There are people who believe that the days of finding positive cash flow rental properties are long gone and that beginner real estate investors may as well give up the search before they even start. Well, I am here to let you know that this isn’t true. Even though finding positive cash flow rental properties isn’t easy, it is possible. Positive cash flow investment properties do exist!

Many investors prefer cash flow real estate investing to real estate investing for appreciation. This is because positive cash flow investments offer more upfront gains. This means that you will be able to pay all rental property expenses using rental income and still have profit. This is especially suitable for real estate investors who want to have extra cash to pay down debt and increase their equity so as to make room for further investment. However, many investors simply don’t know how to find positive cash flow properties. There are some important factors that influence the cash flow of a rental property which need to be considered.

Here is how to find positive cash flow rental properties.

Related: Why Positive Cash Flow Is a Must with Income Properties

1. Find a Suitable Location to Invest In

Picking a suitable location is the first step to finding positive cash flow properties. As you probably know, location is the most significant success factor when it comes to real estate investing. The location you select will have a key influence on the potential positive cash flow of the rental property.

Choosing an area that is close to you may be more convenient due to easier management. However, sometimes it may be prudent to look for an area far away in order to find positive cash flow rental properties. A location needs to fulfill a number of conditions for it to be an excellent choice. Do your homework and find out what would make a particular area viable for real estate investing. Be aware of the opportunities in the area and the type of tenants to expect as it all can affect your cash flow.

With Mashvisor, finding areas with positive cash flow rental properties is made easy. Whether you plan to invest in local or out-of-state areas, you can find locations with positive cash flow properties for sale within minutes. You can do it by performing neighborhood analysis using Mashvisor’s heatmap tool. This tool will help you to filter out areas within a city using different metrics related to positive cash flow. These metrics include median property price, rental income, and cash on cash return.

2. Narrow Down the Available Rental Properties

Depending on the neighborhood you have picked, there could be many investment properties for sale to consider. After finding a lucrative area, the next step is deciding on the type of rental property you want to buy and how it ties up with the neighborhood. Be sure to stick with a property type that is in demand in that location. For instance, buying a condo or a single family home would be ideal if the area is a school district. You can also increase positive cash flow by finding rental properties with other features such as more bedrooms, more bathrooms, a garage, or basement.

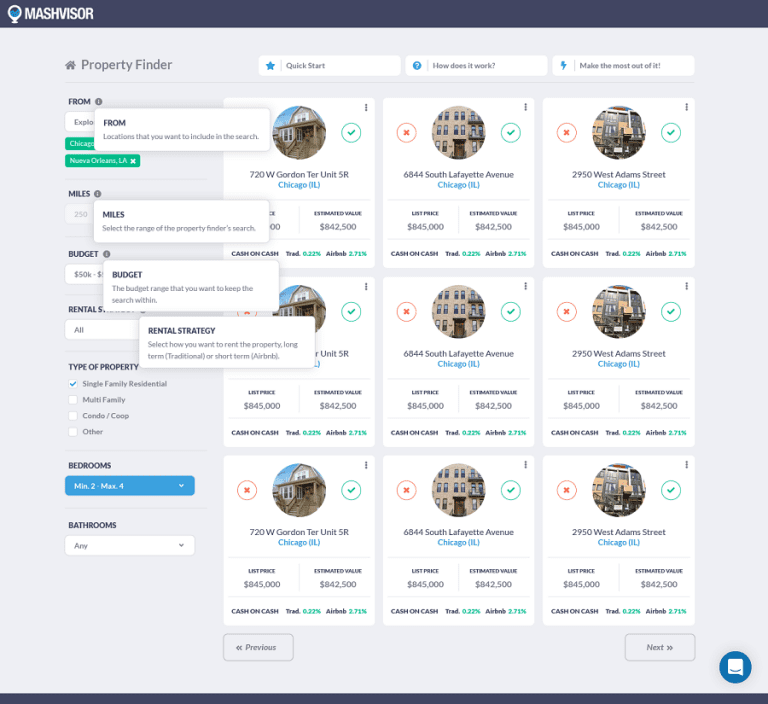

You can narrow down your search for positive cash flow rental properties using Mashvisor’s property finder. This tool uses rental comps to quickly help you narrow down your search depending on your investment goals. You can search for rental properties using filters such as city/ies, rental strategy, type of property, number of bedrooms/bathrooms, and the distance from the city of choice. The tool then shows properties with the highest cash on cash return in the location.

At this point, you don’t have to perform thorough investment property analysis. You have already decided on your location and need a few real estate listings to find your ideal investment property. For instance, you may decide to go for a single family home with one bathroom and two bedrooms. The properties presented will be those that meet your standards. You will be able to eliminate any rental properties that are overpriced or that don’t suit your goals. Try the property finder for free right now.

3. Conduct an Investment Property Analysis

After narrowing down your options, the next step in finding a positive cash flow rental property is evaluating its performance as a real estate investment. For an investment property to have positive cash flow, the rental income should be higher than the expenses. You need to perform a thorough investment property analysis using a real estate investment calculator before you purchase an income property. Mashvisor’s Airbnb calculator is an advanced tool that analyzes investment properties using different metrics like cash flow, cap rate, and cash on cash return. It also shows the optimal rental strategy that will generate positive cash flow (Airbnb or traditional). With this tool, you don’t have to waste a lot of time and energy conducting investment property analysis by yourself.

Related: How to Do Investment Property Analysis

4. Work with a Real Estate Agent

It is recommended that you work with a real estate agent if you want to find positive cash flow rental properties. This is very important, especially if you are a beginner real estate investor. A good buyer’s real estate agent will guide you through the whole process of finding positive cash flow rental properties. The agent will help in negotiating the best terms possible on your behalf. This will enable you to secure a lower price for the rental property. The lower the price, the higher the cash flow that will accrue from it. A knowledgeable and well-connected agent will also be aware of profitable listings as soon as they hit the market.

Related: Working with a Real Estate Agent: What Investors Should Expect

The Bottom Line

Investing in positive cash flow rental properties can be a great investment strategy. If you are looking to make money through real estate investing, then having positive cash flow rental properties should be your priority. The beauty of these properties is that they won’t burn a hole in your wallet. However, it can be difficult to find them if you are not experienced enough. You will have to work hard and follow the right strategies. In your investment property search, be sure to use Mashvisor to find positive cash flow rental properties in the US housing market 2019. It will save you plenty of effort and time.

To start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.