What will short term rental Colorado Springs look like in 2023? Is it a market worth looking into the coming year? What can investors expect?

We will talk about Colorado Springs and what it can offer real estate investors in 2023 and discuss how you, as an investor, can get the most out of the market.

Table of Contents

- Real Estate Market Trends and Forecast in Colorado Springs

- How to Find a Profitable Short Term Rental Property in Colorado Springs

- Top 5 Colorado Springs Neighborhoods for Short Term Rentals

It is no secret that short term rentals are quite profitable, especially if they’re situated in a region that gets a lot of visitor traffic annually. For an investor looking for an investment property, converting it into a short term rental might be something worth considering, given its income-generating potential.

Short term rental properties have a proven track record of making a lot of money for their owners. However, not all of them are created equal. It will still depend on the location of the said property. That said, is Colorado Springs a good investment location for vacation rentals?

We’ll find out in this article if the area is worth looking into. We’ll also give you tips on how you can spot the best and most profitable rental property investments with the help of a website like Mashvisor, among others.

We hope that by the end of this article, you will have greater knowledge and understanding of the 2023 Colorado Springs short term rental market, which will lead to more informed investment decisions.

Real Estate Market Trends and Forecast in Colorado Springs

As we near the end of 2022, forecasts and predictions about the national and local real estate markets are starting to come out. A lot of experts and analysts have plenty to say about the condition of the 2022 US housing market and what it has to offer investors in 2023.

If you can remember, one of the predictions about the US housing market for 2022 is that we will see the year end with mortgage rates hitting 5%. A lot of industry experts agreed with the said forecast, given the record low-interest rates in 2021, as well as its inevitable increase due to certain factors.

However, we did not take into account the very unexpected Eastern European geopolitical conflict, which significantly contributed to the inflation surge. As early as April 2022, we’ve already broken through the 5.00%-mark for mortgage rates. At the time of this writing, mortgage rates are above 7% for 30-year fixed-rate mortgages (7.32%, to be exact).

The above comes as the Federal Reserve continues its aggressive battle against inflation. The Fed recently raised interest rates by 75 basis points, which also brought up refinance rates to 7.30%.

At this point, even if most of the real estate markets in the US are experiencing some sort of cooling down, many investors are hesitant to make any moves. A lot of them are putting off plans of buying investment properties because they don’t want to be tied to high-interest rates for a long time.

That being said, what should investors look forward to where the short term rental Colorado Springs market is concerned?

Colorado Springs by the Numbers

Let’s take a look at the numbers for Colorado Springs, based on Mashvisor’s November 2022 location report:

- Median Property Price: $517,623

- Average Price per Square Foot: $249

- Days on Market: 48

- Number of Long Term Rental Listings: 542

- Monthly Long Term Rental Income: $1,938

- Long Term Rental Cash on Cash Return: 2.93%

- Long Term Rental Cap Rate: 2.96%

- Price to Rent Ratio: 22

- Number of Short Term Rental Listings: 1,295

- Monthly Short Term Rental Income: $2,906

- Short Term Rental Cash on Cash Return: 3.58%

- Short Term Rental Cap Rate: 3.62%

- Short Term Rental Daily Rate: $177

- Short Term Rental Occupancy Rate: 50%

- Walk Score: 28

Given the numbers above, Colorado Springs seems a good location for rental property investment. Aspiring landlords will greatly benefit from a nearly 3% cash on cash return and a high price to rent ratio of 22.

On the other hand, vacation rental owners can enjoy a high monthly rental income of a little over $2,900, a cash on cash return of 3.58%, and a decent occupancy rate of 50%.

All in all, Colorado Springs looks like one of the markets that can give you a very good return on investment in 2023.

Housing Market Trends and Forecasts in Colorado Springs

As far as forecasts are concerned, here are some of the things local market experts have to say about Colorado Springs:

It Will Remain a Strong Seller’s Market

According to Norada Real Estate, Colorado Springs is still set to be a seller’s market in 2023. Despite the slight cooling down of property prices in the market, it is still poised to become a strong seller’s market.

It is brought about by two things: inventory and increasing prices. One, despite the increase in housing inventory over the past few months, there is still a shortage of homes in the Colorado Springs area.

Two, just because the market is cooling down doesn’t necessarily mean that prices are dropping. It just means that the rate of increase isn’t as fast as in the previous months.

The said conditions make Colorado Springs swing in favor of sellers, unless something extraordinary happens that could bring a shift in power from sellers to buyers.

It Will Still Be One of the Best Long Term Markets in the US

When we talk about long term markets, we mean long term investment and not rental properties. If you’re in the market looking for a property to hold on to for a long time that will give you a good ROI, Colorado Springs is a good place to invest in.

The appreciation rate alone is enough to make you want to invest in a Colorado Springs income property. Industry analysts and experts expect home values in Colorado Springs to go up by 2.3% by September 2023’s end. Considering that Zillow recently dropped its initial prediction to a year-over-year growth rate of only 1.2%, it’s still a good number.

Rental Rates Are Expected to Soften

Another thing that real estate investors should anticipate is that rental rates are expected to soften compared to the previous months. It is welcome news for many renters, especially since housing affordability seems to be out of reach for a lot of people at this time.

However, it does not seem to favor rental property investors since it means that they can only expect to get a moderate rent increase of 3% for the time being. But it doesn’t mean that investing in rental properties is not a good thing right now.

A lot of investors are still turning to real estate investing because it still is a great investment vehicle that’s far less volatile than stocks. Plus, with home prices declining, investing in rental properties might be the best option at the moment. Regardless of your investment strategy, real estate investing remains one of the best investment options for you today.

Short Term Rental Laws in Colorado Springs

Now let’s talk about short rental laws, permits, ordinances, and other rules you should be aware of if you’re keen on investing in Colorado Springs.

Generally, every location has a different set of rules and ordinances regarding short term rental properties. The rules serve to protect housing communities and residents from being forced out of their homes and run over by rental property investors.

The rising popularity of vacation rentals has placed them under the microscope, becoming the subject of debate in several communities all over the country. Some of the more common complaints against vacation rentals are they drive up rental rates and limit the availability of homes for residents.

For this reason, each locale enforces different ordinances, rules, and laws to ensure that short term rentals remain beneficial to everyone. It falls on the local government to pass ordinances that will safeguard the community’s interests while promoting a healthy tourism industry to boost its economy.

In Colorado Springs, the local government recently amended its regulations and established two types of short term rentals: owner-occupied and non-owner-occupied.

Owner-occupied properties are properties that are occupied by owners for no less than 185 days annually. Such properties are allowed in lawful dwelling units.

On the other hand, non-owner-occupied properties aren’t allowed in single-family home zones. And while there is no approval cap on the number of short term rentals, certain limitations are in place for non-owner occupied homes.

Things to Do Before Starting a Vacation Rental Property

If you’re seriously considering starting a rental property business and having it listed on platforms like Airbnb and Vrbo, you need to keep the following in mind:

Check the Local Short Term Rental Laws and Ordinances

Before you even think of permits and licenses, you need to find out if your preferred location has strict (or lenient) short term rental laws. It is especially important when zoning is involved, as not all areas of a market are zoned for short term rentals.

Knowing the different regulations will also allow you to formulate a proper strategy for your rental property.

Put Your Plan Into Writing

The next thing you need to do is to put all of your ideas and plans into writing. Creating a business plan can guide you every step of the way. A well-thought-out plan that is well-researched will increase your chances of investment success.

So, before spending all of your time and money working on acquiring permits, licenses, and documents, spend some time coming up with a solid strategy first.

Create a Business Entity

Even if it’s considered personal property, you need to treat your vacation rental as a legitimate business. Forming a business entity for your property will protect you and your business from any legal issues that may arise with a disgruntled guest. It can also give you certain tax benefits to enjoy. Talk to a lawyer or real estate professional before making any moves.

Know the Different Tax Rules

One of the benefits of talking to real estate professionals and consulting with them first is you get better in-context information when it comes to taxation. On top of the costs of paying for the property, closing costs, permits, licenses, inspections, and all other expenses associated with running your business, you are also obligated to pay your taxes.

As a citizen, it is your duty to file and pay taxes. However, each state and county have different tax rules regarding vacation rentals. For this reason, you should spend enough time knowing the different tax rules in a specific county or location like Colorado Springs.

Apply for Permits and Licenses

Lastly, before you launch your business, you need to secure permits and licenses to make sure everything is legal and passes the local government’s standards.

Acquiring the permits and licenses can be quite a chore, depending on the requirements and documents you have on hand. According to the Colorado Springs government website, permit and license applications can be completed in 30 days or less. The duration will depend on your circumstance, of course. The same goes for both renewal and application of new permits.

Learn more about the different short term rental regulations in other locations and how they vary from each other.

How to Find a Profitable Short Term Rental Property in Colorado Springs

Now that we’re done with the basics of the short term rental Colorado Springs market, we’ve listed a few tips that will help you find the most profitable vacation rentals in the area.

Perform Due Diligence

We cannot emphasize enough how important due diligence is to any investment opportunity. Generally, most investors fail because they overlook its importance in the entire process. Some make decisions from a hunch or gut feeling. While sometimes you will find luck on your side, a wise investor does not leave anything to chance.

This is where due diligence comes into play. Nothing beats thorough research when it comes to investing in real estate. The numbers matter. The market conditions matter. If you’re armed with the right information and data about the market you’re considering, Colorado Springs in particular, then you can make wiser investment decisions.

Mashvisor: Your One-Stop Shop for Rental Property Investing

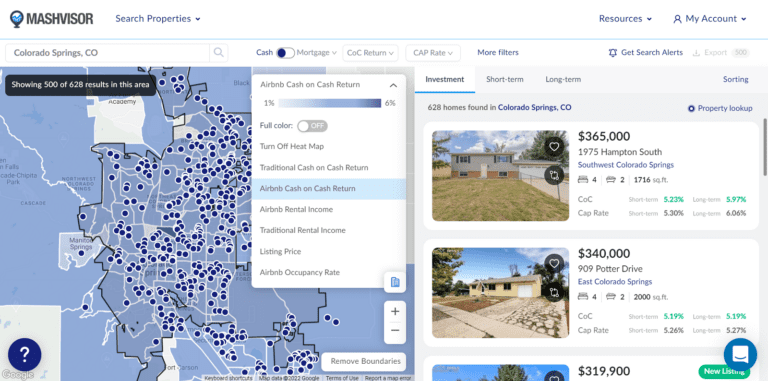

To start making better investment decisions, you need the help of the real estate website Mashvisor. Mashvisor is a platform that helps real estate investors find the best properties that line up with their investment goals.

Mashvisor’s users can access a wide range of data that covers almost every corner of the US real estate market, including Colorado Springs. It gathers data from highly reliable sources like Zillow, Realtor.com, and even Airbnb to give investors the most accurate and up-to-date information for rental property analysis.

The platform also provides a Property Search tool that lets you look for the best properties in the most profitable neighborhoods. The tool allows users to identify which properties offer the best rental income, cash on cash return, and short term rental occupancy rate. Such types of data help them make realistic ROI projections and build their confidence as investors.

If you’re really serious about investing in rental properties in Colorado Springs, give Mashvisor a go.

Mashvisor provides investors access to a wide range of property data that covers almost every US real estate market, including Colorado Springs.

Do Not Make Any Emotional Decisions

One of the mistakes investors make is emotion-based decision-making. Our natural instinct as human beings is to get overly hyped and excited about a once-in-a-lifetime deal that presents itself. When we’re faced with something similar, we tend to overlook reason and go with our feelings.

This is a no-no in real estate investing. As an investor, you need to exercise self-control and temper your emotions to evaluate the facts properly. No matter how promising the numbers are, if the circumstances surrounding it are telling you otherwise, you need to take them into account. The numbers and stats do not lie. Learn to value empirical evidence over a feeling or a hunch.

Talk to Real Estate Professionals and Investors

Lastly, if you’re unsure about a certain location, connect with some locals who possess first-hand knowledge of the area. Connect with fellow real estate investors, some brokers, and other professionals. Consult with them and ask them all the questions you can think of.

In most cases, they will not withhold information and gladly answer your questions. You may even end up with a string of solid leads at the end of the day.

If you want to see what other real estate investors are privy to, go to Mashvisor to get access to its real estate investment tools for a 7-day free trial, followed by a lifetime discount of 15%.

Top 5 Colorado Springs Neighborhoods for Short Term Rentals

If you’re looking for profitable investment opportunities for rental properties, you might want to consider the following neighborhoods in the short term rental Colorado Springs market. The neighborhoods below were selected based on the following criteria:

- Each neighborhood must have a median property price of no more than $1,000,000;

- Each neighborhood must have a minimum $2,000 short term rental income;

- Each neighborhood must have a cash on cash return of 2.00% and above; and,

- Each neighborhood must have no less than 50% short term rental occupancy.

The following locations are ranked from highest to lowest cash on cash return. Here are the best locations for rental property investment in Colorado Springs, according to Mashvisor’s November 2022 location report:

1. East Colorado Springs

- Median Property Price: $395,549

- Average Price per Square Foot: $235

- Days on Market: 43

- Number of Short Term Rental Listings: 78

- Monthly Short Term Rental Income: $2,780

- Short Term Rental Cash on Cash Return: 4.35%

- Short Term Rental Cap Rate: 4.41%

- Short Term Rental Daily Rate: $153

- Short Term Rental Occupancy Rate: 53%

- Walk Score: 64

2. Central Colorado Springs

- Median Property Price: $474,945

- Average Price per Square Foot: $314

- Days on Market: 71

- Number of Short Term Rental Listings: 579

- Monthly Short Term Rental Income: $2,578

- Short Term Rental Cash on Cash Return: 3.55%

- Short Term Rental Cap Rate: 3.60%

- Short Term Rental Daily Rate: $150

- Short Term Rental Occupancy Rate: 51%

- Walk Score: 48

3. Southeast Colorado Springs

- Median Property Price: $356,740

- Average Price per Square Foot: $227

- Days on Market: 52

- Number of Short Term Rental Listings: 50

- Monthly Short Term Rental Income: $2,180

- Short Term Rental Cash on Cash Return: 3.37%

- Short Term Rental Cap Rate: 3.42%

- Short Term Rental Daily Rate: $123

- Short Term Rental Occupancy Rate: 53%

- Walk Score: 65

4. Powers

- Median Property Price: $492,745

- Average Price per Square Foot: $212

- Days on Market: 69

- Number of Short Term Rental Listings: 59

- Monthly Short Term Rental Income: $2,764

- Short Term Rental Cash on Cash Return: 3.18%

- Short Term Rental Cap Rate: 3.21%

- Short Term Rental Daily Rate: $157

- Short Term Rental Occupancy Rate: 56%

- Walk Score: 23

5. Northwest Colorado Springs

- Median Property Price: $524,960

- Average Price per Square Foot: $229

- Days on Market: 53

- Number of Short Term Rental Listings: 69

- Monthly Short Term Rental Income: $2,892

- Short Term Rental Cash on Cash Return: 3.10%

- Short Term Rental Cap Rate: 3.13%

- Short Term Rental Daily Rate: $256

- Short Term Rental Occupancy Rate: 50%

- Walk Score: 26

Start looking for and analyzing the best investment properties in any Colorado Springs neighborhood of your choice.

Wrapping It Up

At the end of the day, no matter how high the interest rates are now or how challenging it is to acquire permits and licenses to operate short term rental Colorado Springs, it’s a worthy investment to pursue. Especially if you don’t plan on selling the property any time soon, it is a good long term investment market due to its appreciation rate.

Investing in short term rentals in Colorado Springs may be a good move for rental property investors, given its affordability and good cash on cash returns. However, even if the general numbers are showing you all good signs, you still need to do your research so you can verify it for yourself.

Mashvisor is your best friend when it comes to investment property analysis. The platform’s regularly updated database will give you the most accurate and realistic ROI projections on any property in any market. Its tools allow you to spot the most promising properties in the best neighborhoods that will give you a great return on your investment.

To learn more about how Mashvisor can help you find profitable investment properties, as well as the tools that real estate investors find valuable, schedule a demo now.