Out of state real estate investing is becoming an increasingly popular phenomenon in our world today. That’s because, with the right real estate investment tools, you can invest anywhere without being present physically. For example, you can live in the Chicago real estate market and purchase an investment property in the Las Vegas real estate market easily using real estate technology. Even closings can be carried out remotely; your agent can attend in person while you sign the paperwork using an electronic signature system.

Related: A Step-by-Step Guide to Out of State Real Estate Investing

Due to the COVID-19 pandemic, more and more property investors are now involved in remote real estate investing. With all the social distancing and stay in place orders, buying or selling remotely is making sense now more than ever.

Before we explore the different real estate investment tools you need to succeed with this investment strategy, let us look at the pros and cons of buying a rental property out of state.

Pros of Remote Real Estate Investing

- Access to nationwide, lucrative real estate markets – One of the best things about virtual real estate investing is that it offers unlimited access to properties nationwide. When you free yourself from a ‘local only’ mindset, a whole world of opportunities opens up. If your local market is not doing well or if the real estate is far too expensive, you can invest in remote real estate in another market that is thriving and affordable.

- Diversification – Having your whole real estate portfolio in one state is like having all your eggs in one basket. If there is a sudden downturn in the local economy, you could lose everything. Investing remotely in multiple markets nationwide is the best way to spread your risk.

- Get rid of emotional attachment – When it comes to real estate, emotions can really mess things up. If your investment properties are located close to you, it is easy to get emotionally attached. This attachment could cause you to make subjective decisions. For instance, you might be unwilling to sell a house when it ceases generating positive cash flow. Being a remote landlord allows you to stay emotionally detached from your portfolio.

- Hands-off investing – Remote real estate investing frees you from the day-to-day running of your rental properties. This allows you to focus on other priorities, earn passive income, and enjoy the financial freedom from your investments.

Cons of Remote Real Estate Investing

- Inability to inspect – Home inspection is a very crucial step in the home buying process. Investing in remote real estate means that you may not be able to be physically present to view the property before buying. As a result, you might miss significant issues that need to be addressed. This could end up costing you lots of money in the long run.

- High expenses – Remote real estate investing means that you have to hire professionals to do things on your behalf. You will need a real estate agent, attorney, contractors, and property manager. The cost of such professional services can eat into your profits, thus reducing the return on investment.

- Loss of control – Another major downside of investing in remote real estate is that you don’t have much control over things. For example, when you hire a property manager or contractor, you cannot be sure if they are doing their job properly on a day-to-day basis. Money meant for renovation or repairs can easily be misallocated or misplaced. If an emergency such as a legal issue, natural disaster, or fire occurs, you can’t get there immediately to address it.

The Tools You Need to Succeed with Long Distance Real Estate Investing

So, what real estate investment software do you need when buying a rental property out of state?

Neighborhood Analysis and the Real Estate Heatmap

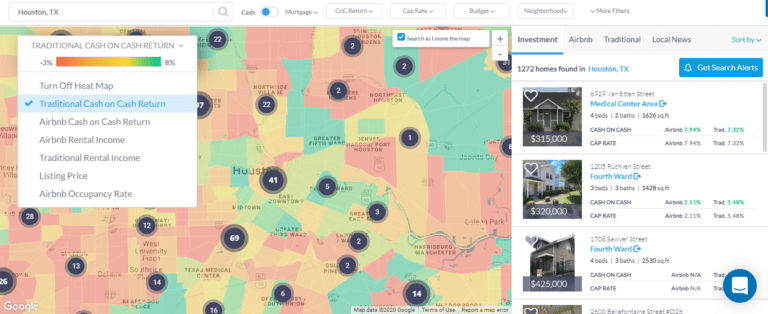

Also known as real estate market analysis, neighborhood analysis is a very important step in the property buying process. Real estate market research tools will help you find the best performing locations based on property data and real estate data analytics. One of the best real estate apps for market analysis is Mashvisor’s real estate heatmap. Once activated, it will show you the performance of different neighborhoods and how they compare using shades of red, yellow, and green. You can filter your search using metrics such as listing price, Airbnb occupancy rate, rental income, and cash on cash return.

Mashvisor’s real estate heatmap will help you find a great neighborhood in a location you’re unfamiliar with.

Related: Buying Airbnb Property? Then You Need These 3 Tools

Rental Property Analysis and the Rental Property Calculator

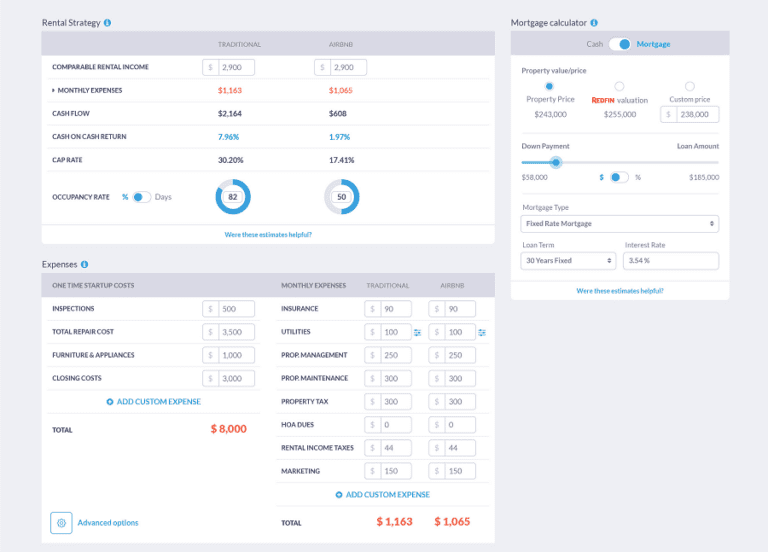

After identifying a great location for out of state real estate investing, the next step is to analyze investment property. Rental property analysis involves doing calculations using property data to determine if buying remote real estate makes financial sense. Mashvisor’s rental property calculator will calculate important numbers for you such as cash flow, cap rate, and cash on cash return. The platform also has a free Airbnb calculator if you only care about Airbnb analysis.

Want to get access to these real estate investment tools today? Sign up now and get 15% off!

Related: 5 Best Real Estate Investment Tools for 2020

Tours and Virtual Reality

A virtual tour allows you to view remote real estate using your computer or smartphone. The tour could be in the form of a 3D floor plan, 360 virtual tours, or virtual reality. You can use an app to view all the rooms, floors, lounges, and parking lots in the investment property for sale. Some of the best virtual tour software include Matterport Capture, Cupix, GeoCV, Zillow 3D home, OpenSpace3D, and Vitality. You can also take a virtual tour of many of the investment properties for sale listed on Mashvisor. If you want to look at the surrounding areas, try the Google Street View app.

Management and Property Management Software

Property management software makes it easier to manage multiple income properties across different states. It will help automate tasks such as communication, rent collection, accounting, maintenance, and data analysis. With the click of a button, you will have real-time access to information on your remote real estate. You can choose from property management tools such as Appfolio Property Manager, Buildium, Planon, Rentec Direct, and Propertyware.

Conclusion

When done right, long distance real estate investing can be a very lucrative venture. However, take time to understand the benefits and risks first before taking the plunge. Explore the different out of state real estate investing tools available and find something that works best for you. Above all, be sure to find a trusted real estate agent who can be your eyes and ears on the ground.