We know you’ve been eyeing the Scottsdale real estate market for a while. Well, we’re here to tell you to stop thinking about buying an investment property in this housing market and to take action now.

Of course, no real estate investor should take action blindly, even in some of the best places to invest in real estate. That’s why we’re here to guide you through what is about to be the best real estate investment decision you could make this year. Learn all about the Scottsdale real estate market and confidently walk into this housing market with our best real estate investing tips in mind.

Scottsdale Real Estate Market: Overview

If you have the unwavering desire to add a piece of Scottsdale real estate to your investment portfolio, it’s probably because of what you have been hearing about the city itself over the past few years.

For example, Scottsdale can proudly flaunt its Voice of the People Award for excellence in economy. The city has a relatively large population- the more people, the more tenants and buyers for your rental properties. These factors largely contribute to the healthy real estate market and are top reasons to invest in Scottsdale real estate.

For a closer look at factors like the economy, crime rate, and population in the Scottsdale real estate market, read this.

Scottsdale Real Estate Analytics

Let’s take a quick peek at the numbers provided by Mashvisor’s real estate investment calculator for the Scottsdale real estate market:

Median Property Price: $871,027

Airbnb Rental Income: $1,583

Airbnb Cash on Cash Return: 1.2%

Airbnb Cap Rate: 1.2%

Traditional Rental Income: $3,369

Traditional Cash on Cash Return: 2.34%

Traditional Cap Rate: 2.34%

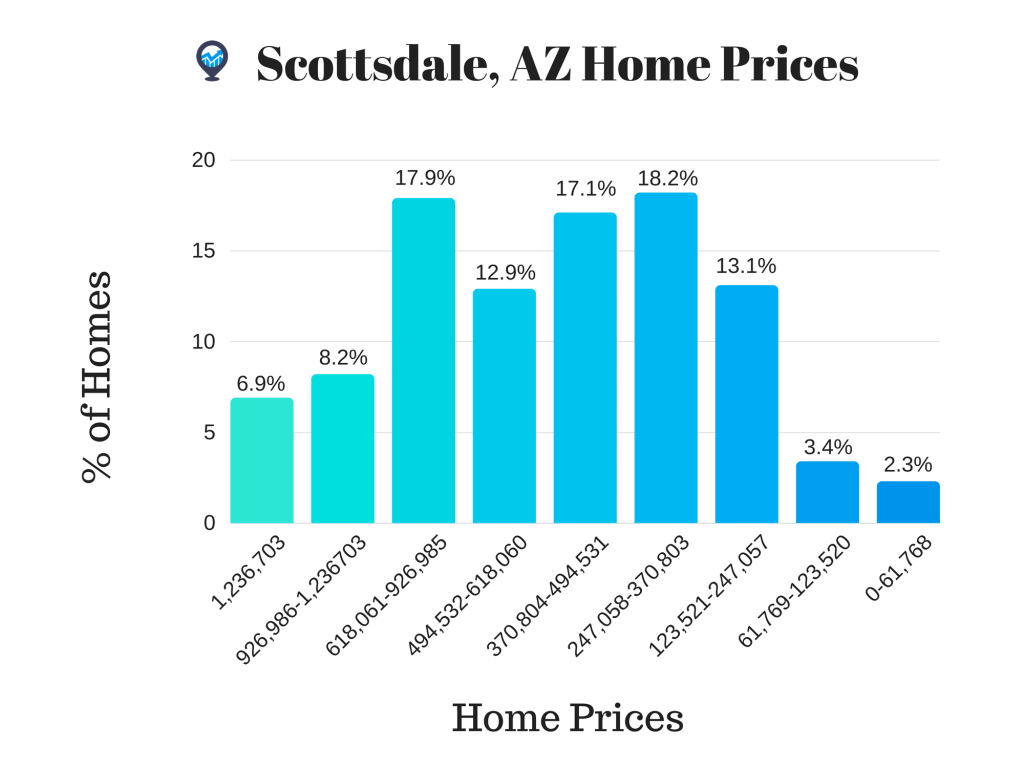

Now, we know right off the bat, you might have some problems with these real estate investing stats. For one, it seems that affordability might be an issue with a Scottsdale investment property. However, take a look at this:

Data source: neighborhoodscout.com

What it shows is that while the median property price is a good form of real estate analytics we use to determine housing affordability in a particular market, it doesn’t mean that you’re doomed to pay that exact price when buying an investment property. In fact, there is a relatively decent amount of Scottsdale investment properties in the $120,000-$500,000 range.

Another thing a real estate investor might be wary of is those return on investment metrics. (Before diving deeper into this aspect, I suggest you read this to learn all about why the common perception of a “good cap rate” may be flawed.) Again, those metrics don’t mean that every Scottsdale investment property will have that cap rate and cash on cash return. Take a look at these high performing investment properties in the Scottsdale real estate market that Mashvisor’s property finder tool pulled up (in a matter of seconds, btw).

Scottsdale Traditional Rental Property #1

List Price: $359,900

Cash on Cash Return: 14.33 %

Scottsdale Traditional Rental Property #2

List Price: $359,900

Cash on Cash Return: 14.33 %

Scottsdale Traditional Rental Property #3

List Price: $395,000

Cash on Cash Return: 12.54 %

Airbnb Scottsdale Property #1

List Price: $119,900

Cash on Cash Return: 5.11 %

Airbnb Scottsdale Property #2

List Price: $279,000

Cash on Cash Return: 4.18 %

Airbnb Scottsdale Property #3

List Price: $289,000

Cash on Cash Return: 4.04 %

That’s just a handful of Scottsdale properties with great return on investment metrics. Look at these in detail (addresses + investment property analysis values) and the rest of the top performing properties right here.

Something else I see? None of those top performing real estate investment properties are near the median property price. Just goes to show you don’t have to pay the prettiest penny to be making money in real estate.

Try our property finder tool yourself! Click here to find top performing Scottsdale real estate.

Real Estate Appreciation

Investing in Scottsdale real estate means you’ll get to enjoy some serious real estate appreciation. Scottsdale real estate investors have enjoyed an annual rate of appreciation of 3.95% since 2000. The total real estate appreciation over those eight years for Scottsdale real estate was 102.77%. While real estate appreciation isn’t a deciding factor when choosing where to invest in real estate, it’s still important to make a well-rounded investment decision.

Related: How to Calculate Real Estate Appreciation

Buyer’s Market or Seller’s Market?

This is the real estate investing question. All property investors want to find out if their real estate market of interest is a buyer’s market or seller’s market. Buying an investment property? You need to hone in the buyer’s markets (and vice versa). It just happens to be that the Scottsdale real estate market is leaning towards a buyer’s market.

It’s true, there is tangible real estate appreciation in this property market. But it is slowing down (not depreciating, because even as a buyer, you wouldn’t want that). So while investment property prices are up there, they won’t be climbing at alarming rates this year for buyers.

That’s not even the strongest indicator of a Scottsdale buyer’s market. The strongest indicator is provided by Zillow real estate analytics. The difference between the median listing price and the median sales price is $204,500!

What that shows about the Scottsdale real estate market is that buyers have a lot of negotiating power. On top of that shift in power, the month-to-month days on market in have shown some dips but also some pretty steep increases (most recently as a matter of fact). Take a look (provided by this source):

Jan 2018 DOM: 114

Feb 2018 DOM: 97

March 2018 DOM: 99

April 2018 DOM: 82

May 2018 DOM: 93

Typically in a seller’s market, the days on market are much lower and forever dropping. This is a major sign that this real estate market is favoring buyers, even with the housing inventory being low.

A real estate market with a great rate of return on real estate investment AND it’s showing characteristics of a buyer’s market?! What are you waiting for?

To start looking for and analyzing the best investment properties in Scottsdale, click here.

Scottsdale Real Estate Market Forecast

It’s important for real estate investors to understand the way things are right now in the Scottsdale real estate market. But if you wish to be buying an investment property pretty soon, you want to know how it will fare in the future as best as you can.

According to Zillow, the Scottsdale real estate market forecast for home prices shows an increase of 4.4% over the next year. Essentially, the real estate market will keep going strong for years to come accompanied by steady growth in property values.

Be confident in your decision to invest in Scottsdale real estate. Read: Is Buying a Scottsdale Investment Property a Smart Choice?

The Best Real Estate Investing Tips for Future Scottsdale Real Estate Investors

The Optimal Rental Strategy

Based on the return on investment alone (cash on cash return and cap rate), the traditional rental strategy would be the optimal rental strategy. Not only is the average cash on cash return and cap rate for the Scottsdale real estate market higher for long term rental properties, but the top performing properties provided by our property finder tool also show higher returns for this rental strategy.

That’s not to say you should avoid Airbnb Scottsdale. For one, the lack of strict laws against Airbnb Scottsdale is enough to make, say a New York real estate investor run head-on into this real estate market. That’s not the only reason to consider owning an Airbnb Scottsdale investment property. With 4.5 million overnight domestic visitors in 2016 contributing $2.3 billion to the economy, buying a short term rental means you can enjoy part of that average 68.1% occupancy rate other Scottsdale real estate investors enjoyed that year.

So, while Airbnb Scottsdale won’t bring a higher return on investment than a traditional investment property, it can earn high rental income as well. It could be the optimal rental strategy for you, depending on your investment portfolio and goals.

The Best Types of Real Estate

Residential Real Estate

The best types of real estate in the Scottsdale real estate market depend on where you’re looking as well as what rental strategy you opt for. In general, your typical single family homes, condos, and apartments do well in this location. Just pay close attention to the type of demographic the neighborhood attracts as well as the type of tenant you want to attract- Airbnb guests or long term rental tenants.

Scottsdale Luxury Homes

What’s more interesting in the realm of Scottsdale residential real estate is the fact that luxury homes promise a great return on investment. Now we understand not everyone can afford to go after these highly-priced investment properties. But if a Scottsdale real estate investor can afford to do so, this type of rental property can bring a return on investment that is two to three times the initial cash investment according to this sales associate with Coldwell Banker Residential Brokerage in Scottsdale.

Commercial Real Estate

It’s also important to note, that while residential real estate investing takes the cake in the Scottsdale real estate market, the realm of commercial real estate investment properties is getting a boost through major construction plans. While you may have to wait a while to plan this into your investment portfolio, it’s something to keep in mind as you snatch up a few residential rental properties for now.

The Best Neighborhoods in Scottsdale for Real Estate Investing

Our best real estate investing tips wouldn’t be complete without telling you where the best neighborhoods in Scottsdale for real estate investing are. Our focus here is on traditional rental properties and their return on investment values, simply because it is the optimal rental strategy in Scottsdale. Here are the three best neighborhoods in Scottsdale to invest with this strategy:

Pinnacle Peak

Median Property Price: $1,289,450

Traditional Rental Income: $5,725

Traditional Cash on Cash Return: 3.46%

Traditional Cap Rate: 3.46%

North Scottsdale

Median Property Price: $814,880

Traditional Rental Income: $2,903

Traditional Cash on Cash Return: 2.07%

Traditional Cap Rate: 2.07%

South Scottsdale

Median Property Price: $609,542

Traditional Rental Income: $2,208

Traditional Cash on Cash Return: 1.9%

Traditional Cap Rate: 1.9%

Don’t forget you can find the top performing Scottsdale properties with Mashvisor’s property finder in these best neighborhoods in Scottsdale. Click here to get started.

With our ultimate guide to the Scottsdale real estate market, any real estate investor can now enter the market knowing what’s up and where to invest.

We did, however, save our best real estate investing tip for last! Invest in Scottsdale with Mashvisor! To start your 7-day free trial with Mashvisor and subscribe to our services with a 15% discount after, click here.

Have any experience with the Scottsdale real estate market? Share with us in the comments below.