Real estate investing is a great way to make money, but in order to be a successful real estate investor, you need to buy an investment property that is profitable. Rental income is the stream of income that property investors make when renting their investment properties. Thus, it’s only logical that the most profitable investment properties are those that generate a high rental income. Keep reading to learn where property investors can find the most profitable investment properties in the US housing market – according to numbers from Mashvisor’s investment property calculator. But first, let’s explain some more about rental income in real estate investing.

What Determines Rental Income?

Location

In real estate investing, the location of the rental property affects every aspect related to it, including how much a real estate investor can charge for rent. This is why we hear the term “location, location, location” a lot in the real estate business. Some locations yield a profitability and return on investment higher than others. This mainly depends on the demand for real estate investing in the area.

Typically, the best places to buy a rental property are those with an increasing rental population – this means a larger pool of potential tenants. Moreover, property investors should invest in areas with high traditional or Airbnb occupancy rate as this allows them to charge higher rent and still guarantee that their investment properties will be occupied.

Rental Strategy

Your rental strategy is how you decide to rent out your rental property. In real estate investing, property investors can rent either for the long-term (traditional) or for the short-term (Airbnb). Which rental strategy you opt for will also affect your return on investment. This is why determining the optimal rental strategy is a crucial decision that should be made carefully!

Related: Airbnb Investment or Traditional Investment: How to Determine The Optimal Strategy

The location should also be taken into account here. Some locations yield a higher return on investment for traditional rentals while others are more profitable for Airbnb rentals. For example, a city that is considered a tourists destination will generate a higher Airbnb rental income because these locations have a higher demand for short-term rentals. Therefore, a real estate investor needs to perform a real estate market analysis to see which rental strategy is more profitable.

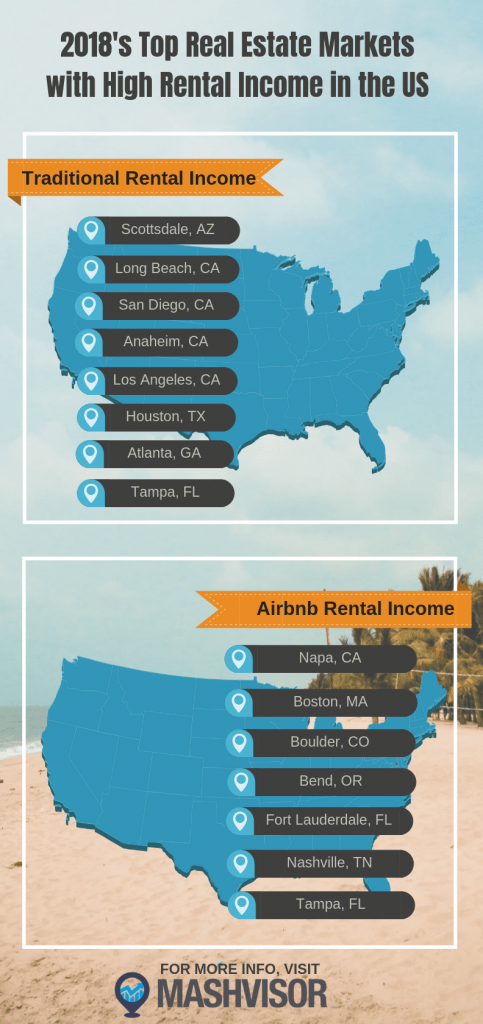

Accordingly, we provide you with two lists regarding the best places to buy a rental property in terms of traditional and Airbnb investments:

To start searching for and analyzing investment properties in the city of your choice, click here!

To start searching for and analyzing investment properties in the city of your choice, click here!

Here is further information and data that any real estate investor should know before buying an investment property. These numbers are provided to you by Mashvisor’s investment property calculator – the ultimate real estate investing tool which uses traditional as well as predictive analytics to provide every real estate investor with reliable estimates for both traditional and Airbnb investments.

Cities with Highest Traditional Rental Income

Scottsdale, AZ

- Median Property Price: $871,027

- Rental Income: $3,369

- Cash on Cash Return: 2.34%

- Cap Rate: 2.34%

Long Beach, CA

- Median Property Price: $827,550

- Rental Income: $3,052

- Cash on Cash Return: 12%

- Cap Rate: 12%

San Diego, CA

- Median Property Price: $831,560

- Rental Income: $2,678

- Cash on Cash Return: 1.19%

- Cap Rate: 1.19%

Anaheim, CA

- Median Property Price: $588,186

- Rental Income: $2,650

- Cash on Cash Return: 1.68%

- Cap Rate: 1.68%

Los Angeles, CA

- Median Property Price: $831,560

- Rental Income: $2,678

- Cash on Cash Return: 1.19%

- Cap Rate: 1.19%

Houston, TX

- Median Property Price: $421,159

- Rental Income: $1,819

- Cash on Cash Return: 1.34%

- Cap Rate: 1.34%

Atlanta, GA

- Median Property Price: $465,824

- Rental Income: $1,793

- Cash on Cash Return: 1.82%

- Cap Rate: 1.82%

Tampa, FL

- Median Property Price: $368,521

- Rental Income: $1,586

- Cash on Cash Return: 1.62%

- Cap Rate: 1.62%

Cities with Highest Airbnb Rental Income

Napa, CA

- Median Property Price: $1,462,860

- Rental Income: $6,627

- Cash on Cash Return: 3.68%

- Cap Rate: 3.68%

Boston, MA

- Median Property Price: $852,782

- Rental Income: $3,203

- Cash on Cash Return: 1.15%

- Cap Rate: 1.15%

Boulder, CO

- Median Property Price: $1,027,305

- Rental Income: $3,126

- Cash on Cash Return: 1.36%

- Cap Rate: 1.36%

Bend, OR

- Median Property Price: $606,541

- Rental Income: $3,019

- Cash on Cash Return: 2.64%

- Cap Rate: 2.64%

Fort Lauderdale, FL

- Median Property Price: $667,305

- Rental Income: $2,947

- Cash on Cash Return: 1.46%

- Cap Rate: 1.46%

Nashville, TN

- Median Property Price: $428,107

- Rental Income: $2,288

- Cash on Cash Return: 3.33%

- Cap Rate: 3.33%

Tampa, FL

- Median Property Price: $368,521

- Rental Income: $1,481

- Cash on Cash Return: 2.03%

- Cap Rate: 2.03%

How to Find the Best Investment Property in These Real Estate Markets

We understand the difficulties real estate investors face while searching for the right rental property, and we offer the solution! Mashvisor helps property investors find the best investment properties in any city or neighborhood in the US housing market based on different criteria which you can set to match your preference. You can do that using our real estate investing tools including:

- Investment Property Calculator: A versatile tool that allows you to calculate the different values related to a rental property, including the cap rate, cash on cash return, cash flow, and occupancy rate (for both traditional and Airbnb investment). This will help with your investment property analysis to ensure it’s profitable.

- Investment Property Finder: A powerful and heavily customizable search tool that allows you to search for investment properties using different filters, such as finding rental properties in a certain neighborhood and with a certain cap rate. This makes it easier to compare different investment properties in the same location and determine which one has the best profitability.

- Heat Map Function: The heat map function for the property finder tool allows you to find investment properties much faster using visual cues. For example, you can set the heat map to indicate the areas with the highest rental income, and the heat map will highlight which areas are hot or cold for this feature. This will make it easier to compare different neighborhoods and see which one has more profitability for real estate investing.

Sign up with Mashvisor to quickly find the best investment properties in any city or neighborhood across the US housing market within 15 minutes! To start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.