A short-term rental income calculator is a tool that’s indispensable when calculating the potential profit of your short-term rental property.

The most significant motivation for entering the real estate business is making high returns on your investment property. Luckily, potential investors see the short-term rental market as a profitable field for generating considerable income. They just need to find the right locations.

But that’s just half of the story. The other half is doing the calculations.

Just because the market is doing good at the moment and the demand for short-term rentals is not slowing down in 2022, it doesn’t guarantee the investor the income they’ve envisioned.

To be 100% sure you’ll be able to generate profit, you need a calculator that will factor in all the variables and do the math for you. More precisely, you need a short-term rental income calculator that does the math for you. The rental income calculator helps predict the success of your investments — allowing you to make the right decision.

So, there’s no doubt that investors are in need of some sort of short-term income calculator. Luckily for you, Mashvisor’s tools are designed for such a purpose — to help investors estimate their potential profit and make an informed investment decision.

To learn more about the features and importance of a rental income calculator, continue reading.

How Profitable Are Short-Term Rentals?

Generally speaking, short-term rentals are deemed profitable investments in today’s market. In fact, we’re glad to inform investors that short-term rentals reached their peak in annual revenue in 2021, clocking in at $56,000.

Owning short-term rentals in 2022 is still considered a profitable business — but you shouldn’t view it as a definite statement. The success of your short-term rental business depends on a few key variables, mainly location, occupancy, and pricing.

Still, many investors consider rental businesses lucrative, because they allow for a greater level of flexibility, better maintenance, and higher earnings for the owner.

Correctly operated and calculated — by using the calculator we mentioned — seasonal income from short-term rentals can exceed the investor’s expectations.

It’s safe to conclude that vacation destinations are the best choice for such type of investment location-wise — but more on that in a bit.

Travel Trends and Forecasts in 2023

Even though the travel industry is witnessing a definite rise in the numbers, it may take some time before the “pre-pandemic levels” are reached again.

That said, some experts already predict that the travel industry will fully recover in 2025, with international departures reaching 68%. In other words — we might need to wait roughly three years to make a 101% recovery.

It’s important to stress that the said improvement will not be the same in all regions. North America is expected to witness the most significant rise when it comes to tourism, and there’s a possibility that it can fully recover as early as 2024.

The US News & World Report recently identified the following destinations as most attractive to visit in the country in 2022/2023:

- Grand Canion National Park, AZ

- Yellowstone National Park, WY

- Yosemite National Park, CA

- Maui, HI

- Glacier National Park, MT

Risks of Running a Short-Term Rental Business

Renting your cabin, apartment, condo, or any other property type is a good source of income for the owner. However, it’s still a business venture — meaning that things can go wrong.

We’re not trying to burst your bubble and dissuade you from investing in a short-term rental. But real estate investors must be aware of the potential risks, too. Ignoring them can lead to some unexpected expenses on your end — and, in some cases, even time in court.

Even if you’ve used the most reliable income calculator out there, you won’t be able to earn the profit you’ve hoped for if you encounter any unexpected problems.

That takes us back to the risks of investing:

The three most common risks that are associated with the short-term rental (STR) business are stolen or damaged property, guest injuries and fatalities, and vacancies between renters.

Damaged/Stolen Property

Damaged or stolen property is arguably the number one risk associated with rentals.

The intention to deprive the owner of their personal property could play out differently. For instance, the renter could take something valuable from your rental, like expensive decorations and accessories, gadgets, or paintings, among other things.

Another common scenario — be it intentional or unintentional — would be damaged property. It is not uncommon to find broken glassware, plates, windows — or even damaged furniture and walls.

Regardless of how much you trust your renters, situations like the above still happen — and you must be prepared to deal with them.

How can you do that?

The answer would be to get a commercial vacation rental insurance policy in due time. It will help you deal with all the relevant expenses — at least to some extent.

Guest Injuries/Fatalities

One of the biggest obligations you’ll assume as an owner is to make your rental safe for guests, adults, and children alike. That said, there’s always a possibility that your guests can get hurt or, in the worst-case scenario, die during their stay.

Injuries and, even worse, fatalities are also risks that owners can face.

Regarding injuries, you can ensure that there are no defective appliances or run-down areas on your property that would increase the risk of injury. That is why it is extremely important to devote some of your time to inspections and repairs.

Also, you can purchase insurance coverage that will help you if the situation with your rental escalates and the renter (or their family) decides to file a lawsuit against you.

Vacancies Between Renters

Vacancies between renters are, quite possibly, a short-term rental owner’s worst nightmare.

The time between the departure of your previous renters and the arrival of your new ones can potentially create two types of problems — financial and property-oriented.

We believe that owners are mostly afraid of financial problems because the ideal situation is one where the rentals are occupied at all times. However, the absence of renters may cause you some issues income-wise.

In addition to the obvious financial problems, there are also problems related to the property itself. They can be water leaks, broken light bulbs, and other stuff that may go unnoticed.

That’s why it’s important to visit your property regularly — especially if no one’s occupying it.

A reliable investment calculator can help you predict and prepare for the expenses ahead of time — and save you the trouble of allocating your money to an unprofitable investment.

How Mashvisor’s Short-Term Rental Income Calculator Can Help You Succeed in 2023

Relying on the right investment tools can pave your way to success. In such a case, you need a reliable income calculator that will help you estimate the success of your rental business in 2023.

The thing is, with the size of the US real estate market, the choices available to you, and the amount of data you need to handle, investment tools — like online calculators — are the only way to move forward.

One of them happens to be our short-term rental calculator. Mashvisor’s Rental Calculator is designed to help real estate investors navigate the chaos of today’s tourism sector and answer the most important question — which is:

How much revenue can I expect from my short-term rental?

Pricing your rental accordingly — and taking into account certain factors that can impact the outcome — can be overwhelming. But with the features that Mashvisor’s income calculator offers, the process becomes incredibly simple.

The features of our calculator, which are outlined below, will be key to analyzing the returns on your short-term rental:

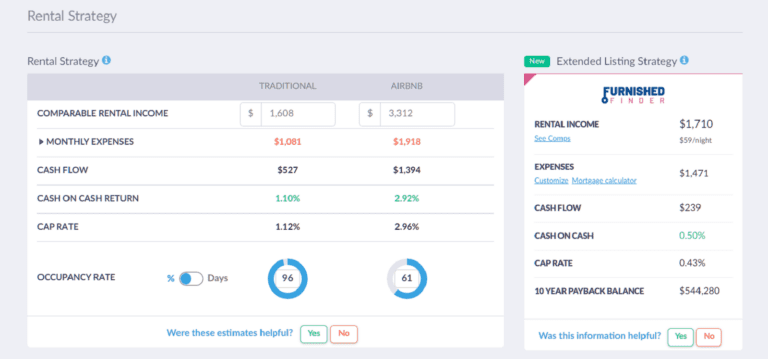

Rental Strategy Calculator

Before entering variables into a rental strategy calculator, one of the first things you should do is check whether your initial strategy is genuinely the best one for your preferred method.

On that note, Mashvisor’s Rental Strategy Calculator helps investors determine what strategy will suit their investment property.

There are two main rental strategies — long-term and short-term. Both come with advantages and disadvantages — and Mashvisor’s calculator can direct you toward the more profitable option.

Comparable Rental Income

Comparable rental properties are properties in your area that share similar features with your investment property. Analyzing them can be a key factor in developing your investment strategy.

With Mashvisor’s Comparable Rental Calculator, you can determine the median rental price in your preferred neighborhood. If the calculator shows that your rental is priced high above the average, it will not appeal to renters seeking accommodation — meaning you’ll need to make adjustments.

Overall, though, rental comps also focus on current performance — which is essential for real estate investors because they help them compare rental income.

Monthly Expenses

Mashvisor’s short-term rental income calculator helps investors predict and handle their expenditures, too. In fact, the tool helps you determine your monthly expenses, including:

- Insurance

- HOA fees

- Maintenance

- Property tax

- Utilities

- Property management

- Cleaning fees

- Rental income taxes

One-Time Startup Costs

Your rental expenditures will include monthly expenses — which we mentioned a moment ago — and one-time startup costs.

The latter include:

- Furniture and appliances

- Closing costs

- Total repair costs

- Inspections

A short-term rental income calculator can help you estimate the above one-time costs before deciding to invest in a property.

Cash Flow

If you want to know whether your short-term property is doing well, consider calculating how much cash flow it generates. With Mashvisor’s short-term rental income calculator, you’ll be able to see the results in a matter of minutes.

There is positive and negative cash flow — but don’t let that confuse you. The bigger the positive cash flow on your calculator, the better your rental is doing.

There is no universally good cash flow for a rental. With that said, most real estate investors will try to increase it by increasing their rent rates.

Although it is the most obvious way to ensure that your income outweighs your expenses, you should be careful not to overprice your property — or you could end up losing renters.

Cash on Cash Return

The so-called “rate of return” is often used in real estate to calculate the cash income earned on the investment property — in this case, a rental. Simply speaking, it’s the investor’s annual return.

A short-term income calculator helps you discover your property’s cash-on-cash return. Even though there is no precise number for good cash-on-cash returns, investors typically consider cash-on-cash returns between 8% and 12% satisfactory.

Cap Rate

The capitalization rate — or cap rate — is another measure investors can use to compare real estate investments.

Using an income calculator can help you determine how risky your investment is. The higher the percentage the calculator shows, the riskier your investment is.

There’s no official rule, but a cap rate between 4% and 10% is generally considered “safe.”

Occupancy Rate

The occupancy rate is perhaps the most reliable indicator of the success of your short-term rental — an income calculator can show you the numbers. It is the percentage of occupied rooms over a given time. And the higher the occupancy rate predicted by the calculator, the better.

Needless to say, investors should strive toward getting their property occupied at all times.

Extended Listing Strategy Calculator (c/o Furnished Finder)

Another thing that your income calculator can help you with is extended listings.

As a landlord, you should know that listings may be extended for up to seven days by a valid listing extension on the MLS system. Likewise, Furnished Finder is an organization that helps your renters during their relocation process.

Mashvisor’s Rental Income Calculator also helps real estate investors work with extended listings on the MLS.

Mortgage Calculator

If you opt for a mortgage loan as a source of financing, the monthly installments will be an important factor for you. Mortgage payments should be dealt with carefully. It is one of the many reasons why you need an income calculator.

Luckily, Mashvisor’s mortgage calculator helps you determine how much those installments will be — and how long it would take to pay them off.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.

Why Is a Rental Income Calculator Essential to Investors?

We’ve already gone through all of the relevant features of a rental income calculator — but it won’t hurt to confirm its significance to real estate investors looking to continue their careers in the STR business.

Here are a few key things we’d like to point out:

- A short-term rental income calculator provides instant and highly accurate information and data.

- It is one of the most reliable methods for estimating profit.

- Income calculators are easy to navigate — even for beginner investors.

- Relying on the calculator instead of the “old school ways” will save you considerable time.

- The income calculator helps you learn about investment strategies that will suit your goals.

- Online income calculators are generally inexpensive.

How to Run a Short-Term Rental

It’s time to turn your attention to the real matter at hand — how to run your rental successfully.

When investing in short-term rentals, the key thing to remember is that there is always room for improvement. If you’re starting out — or simply looking for some new tips on running your rentals — here are a couple that might help:

Stick to a Budget

Investors should be prepared for recurring expenses if they’re planning on running a rental business. You’re looking at frequent cleaning, maintenance costs, small repairs, and the like.

As the expenses are not fixed, sticking to a budget is important. It’s also useful for keeping records. Imagine that you suddenly need to explain to your business partners what you spent $2,000 on — and you’re not even sure where that money went.

We’ve already mentioned how an income calculator can help you meet your monthly expenses and save you from overspending on unnecessary items. So, set a budget, and stick to it.

Make Your Listing Stand Out

In a sea of short-term rentals, your aim should not only be to generate income — but to make your listing stand out, too.

Here are a few things investors can try to make their listing more “clickable” and attractive:

- Use exceptional photography: Adding professional photographs to your listings or hiring someone to do it is a definite advantage. Supposedly, 60% of people are more likely to click if they see a high-quality picture.

- Mention local attractions: Since your guests will occupy your property for a shorter period, they will probably want to know which places and attractions in their area are worth visiting.

- Update your listing regularly: Don’t be lazy when it comes to updating your listings. During the summer, you may talk more about the beaches nearby. However, during winter, you may want to draw the attention of your future renters to Christmas festivals and similar attractions. Keeping your listings up-to-date usually helps attract new guests.

Know Tax Laws

Tax benefits mean a lot to landlords. For example, investors can be tax-free if they rent out their homes for 14 days or less.

Before jumping into vacation rentals head-first and signing the deal, make sure to check the tax rules and regulations of the state you’ll be running your rental business.

Final Thoughts

We’ve successfully covered the topic of a short-term rental income calculator and saw why such an online tool is necessary for real estate investors.

Let’s review the key points, though:

Considering today’s real estate climate, investing in short-term rentals can be a profitable business venture — as long as the investor pays attention to important factors such as location, seasonality, and the like.

In 2021, the short-term rental business reached its peak. Currently, North America is making the fastest progress — and there’s an increasing number of attractive places for tourists. However, future landlords should also be aware of the risks of damaged property, injuries, and vacancies, among other things.

Mashvisor’s Rental Property Calculator comes with several features that can allow real estate investors to get all the necessary information when analyzing a short-term rental. It allows users to calculate cap rates, cash on cash return, mortgage payments — and more.

Additionally, the calculator helps you determine the income that your property generates.

So, by using our rental income calculator, you are guaranteed accurate information, time efficiency, and reliable estimates. Also, operating the calculator is super-easy — and inexpensive.

Finally, to run a successful rental, you should update your listings, know your tax laws — and stick to a budget you’ve agreed on.

Now that you’re sure of the reliability of Mashvisor’s calculator, there is one more thing we’d like to draw your attention to:

If you’re still unsure about the location of your investment property, know that Mashvisor can help with it, too. Put your worries to rest and rely on Mashvisor’s Property Finder to help pin down the most profitable location for your next investment.

To start using Mashvisor, sign up now.