To determine whether short term vacation rentals for sale are actually profitable and whether these investments can help you generate profit, read on.

Table of Contents

- 5 Reasons Why Short Term Vacation Rentals for Sale Are a Profitable Investment

- 5 Steps to Finding Profitable Short Term Vacation Rentals for Sale

- 3 Tips for Maximizing Income From Your Vacation Rental

- Top 10 Cities for Short Term Vacation Rentals

Investing in short term vacation rentals seems a popular venture in the US real estate market. The vacation rental industry’s total revenue was estimated to reach a massive $13.3 billion in 2021, according to Hotel Tech Report.

And when it comes to short term rental investing, beginner and experienced investors alike are tempted for various reasons—including accommodation style, location, prices, and flexibility, to name a few.

However, is the frenzy for short term vacation rentals for sale justified?

That’s what we’ll be discussing today.

With Mashvisor’s help, investors are guaranteed to get up-to-date and accurate information regarding the profitability of vacation rentals across the US real estate market.

So, to find out whether short term vacation rentals for sale are as profitable as the real estate investment industry makes them out to potential investors, read on.

5 Reasons Why Short Term Vacation Rentals for Sale Are a Profitable Investment

If you are contemplating investing in short term vacation rentals, here is a reassuring fact that’ll get you planning your investment strategy immediately:

Tourists (regardless of age) are more likely to opt for a vacation rental because of the space such properties provide.

The average hotel room is around 325 square feet in size, while a vacation rental can span more than 1,300 square feet. That’s quite a difference, right?

Of course, it is only one of the reasons why investors and travelers favor vacation rentals as opposed to hotels when planning their stay.

And to help potential investors realize the benefits of investing in short term vacation rentals, here are the top five reasons:

1. Maintenance Is Easier

The first advantage of investing in short term vacation rentals for sale is easier maintenance. You might think:

Doesn’t higher turnover mean more cleaning?

Well, technically speaking, yes—but the emphasis here is on the scope of your property and its furnishing. If you offer a completely furnished property, you might be able to avoid moving damages. Additionally, cleaning smaller vacation rentals is generally much easier than committing to a detailed inspection of a huge house you’ve rented for a longer period.

Nevertheless, regular maintenance should not be neglected—it’s a must!

Some regular maintenance inspections of your vacation rental include checking the light bulbs, most used gadgets, and furniture, among other things.

2. More Flexibility

What distinguishes short term rentals is the flexibility they provide to tenants and the landlord. We’re talking about a short term lease, meaning landlords can accept more tenants during a certain period and coordinate the time that suits both parties.

And here’s another perk of owning such investment property:

You can opt to use your short-term rental when you need it. For example, if the owner’s main property is undergoing repairs, they can choose to lodge in their vacation rental and avoid additional—and unnecessary—costs.

3. Tax Advantages

Investing in short term vacation rentals usually comes with certain tax benefits. The so-called “Masters Rule,” for instance, is one of the popular benefits linked with such investment opportunities.

The rule allows landlords to avoid paying taxes if they rent out their vacation rental for less than two weeks. It applies to renting out separate rooms—or the entire property.

Either way, the bottom line is:

Landlords don’t need to report rental income if the property was rented for less than 14 days. Essentially, it facilitates the resolution of tax issues.

Landlords should also know that some state and local governments impose occupancy taxes on vacation rentals. Moreover, tax rules tend to vary from one jurisdiction to another, so do your research before proceeding.

The key is to stay updated and informed regarding taxation tips for vacation rentals.

4. Higher Income

Investors who opt to buy vacation rental property stand a chance of generating a higher income than those who choose to invest long-term.

The experts’ prediction that the vacation rental industry in the US would generate $15 billion in revenue in 2021 was pretty spot-on—the short term rental market fell short by just 1.55%, which is much better than expected.

If you manage to buy a short term vacation rental in a convenient location, your rental could potentially generate a high income within just three months of running.

5. Property Appreciation

Home appreciation describes the scenario in which your investment property increases in its value over a given period of time. It goes without saying, but:

It’s one of the crucial aspects of the investment industry and something to strive for as an investor.

An increase in value can affect many things, such as raising your rent or generating more profit upon deciding to sell your property.

The national average appreciation rate in the US currently falls somewhere between 3% and 5%. That said, renovating your vacation rental property can significantly affect appreciation.

5 Steps to Finding Profitable Short Term Vacation Rentals for Sale

To make finding a location for a vacation rental more straightforward and efficient, follow the five steps outlined below:

1. Make a Business Plan

Searching for vacation rentals is not a venture one should enter casually and on a whim. On the contrary, for this kind of business venture, you need to have an elaborate plan.

Your business plan must include everything you currently have—from assets to finances—as well as everything you expect to gain from your vacation rental in the future.

Of course, planning can take some time; it usually does. But you shouldn’t underestimate the significance of this first step because the future of your investment may depend on it.

On a related note, carefully evaluate the budget you’re working with and will use to buy your vacation rental. If you see that your current financial situation is too weak, you might need to deviate from the initial plan a bit and apply for a mortgage.

2. Research the Market

Now that your overall business plan is ready, it’s time to “step into the market.”

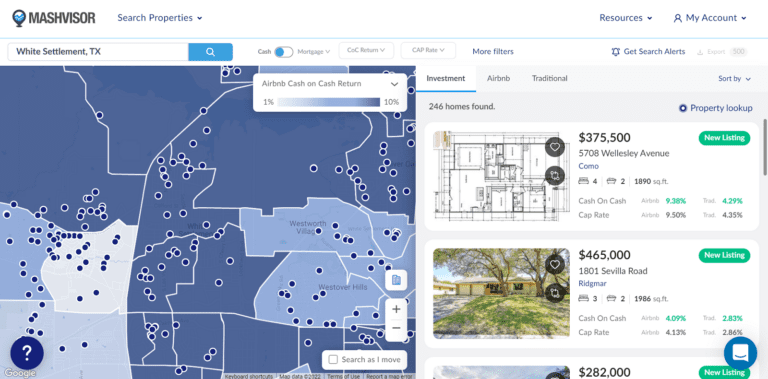

Of course, the traditional way of researching the market would require you to spend some time in the field. But luckily enough, with Mashvisor, you can do all your research from the comfort of your home or office.

Once you’ve narrowed down the area that is profitable for your vacation rental investment, you should do some deep digging.

Parameters that will be of help when finding the best vacation rental are:

- Proximity to tourist attractions

- Local demand trends

- Median listing price

- Amenities

- Average daily rate

- Number of bedrooms

The above are just a few of the factors you should check, but you can filter them according to your priorities.

Real estate investors can use Mashvisor to find short term vacation rentals for sale and other properties based on their investment goals.

3. Run the Numbers

Next, you should run the numbers on your vacation rental and determine whether it would be profitable to proceed with your investment plans or, perhaps, continue your search.

When running the numbers, you should check the following:

- Average daily rate

- Cash flow

- Cap rates

- Average rent per day

Your desired vacation rental for sale is only as good as the numbers—they are the leading indicators of future profitability.

4. Make an Offer

After you’ve found the vacation rental for sale that is most fitting to be your next investment, it’s time to make an offer. But, before you do so, you should visit the property and see it with your own eyes.

Here’s something we recommend doing before making an official offer with the seller:

Arrange an appraisal of the vacation rental. That’ll help you make a realistic offer and ensure the seller isn’t overpricing the property.

5. Hire a Property Manager

Once the investment property for sale is finally yours and your vacation rental is ready to go into business, it’s time to think about how you’ll manage it.

This step is especially useful for those investors who do not have much time or can’t afford to be on the field. And let us remind you, vacation rentals will require a little more presence from you because guests will be coming and going more often.

In other words, hiring a property manager might be a good idea.

3 Tips for Maximizing Income From Your Vacation Rental

Here are the three tips that will help investors maximize income from their vacation rental:

1. Prioritize Maintenance and Cleanliness

Since your vacation rental will be visited many times during the peak season—or throughout the year—it is your responsibility as the owner to keep it clean for your future guests.

The first and most important thing that guests will pay attention to is the maintenance of your vacation rental. The first impression after they settle into the vacation rental can often decide whether you will receive a good or bad review.

2. Offer Attractive Features

When guests come to your vacation rental, they want to feel comfortable—and it is up to you to ensure that they do.

Buying a lucrative vacation rental is not enough; you need to invest in your property in order to attract more guests.

How can you do it?

Equip your vacation rental with attractive and modern features, decorate it, offer gadgets, and so on. With so many amenities available, your guests will surely enjoy their stay and want to return at some point.

3. Read Feedback

Read the feedback you get. Whether it’s good or bad, you should know what your previous guests thought about your vacation rental and how they would rate their stay.

More importantly, take their opinion into account. It can help you see things from your guests’ perspectives and work on improving your accommodation.

Top 10 Cities for Short Term Vacation Rentals

Here are the top 10 cities to invest in short term vacation rentals, according to Mashvisor’s September location report:

1. White Settlement, TX

- Median Property Price: $279,843

- Average Price per Square Foot: $161

- Days on Market: N/A

- Number of Short Term Rental Listings: 142

- Monthly Short Term Rental Income: $3,636

- Short Term Rental Cash on Cash Return: 8.05%

- Short Term Rental Cap Rate: 8.31%

- Short Term Rental Daily Rate: $152

- Short Term Rental Occupancy Rate: 57%

- Walk Score: 42

White Settlement in Texas makes a good location for investing in vacation rentals because it is a safe community with plenty of tourist attractions. They include historical museums, the Veterans Park, and the Secret Chambers Escape Room Challenge, to name a few.

2. Nashville, IN

- Median Property Price: $468,167

- Average Price per Square Foot: $189

- Days on Market: 59

- Number of Short Term Rental Listings: 140

- Monthly Short Term Rental Income: $4,968

- Short Term Rental Cash on Cash Return: 7.72%

- Short Term Rental Cap Rate: 7.87%

- Short Term Rental Daily Rate: $260

- Short Term Rental Occupancy Rate: 52%

- Walk Score: 50

Investing in a vacation rental in Nashville in Indiana means you can open a fantastic romantic getaway for couples. The city is known for music festivals, theater venues, and a guaranteed good time.

3. Sweetwater, FL

- Median Property Price: $584,713

- Average Price per Square Foot: $352

- Days on Market: 63

- Number of Short Term Rental Listings: 411

- Monthly Short Term Rental Income: $5,023

- Short Term Rental Cash on Cash Return: 7.65%

- Short Term Rental Cap Rate: 7.80%

- Short Term Rental Daily Rate: $166

- Short Term Rental Occupancy Rate: 51%

- Walk Score: 82

By investing in a vacation rental in the suburb of Sweetwater, you’re providing your guests with the best of southeast Florida. You may be surprised, but the months of December, January, and February are the most pleasant in the region.

4. Port Ewen, NY

- Median Property Price: $388,960

- Average Price per Square Foot: $234

- Days on Market: 46

- Number of Short Term Rental Listings: 229

- Monthly Short Term Rental Income: $4,704

- Short Term Rental Cash on Cash Return: 7.61%

- Short Term Rental Cap Rate: 7.80%

- Short Term Rental Daily Rate: $217

- Short Term Rental Occupancy Rate: 56%

- Walk Score: 55

Investing in a vacation rental located in Port Ewen means investing in a suburban neighborhood where most residents own their homes. Tourists seeking a nice, quiet getaway should consider such an idyllic NY location.

5. Rio Grande, NJ

- Median Property Price: $361,309

- Average Price per Square Foot: $244

- Days on Market: 46

- Number of Short Term Rental Listings: 721

- Monthly Short Term Rental Income: $4,068

- Short Term Rental Cash on Cash Return: 7.54%

- Short Term Rental Cap Rate: 7.73%

- Short Term Rental Daily Rate: $284

- Short Term Rental Occupancy Rate: 52%

- Walk Score: 52

Rio Grande in New Jersey is very family-oriented, making it an excellent place for investing in vacation rentals. Families with kids get to explore all sorts of different attractions—from the beaches and parks to shopping centers.

6. Clawson, MI

- Median Property Price: $280,493

- Average Price per Square Foot: $233

- Days on Market: 28

- Number of Short Term Rental Listings: 281

- Monthly Short Term Rental Income: $3,531

- Short Term Rental Cash on Cash Return: 7.51%

- Short Term Rental Cap Rate: 7.73%

- Short Term Rental Daily Rate: $175

- Short Term Rental Occupancy Rate: 60%

- Walk Score: 69

Clawson is another in a series of suitable locations for investment in vacation rentals. The city is characterized by a friendly atmosphere, with many amenities within walking distance.

7. Del Haven, NJ

- Median Property Price: $449,939

- Average Price per Square Foot: $301

- Days on Market: 47

- Number of Short Term Rental Listings: 196

- Monthly Short Term Rental Income: $5,010

- Short Term Rental Cash on Cash Return: 7.34%

- Short Term Rental Cap Rate: 7.48%

- Short Term Rental Daily Rate: $282

- Short Term Rental Occupancy Rate: 57%

- Walk Score: 14

By investing in Del Haven vacation rentals, you’re providing your guests with different tourist attractions, including beachfront water parks, zoos, wineries, aviation museums—and more.

8. Robbinsdale, MN

- Median Property Price: $307,235

- Average Price per Square Foot: $160

- Days on Market: 35

- Number of Short Term Rental Listings: 295

- Monthly Short Term Rental Income: $3,411

- Short Term Rental Cash on Cash Return: 7.15%

- Short Term Rental Cap Rate: 7.35%

- Short Term Rental Daily Rate: $145

- Short Term Rental Occupancy Rate: 63%

- Walk Score: 73

Robbinsdale is a small town with a population of only about 14,000, and it’s one of the safest places to live in Minnesota. Here, your guests can enjoy “simple pleasures” like coffee shops and parks.

9. Juneau, AK

- Median Property Price: $440,750

- Average Price per Square Foot: $277

- Days on Market: 47

- Number of Short Term Rental Listings: 211

- Monthly Short Term Rental Income: $4,782

- Short Term Rental Cash on Cash Return: 7.15%

- Short Term Rental Cap Rate: 7.30%

- Short Term Rental Daily Rate: $217

- Short Term Rental Occupancy Rate: 65%

- Walk Score: 84

Investing in vacation rentals in Juneau can be profitable if your main target groups are fans of the wilderness and people who love exploring beautiful landscapes.

10. Columbia Heights, MN

- Median Property Price: $304,388

- Average Price per Square Foot: $145

- Days on Market: 34

- Number of Short Term Rental Listings: 257

- Monthly Short Term Rental Income: $3,580

- Short Term Rental Cash on Cash Return: 7.14%

- Short Term Rental Cap Rate: 7.34%

- Short Term Rental Daily Rate: $135

- Short Term Rental Occupancy Rate: 64%

- Walk Score: 82

Investing in vacation rentals in Columbia Heights is a great idea because—one, housing isn’t expensive here, and two, you can meet a lot of people from different cultures.

Finding the ideal place to buy a profitable short term vacation rental for sale is made a lot easier with Mashvisor. Let our investment tool help you in your search for the best location for your next investment.

Conclusion

We’ve successfully reached the end of our discussion about short term vacation rentals for sale. To sum up and give you a brief overview, let’s go through the most important points.

Vacation rentals have been and will continue to be a profitable investment. The US housing market is slowly getting back on its feet, and buying a vacation rental can help you generate a high income.

In addition, short-term rentals offer more flexibility, tax advantages, and easier maintenance.

To pick the most fitting location for your investment, you first need to come up with a solid business plan, get your finances in order, research the market, run the numbers—and finally, make an offer. You might need to ask for professional help with running it, though.

And how can you get the most out of your vacation rental?

Prioritize maintenance, equip your rental with modern features and gadgets—and ALWAYS read the reviews. The feedback you get from previous guests is invaluable when it comes to improving your rental.

And if you still haven’t chosen a spot, know that Florida, Minnesota, New York, and Texas, among others, are currently some of the most profitable locations for investing in vacation rentals.

With Mashvisor, your search for the most profitable investment properties can be as easy as A-B-C. Our investment tools are designed to assist investors and provide them with accurate and up-to-date information on any property in the US housing market.

By using our Property Finder tool, you can start your real estate journey—and pin your next successful investment down in no time.

Sign up for Mashvisor now and get 15% off.