Saint Paul, Minnesota is one of the top places for investment in the Midwest real estate market. The Emerging Trends in Real Estate 2019 survey found that the St. Paul real estate market scored a 4.02 out of 5 on overall market strength (the highest in the Midwest region).

Real estate investing in this city continues to be a great way to build wealth. However, you need to know exactly where to invest. So here’s why the St. Paul real estate market is where you should be buying rental properties and the neighborhoods where you should do so.

St. Paul Housing Market 2019: Key Factors to Consider

There are certain things you need to consider when choosing where to invest and whether the market you’re interested in is an adequate market for your needs. After all, the investment location you choose could make all the difference when it comes to a rental property’s performance. So what’s the call for the St. Paul real estate market? Is it the right city for buying an investment property in 2019? Let’s see.

Home Prices and Home Values

Appreciation is a big part of the value that comes with real estate investing. If you’re thinking about a more long-term approach for a higher return on investment, you need to invest in a market that holds properties with increasing value.

The median home value in the St. Paul real estate market is currently $215,900. Saint Paul real estate has appreciated 6.6 percent in the past year. You should invest in St. Paul real estate because home values are expected to rise another 6.4 percent within the next year, according to Zillow.

Buyer’s Market or Seller’s Market?

The St. Paul real estate market is very hot right now. This means the market currently favors sellers due to the low housing inventory. The listing of houses for sale is at a 1.7 month supply, down from last year. Buyer demand remains strong and houses are selling faster and faster. According to Mashvisor’s data, the average days on market is currently 65.

This shouldn’t turn you away from the St. Paul real estate market; it just means you might have to put in a bit more effort to find the best deals. People are buying fast for a reason and you’re going to want to invest while you still can.

Related: The Best Tips for Investment Property Buyers in a Seller’s Market

Population Growth Supports Economy

The Minneapolis/St. Paul population is expected to grow above the national rate in 2019. The St. Paul real estate market is benefiting from positive net migration. With new residents moving into the region, the labor force widens. Population growth and a strong economy make for a healthy real estate market.

Airbnb Is Working with the City of St. Paul

You may have heard of the short term rental regulations the Saint Paul City Council passed back in 2017 complicating licensing. After Airbnb sued the city on the basis that these regulations violated federal law, new efforts are being made for cooperation. The two joined forces back in July of 2018 to make sure Airbnb hosts are licensed before listing their properties for rent on the platform.

Under St. Paul ordinance, short term rental hosts have to pay an annual fee of $40 for each unit they rent out. To make sure your Airbnb investment property is legal, check out the help page on Airbnb regarding these regulations.

Related: Is Airbnb a Good Investment Considering All of the Regulations?

St. Paul Investment Property: Mashvisor’s Real Estate Data

Everything we talked about above is important, but if you want to really understand the performance of rental properties in the St. Paul real estate market, you need to know the numbers.

Mashvisor’s investment property calculator has the key numbers and stats for rental property performance in St. Paul (for both long term rentals and short term rentals). Here’s a summary of the market:

- Median Property Price: $256,969

- Price per Square/Foot: $163

- Price to Rent Ratio: 14

- Average Days on Market: 65

- Monthly Traditional Rental Income: $1,490

- Traditional Cash on Cash Return: 2%

- Monthly Airbnb Rental Income: $2,544

- Airbnb Cash on Cash Return: 4%

- Airbnb Occupancy Rate: 61%

The St. Paul real estate market seems to be performing well according to these city averages. But don’t worry, if these numbers aren’t up to your expectations, we have neighborhood-level data. Real estate investing is local and having access to neighborhood-level data is a huge advantage. If this interests you, click here to start out your 14-day free trial with Mashvisor now.

Related: The Best Real Estate Investing Tips for Choosing a Top Location

Best Neighborhoods in the St. Paul Real Estate Market 2019

Here’s where to start looking for St. Paul investment property for a high return on investment.

West Side

- Median Property Price: $187,983

- Price per Square/Foot: $135

- Price to Rent Ratio: 12

- Average Days on Market: 100

- Monthly Traditional Rental Income: $1,272

- Traditional Cash on Cash Return: 3%

- Monthly Airbnb Rental Income: $3,027

- Airbnb Cash on Cash Return: 9%

- Airbnb Occupancy Rate: 54%

Merriam Park

- Median Property Price: $333,740

- Price per Square/Foot: $169

- Price to Rent Ratio: 15

- Average Days on Market: 75

- Monthly Traditional Rental Income: $1,859

- Traditional Cash on Cash Return: 3%

- Monthly Airbnb Rental Income: $4,262

- Airbnb Cash on Cash Return: 7%

- Airbnb Occupancy Rate: 69%

Dayton’s Bluff

- Median Property Price: $196,466

- Price per Square/Foot: $123

- Price to Rent Ratio: 13

- Average Days on Market: 42

- Monthly Traditional Rental Income: $1,292

- Traditional Cash on Cash Return: 2%

- Monthly Airbnb Rental Income: $2,351

- Airbnb Cash on Cash Return: 6%

- Airbnb Occupancy Rate: 62%

To start your search for investment property in the St. Paul real estate market, click here.

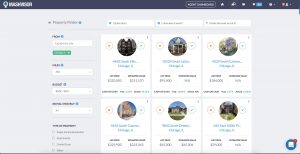

Use Our Property Finder Tool

If you really want to find the most profitable investment properties in the St. Paul real estate market, you need to use Mashvisor’s property finder. All you need to do is sign up for a free account, and you can personalize the search results to your needs. By specifying your preferred rental strategy, property type, budget and more, you can be sure to find the perfect investment properties with Mashvisor.

Related: Searching for Property in a Low-Inventory Real Estate Market: 6 Tips

To show you just how easy it is, we’ve used the tool to pick out two top-performing properties.

Property #1

- Listed Property Price: $71,300

- Estimated Value: $78,937

- Airbnb Cash on Cash Return: 15%

- Traditional Cash on Cash Return: 8%

Property #2

- Listed Property Price: $199,900

- Estimated Value: $191,345

- Airbnb Cash on Cash Return: 14%

- Traditional Cash on Cash Return: 10%

These are just two out of many other profitable properties currently listed for sale in the St. Paul real estate market. Do you already have a free Mashvisor account? Use our Property Finder now for more details on these properties and others.