Rental properties have historically been one of the most profitable and safest asset classes for investors. One of the main reasons they are popular is because they can provide you with cash flow for years. However, rental real estate investing for beginners can also be intimidating due to the challenges and risks involved. This should, however, not discourage you from trying it out. Want to begin investing in rental real estate but not sure where to start? The purpose of this guide is to help you have a smooth start in rental real estate investing. Read on!

1. Learn About Rental Real Estate Investing

Learning how to invest in rental property as a beginner is the first step to becoming a successful rental property investor. Even before you think about buying your first rental property, make sure you have learned the basics of real estate investing. Real estate education can help you avoid any unnecessary mistakes that could be very costly.

As a beginner, there is a lot you need to learn to effectively invest in rental properties such as how to find properties, rental property analysis, negotiation, property management, market trends, financing options, etc. The good thing is that you can easily access handy resources online like real estate investment blogs, videos, online courses, webinars, etc. Also, consider reading books on rental investing and attending seminars. Mashvisor’s real estate investment blog is a good place to begin learning about rental real estate investing.

Nevertheless, you should designate the appropriate amount of time to learn the basics of rental investing. You don’t have to know everything before getting started. You can always hire professionals or partner with people who can handle the things that are beyond you.

2. Come Up with a Comprehensive Business Plan

Next, you should create a comprehensive plan for your rental real estate investing business. A plan will help you to be more focused on your goals and to be better prepared for unexpected situations.

What are your investment goals and how do you plan to achieve them? Decide the rental strategy you want to follow (traditional rental real estate investing or vacation rental real estate investing), the amount of money you are willing to spend on your rental property investment, and create a working budget.

Related: How to Develop a Rental Property Business Plan

3. Build a Team of Professionals

Rental real estate investing can be complex for beginners because there are lots of moving parts. Therefore, it can be hard to do everything alone. You are also likely to make unnecessary mistakes that can limit your return on investment due to your inexperience. For these reasons, you should create a basic team of real estate experts to handle different tasks depending on their skills. This way, you will be able to compensate for your inexperience.

A basic team for a beginner in rental real estate investing should include real estate professionals like real estate agents, real estate attorneys, accountants, home inspectors, and property managers. When assessing these real estate professionals, make sure they have the right credentials and level of experience in line with your niche.

4. Find a Good Housing Market for Rental Real Estate Investing

With a comprehensive plan, basic knowledge on real estate investing, and a competent team, it’s now time to begin searching for a lucrative rental property to buy. The first step in this process is to find a good market for investment. Location is the most important factor when buying rental property because it will affect your return on investment.

While buying real estate investment properties in the same city or state as your current residence has it’s own advantages, it’s not always the best choice. You can invest in any real estate market. Just make sure to conduct thorough market research. For instance, when investing in vacation rental real estate, you will need to find a market near tourist attractions and with favorable short-term rental regulations. Be sure to check our blog for city data on occupancy rates, average listing prices, average rental income, and more.

Related: Location Location Location: What Makes for the Best Place to Invest in Real Estate?

5. Find a Profitable Neighborhood

After finding a good city for rental real estate investing, you should narrow down your market analysis to the micro-level. Look for a neighborhood with a high population growth rate, thriving job market, low crime rate, good infrastructure, future developments, and with close proximity to social amenities. Such neighborhoods usually have the highest demand for rental properties.

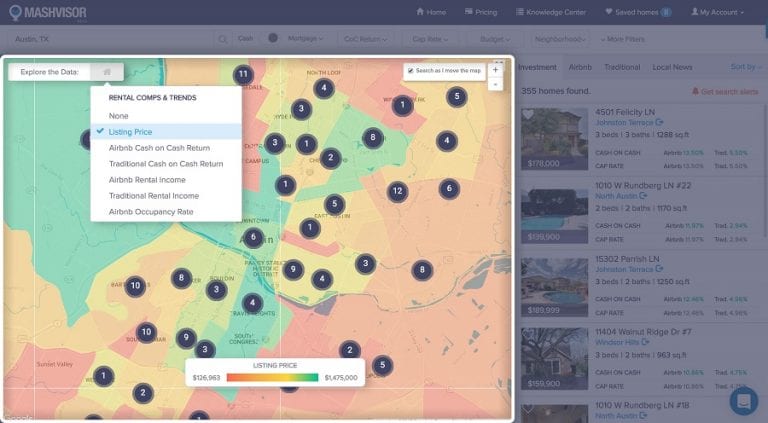

Using Mashvisor’s heatmap tool, you can easily and quickly find the best neighborhoods in your city of choice based on real estate metrics like listing price, rental income, cash on cash return, and Airbnb occupancy rate.

6. Conduct a Rental Property Search

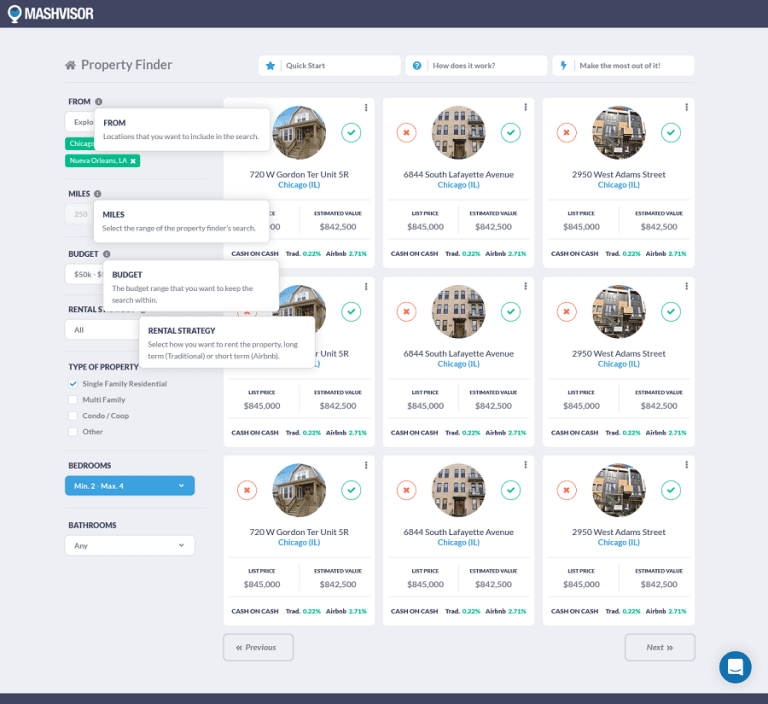

After finding a good neighborhood for rental real estate investing, the next step is to search for potentially profitable investment properties that meet your criteria. There are many methods you can use to find investment properties in your area of choice. However, the best way to find the top-performing rental properties in any area in the U.S. housing market is to use Mashvisor’s Property Finder.

7. Conduct a Rental Property Analysis

An in-depth rental property analysis on potential investment properties is crucial for assessing their profitability. This will help you decide on the best rental property to buy.

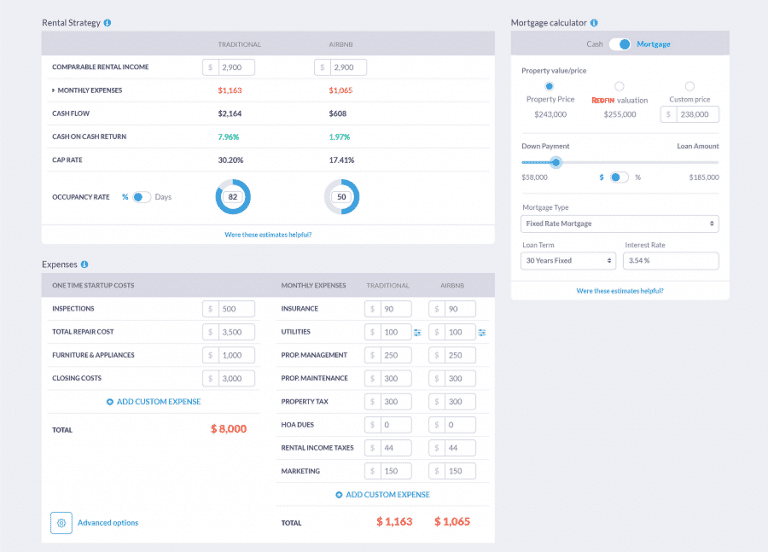

Mashvisor’s rental property calculator will help you analyze real estate investment properties in the U.S. housing market in a matter of minutes. You can analyze rental properties based on metrics like rental income, cash flow, cap rate, cash on cash return, and Airbnb occupancy rate for both vacation rentals and traditional rentals. After finding the best rental property for investment, you can now finalize the purchase process.

Related: The Beginner’s Guide to Rental Property Analysis

To start your 7-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.

The Bottom Line

Rental real estate investing can be a lucrative way to get into real estate if done properly. As a beginner, you are usually exposed to a variety of risks. However, you can mitigate these risks by planning well, doing your due diligence, and using the right real estate investment tools. This simple guide provides you with the fundamentals of rental real estate investing for beginners.