When it comes to owning rental property, many agree that the key to success is ensuring you are making positive cash flow. This means that you will have sufficient income to cover expenses and generate profits. Building a real estate portfolio of positive cash flow rental properties can be one of the best ways to bring about financial freedom! The problem is, however, if you haven’t been in the real estate investing business very long, you may not know what to do in order to make positive cash flow from an investment property. In this article, we have some of the best ideas and tips that will help you turn properties into positive cash flow investments.

But before we start, let’s break down real estate positive cash flow a little bit more and discuss what it is.

Positive Cash Flow 101

So, what is positive cash flow in real estate? It’s actually a very simple concept. For property investors, the positive cash flow definition is: the money you’ll get to keep from your total cash income after deducting all rental property expenses. These include everyday expenses, capital expenses, financing costs, as well as taxes. Here’s the simple formula of how to calculate positive cash flow:

Cash Flow= Total Cash Income – Total Cash Expenses

If you’re an owner of a positive cash flow rental, life is good and you might not have to spend money out of your own pocket again. But if you have negative cash flow, you’ll be in the red and seriously need to re-evaluate your real estate investment. Some investors might sell their negative cash flow rental while others would think of ways to increase cash flow so it’s no longer negative. If you opt for the second option, keep reading our ideas for generating positive cash flow in real estate. While not all these ideas apply to everyone reading this, we’re sure they’ll open your eyes to opportunities that you’ve overlooked or might not have been aware of.

#1. Set the Right Rent Price

Based on the positive cash flow definition and formula for how to calculate positive cash flow, you already know that rent is the #1 factor affecting whether you’ll end up with a negative or positive cash flow rental. As a landlord, it’s your responsibility to decide how much to charge for rent after buying rental property. If you underprice your house for rent, you could lose out on hundreds of dollars every month that could have increased your cash flow. But that doesn’t mean you should overprice your rental property – it could sit empty and make no income until you have no choice but to drop the price. Hence, to make real estate positive cash flow, investors charge the right amount for rent.

So how can you find out what the right rent price is? The best way is to know your property’s market value and find at least 3 – 5 rental comps. These are similar rental properties in your neighborhood. Check how much other landlords of similar properties are charging and set a competitive rent price. This can help you attract demand from potential tenants and rent the property for positive cash flow right after it hits the market. However, make sure that whatever price you choose is enough to pay for all your expenses and leaves a profit margin at the end of the month.

Don’t know how to start looking for rental comps? Read this: How to Easily Find Real Estate Comps.

#2. Increase Rental Income

If you’ve owned an income property for a while and it hasn’t brought any return, turn it into a positive cash flow rental by increasing the rent. Taxes, insurance, and utilities are all going up which can eat into your earnings. Instead of carrying the burden of increasing costs, you need to pass a portion of these onto your tenants. If you’re in an area with rent control or have already increased rent recently, this might not be an option. But when you know the law, provide value to tenants, and your increases are reasonable and in-line with the real estate market, it shouldn’t be a problem.

Beginner real estate investors, nonetheless, often worry about increasing rent even if it’s for the purpose of owning positive cash flow homes. After all, tenants rightfully fight to keep rents low. Increasing your rent may cause them to move out, or lead an unhappy tenant to damage your property. If this is something that worries you, here are some tips for raising rent without losing tenants:

- Have a rental escalation clause in your lease. This requires tenants to pay a higher aggregate rent by adjusting the annual base rent during the term of the lease agreement.

- Allow pets: This service is in great demand. Tenants with pets are generally willing to pay more to keep their pets with them and, accordingly, can turn your property into a positive cash flow rental.

- Renovations & home improvements: Any improvement (from curb appeal to kitchen remodeling) can increase the property’s value. It’ll have higher demand and, thus, can be rented out for more.

#3. Add New Sources of Income

When investing in rental properties, your main source of income is the collected rent. However, it doesn’t have to be the only one! If increasing rent doesn’t work for you, there’s another way to boost your rental income for positive cash flow investment properties. And that is to create new sources of income and revenue. There are many ideas on how to go about this option. Some examples include providing and charging for services that other landlords in the area don’t offer like a laundry facility, vending machines, and cleaning services. These are not only added sources for revenue but will also make your rental property more appealing than the one next door.

One of the best and most popular ways to add a new source of income and turn a property into a positive cash flow rental is providing storage and parking. For example, do you have lots of storage space in your property’s basement? Offer it as storage space for rent! If you have a double garage, turn it into a granny flat to have more than one tenant on one property. If you have a duplex house, consider adding a detached garage and rent it out separately for a total of three revenue streams. There are a lot more examples of how to add new streams of rental income to generate positive cash flow in real estate!

Looking for homes for sale that are already cash flow positive? Mashvisor’s tools will help you find and analyze the best investment properties in your city/neighborhood of choice. Sign up to get started!

#4. Refinance Your Loan

Going back to our definition of what is positive cash flow, the second part of the equation is the operating expenses that keep real estate investments running. When investing in rental properties, your biggest cost is related to your financing – that is, the monthly mortgage payments you have to pay to the bank.

Before buying rental property, you need to research your financing options and find the best one available. Typically, loans with lower rates and longer amortization periods increase the cash flow of rental properties.

If you want to turn a house into a positive cash flow rental, one of the fastest ways to do so is by refinancing the loan. If you have a loan for, say, five years on an income property, consider speaking to your lender about refinancing that loan to ten, twenty, or more years. By extending the amortization over a longer period (like 30 years), you can immediately reduce your monthly payments and add to your positive cash flow. In addition, you can negotiate a better mortgage interest rate with your bank or lender. Normally, lenders are more than willing to drop the interest rate when you extend the amortization period. Real estate investors may also be able to pull out some cash from the property and then use it for repairs, improvements, or even to buy another property!

Related: How to Refinance Investment Property to Buy Another

#5. Cut Your Operating Expenses

As an investor aiming to make real estate positive cash flow, your financing costs are not the only expenses that affect your profits. You also need to pay attention to other operating expenses and cash going out of your rental property business. Underestimating your expenses and overestimating the expected rental income is the most common mistake beginners make which leads to negative cash flow. Fixed costs like mortgage, insurance, and taxes are easily calculated. Unexpected expenses like maintenance and repairs, however, are not. A simple real estate rule of thumb to follow is that you should estimate your operating expenses to be 50% of your gross income.

So, keep a close eye on your operating expenses and apply the 50% rule to find out if they cost more than the rental income the property is generating. If yes, the obvious solution for turning this property into a positive cash flow rental is cutting your operating expenses. For example, if providing utilities like water or trash services is eating a big chunk of your cash flow, consider dropping this option and have the tenant pay for them. In addition, instead of adding management fees to your expenses, why not manage the property yourself? Reducing operating expenses can also save you money over the long-term.

For more ideas, read: The Best Real Estate Investing Tips for Cutting Down on Your Expenses

#6. Change Your Rental Strategy

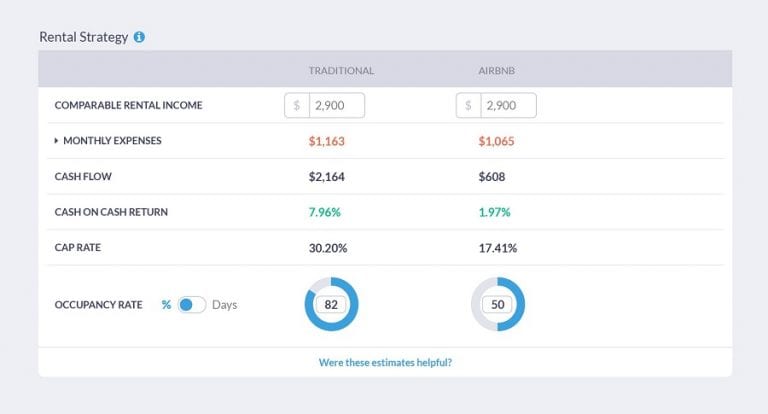

If you’ve tried everything we suggested so far to make positive cash flow in real estate but it’s not working, then maybe there’s nothing wrong with the investment property itself. The reason why your property is not a positive cash flow rental could lie behind the way you rent it out – i.e. your rental strategy. To make money in real estate, there are two rental strategies to choose from: renting out traditionally (to long-term tenants) and renting out on Airbnb (to short-term guests). There are certain factors that determine the optimal rental strategy, most importantly are the location and rental demand.

For example, say you’ve bought an investment property in a hot tourist destination but you’re leasing it to a long-term tenant. In this case, the property may not be generating rental income to its fullest potential. Turning it into a vacation home and listing it on Airbnb could be a smarter investment decision. Demand from tourists means the property will enjoy a high Airbnb occupancy rate which, in turn, will drive up your rental income and positive cash flow in real estate.

You can see which rental strategy is best with Mashvisor’s Airbnb Calculator. We provide comparative data on how the property will perform as a traditional and Airbnb rental in terms of cash flow and other metrics.

To start analyzing investment properties in your city and neighborhood of choice, click here.

The Bottom Line

By combining some of these ideas, real estate investors can easily turn any property into a positive cash flow rental. Of course, that is not to say that you should buy negative cash flow properties for cheap and turn them into cash flow positive ones. That’s a losing strategy because even positive cash flow properties need you to spend money on them sometimes. The most successful investors are those who know how to find houses for sale that promise positive cash flow from the start.

Not sure where to start looking for positive cash flow property for sale? Mashvisor’s got your back! Start out your 14-day free trial with Mashvisor now and find positive cash flow rental properties anywhere in the US housing market in a matter of minutes.