Investing in rental property is a big financial commitment and can be quite daunting. If you are a beginner real estate investor, you need to be keen to avoid the common pitfalls of buying an investment property. It’s absolutely critical to get things right. Even one little wrong investment decision can cost you a lot of money. But you don’t have to worry. There’s a simple remedy – real estate due diligence.

Conducting real estate due diligence before buying an investment property can ensure that your investment is protected. Due diligence is what separates savvy real estate investors from amateurs. The reason why most real estate investors never get past their first property is that they invest without proper due diligence. To learn what real estate due diligence means and what it entails, keep reading.

What Is Real Estate Due Diligence?

You have probably heard of the term “due diligence” a number of times and know it to mean some kind of “homework”. But what does due diligence mean in real estate? Due diligence in real estate is basically the process of investigating potential investment properties for sale to determine whether they are going to fit your investment goals.

If you are buying an investment property, you want to make sure that it’s actually going to generate good returns before purchasing it. During the due diligence period, you’ll examine all aspects of the property and gauge the feasibility of buying it.

Generally, real estate due diligence helps to minimize the risks of buying investment property. You’ll be able to make informed decisions and avoid any unpleasant surprises. While real estate due diligence is not a guarantee that the risk factor will be eliminated entirely, it will give you the confidence that your investment decision is sound.

Related: How to Avoid a Bad Real Estate Deal in 2020

Real Estate Due Diligence Checklist

There are several things you need to learn about an investment property before you can reasonably decide whether buying it is a wise decision or not. Therefore, to successfully perform real estate due diligence, you have to be rigorous and exhaustive.

If you are a first-time real estate investor and unsure where to start, we’ve compiled a comprehensive real estate due diligence checklist that you can use as a guide.

1. Market Analysis

The first and most important real estate due diligence step when buying an investment property is market analysis. The location of your investment property will have the greatest impact on its performance. It not only affects the rate of return on a rental property but also the quality of tenants.

To ensure that you buy investment properties with the highest ROI potential, you should thoroughly research the housing market. When studying the real estate market, some of the crucial things to take into account include:

- Population growth

- Job growth

- Household income trends

- Public transportation

- Social amenities

- School rankings

- New developments

- Crime rate

- Property value trends

- Occupancy rates

- Price to rent ratio

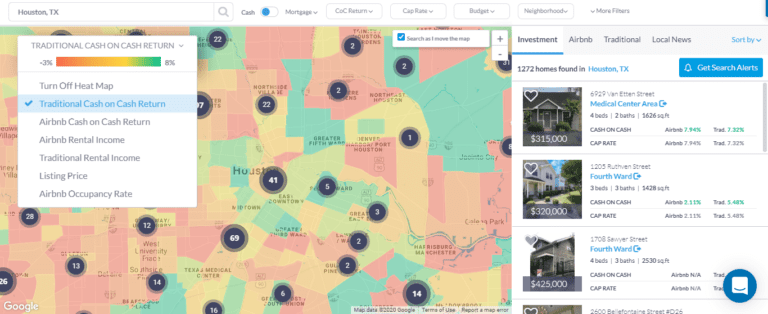

After analyzing the general real estate market, you need to analyze the neighborhood where the investment property is located. You can easily do a neighborhood analysis on any area in the US using Mashvisor’s real estate heatmap.

2. Financial Due Diligence

When performing real estate due diligence, you also want to review the actual financials of the property. In an effort to have a quick sale at the best price, sellers will typically hype their properties as being highly profitable. However, you shouldn’t take what they say as the gospel truth. Instead, perform financial due diligence on your own before making an offer.

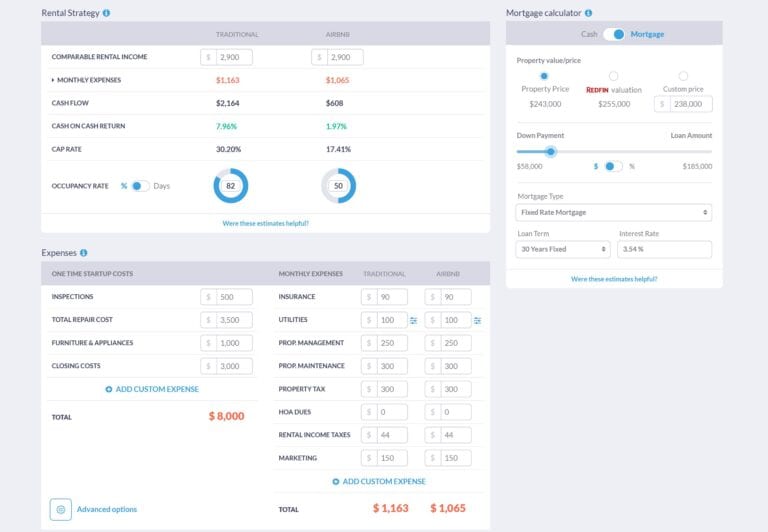

When reviewing an investment property’s financials, you’ll want to look at the following key metrics:

- Rental income

- Rental expenses

- Cash flow

- Vacancy rate

- Cap rate

- Cash on cash return

Remember, your investment decision is only as good as your analysis. If your analysis is inaccurate, you can’t make a sound purchase decision.

Mashvisor’s investment property calculator is the solution to this problem. It makes investment property analysis easier. With this tool, you can get accurate estimates of the above metrics for properties in the US housing market in a matter of minutes.

Looking for a free tool to estimate the potential Airbnb rental income of a specific property? Use our Airbnb calculator.

As a real estate investor, you should find investment properties with positive cash flow and a high return on investment (cash on cash return and cap rate).

3. Real Estate Appraisal

If you are financing your investment property, an appraisal will also be part of your real estate due diligence. A real estate appraisal is the process of determining a property’s value. Your lender will select an appraiser, who will inspect the property and estimate its value based on property features (location, lot size, property size, condition, upgrades, etc.) and how it compares with real estate comps.

Your lender conducts an appraisal to ensure that the investment property is worth the sale price before approving the loan. This will ensure that you don’t overpay.

4. Mortgage Financing

If you will be using mortgage financing, it’s important that you shop around to ensure that you are getting the best financing deal. Get multiple bids and compare the interest rates and loan terms.

5. Property Inspection

During the real estate due diligence period, you should hire a professional home inspector to assess the overall condition of the investment property. The property inspection covers the main structures and systems of the house. The home inspector will then give you a full report on any major and minor issues found.

The purpose of a home inspection is to identify any material defects or deferred maintenance in order to avoid unexpected expenses. Major repairs can have a significant impact on your cash flow.

Sometimes, the seller may agree to make minor repairs. Nevertheless, you have the right to terminate the contract if the property needs significant repairs and an agreement can’t be reached.

6. Title Search

As part of your real estate due diligence, you should hire a professional title company to conduct a title search on the property.

The title company will verify the legal ownership of the property and identify any outstanding liens or claims on the property. You should ensure that the seller has a free and clear title to the property. For the real estate transaction to go through smoothly, the title has to be clean. Moreover, any liens placed against the property will be your responsibility once you purchase it.

After doing a tile search, consider buying an owner’s title insurance. It will protect you from any liens that weren’t discovered. Your lender will often require a title search and title insurance before financing your investment property.

7. Check Out Homeowners Association (HOA) Rules

Condos and houses in planned developments are usually bound to an HOA’s covenants, conditions, and restrictions. The HOA rules and regulations restrict what members can do with their properties so as to protect the value of properties in the neighborhood.

If you are buying a house that is part of an HOA, you are expected to adhere to the HOA rules. If you break the rules, the association will impose a fine on you. Therefore, you’ll want to review the HOA rules and fees to make sure they are in line with your investment plans.

Related: Homeowner Association: What Real Estate Investors Need to Know

8. Get the Right Type of Insurance

There are several types of property insurance for real estate investors. As part of your real estate due diligence, you want to shop around so as to get the right type of insurance for your situation and needs.

As you shop around for insurance, ensure that the investment property meets the minimum requirements. It’s important to work with a professional insurance agent- he/she will help you pick the best property insurance.

Related: 10 Types of Insurance for Real Estate Investors

9. Zoning Regulations

It’s also important to check the property’s zoning to know whether there are any restrictions on how you can use it. For instance, if you buy property in an area zoned for commercial real estate, you will not be allowed to convert it into a residential rental property.

The Bottom Line

Conducting proper real estate due diligence before buying residential real estate is the only way to know whether you are getting a good deal or not. Always be willing to walk away if the deal doesn’t meet your expectations. Remember, you should also have a general understanding of the due diligence documents and their purposes.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today and enjoy 15% off for life.