Real estate investing is not a new concept. But there are new real estate investors entering the field every day and with them, they bring a lot of misconceptions. Mashvisor deals with new real estate investors on a daily basis and we often come across a lot of real estate myths. While it may not sound like a big deal to have the wrong idea about real estate investments or the housing market, some of these ideas actually hold back a lot of people from walking a great path to financial independence. Or worse, they cause many beginners to make mistakes along the way. That’s why we’ve decided to debunk 25 common myths about real estate.

Myth #1: Investing in Real Estate with Little to No Money Is Impossible

Whenever newbies ask whether investing in real estate with little to no money is possible, they are often met with ridicule. But, if you break down the question, most people who are asking it aren’t referring to getting into real estate with $10. They are usually carrying around the misconception that you need hundreds of thousands of dollars to get started – the prices they see for investment properties for sale. And even then, some of them aren’t aware that you can invest in real estate without actually buying an investment property.

So, not only can you invest in real estate with little to no money (sometimes as little as $30k or even $5k), but there are actually a few different strategies that you can try including:

- House Hacking

- REITs

- Real Estate Wholesaling

- Lease Option/ Lease Purchase

- Seller Financing

- Home Equity

- Real Estate Partnerships or Syndication

- Real Estate Crowdfunding

- Hard Money/Private Money Lenders

Myth #2: You Can’t Shop Around for a Mortgage

This is one of the most common real estate myths about investment property financing. Most beginners will turn to the bank where they currently have an account and settle on whatever investment loan terms they are offered. But why settle when you can shop around? Banks want your business and if you generally meet the requirements for an investment property loan, they may try to offer you competitive rates if they know you’re shopping around. Your author is a property owner and can tell you from personal experience that shopping around can help you get the best interest rates and terms.

Don’t be fooled, however, into thinking that banks are dying for your business and will go to crazy lengths to give you a real estate investment loan. We are not trying to create new real estate myths around the topic. Still, consider working with a mortgage broker who can help you find the best rental property mortgage rates and terms or visit a few different mortgage lenders to discuss what they can offer you. Keep in mind that you can also negotiate and reduce certain closing costs as well.

Myth #3: Successful Real Estate Investors Make It Thanks to the “Gift of Intuition” or a “Gut Feeling”

This is one of those real estate myths that really intimidates people and keeps them out of the game. If you don’t have some kind of inner voice telling you which houses for sale in your neighborhood will make you rich, then becoming a real estate investor isn’t for you, right? Or if you cannot predict when the next housing market crash or recession will take place, then you have no place investing in real estate. This just isn’t true.

Successful real estate investors have made their way in this business by:

- Accumulating knowledge

- Understanding the risks and how best to mitigate them

- Learning how to properly evaluate a housing market through real estate market analysis

- Learning how to conduct investment property analysis to determine return potentials

- Working with professionals and using all the real estate investment tools available to them

Although experience in real estate investing may lead to a kind of “gut feeling” about real estate deals, be sure that successful investors back this up with research and analysis before making any kind of investment decision.

What this means is that, if you’re willing to put in the work and the time to develop your knowledge and real estate skills, you too can succeed in the real estate market.

Myth #4: There Is a Wrong Time and a Right Time to Invest in Real Estate

Is there a right time or a wrong time to invest in real estate?

Let’s clarify what is meant by this real estate myth:

Yes, there could be a wrong time and a right time for you to invest in real estate. Perhaps you lost your job and have little money saved up? Then it’s probably not a good time to visit your mortgage lender and start searching for investment properties for sale. On the other hand, if you have job security and are starting to think about your retirement plan, now is a good time to invest in real estate.

On a personal level, timing matters. But when it comes to trying to figure out the best time to invest in real estate, there is only one way to time it: Invest when you find a good real estate deal in a good housing market. Whether it’s spring, summer, winter, or fall, 2020, or 2030, that’s when it will be the best time to invest in real estate.

Myth #5: Only Buy an Investment Property for Sale in a Buyer’s Market

Speaking of timing, waiting for a buyer’s market to roll around is another one of the real estate myths that keep people out of the game. Yes, a buyer’s market is ideal when shopping around for income properties for sale. However, so many top real estate markets are seller’s markets in the US housing market today. For instance, the Phoenix housing market is a very hot seller’s market right now, according to Zillow. But it’s actually one of the best places to invest in real estate for a high return on investment.

Myth #6: Beginner Real Estate Investors Should Stick to Buying Rental Property Close to Home

When it comes to choosing a real estate market to invest in, there are plenty of real estate myths floating around out there. But this one can really lead to a bad real estate investment. Your local housing market doesn’t have to be your first choice for location when buying a rental property. Sure, it comes with some advantages. You can easily travel back and forth during the purchase as well as afterward when operating the rental property. Trying to land a mortgage for an out of state rental property has different implications.

At the same time, your local real estate market may not be the best place to buy a rental property. There could be plenty of reasons why:

- The market could be too expensive

- Property taxes could be too high

- There could be rent control or other restricting landlord-tenant laws (or Airbnb regulations)

- Demand for rental property (or short term rental properties) may be low

- Rental properties for sale may promise a very low return on investment

Even if you’ve done your real estate market research on your local area and found that you can get a decent return on investment, a neighboring city or state could help you make more money. Don’t limit yourself. Conduct a real estate market analysis to ensure your location of choice is the best choice.

Myth #7: A “Nice” Neighborhood Is the Best Place to Invest in Real Estate

Neighborhood analysis and research don’t only consist of driving around the area to ensure it’s quiet and clean. If that’s how you’re going about it, you’re buying into a common real estate myth. A “nice” neighborhood isn’t always profitable. It may be (and very likely will be), but you cannot know for sure without conducting a proper neighborhood analysis.

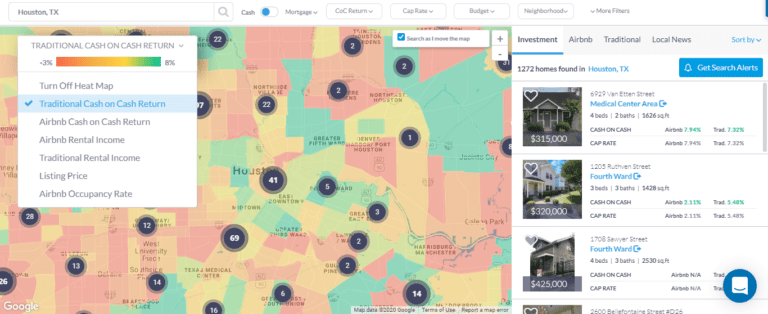

The best way to conduct a neighborhood analysis is with a Real Estate Heatmap. Mashvisor’s Heatmap will help you find the best neighborhoods in any city in just a few clicks. You can analyze neighborhoods using important metrics like listing price, rental income, cash on cash return, and Airbnb occupancy rate.

Besides the numbers, be sure to get more detailed information about the neighborhood like crime rates, transportation, and even real estate appreciation rates. Don’t just “eyeball” it.

Myth #8: Airbnb Investments Are Bad Real Estate Investments

The debate surrounding traditional vs Airbnb investments is littered with real estate myths. But let’s debunk one now: Airbnb investments are not bad real estate investments. While long-term rental properties are reliable sources of income, Airbnb rental properties can also be turned into a profitable real estate business. How can you be sure? Just look at the Airbnb data. You will see that those who invest in Airbnb often earn a higher rental income and cash on cash return than long-term rental investors. Let’s look back at the Phoenix real estate market as an example. Mashvisor’s Airbnb analytics reveals that Phoenix short-term rentals outperform traditional rentals:

Airbnb Phoenix Investment Properties

- Airbnb Rental Income: $2,684

- Airbnb Cash on Cash Return: 3.2%

Traditional Phoenix Investment Properties

- Traditional Rental Income: $1,702

- Traditional Cash on Cash Return: 1.7%

Of course, it takes some finesse to get to the point of owning an Airbnb that is profitable. Be sure to:

- Find the best neighborhoods for Airbnb rentals

- Conduct Airbnb investment analysis on properties for sale and estimate Airbnb income and occupancy rates

- Buy an Airbnb for sale that promises cash flow

All of this can be achieved using Mashvisor’s Airbnb income calculator.

Myth #9: Fixing and Flipping a House Is Easy

Unfortunately, reality TV has created a lot of real estate myths. But no other real estate investment strategy has been tainted as much as fix and flip. Can it be a fun and profitable venture? Sure. Is it easy? No. It will take a lot of planning, cash, and knowledge to successfully pull off a fix and flip. Even then, you will have to do it over and over again to produce an actual income from it. That’s why most experts recommend the buy and hold real estate investment strategy for beginners.

Myth #10: A Low Price to Rent Ratio Is a Good Price to Rent Ratio

Mashvisor has put out a few articles on why investing in cities with a high price to rent ratio can be a good idea. These cities will be places where the average resident can’t afford to buy a home. Instead, they will choose to rent, resulting in high demand for long-term rental properties and a high renter population. At the same time, if the real estate investor also can’t afford to buy a rental property here, then it’s not a good location.

Mashvisor also agrees that cities with a low price to rent ratio can make for good rental markets. Although more people can afford to buy a home and the renter population will be lower, you may only be able to afford an investment property in such a location. As long as there is some demand for rental properties here, then it could be a good place.

So why did we include this on our list of real estate myths?

This is a tricky one. It’s not that a low price to rent ratio is bad. But a high price to rent ratio may also not be bad. It’s important to highlight that either can work out depending on your situation. The price to rent ratio is only a part of the picture. It is real estate data you should have on the housing market and it will ultimately help you make a decision on where to buy investment property. But like most market and property metrics, it cannot be the only number you use to make a decision.

If your budget for investing in real estate is over $800,000, then you may be able to benefit greatly from a location where others cannot afford to buy homes. If your budget is much lower, closer to $100,000, then yes, a low price to rent ratio could work for you. Just be sure to break it down- look at property prices, expected rental income, cash flow, and more.

Myth #11: A Cheap Investment Property for Sale Is Always a Good Real Estate Deal

One of the real estate myths that beginners often believe is that a good deal means a low price. When experts say “good real estate deal” they aren’t really referring to a cheap investment property for sale. Rather, they are referring to an investment property that:

- You can afford/is below market value

- Can be flipped for a good return on investment

- Or will produce positive cash flow and a good return on investment after a few years

Being cheap can be part of the formula, but it should not be the only reason you jump on a deal.

Myth #12: A Good Cap Rate Is Always a High One

There is always a heated debate when it comes to determining what is a good cap rate. Some will argue that there is no such thing as a good cap rate, others say it’s a high one, some say it’s a low one. Most real estate experts agree that a good cap rate is somewhere between 8% and 12%.

The real estate myth we’re debunking today is that a good cap rate is always a high one. Yes, it can be wise to start your search for investment properties for sale in high cap rate markets. You may even set your eyes on high cap rate investment properties for sale. But what you have to understand is that the cap rate is not a deciding factor, just like the price to rent ratio.

A high cap rate rental property that produces positive cash flow, is located in a good real estate market, and has the potential to appreciate in value is a great real estate deal. But a high cap rate rental property that is priced so low because it requires major renovations before it could ever be rented out is not.

On the other hand, a low cap rate rental property that will bring cash flow and appreciate would make for a better real estate investment here. Once again, it’s important to grasp that it’s a myth to think that you can make your investment decision based on one grandiose number. So when Mashvisor or other experts tell you to go after a high cap rate property or start finding investment properties for sale in neighborhoods with a high average cap rate, we always mean that is only if all of the other pieces fall into place. That’s why our tools (the Investment Property Calculator and Real Estate Heatmap) allow you to analyze real estate based on multiple metrics and not just the cap rate:

- Rental Income

- Expenses

- Cash Flow

- Cash on Cash Return

- Traditional and Airbnb Occupancy Rate

- Comps

- And More.

Myth #13: You Can’t Find High Return Properties for Sale

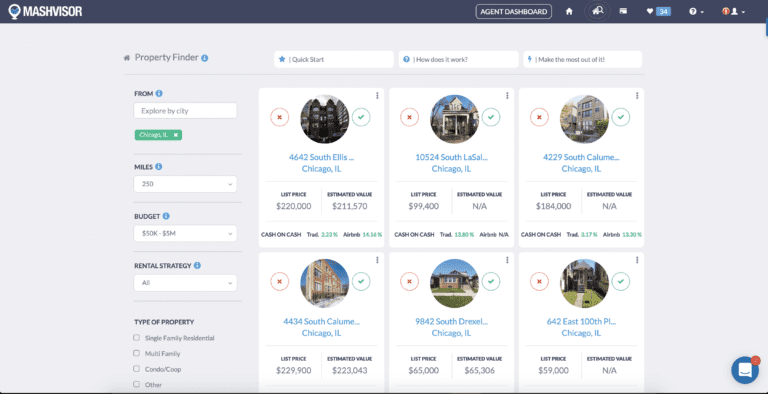

Some investors steer away from real estate because they believe that other types of investment offer higher returns and that you cannot find high return investment properties for sale. This may be true depending on how you go about your search. But there exist real estate investment apps that allow you to find high return properties, even those that promise a 20% return on investment!

Once such app is Mashvisor’s Rental Property Finder. This tool just asks that you set a few filters like your location of choice, budget, preferred rental strategy (traditional or Airbnb), and property type of choice (single family home, multi family home, condo/coop, etc.). The data-driven AI will then generate a list of high return income properties for sale right before your eyes.

While you will have to continue the analysis to ensure your personal investment property financing will not lower the return on investment, it is still very possible to find high return properties in the US real estate market. If it wasn’t, you wouldn’t have so many real estate investors retiring early and becoming financially independent.

Myth #14: Real Estate Investment Analysis = Endless Spreadsheets

When you decide to get started in real estate and begin to do a little research, you may be bombarded with real estate investment analysis spreadsheet templates (do a quick Google search and you’ll see what we mean). While you absolutely need to conduct a thorough and comprehensive real estate investment analysis before making a purchase, it doesn’t have to involve spreadsheets. Not in 2020. Every type of analysis including:

- Real Estate Market Analysis

- Neighborhood Analysis

- Investment Property Analysis

- Comparative Market Analysis

can be carried out using real estate investment software as opposed to spreadsheets. Tools like Mashvisor’s Real Estate Heatmap and Investment Property Calculator eliminate the need for spreadsheets and offer everything in the way of data collection and analysis for the modern real estate investor. So it’s definitely a real estate myth to think that you need to be an Excel master or a math wiz to successfully invest in real estate.

Myth #15: You Should Never Invest in a Negative Cash Flow Rental Property

Positive cash flow properties are ideal (and Mashvisor can easily help you find one in a matter of minutes). It’s also true that beginner real estate investors should generally avoid negative cash flow rental property. But not every negative cash flow property is a terrible real estate investment.

There are many reasons why a rental property could be generating negative cash flow where the operating costs are higher than the rental income. While the solution may seem obvious (raise the rent or find a way to cut costs), some landlords or property managers struggle to generate positive cash flow and choose to put the property up for sale instead. If you have some experience and have conducted a full investment property analysis, you may be able to come up with a fool-proof solution to the negative cash flow.

But this is one of those real estate myths you need to approach with caution. Positive cash flow is definitely the better option. Your goal should be to find a rental property for sale that promises positive cash flow right off the bat. However, it’s important to understand that sometimes negative cash flow can be turned around and such an investment property can also make for a good real estate deal at times.

Myth #16: Off Market Properties Are Hard to Find

It’s easy to find an investment property that has been listed for sale on the MLS or other popular real estate investor websites. But that doesn’t mean that is it very hard to find off market properties. There are actually a few tried and tested strategies that real estate investors have implemented successfully that you can try:

- Working with a real estate agent

- Driving for dollars

- Using homeowner data to find out who owns a house and market to them

- Searching for foreclosures, auction houses, bank owned homes, and short sales

Are off market properties harder to find than those on the market? Generally, yes. But there are still plenty of ways to conduct an investment property search that will lead you to off market real estate deals. In fact, you can check out this tool which will help you find off market investments in a matter of minutes.

Myth #17: Real Estate Agents Only Care About Making Commission

A real estate agent is ultimately running a business and intends to make money on the sale of a property. But a good real estate agent, like most successful business people, understands that only caring about turning a profit will get you nowhere. You have to care about your clients and offer the best service possible. And so, many real estate agents follow this basic business practice. Unfortunately, real estate agents have gotten a bad reputation for being selfish, money-grubbing professionals. But many of them provide a much-needed service and paying for that service means finding a cash flow investment property.

Not only do a lot of real estate agents actually care about helping you find the perfect real estate investment property for sale, but many beginners actually need them to succeed. Real estate agents have a lot of experience and skills that they will gladly pass on to you for a fee. They can help you negotiate a better deal, find off market properties, and more.

Find a talented real estate agent now.

Myth #18: All Real Estate Gurus Are Con Artists

Some real estate gurus are con artists, others have real advice, experience, and wisdom to pass on. Simply do your research and never follow anyone blindly. Don’t miss out on learning something new from a real estate investor just because the word “guru” comes with negative connotations! Just beware if they are asking for money without offering anything substantially valuable.

Myth #19: Always Lowball Your Offer When Buying an Investment Property

You want to negotiate and try to get the best price when buying an investment property for sale. But the quickest way to pull yourself out of the running is to put forth a lowball offer. Even in a buyer’s market or when dealing with a motivated seller, a really low offer will not be taken seriously.

Check out real estate comps and conduct a comparative market analysis. You can easily find real estate comps for any home for sale here, at Mashvisor. Consult your real estate agent before making an official offer. Also, look over the results of the home inspection closely. Some neighborhood research may also help you decide on the property value. All of these crucial steps will help you decide how much to offer. You may find actual reasons to offer less than asking price rather than just lowballing because you’re hoping to save some money upfront.

Myth #20: Investing in Real Estate Means Becoming a Landlord

People often ask if becoming a landlord is worth it. This is a serious thing to consider if, for one reason or another, you cannot afford (or it doesn’t make financial sense) to hire a professional property manager. However, it doesn’t necessarily have to be taken into consideration when you’re thinking about becoming a real estate investor.

There are many professional property management companies in housing markets across the US. They have the people, resources, knowledge, skills, and experience to effectively manage multiple rental properties for you and many other rental property owners at the same time. In fact, a great property manager will even ensure you enjoy high occupancy rates, positive cash flow, and a high return on investment.

So if you know you don’t have what it takes to become a landlord or deal with tenants and rental property maintenance, you don’t have to write off investing in real estate completely. Also, keep in mind that there are plenty of real estate investment strategies that don’t even involve owning a rental property or being a landlord at all.

Myth #21: Real Estate Is Not a Passive Income Investment

We’ve just discussed the fact that you can hire a manager (even an Airbnb property manager) to turn a rental property into a passive income investment. You also have plenty of other options for earning passive income in real estate like REITs or crowdfunding.

But can rental properties be passive income investments? Yes, to an extent. Becoming an Airbnb host may require more work day to day, but being a landlord of a long-term rental property can be passive most of the time. There is a ton of work upfront, no doubt. But even these steps can be made easier with the right real estate investment software. Advertising and screening tenants can be outsourced or made easier using the right property management software. Managing tenants will require work from time to time. But for the most part, rent payments can be carried out automatically online and repairs and maintenance can be done by handymen and contractors. If you screened your tenants well, you probably won’t have to deal with complaints all that often (although many will have you believe that 2 am phone calls are a common occurrence for landlords- another real estate myth debunked!).

So yes, becoming a landlord and owning rental property is not completely passive. But if done correctly, it can be a passive real estate investment most of the time.

Myth #22: You Can Charge Whatever You Want for Your Rental Property

Some people have the misconception that landlords make a lot of money in real estate because they charge whatever they want. If that was the case, either landlords would all be millionaires or no one would ever be able to afford their rent.

You cannot charge whatever you want to ensure that you generate a high profit. A high rental rate in the wrong location for the wrong property will lead to a high vacancy rate. Even charging very low to boost occupancy rates could lead to negative cash flow in some cases.

Instead, you have to look at rental comps and conduct a rental market analysis. You can do this using Mashvisor’s rental property calculator. Based on this analysis, you will learn how much others are charging for rent. You can use this amount as a baseline. Does your rental property offer anything extra that tenants would be willing to pay more for like an extra bedroom, a pool, or a parking space? Then you can charge a higher rental rate. Perhaps you are offering less and need to lower your rental rate. Either way, a proper rental market analysis will help you determine how much to charge for rent.

Myth #23: Tenants Are a Pain to Deal With

Real estate myths about dealing with tenants are pretty unfair. Yes, some tenants are a nightmare. They will refuse to pay rent on time with no real excuse, damage your rental property, and drag you through the eviction process. But that’s a very small minority. Becoming a landlord doesn’t mean constantly engaging in battles with tenants. And what’s even better is that you can avoid bad tenants most of the time. Screen applicants, conduct background checks, and have a clear and strict lease in place and follow through. This can help to keep even potentially bad tenants in check.

Myth #24: You Can Save Tons of Cash with DIY Rental Property Maintenance

Can you paint the rooms in your rental property yourself or fix a leaky faucet? Probably and doing so will help save you some money. But DIY rental property maintenance is not always smart. There may be a few great videos on Youtube on how to fix a broken water heater, but that doesn’t mean you should grab your toolbox and attempt it on your own. If you really have no clue what you’re doing, you could cause more damage to your rental property, serious harm to your tenants, and incur higher costs. Form relationships with local contractors and take advantage of their knowledge and skills to help run your rental property business smoothly.

Myth #25: When Property Prices Drop, It’s Time to Panic

A major benefit of investing in real estate is that property appreciates. Buy and hold an investment property and down the line, it’s value will increase. Better yet, invest in buy and hold rental properties and benefit from cash flow and real estate appreciation. However, on a lot of these lists debunking real estate myths, we’ve seen this included:

The real estate market will only go up.

And then this is debunked with the idea that property values and prices have dropped many times over the years. This is true, but it’s not the entire picture. Just as property values have fallen (drastically) at some points in history, they have climbed back up and to greater value in many places in the US housing market. Historically, values have fluctuated. They go up and down, sometimes to minor lengths, other times, to the point of real estate market crashes.

It’s important to follow fluctuations in property prices but do not panic when it happens, especially if you’re a buy and hold rental property investor. In the right location, property prices that drop usually come back up. Keep an eye on housing market trends and never panic sell if you’re producing positive cash flow.

There You Have It – 25 Real Estate Myths Debunked

Hopefully, this article has somewhat opened your eyes to the reality of real estate investing. While it’s definitely not all fun and games and you may be putting a lot of money at risk, it also is not an impossible and grueling venture that only the rich embark upon successfully.

If you’ve gained the confidence to take the first step, then continue learning and educating yourself on the topic. Once you’re ready to make the first move, do so with Mashvisor’s real estate investment tools. Sign up for a 7-day free trial now to take advantage of some of the tools mentioned in this article.