While coronavirus cases may be on the rise in some parts of the US, that hasn’t stopped people from looking for homes and rental properties. Seeing as the US Department of Homeland Security Cybersecurity and Infrastructure Security Agency added real estate activity to the list of essential businesses, it makes sense why Americans are still demanding home. Moreover, it looks like this demand has been increasing in the suburbs. As COVID-19 began to spread in densely populated metro areas back in March, many people fled these areas to social themselves in vacation home rentals in rural and suburban areas. However, the pandemic didn’t blow over in just a month or two so, now, many want to move there for good. As a result, the suburban real estate market is experiencing a boom which leads investors to ask: should I invest in suburban rentals?

Related: Buying a Rental Property in the City vs. Suburbs

Suburban Real Estate Statistics

In order to answer this question, we must first look at the real estate data and statistics regarding suburban residential real estate in 2020. A new study from Realtor.com has found that Americans are showing a more profound interest in rural and suburban homes as the US housing market began to recover from pandemic-induced shutdowns in May. According to the real estate listing website, property searches for suburban zip codes grew by 13% in May 2020 compared to the same period last year. This is roughly double the rate of urban areas. Meanwhile, listing views for rural homes were up 16% year-over-year.

Even though it’s not rare for views of suburban real estate listings to outpace views of urban ones, Realtor.com reported that the discrepancy was the second-largest since 2016. In addition, while homes for sale now spend more time on the market overall as it takes longer to close a deal due to the coronavirus pandemic, both rural and suburban housing markets are not experiencing that lag time as much. Due to very strong demand, the time homes spend on the market in the suburbs has not increased as substantially as in urban areas. Average days on market increased 35% in urban areas in May, while it was up 25% in rural areas and 30% in the suburbs.

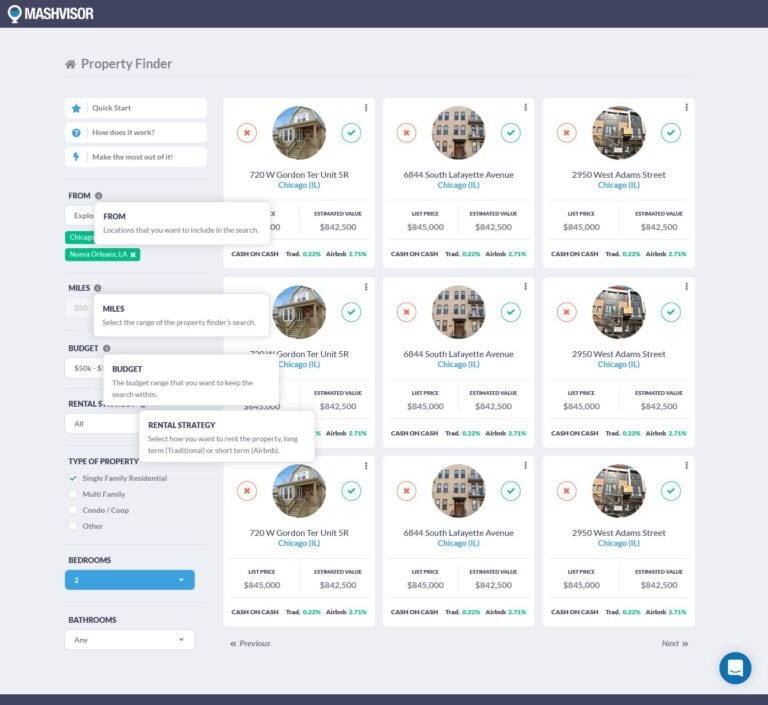

This presents an opportunity for investors to buy suburban investment properties to rent out. As many people move to suburbs, not all of them will be lucky enough to actually buy a home there. Many of these people are already renters and looking for long-term rental properties. If you want to start searching for suburban real estate rentals, all you’ve got to do is use the Mashvisor Property Finder. Simple set the filters to your desired location, budget for real estate investing, the type of property you’re interested in, and others. The tool will then provide you a list of top-performing properties that match your criteria. You’ll also get a full rental property analysis for each listing to decide which property yields the highest ROI.

Sign up for free to use our tools to find and analyze suburban real estate rentals now!

What’s Attracting Americans to the Suburbs?

The surge in views and the stable number of days on the market are signs that suburban houses are attracting greater demand in the US housing market 2020. But, besides wanting to escape COVID-19 in urban areas, what are the other factors that are driving the demand for suburban real estate? Javier Vivas, the director of economic research at Realtor.com, said in the report:

“This migration to the suburbs is not a new trend, but it has become more pronounced this spring. After several months of shelter-in-place orders, the desire to have more space and the potential for more people to work remotely are likely two of the factors contributing to the popularity of the burbs.”

#1 Remote Work

Vivas says it very clearly: the desire to have more space and more people working remotely are new trends causing the suburban housing market to boom in 2020. After all, where people choose to live has traditionally been tied to where they work. This dynamic spurred extreme home value growth and an affordability crisis in coastal job centers over the past decade. However, with more and more companies shifting to remote work, a vast majority of employed Americans who had the opportunity to work from home want to continue.

Indeed, a new survey conducted by Zillow found that Three quarters (75%) of Americans working from home because of the coronavirus say they want to continue if given the option. In addition, two-thirds (66%) say they would consider moving if given the flexibility to work from home as often as they want. As a result, these trends in the job market are leading economists to predict a boom in suburban real estate and secondary markets post-pandemic. According to the Pew Research Center, over 40% of jobs could be performed remotely, but only 7% of American workers had the benefit of working from home before the COVID-19 pandemic. Now, as more employers see that remote work is a possibility, this gap might narrow once the pandemic is over.

Related: The Future of Real Estate Investing After the Pandemic

#2 Space Seekers

The next trend causing the demand for suburban rentals to increase is the shift in people’s desire for more space. Zillow predicts that larger homes (particularly those with extra rooms or home offices) will be in high demand in the US housing market 2021. Additionally, the affordability crisis in urban cities may also have a major impact on the suburban real estate surge. Zillow found that those who can work remotely seek out more space – both indoor and outdoor – farther outside city limits, and where they can find larger homes with prices within their budget. Skylar Olsen, Zillow’s senior principal economist, said in the survey:

“Moving away from the central core has traditionally offered affordability at the cost of your time and gas money. Relaxing those costs by working remotely could mean more households choose those larger homes farther out, easing price pressure on urban and inner suburban areas.”

Real estate agents say they’re already seeing the early beginnings of a shift to suburban real estate as buyers and renters are looking to leave the city. According to one agent, buyers who were looking for walkability just a few months ago are now looking for extra land to go along with more square footage. Now that renters are not burdened by a five-day-a-week commute, living in the suburbs is becoming a more viable and affordable option.

Investing in Suburban Real Estate Rentals

While cities like New York and Seattle were the biggest hot spots for the COVID-19 pandemic in the US, these were not the metro areas that appeared most primed for a migration to the suburbs. According to Realtor.com, interest in suburban homes increased the most in the south. Here are the top 10 metros seeing the largest gains in suburban real estate demand and where investors should consider buying an investment property in 2020 according to Realtor.com. The real estate data for each market provided below are obtained from Mashvisor’s analytics. To learn more about our product and how we’ll help you make faster and smarter investment decisions, click here.

1) Columbia, SC

- Median Property Price: $248,823

- Price Per Square Foot: $120

- Monthly Rental Income: $1,264

- Price to Rent Ratio: 16

- Days on Market: 88

2) Little Rock, AR

- Median Property Price: $304,618

- Price Per Square Foot: $127

- Monthly Rental Income: $1,365

- Price to Rent Ratio: 19

- Days on Market: 88

3) Tulsa, OK

- Median Property Price: $417,477

- Price Per Square Foot: $147

- Monthly Rental Income: $1,324

- Price to Rent Ratio: 26

- Days on Market: 60

4) Fort Myers, FL

- Median Property Price: $326,062

- Price Per Square Foot: $168

- Monthly Rental Income: $1,630

- Price to Rent Ratio: 17

- Days on Market: 116

5) Charleston, SC

- Median Property Price: $655,485

- Price Per Square Foot: $314

- Monthly Rental Income: $2,133

- Price to Rent Ratio: 26

- Days on Market: 112

6) Phoenix, AZ

- Median Property Price: 431,544

- Price Per Square Foot: 215

- Monthly Rental Income: 1,838

- Price to Rent Ratio: 20

- Days on Market: 58

Read the full Phoenix real estate market report 2020.

7) Virginia Beach, VA

- Median Property Price: $415,452

- Price Per Square Foot: $202

- Monthly Rental Income: $1,627

- Price to Rent Ratio: 21

- Days on Market: 73

8) Knoxville, TX

- Median Property Price: $340,005

- Price Per Square Foot: $149

- Monthly Rental Income: $1,259

- Price to Rent Ratio: 22

- Days on Market: 95

9) New Haven, CT

- Median Property Price: $269,263

- Price Per Square Foot: $173

- Monthly Rental Income: $1,615

- Price to Rent Ratio: 14

- Days on Market: 80

10) Grand Rapids, MI

- Median Property Price: $289,015

- Price Per Square Foot: $157

- Monthly Rental Income: $1,121

- Price to Rent Ratio: 19

- Days on Market: 75

Related: Best Places to Buy Rental Property During COVID-19

Mashvisor’s real estate investment tools will help you identify the best suburban neighborhood in your city of choice and analyze suburban real estate rentals for sale. Start out your 7-day free trial with Mashvisor now!