If you’re thinking about selling a rental property, you need to consider a lot of things first so that you can make a decent profit from it. The process of selling rental property can be very intimidating, complicated, and overwhelming to most folks, especially for first-timers and noobs. If you want to get the most out of it in the least stressful way, you need to know what to expect and prepare for all sorts of contingencies. ;

We have prepared a guide to help you sell your rental property in the best and most pleasant way possible.

What You Need to Know About Selling a Rental Property for a Profit

There are plenty of ways to make money in real estate. If you’re an investor and you want a good return on investment, real estate is almost always a great avenue for that. Making money in real estate is quite commonplace. It’s not a matter of whether you’ll earn from it or not but more of how much and how fast will the return be. This is why a lot of folks want to get into real estate investing.

One of the main ways people earn from real estate investing is by converting their properties into rental homes. Both traditional and short-term rentals guarantee income for the owner-investor. However, certain instances may arise that might require owners to sell them.

Selling a rental property isn’t as easy as selling stocks or shares. You cannot be hands-off and just leave it to bots and AI then go on about your day, hoping that when you get back to it, it will have already sold. If you own a rental property and are seriously considering selling it, here are the important questions and answers you need to know about selling a rental property.

Why Should I Sell My Rental Property?

Property owners have different reasons why they place their rental properties on public listings. But generally, real estate investors know when it’s time to sell. Here are the most common reasons why owners and landlords decide to sell their rental properties:

Relocation

There are instances where certain life changes leave property owners with no other choice but to let go of their houses. One such case is if the owner needs to move to a different city, state, or country where he or she can no longer run the rental business. The most logical thing for them to do is have the property listed and take whatever money they get from it and reinvest it in another property in their new location.

Appreciation

A lot of times, rental property owners decide to sell when their investments have already generated good returns and just reap the benefits instead of renting it out. Investors in this situation decide to just cash in on the appreciation while it’s still great.

Loss

On the other hand, not all properties are made equal. While most do give investors a good return on their investment, some are just eating up money on maintenance and upkeep. This is especially true for homes that are guaranteed to not get a good return in the foreseeable future. Even if a certain property has more than doubled in value in just a couple of years but if the upkeep will cause them to just break even – or worse, lose money – after a few years of ownership, it’s best for owners to let go of them and sell while they’re still ahead.

Stress

There are instances where homeowners have decided to sell a property because of the unnecessary amount of stress they’re getting in keeping and maintaining their rental properties. Perhaps they were initially chasing numbers and have stumbled upon certain very promising houses. But then eventually they start getting problems associated with the properties – bad tenants, rough neighborhoods, inflation, and several other factors that made selling the most reasonable decision to make.

Will I Incur Taxes When I Sell My Rental Property?

Benjamin Franklin, one of the most brilliant minds throughout all history, once said this: Nothing is certain except death and taxes.

So the answer to this question is a resounding YES.

The taxman is always there waiting to grab the state’s fair share in all real estate transactions. There’s no way around it. As a responsible citizen, it is also your duty to pay your taxes. You will incur taxes that are greater than the ones you can incur selling your family home. The profits from selling a family home aren’t taxable up to a certain amount. Once you get past this point, your profits are now considered capital gains.

Taxation is different when it comes to selling a rental property. Any, and all profit, made from a rental property sale is taxable. On top of capital gains taxes, you also need to prepare for depreciation recapture.

Capital Gains Taxes

Capital gains taxes are split into two categories. The rate at which you will be taxed will greatly depend on how long you’ve had the asset in your possession and portfolio.

Short-term Capital Gains Tax

This type of capital gains tax occurs when the asset was held by the owner for less than a year. These gains are taxed similarly to a regular income. This means that property owners need to pay the regular income tax for their bracket.

Long-term Capital Gains Tax

On the other hand, a long-term capital gains tax happens when the asset has been in the owner’s portfolio for over a year. These gains have a more favorable tax rate, much to the property owners’ relief.

Here are the updated 2022 long-term capital gains tax rates from the Internal Revenue Service:

| FILING STATUS | 0% RATE | 15% RATE | 20% RATE |

| Single | Up to $40,400 | $40,401 – $445,850 | Over $445,850 |

| Married filing jointly | Up to $80,800 | $80,801 – $501,600 | Over $501,600 |

| Married filing separately | Up to $40,400 | $40,401 – $250,800 | Over $250,800 |

| Head of household | Up to $54,100 | $54,101 – $473,750 | Over $473,750 |

Source: Internal Revenue Services

On top of this, regardless of whether they have short-term or long-term gains, investors should also be aware that high-income taxpayers will also need to pay an additional 3.8% net investment income surtax.

Depreciation Recapture

The other tax that property owners also need to prepare for is depreciation recapture. Most investors know that they can write off depreciation as an expense as long as they have the asset in their portfolio.

While this is all good and well, when an owner decides to sell the property, the IRS will come a-knocking to take back all that money.

Think of it in terms of a traditional IRA. Investors are allowed to deduct contributions on tax returns but once they withdraw the money, it is now taxable.

For instance, if you own a property and have had it for three years and you write off $5,000 for depreciation annually, you will have to pay back $15,000 in depreciation recapture tax once the property is sold.

It is important to note, however, that depreciation recapture is taxed in the same way as your regular income tax despite having held the asset for more than a year. This is because you have already been allowed to reduce your taxable rental income by writing off depreciation as an expense. Additionally, the IRS computes the rate for depreciation recapture based on the allowable depreciation. This means that a property owner is subject to a depreciation recapture tax even if he or she has never written any depreciation off as an expense.

How Can I Offset the Taxes From Selling My Property?

Although taxes are inevitable, there are a few ways to offset them to lessen the blow on your income.

Tax-Loss Harvesting

Plenty of investors today utilize tax-loss harvesting as a means to mitigate the impact of taxes on their profits. Investors have found this method to be very helpful as it allows them to sell losing investments to generate capital losses. They use these capital losses to offset any capital gains on their tax returns.

While this method presents investors with a few great benefits such as using capital losses to offset an unlimited amount of gains, it is important to note the following:

- This only applies to taxable investment accounts. Accounts like a 401k and an IRA allow folks to defer on tax payments so they are not subject to capital gains.

- This can be applied to both short-term and long-term capital gains, albeit in different ways. The sequences in which they are applied are different. Short-term losses are first applied against short-term gains while long-term losses are first applied to long-term gains and followed by its application against short-term gains.

Be sure to read up on tax-loss harvesting a bit more and consult with a tax expert for a clearer understanding of how it works and how it can benefit you as an investor.

Swap Property

Next, the IRS has certain provisions in place for real estate investors to truly benefit from. The 1031 Exchange allows investors to defer on tax payments by “swapping” an investment property for another. It essentially allows investors to acquire an investment property on a tax-deferred basis using the sales proceeds from the previous property. The idea here is since the investor did not receive any actual proceeds from the sale, there is no income to tax.

This is one of real estate investors’ go-to methods, especially if they want to upgrade to a better investment property without taking any tax hits on the sales of their smaller properties.

However, before you take this route, you need to know about certain conditions and rules that need to be met, including:

- It can only be used for investment assets and business;

- You only have 45 days to “swap” the sold property for the one you wish to acquire;

- You are given a period of 180 days to close on the new property; and

- Leftover money after the swap is already considered as partial capital gains and is, therefore, taxable.

Incorporation Shield

More and more real estate investors have been taking this route within the past few years. Incorporation allows them to minimize their liability and use the corporation as a shield to protect their personal finances and assets in case things go sideways.

To many investors, incorporation makes a lot of sense as it reduces their capital gains tax bill significantly as well as gives them the opportunity to make a great profit through its share structure.

All matters involving taxes when selling rental property should be discussed extensively with tax professionals.

How Do I Sell My Rental Property?

Once you get past all the tax-related concerns, selling a rental property is pretty much like selling a regular house. Let’s break the process down into simpler steps.

Step 1: Make Sure the Property Is Vacated

If your house is still occupied by a tenant, you must first notify them about your decision to sell beforehand. Give them enough time to look for a place to move to and vacate your property. Don’t just inform them verbally. It is best to have it in writing so that you’re both on the same page.

Step 2: Spruce It Up

If you want to get the most profit out of the sale, you will have to make sure that the property is in great condition before you have it listed.

Work on the necessary repairs and updates

It is normal for a home to need a few updates and upgrades as it transitions ownerships. On top of the typical signs of wear-and-tear, property owners should also pay attention to the following:

- Outdated appliances

- Replacing or fixing of lighting fixtures

- Ensuring a good working HVAC system

- Replacing broken or loose tiles and damaged flooring

- Cleaning or replacing worn-out carpet

- Replacing or fixing loose doorknobs, handles, hinges, and other hardware

- Cleaning and repainting of both exterior and interior walls

Stage it well

Ensure that the property is dressed up enough to give potential buyers a vision of what it will look like if they live there. A cold and empty space just doesn’t do much for a lot of folks. Setting it up well can make it more inviting and highly attractive for homebuyers.

Step 3: Work With the Pros

The entire process of selling a rental property is exhausting and overwhelming. Fortunately, investors don’t have to do it alone. They can – and should – hook up with credible and reputable professionals in their respective fields.

Real estate agents, for one, can help make the entire process a lot easier since they have an extensive understanding of the different market conditions and trends. If you don’t know any local agent, you can always go online and search for one.

Mashvisor is a website that specializes in real estate investments. One of their features is a real estate agent directory that investors can use to connect with the right people, whether they’re buying or selling.

Next, when it comes to home rehabilitation and renovation, it is best to work with professional contractors and service providers. Working with pros guarantees that a job will meet industry standards. When inspection time comes, you will thank yourself that you decided to spend a few extra dollars on their services.

Lastly, make sure you consult with a tax professional for any and all tax-related concerns when selling a rental property. It’s always better to be safe than sorry.

What Can I Do to Make Selling My Rental Property a Breeze?

To anyone who has ever sold any rental property, it is no secret that it poses certain unique challenges. Here are some of the things that will make your life a lot easier if you decide to sell your rental home:

Work With Reputable Local Agents

It may cost a little extra on the seller’s end but working with a real estate agent gives property owners greater access to a wider market.

Avoid Selling Future Bookings

Extra income is always welcome but we advise against selling your future bookings to potential buyers. Most investors prefer properties that are ready to be rented out to new tenants.

Price Accordingly

Since real estate investing is generally lucrative, a lot of sellers make the mistake of overestimating their properties and pricing way too high. Overpriced properties tend to stay on the market longer which will cost owners more money in the long run.

Invest in Good Photos

First impressions truly last. If you want your property to stand out and make a huge impact on buyers, invest in a good photographer to take high-resolution and professional-grade pictures of it. The visual impact it creates will help generate more interest in your property.

Use Technology to Your Advantage

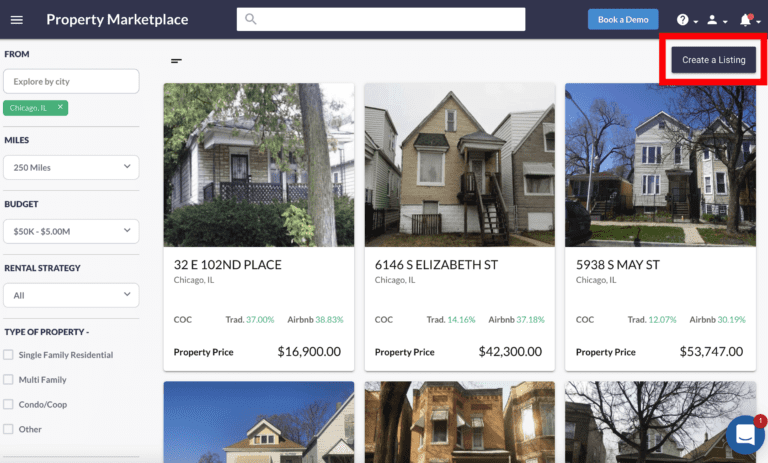

Lastly, take advantage of modern-day technology. Gathering information and analyzing data is a lot faster now, thanks to the internet. Sites like Mashvisor allow investors to do what used to be weeks’ worth of research and analysis in just minutes. If you go on Mashvisor, you’ll even find a very wide property marketplace where you can find all sorts of listings in all corners of the US.

The Mashvisor Property Marketplace is a valuable tool for investors to locate the most profitable properties in the hottest markets all around the US. Selling a rental property is easy using this tool as it helps sellers reach thousands of potential homebuyers, property managers, real estate investors, and agents. It’s pretty much a one-stop shop where serious real estate investors can find the best properties, analyze investment potential, connect with the right people, and list their properties.

The Bottom Line

Selling a rental property can be very challenging and complicated but knowing what to expect can help one make better preparations for the road ahead. Know what to do, perform your due diligence, connect with the right people, and have the right tools to help you make the sale as easy as 1-2-3.

Read our FAQs and learn about our tools. To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.