Virtual real estate investing is believed to be for the more experienced real estate investors. But this is not entirely true. Especially with the impact of coronavirus on the US real estate market, virtual real estate investing is here to stay. You do not need to travel out to other states to do property research. Buying investment property is not limited by location anymore. Thanks to real estate investment tools and real estate investor websites, anyone from anywhere can make profitable investment decisions.

What Is Virtual Real Estate Investing?

Virtual real estate investing means using real estate investment software to do property research and investment property analysis, and ultimately, buy investment property. It is essentially remote real estate investing, an alternative to the traditional approach where you would physically go to showings. It is a cost-effective way to do out of state real estate investing because it saves on traveling and the associated costs and time needed. Not to mention, it makes scouting for off-market properties so much easier as this typically requires physically driving around areas. Virtual real estate investors do long distance real estate investing from the comfort of their home.

How to Get Started in Virtual Real Estate Investing

Becoming a real estate investor does not have to be hard. With the right real estate resources, you can even start it as a side hustle for passive income. Virtual real estate investing opens up a lot of opportunities for any budget and investment goals because you are no longer restricted to your city. Buying rental property out of state might actually be more profitable for you. So, if you’re ready to take advantage of this strategy, here’s how to get started:

How to Choose a Real Estate Market

Long distance real estate investing can be confusing at first – so many options to choose from! If you do not know where to start, decide on a state you are interested in. It can be a state that is good for a vacation home or just one with favorable Airbnb regulations. Or if you’re looking to get into traditional rental properties, it can be one with no rent control and a large population. Then choose cities or towns in it that can be of interest to long term tenants or tourists. How can you know that? Well, if there are tourist attractions, sights, or natural landmarks nearby, there will be people visiting. As for whether there will be demand for long term rental properties, you can check out market stats online like renter population, price to rent ratio, and the state of the job market and economy.

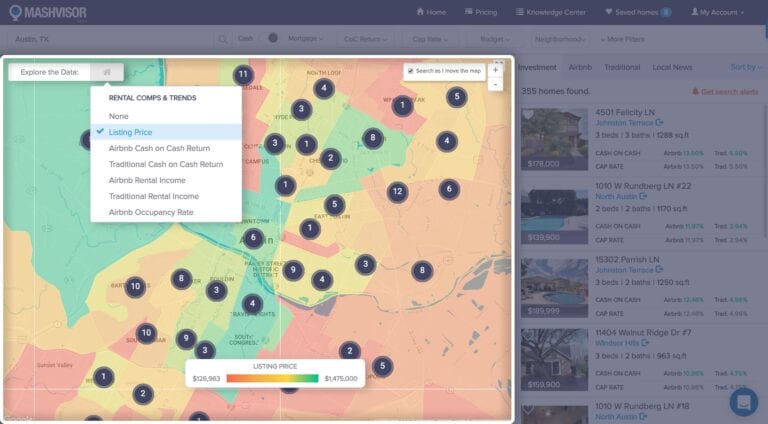

Of course, even with a little research, this step can be difficult. That is why real estate investment tools are essential for virtual real estate investing. You cannot know the state of the housing market in every town, but real estate investment software like Mashvisor does. It pulls data from numerous listing sites to literally automate your real estate market research for you. Mashvisor’s real estate heatmap lets you explore neighborhoods in the city of your choice across all 50 states. You can conduct analysis based on different kinds of neighborhood data:

- Listing price

- Traditional and Airbnb rental income

- Average rate of return on a rental property (in the form of traditional and Airbnb cash on cash return)

- Airbnb occupancy rate

This way, you can easily understand the housing market in the location of your interest and see if it is a good place for investing in real estate. It literally visualizes the real estate market analysis for you. The heatmap lets you search by criteria important to you, say cash on cash return. You get the map filtered and the matching neighborhoods with high values highlighted in green. With such data, you do not need to have ever visited the place – virtual real estate investing means you actually know more about the investment potential than people living there.

Making an Investment Decision

Buying rental property out of state and investing close to your home base have one thing in common: in either case you have to do investment property analysis before choosing a property for sale. This means going deeper into the financials about a property and evaluating how profitable an investment it would make. Mashvisor can help both traditional and virtual real estate investors with this. The platform does this analysis for you, letting you compare different options. Here is a brief look at what is included in the automated analysis:

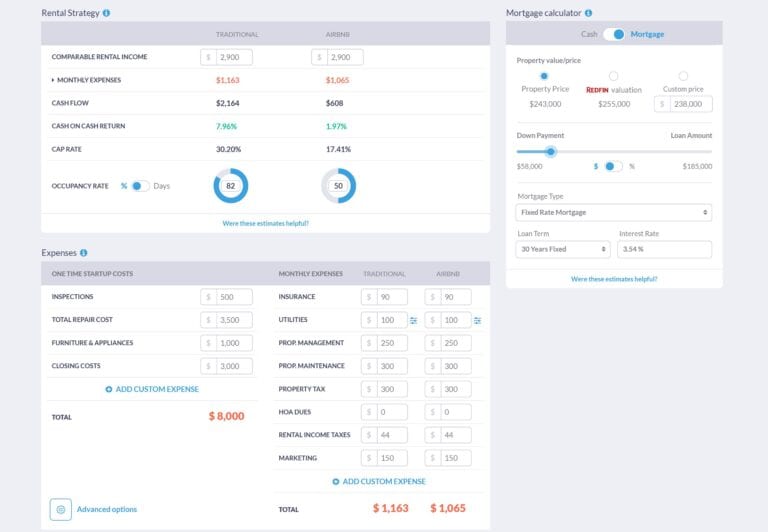

Expenses and method of financing. In the investment property calculator, you can input your mortgage or cash details and get costs and return on investment calculated. Expenses like utilities, insurance, property management fees, or HOA fees are estimated for you based on historical property data of the location. You will quickly see if a particular investment property for sale fits your real estate investment strategy.

Related: How to Estimate Rental Property Expenses Before Buying

Rental strategy. Mashvisor reports rental income, cash flow, cash on cash return, cap rate, monthly expenses, and occupancy rate. You get a neat side-by-side comparison of Airbnb vs traditional renting to help you choose the most profitable rental strategy.

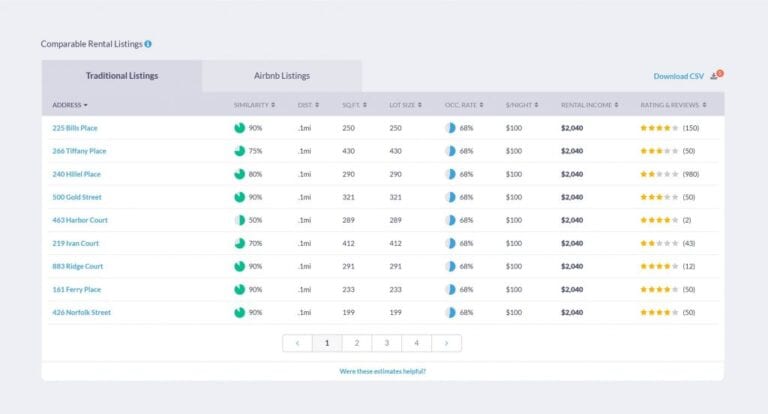

Spy on the competition. To make out of state real estate investing even easier, Mashvisor lists similar rental properties in the area. You’ll get both traditional and Airbnb rental comps. You can see their metrics like size, occupancy rate, and for Airbnbs, the Airbnb nightly rate, even Airbnb ratings, and reviews. Thus, you will be able to set a competitive rental rate.

A Few Things to Consider

In order to close the deal once you have found your ideal investment property, you can do it remotely with some help. There are home inspection services available for hire in most places that will visit the property without you and give you peace of mind. Then, it would be helpful to find a local agent to work with on the negotiations and the offer. This can easily be done over the phone or email (listings on Mashvisor give all contact details of the agents). Finally, you will need a digital signature. There are many documents to be signed before the deal can be closed, not to mention leases after you take possession. Most counties already accept digitally signed documents so it will save you lots of back and forth on papers. After all, virtual real estate investing is tech-savvy and should not burden you with paperwork.

Related: Do I Need a Real Estate Agent to Buy Investment Property?

Also, you will probably need to hire a property management company. Dealing with long-term tenants from a distance is doable, but managing an out of state Airbnb is a bit more difficult. You will likely need someone to check guests in and out, clean, restock toiletries, etc. although some of this can be automated through Airbnb management software.

Related: The Ultimate Guide to Managing an Airbnb Remotely

To Sum Up

Virtual real estate investing is the future. You should not be restricted to investing in the city where you live. Technology helps you make better and more lucrative investments when you have access to a larger market. Start using real estate investment tools like Mashvisor today to find new opportunities.

Start out your 7-day free trial with Mashvisor now.