In this comprehensive guide for real estate investing you will find all the important tips, tricks, and insights to invest like an expert.

Your house is usually the first thing that pops into your mind when you think of real estate investing. Of course, real estate investors can choose among several options for investing, and they are not just physical assets.

Table of Contents

- What Is Real Estate Investing?

- How Does a Real Estate Investor Make Money?

- Why Are More People Investing in Real Estate?

- 4 Ways Beginners Can Invest in Real Estate

- Where Can Beginners Learn How to Invest in Real Estate?

When done correctly, real estate investing may be profitable—despite the recent increases in interest rates. Real estate investing can also help expand your current investment portfolio and provide an extra income source. And many of the finest real estate ventures don’t necessitate answering all possible calls of a renter.

You’re not alone if you don’t know where to begin. Real estate investment is an excellent approach to achieving your financial objectives. However, it may be challenging to manage the process as a beginner. As a result, we provide guidance, recommendations, and beginner-friendly tactics to help you, as well as traps to avoid.

The following “how to invest in real estate for beginners” article from Mashvisor will be of great help, and it will make your invest in real estate learning process more manageable.

What Is Real Estate Investing?

There are a lot of misconceptions surrounding real estate investing. The biggest one is that you need to have plenty of money to make an investment. That’s not true at all since there are alternative ways of getting into real estate investing. However, if you want to get a good return on investment and a decent profit to take to the bank, yes, a larger capital might be needed.

Real estate investing simply refers to the purchase of real estate properties as a means to generate additional income instead of using them as a primary residence. It can be any land, building, infrastructure, or any other tangible asset that is mostly immovable but transferable.

Real estate is classified into the following:

- Residential

- Commercial

- Industrial

- Mixed-Use Properties

- Retail Spaces

- Fix-and-Flip Properties

- Land

Among all of them, most investors prefer to go into residential real estate and fix-and-flips. It is easier to make money off them since there will always be a demand for housing.

Investors can earn from real estate in several ways. A house flipper, for instance, buys undervalued properties and rehabilitates them to sell at a profit.

Rental property owners, on the other hand, create a passive income source with their monthly rental income. The amount will depend on the rental strategy, though. Traditional rentals provide landlords with a fixed but smaller income compared to vacation rental owners, who make up to three times as much depending on the season.

How much you make from real estate investing largely depends on your chosen investment strategy.

How Does a Real Estate Investor Make Money?

Now that you know what real estate investing has to offer, the next thing you’d want to find out is how you can make money from it.

Generally, an investor can make money off a real estate investment with any of the following:

- Appreciation

- Rental Income

- Related Commission

- Real Estate Investment Trusts

Let’s discuss each quickly.

Appreciation

As we already mentioned earlier, real estate properties tend to increase in market value as the years go by. An investor who buys real estate, regardless of investment strategy, is bound to end up with a property of higher value compared to how much they initially put into it.

However, while real estate has no correlation with the stock market and is spared from its volatility, there are instances when home prices may go down unexpectedly.

Rental Income

Another great way of earning well in real estate is by investing in rental properties. There will always be a demand for rental properties as not everyone can afford homeownership, especially at this time. Prospective homebuyers are pushed to the rental space instead.

The savvy investor knows to take advantage of such a situation and looks for income properties to rent out as traditional rentals. This is a win-win situation in that a tenant’s need for housing is met, and the landlord gets to earn a reasonable monthly income.

When it comes to vacation rentals, you will find that the demand for short-term rentals is also increasing, especially in a post-pandemic economy. While the monthly income varies, vacation rentals have the potential to generate up to three times what you would earn from a long-term rental.

Real Estate Investing With Mashvisor

Your success as a real estate investor lies in finding the right rental property. Fortunately, a website like Mashvisor exists.

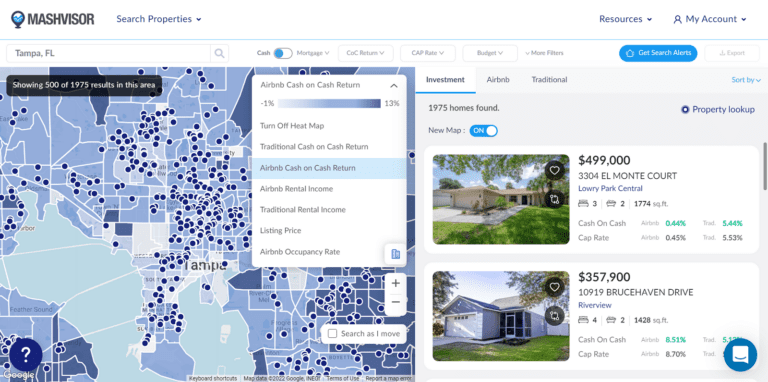

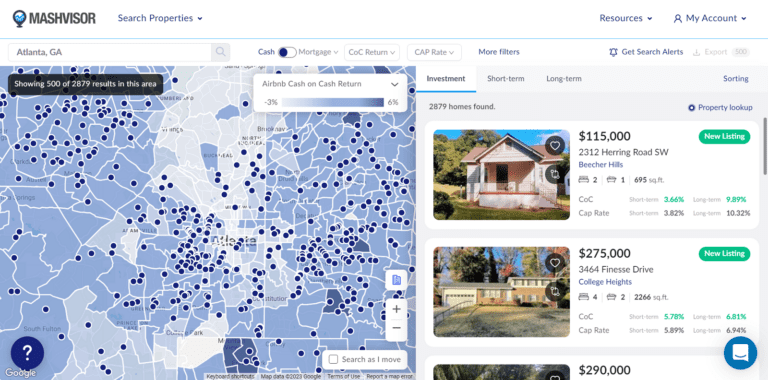

Mashvisor is a real estate investing website that gives its users access to valuable data on almost every real estate market in the US. Its massive database is regularly updated so you can come up with the most accurate and realistic investment property analysis.

The platform offers one of the best real estate investor software in the industry today. The site is easy to navigate and very user-friendly. Tens of thousands of investors have found lucrative investment deals with Mashvisor’s help.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.

As a real estate investor, a website like Mashvisor can help you find the right investment property using its massive database of properties located across the US.

Related Commission

Commissions typically apply to real estate brokers and agents, as well as management companies. They earn a certain amount of money from real estate transactions by getting a percentage of the total amount involved.

If you’re in the wholesale or micro-flipping business, it may also be synonymous with how you make money. Wholesalers act as middlemen between buyers and sellers. They purchase contracts from buyers and assign them to potential sellers at a small profit.

Microflippers, on the other hand, look for distressed properties online to sell quickly at a slightly higher price. A lot of times, they just go online to find buyers for certain properties and do what wholesalers do.

Either way, they earn by selling properties at a slightly higher price than the buyer is asking for. The spread or the price difference serves as their commission for helping make the sale happen.

Real Estate Investment Trusts (REITs)

Real estate investment trusts, or REITs, are an alternative way of investing in real estate without owning physical property.

REITs are companies that own and operate income-generating real estate properties. They include commercial buildings, apartment complexes, shopping centers, hospitals, warehouses, and other similar income-producing properties.

Historically, REITs have delivered very competitive returns, making them one of the more popular real estate investment alternatives today.

Why Are More People Investing in Real Estate?

Investing in real estate offers numerous advantages. Investors may enjoy consistent cash flow, good profit, tax benefits, and versatility with well-chosen assets—and it is possible to use real estate to generate wealth.

Moving on with our “how to invest in real estate for beginners” topic, we will now cover some main reasons why more people learn and invest in real estate.

1. Cash Flow

The net income from an investment in real estate after mortgage payments and operational expenditures is referred to as cash flow. The capacity to produce cash flow is a significant advantage of real estate investing.

In many circumstances, cash flow improves over time as you pay your mortgage and accumulate equity.

2. Deductions and Tax Breaks

Real estate beginner investors can benefit from a variety of tax benefits and deductions, which can result in tax savings. You can generally deduct fair property ownership, operation, and management expenses.

Furthermore, because the cost of purchasing and developing the best investment property may be reduced throughout its useful life (39 years for commercial properties and 27.5 years for residential housing), you profit from years of deductions that help decrease your taxable income.

3. Real Estate Investment Trusts

If you wish to invest in real estate but aren’t yet ready to dive into property ownership and management, you should look into a real estate investment trust (REIT).

On major stock markets, you may purchase and sell publicly traded REITs. Many trade at large volumes, allowing you to enter and exit positions swiftly. REITs must distribute 90% of their earnings to shareholders. Therefore, their dividends are often greater than those of other stocks.

4. Inflation Protection

The capacity of real estate to hedge inflation arises from the positive link between the demand for real estate and GDP growth. Rents rise as economies grow and demand for real estate increases.

As a result, real estate strives to preserve capital’s purchasing power by transferring some of the inflationary pressure to renters. It also integrates some of the tension in inflationary in the form of capital appreciation.

5. Leverage in Real Estate

Leverage is the use of different financial tools or borrowed resources (e.g., debt) to boost the possible return on investment.

For instance, a 20% down payment on a mortgage provides you 100% of the property you want to buy—an example of leverage. Financing is widely available since real estate is a physical asset that can be used as security.

4 Ways Beginners Can Invest in Real Estate

Getting into the real estate industry might be scary if you need to learn how to start investing. It might take years for a beginner real estate investor to feel at ease and comfortable.

As a result, beginner-friendly investing techniques are an excellent starting point. While they are ideal for inexperienced investors, they may be tremendously rewarding when learned and managed correctly.

Starting off in a beginner-friendly investing area is an excellent method to learn the basics before moving on to more challenging assets. By beginning with a simpler plan, beginner investors may learn about their network and local market. They can then find out how to raise funds without agreeing to a venture they may not be capable of handling.

But the “how to invest in real estate for beginners” question is broad and detailed. Below are some of the best ways beginners can learn and invest in real estate.

1. Real Estate Wholesaling

Real estate wholesaling is one of the quickest methods to learn and get started in real estate. Such a one-of-a-kind approach requires obtaining a property for less than the real estate market value and appointing an end buyer to acquire the contract. Wholesalers never own the asset and profit by including a fee in the final deal.

The key to successful wholesaling is to build a solid buyer network. It is basically a list of investors who may be seeking their next investment opportunity. To locate new buyers, wholesalers will frequently undertake a lead generation strategy.

The lead generation approach entails marketing the company, typically through emails, social media sites, or direct mail, and then assembling a list of potential investors.

The fact that wholesaling does not necessitate considerable funds to get started makes it ideal for beginner real estate investors.

Although beginner investors may require funds for effective marketing or favorable interest payments, they will not be acquiring homes. Moreover, wholesaling helps investors establish a trustworthy network and acquire strong market knowledge.

2. Prehabbing in Real Estate

Another excellent way to get started in real estate investment is by “prehabbing.” Unlike a rehab venture, which requires considerable changes, a prehab project requires minor modifications. Usually, beginner investors would improve a home just enough to tempt prospective investors visually.

Prehab is upgrading a house via sweat equity instead of making drastic improvements. Among the prehab projects are:

- Painting: An inexpensive option for beginners to enhance the property’s look.

- Cleaning: Taking the time to clean up garbage and dirt in a home and basic cleaning may strongly influence its appeal.

- Landscaping: If you can convince visitors to enjoy the outside of your property, they’re likely to take the time to go inside. Curb appeal can go a long way for a low expense in real estate.

Beginner investors considering this technique should know that not every house will be suitable for repair. Seek homes with structural stability that need a “simple” repair—avoid residences that may require costly repairs immediately.

When studying how to invest in real estate for beginners, the appeal of prehabbing should be evident. It does not only require less risk and less labor than other investing alternatives, but it also produces a speedy return on investment.

3. Buying Rental Properties

Are you ready to become a beginner landlord? Investing in rental homes might be an excellent strategy to ensure a consistent monthly income. If you can handle the landowner real estate duties, you will undoubtedly appreciate generating a steady income.

If you invest and acquire a short term rental property at the appropriate time and in the best short term rental markets, your rental income may even cover your upkeep, mortgage, and repair costs. Even better, you may have some cash left over.

As an owner of a rental property, you can choose whether you want this revenue source to be passive or active. Landowners who desire not to be a “landlord” at all might delegate their tasks to a property manager.

In addition, some real estate property owners prefer to outsource only repairs and maintenance, while others may do it themselves to save money and maximize profits.

As a beginner investor, you should think about house hacking when investing in rental houses. It implies you will live in one of the bedrooms and rent out the others. You might also buy a vacation rental property that is multi-unit and live in one of the apartments.

Moreover, even if you want to receive rental income from the house, it might make you more eligible for a residential loan.

4. Flipping Houses

House flipping is one of the best beginner ways to invest in real estate. In general, you find a house that is being sold for less than its market worth. It usually needs some repair and renovation. The home is then sold for a profit after refurbishing it.

Beginner investors who wish to flip property should be aware of the dangers and undertake thorough financial evaluations. Several things can go wrong. To begin with, if you overspend on your repair budget, you may not earn a profit.

Moreover, you may risk being unable to sell the real estate property if the pricing or market circumstances are not favorable.

You may sell your property on real estate investment platforms like Mashvisor or your website. While it can save you money on realtor costs, it may take a long time to locate a purchaser. As a result, engaging with a real estate agent with some expertise in flipping properties would be advisable if you are a complete beginner.

Do you need help finding suitable properties and managing the relevant real estate data? Mashvisor can help. Sign up for a 7-day free trial now.

You can use Mashvisor and its tools to search for lucrative real estate investments.

Where Can Beginners Learn How to Invest in Real Estate?

When exploring real estate investing as a beginner, it is vital to keep an open mind and read many valuable articles and books. You can also talk with individuals with previous knowledge and experience.

The following are a few of the most helpful real estate investment recommendations for beginners.

1. Networking Is Crucial

Beginner investors should participate in as many events, conferences, and investing groups as possible. It may seem unsettling initially, but anyone looking to enter the industry needs to make some contacts.

After your first few beginner encounters, try reading some ideas on networking online and attempt to discover a tutor. Engaging with real estate experts allows you to learn precise details about how to land transactions and overcome obstacles. Local networking events can even introduce you to market-specific knowledge.

Networking events are not only a terrific place to learn, but they are also a wonderful opportunity to start establishing a list of contacts. Regarding real estate investing for beginners, your relationships will influence how you handle investments and discover your specialization. When you start closing deals, having the right team to rely on will be critical.

Finally, when connecting, always use your best judgment when speaking with other investors. Take in as much knowledge as possible, but remember to research anything you see. Just because a particular sector or location does not perform for someone doesn’t mean it will not work for you.

2. Learn More About Real Estate for Beginners

To establish a real estate business, you must first study everything you can about the sector. Find investing books, websites, and journals to get you started. While several alternatives are available, try not to become overwhelmed at first.

Instead, pick up a couple of real estate investment books, subscribe to a real estate newsletter, and set aside about 20 minutes each day to study something new. All great real estate investors have one characteristic in common—they never stop growing and learning.

Such a continuous education approach will benefit you well throughout your investment career. Check out Mashvisor’s First Time Investor Resource Center, which is full of knowledge and insights for real estate beginners.

3. Create a Business Plan for Real Estate

A business plan is an excellent way to start investing as a beginner. It will help you figure out why you’re doing it. For instance, perhaps you desire to save for a pension or assist your family’s financial status.

Whatever your motive, visualizing your “why” before you begin will be a powerful source of inspiration. The next stage in developing a business strategy is to outline your unique business objectives. A real estate business strategy may appear strange initially, but its purpose is to provide investors with a road map.

It will assist you with identifying and outlining your goals and creating specific strategies to achieve them. A real estate business plan, with adequate planning, may serve as an important learning tool for real estate investment beginners.

What are Best Types of Real Estate Investment for Beginners

If you have been reading up on all the different types of real estate investment, it might come as no surprise that single family homes are number one on this list. Let’s investigate two major reasons that are the basis of why single family homes can be the best real estate investments for beginners.

1. Single Family Homes: The More Affordable Investment Properties

When it comes to single family vs. multifamily rentals, single family homes are the more affordable investment properties, hands down. Just take a look at any listing price for single family homes compared to multifamily homes.

Not only is the initial investment property price lower, but the rental property costs are lower as well. With a smaller investment property tend to come lower costs for any kind of maintenance imaginable. There are no extra maintenance costs for common areas either, like with multifamily homes. Landlords of single family homes find that their tenants take better care of the investment properties as well. This is because single family homes tend to feel more like a real home to tenants than an apartment. Rental property management becomes much easier and the maintenance much cheaper.

Even the tax deductions are greater for single family homes, making them the more affordable investment properties. This includes a longer depreciation period. These types of real estate investment also have lower property taxes, insurance rates, and even interest rates.

Why does the affordability factor make single family homes one of the best types of real estate investment for beginners? Well, first of all, a beginner real estate investor may not have the funds that a more seasoned investor would have accumulated from other rental properties. In addition, the more affordable the investment property, the more properties a real estate investor can purchase to expand his/her investment portfolio and increase his/her overall rental income and return on investment.

Mortgage Lenders Love Single Family Homes

Real estate investing for beginners can be a bit difficult when it comes to getting approval for investment property financing. Mortgage lenders are taking on a risk of default on every investment property. They tend to see beginners in real estate investing as an even greater risk.

Luckily, mortgage lenders generally view single family homes as a low risk real estate investment. This is because they are pretty stable in almost every real estate market, no matter the conditions. Single family homes also retain property value consistently: when they go down, property prices for these types of real estate investment are bound to come back up. Because of this, with the right single family investment property, mortgage lenders will offer relatively lower interest rates and monthly mortgage payments. All of this means more rental income going into the pocket of the real estate investor.

So, what is the “right single family investment property”? It’s one that has good cash on cash return, cap rate, potential rental income, and return on investment. How can a beginner real estate investor find such low risk single family homes which mortgage lenders will love? One place and one place only: Mashvisor. Mashvisor’s rental property calculator will help you find the best types of real estate investment to land you the best investment property financing.

Duplex House

One of the best ways to get started in real estate investing is with a duplex house in combination with an owner-occupied investment strategy. A duplex house is technically a multifamily home but still in the realm of residential real estate investing. However, it can be a great stepping stone towards commercial real estate investing for beginners. Why is a duplex house one the best real estate investments for beginners?

A Duplex House Qualifies for FHA Loans

Most types of real estate investment do not qualify for FHA loans, to the disappointment of real estate investors who know that with FHA loans come with a significantly lower down payment: 3.5%. Fortunately, a duplex house offers a kind of a loophole. As long as a real estate investor is willing to be an owner-occupier of an investment property for a year, he/she can save a lot of money on a down payment. All the while, the real estate investor will be making rental income from the other unit in the duplex house. This is why a single family home investment property is not ideal for this type of investment property financing.

Being an owner-occupier has other benefits, even though some real estate investors turn away from this investment strategy and miss out on the low down payment. Real estate investing for beginners with a duplex house can be a great way to learn all about hands-on rental property management.

Double Your Rental Income After One Year

What other types of real estate investment promise that, within a year, rental income will double?! None. An FHA loan only requires you to live in the investment property for a year. After that, you can move out and make rental income from both units in the duplex house. This increases your return on investment and allows you to qualify for another investment property financing loan after another year.

Need more reasons why a duplex house is ideal for beginner real estate investors? Read here: Is a Duplex House a Good Real Estate Investment?

2. Turnkey Rental Properties

Turnkey rental properties are types of real estate investment which are provided by a property investment company. Basically, the company has chosen what they perceive as the best real estate investments in the housing market. They, then, prep the investment property and, sometimes, even find tenants to get the ball rolling on rental income. There are two reasons why turnkey rental properties are the best types of real estate investment for beginners:

Learn a Ton with Less Risk

Real estate investing for beginners should be all about learning how to be successful with investment property. That’s what makes turnkey rental properties the best way to get started in real estate investing. A property investment company has done all of the risky work for you: choosing where to invest in real estate and selecting the exact investment properties through real estate market analysis and investment property analysis.

Your job as a beginner real estate investor would be to learn why and how they chose such investment properties. In this way, you learn all about investing in real estate without making any real mistakes. Of course, for this to work, you need to thoroughly research the turnkey rental properties company.

Rental Property Management Is Often Provided

While single family homes and even a duplex house can make rental property management somewhat easier, turnkey rental properties can take care of it all for you. Most of these companies provide rental property management and take care of finding tenants and the day to day maintenance of the turnkey rental properties for a reasonable fee. This can also be a source of education on real estate investing for beginners for the real estate investor who watches the professionals closely and takes note of how things are done successfully.

3. Townhouses

Among the array of single-family homes, townhouses emerge as a compelling option for cash flow-focused real estate investment. But what exactly do we mean by townhouses? Townhouses, often referred to as row houses, are a unique configuration of multiple units connected in a row. Each unit shares a common wall with its neighboring unit. When you choose to rent out these row houses, you’re not just offering tenants living space but also additional amenities such as a backyard, lawn, and driveway. This added value allows you to command higher rental rates, leading to a more robust cash flow. Another advantage of townhouses is their affordability in comparison to standalone single-family homes, making them an attractive choice for cash flow-oriented investors.

4. Apartment Buildings

Apartment buildings take a prominent place on the roster of top-tier real estate investments for cash flow enthusiasts. Their multitude of units bestows upon them the status of highly profitable cash generators. Consequently, investments in apartment rentals often exhibit a swift return on the initial investment. The prospect of passive income isn’t limited to smaller multi-family homes; it’s equally attainable with apartment buildings. Savvy investors may choose to enlist the services of landlords and property managers to handle the day-to-day rental activities, further enhancing the passive income potential. It’s for these compelling reasons that apartment buildings firmly establish themselves as one of the premier choices among real estate investments geared towards maximizing cash flow.

5. Condominiums

Condos, short for condominiums, represent a unique facet of real estate where multiple buildings house separate units owned by individual investors. Similar to townhouses, these units might share a common wall. Condos stand out as prime candidates for the title of best real estate investments for cash flow, and there are several compelling reasons for this distinction.

Foremost among these reasons is the strategic location of condos, often nestled in hot real estate markets where they enjoy robust demand from prospective tenants. This robust demand translates into a steady stream of positive cash flow, especially when juxtaposed with the higher costs associated with single-family homes or multi-family homes in the same sought-after locales. Condos, therefore, shine as a prime choice for astute investors seeking to maximize cash flow potential in the ever-evolving real estate landscape.

6. Multi-Family Properties

Multi-family properties stand as the second most prevalent category of residential real estate, boasting an exceptional prowess in generating cash flow. With their multiple units, they ascend to a realm of income potential surpassing that of single-family residences. Multi-family properties encompass a wide spectrum of unit counts, spanning from duplexes to expansive apartment complexes, all harboring the promise of substantial profitability.

What sets multi-family properties apart is their innate ability to yield substantial cash flow, often affording real estate investors the luxury of enlisting professional property management services. This strategic move elevates the potential for positive cash flow even further, as skilled managers can diligently maintain high occupancy rates and effectively manage expenses.

Nonetheless, it’s imperative to acknowledge the hurdle of accessibility associated with multi-family properties. Depending on the number of units within the property, the price tag can soar above that of other investment property types.

Nevertheless, most mortgage lenders perceive them as low-risk investments, making financing attainable. Additionally, savvy investors can explore ingenious methods for acquiring multi-family properties with minimal to no initial capital, solidifying multi-family properties as among the most lucrative opportunities in the realm of real estate investments focused on cash flow.

Conclusion

How to invest in real estate for beginners is genuinely a complex and comprehensive topic. Hopefully, we’ve covered the essentials in this article.

Undoubtedly, real estate is a very profitable investment option. Nevertheless, one of the most significant obstacles to entry is figuring out how to invest in real estate. The good news is that anybody can learn how to invest in real estate—all you need to do is put in the effort to educate yourself.

Whatever your starting place, there is no reason why real estate should be out of reach. Many investing tactics might spring up a profitable real estate business. Spend some time learning about real estate investment for beginners and determining the best strategy for you.

Most importantly, you want a real estate platform that organizes your investing needs. Mashvisor does precise rental analysis and delivers dependable data and analytics to help you make sound business choices.

Do you need help finding suitable properties and managing the relevant real estate data? Mashvisor can help. Sign up for a 7-day free trial now followed by a 15% discount for life.