Just like any other market, the real estate market is influenced by the forces of supply and demand. Factors that affect

demand and supply of real estate listings include the season of the year, population growth of an area, employment opportunities, legislative changes, and interest rates. At any one time, the housing market is either a buyer’s market or a seller’s market.

‘Should I buy in a seller’s market?’ This is a common question asked by real estate investors all over the world. Before we answer this question, it is important to first understand what such a market means.

Related: Real Estate Question: What Is a Seller’s Market?

What is the seller’s market definition?

In simple terms, this market happens when demand exceeds supply. In real estate, it is a situation where the number of people seeking to buy homes exceeds the available homes in the market. Since fewer properties are available, there is a seller’s advantage during the negotiation process.

On the other hand, a buyer’s market happens when homes available for sale in a market exceed the number of buyers interested in purchasing. Due to the low demand, buyers can negotiate for home price below market value.

Though a seller’s market is a great time for sellers, it can be very tricky for buyers. The shortage of inventory creates a situation where multiple buyers are interested in a single home. This usually leads to bidding wars which could drive home prices higher.

Signs of a seller’s market

Here are some telltale signs that a certain US real estate market is a seller’s market:

- Fewer homes for sale – When you drive through an area experiencing a seller’s market, you will not see many ‘For Sale’ signs.

- Low days on market (DOM) – Another great way to spot such a market is to look at how much time it takes for listings to sell. The lower the days on market, the more likely the market is favorable to sellers. It is not unusual for income properties to be sold on the same day they get listed.

- Sales prices exceeding listing prices – As home buyers and real estate investors try to outbid each other, the market prices of homes usually rise significantly.

- Less incentives from sellers – In a buyer’s market, sellers usually give buyers incentives in order to attract offers. The incentive could be anything from throwing in appliances and furniture, to offering to cover closing costs. However, in seller’s markets, such incentives are almost nonexistent.

Related: Should You Invest in a Seller’s Market or Buyer’s Market?

Current real estate market trends

The current housing market trends in the US can be attributed to the Coronavirus pandemic. Due to the shutdowns and ‘stay at home’ orders last year, many sellers removed their homes from listings. According to Redfin, the year-over-year supply of homes for sale dropped by 24%, while new listings fell by 42% in April 2020. At the same time, most metro areas experienced an increase in home prices.

In January 2021, Redfin reported that the median home sale price rose by 15% year-over-year to $318,280. New listings dropped by 12%, while pending sales increased by 30%. Demand for homes was very high, with 43% of properties that went under contract getting an accepted offer within 14 days on the market. All these metrics show that the US housing market is currently a seller’s market.

According to a recent report by Realtor.com, here are some of the cities that are currently experiencing a seller’s market:

- Raleigh real estate market

- Jacksonville real estate market

- Memphis real estate market

- Tampa-St. Petersburg-Clearwater real estate market

- Phoenix-Mesa-Scottsdale real estate market

- Dallas-Fort Worth-Arlington real estate market

Related: Housing Market Predictions 2021: Experts’ Forecast

How to buy a house in a seller’s market?

The good news is that even in a market that favors home sellers you can still find great deals for investment property. Here is how to buy a house in a seller’s market:

1. Find the best neighborhoods for investment

Location is a very crucial consideration when looking for a real estate deal. The location of your investment property will determine the rental income, return on investment, occupancy rate, and even the type of renters you get. The Mashvisor real estate heatmap is the best tool for real estate market analysis. You can search for the ideal location based on metrics like listing price, cash on cash return (traditional or Airbnb), rental income (traditional or Airbnb), and Airbnb occupancy rate.

Related: What Airbnb Occupancy Rate Can You Expect in 2021?

2. Search for off market properties

Finding the right home in a seller’s market can be very tricky. So when wondering how to find investment properties in such a location, one of the best things to do is to look into off market properties as they usually offer below market prices. Real estate investment software like Mashvisor’s Property Marketplace can make your work much easier. This tool uses predictive analytics and property data to help you find off market properties all over the US. These include properties like bank owned homes, short sales, tenant-occupied rentals, and foreclosed homes. You can narrow down your search using filters like rental strategy, budget, miles, property type, and desired cash on cash return.

3. Analyze investment properties for sale

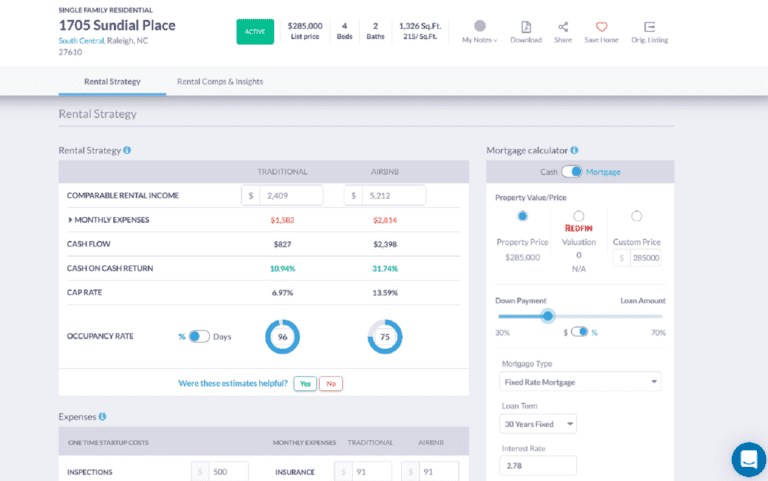

Once you’ve found an ideal investment property in a great location, you need to conduct rental property analysis. This will show you whether the home you are considering would be profitable or not. Use the Mashvisor Investment Property Calculator to get an automated analysis of any residential investment property in the US. This calculator will estimate the startup costs, monthly expenses, rental income, occupancy rate, cash flow, cap rate, and cash on cash return.

Mashvisor’s Investment Property Calculator: Analysis of a Rental Property in Raleigh

4. Get pre-approved for a loan

To enhance your chances of snagging a real estate deal, get pre-approval for investment property loans. Being approved for a mortgage will be determined by factors like your income, debt-to-income score, and credit score. Having proof of funding will show the seller that you are serious about buying the investment property. This will give you an edge when there are multiple offers on the table in a seller’s market.

5. Waive contingencies

Another way to stand out from the competition is by waiving contingencies. This could include things like title search, home inspection, appraisal, or mortgage contingency. However, be aware of the risk you might be taking when you remove or reduce contingencies.

Conclusion

With these home buying tips, you should be able to purchase a profitable investment property in a seller’s market. You should also realize that time is of the essence in such a market. Whether you want to buy traditional or Airbnb investment property, you must act fast, or you will find the home that you are interested in gone. If you are a real estate investor, it would be advisable to work with an experienced agent. Finally, buyers and sellers should leverage Mashvisor real estate investment tools in order to make the right decisions.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today and enjoy 15% off for life.