In addition, you should decide whether you want to invest in a condo, multi family home, apartment or single family homes. Research which type makes for the best cash flow investment in the market of your choice. For example, in the Dallas real estate market, single family homes make for the best rental properties.

4. Conduct Investment Property Analysis

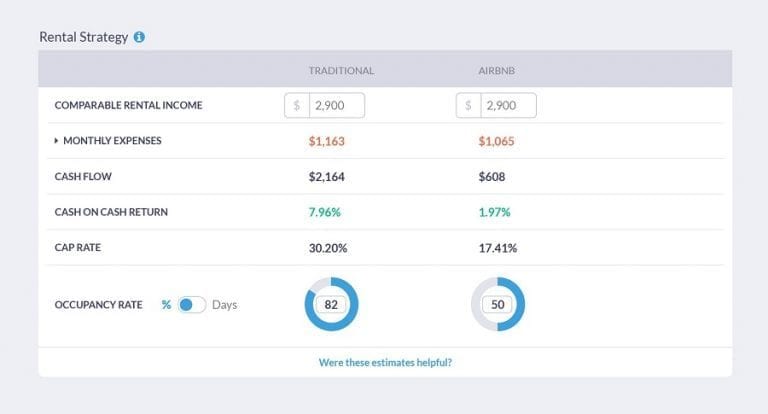

Besides performing a comparative market analysis (CMA), you should also conduct a rental property cash flow analysis to ensure you’re buying a cash flow positive rental. This analysis involves estimating what your running expenses will be, how much rent you should charge, and what cash flow is likely to be generated. Using Mashvisor’s rental property calculator will help you find out if you have a cash flow property on your hands within seconds using metrics such as occupancy rate, cap rate, cash on cash return, rental income, and ongoing costs.

5. Work with an Investor Friendly Real Estate Agent

If you don’t have experience in buying cash flow positive investment properties, it would be advisable to work with an experienced investor real estate agent. A buyer’s agent will come in handy during the negotiation process and can help you secure the lowest price possible. An agent can also help you run a CMA and cash flow analysis.

6. Set the Right Rental Rate

The cash flow generated by your property will ultimately be determined by how you run the business. Once you have purchased the rental property, figure out how much rent you will charge for it. The rent should be high enough to cover your recurrent costs and mortgage while leaving a positive cash flow every month. However, the rent should not be too exorbitant that it scares potential tenants away.

The cash flow investment property analysis performed earlier will help you set a reasonable rental rate for your type of property and neighborhood. If you want to make more money, you can charge your tenants for extra services such as professional cleaning. Tenants would be more than happy to pay extra for a service that makes their lives easier.

Watch our video to learn more about how to make your cash flow property profitable.

Pros and Cons of Finding Cash Flowing Real Estate

Pros of Finding Cash Flowing Real Estate for Sale

- Positive cash flow properties provide you with a monthly stream of income from the start. You start profiting from your investment right away.

- Positive cash flow real estate investing protects you from future interest rate hikes. Even if interest rates rise and your mortgage payment increases substantially, cash flow investments offset some of that burden and keep you afloat.

- Unlike negative gearing, with cash flowing real estate, you don’t need an increase in the value of your property to make bank.

- It makes you more attractive to lenders. Positive cash flow properties make you more liable to receive loans from lenders.

- You can make money even in a market downturn. Your income doesn’t depend on market fluctuations, and you continue to earn despite the state of the local real estate market.

Cons of Finding Cash Flowing Real Estate for Sale

- Profits generated from positive cash flow properties are taxable. Since you are actually earning income, unlike with negative cash flow, you will have to pay taxes.

- Positive cash flow properties for sale are often located in economically volatile areas. Prices do not remain stable for long, and this can negatively affect your investment.

- When you buy cash flow positive properties in low income areas, you often have to deal with high maintenance costs and tenancy problems.

Conclusion

When looking for a positive cash flow income property, take your time. Making rushed investment decisions can be very risky, especially if you’ve never done it before. Similarly, avoid getting emotional when looking for cash flow positive property. Don’t just buy a house because you feel emotionally attached to it. Finally, stick to your budget. Spending more than you can afford will only result in problems later.

FAQs: Cash Flow Properties

1. Should you Consider Buying a Negative Cash Flow Property?

A negative cash flow real estate investment costs more money each month than it earns. This implies that for a time you will have to assume the accrued expenses of the investment property from your own personal account. And let’s face it, not many people want to be in that position. That said, when you play your cards right, it might be very profitable in the long run. But, of course, this strategy is too risky, especially for beginners.

2. What Are the 2% rule and the 50% rule

Many investors use these rules as a quick and fast way to evaluate deals. The 2% rule basically says that any property that rents for 2% or more of its purchase price is usually a good deal. It’s a quick way to determine the profitability of a property. But since price is only one piece of the puzzle, you shouldn’t rely on the 2% rule alone when deciding to invest in a particular income property.

The 50% rule complements the 2% rule. It states that property expenses will represent 50% of gross income. It is worth noting that, like the 2% rule, this rule only helps to arrive at an estimate. It is not completely foolproof. However, it is a valuable tool in deal analysis.

To apply the 50% rule, start with your gross income. Then subtract 50% of revenue to cover property expenses. The result is the net operating income (NOI) of your investment property. Deduct your mortgage payment to get your monthly cash flow.

For example, if you bought a property listed for sale at $175k and had to pay a 25% down payment for a 30-year fixed rate mortgage (at an APR of 3.5%), you’ll be paying ~$1,000 in mortgage monthly. If the current monthly rent is $2,000, here’s how to calculate cash flow using both the 2% rule and the 50% rule.

We already determined, using the 2% rule, that this property is not cash flowing as it rents for less than $3,500 (0.02 * $175,000). But we can’t rely on this estimate alone.

To determine cash flow using the 50% rule:

- Mortgage = ~$1,000

- Annual gross income estimate = $2,000 * 12 = $24,000

- Estimated expenses (according to the 50% rule) = $12,000 annually or $1,000 monthly

- Monthly cash flow = Rent ($2,000) – expenses ($1,000) – mortgage ($1,000) = 0

If this property could rent for $2,500, we have:

- Annual gross income estimate = $30,000

- Estimated expenses = $1,250

- Cash flow = $250 monthly

So, this investment property has the potential to generate positive monthly cash flow of $250.