Sure, there are plenty of ways to find multi unit properties for sale this year. You can drive around looking for “For Sale” signs to find rental properties for sale. You can also directly visit any number of real estate listing sites and browse hundreds, if not thousands of multi family homes for sale across the US housing market. Or, you can just Google “multi family homes for sale near me,” “rental properties for sale near me,” or “rental properties near me for sale” and fall down the rabbit hole of listings across different websites.

But what’s the absolute best way to find multi unit properties for sale? I can tell you right now it’s none of the above-listed ways. Why? Because, with those investment property search methods, all a real estate investor will ever get is basic listing information like listing price, square footage, number of bedrooms/bathrooms, and more. But you’re not buying a home to live in—you’re buying multi-family homes for investment, and you need so much more than this.

What Is a Multi-Family Home?

A multi-family home is a residential building with more than one housing unit. Multi-family real estate can accommodate multiple tenants, each having their own rental unit with its own kitchen, living room, bedroom, and bathroom. A multi-family home is also known as a multi-dwelling unit (MDU), and these multiple separate units can also be held in one or several buildings in the same complex.

Multi-Family Homes vs Single-Family Homes

When it comes to residential housing, the main types of real estate investments are single-family homes and multi-family homes. You already know multi-family homes have multiple tenants simultaneously, so one can only assume that single-family refers to a building that only houses one tenant at a time. That’s the root reason why becoming a multi-family real estate investor is such a great decision; the opportunity of having multiple income streams generating from the same investment property is amazing and can be extremely profitable.

Now that you have the basic answer to “what is multi family real estate?” let’s get into the specifics regarding this type of rental property.

Types of Multi-Family Homes

Before you start searching for multi-family homes for sale, there’s still more to know. There are different types of multi-family real estate investing, depending on how many rental units each building holds. Here are the basic types of multi-family properties:

Duplex

A duplex investment is the simplest multi-family real estate investment. This type of property is one building that is divided into two separate “houses” that are typically side by side. Even though it’s the same building, each house has its own entrance and there are no common areas.

Triplex and Fourplex

Like duplexes, a triplex and fourplex are buildings with three and four housing units, respectively.

Townhouse

A townhouse is any number of houses attached at the sides with separate private entrances. They can also be on top of each other (typically two units vertically), usually with their own private exterior entrance.

Condo and Apartment

Condos and apartments are the more common types of properties that come to mind when people think of multi-family real estate. A condo can be an individually owned unit in a multi-family housing complex. Whereas, apartment buildings are wholly owned by one owner. Although their purpose is to house tenants, apartment buildings are considered commercial real estate investments.

Know which type of multi-family investment properties for sale you want to start looking for? Then you’re ready to use our Property Finder Tool to find the best one right now.

9 Things to Consider Before Buying Multi-Family Homes for Sale

Investing in multi-family homes can be lucrative, but it’s essential to thoroughly evaluate potential properties to ensure a successful investment. Here are nine key factors that you should consider when looking for multi-family homes for sale:

1. Location

Real estate is all about location, location, location, so it’s no surprise that this is the first factor in the list. Because multi-family properties aren’t always permitted, your choice of location may already be limited. This could be a good thing since you won’t be overwhelmed by options, but there’s also a chance that the available options for you aren’t good at all.

When checking out multifamily homes for sale, evaluate the neighborhood’s overall safety, amenities, and proximity to public transportation, schools, shopping centers, and employment opportunities. Make sure to look for areas with a growing job market and population since this can positively impact rental demand.

2. Market Trends

Once you’ve chosen a location, you need to research the current real estate market trends in the area, including property values, rent prices, and vacancy rates. This will help you gauge the health of the local housing market.

You’d want to see property values appreciating by 3% to 5% per year in the last several years. The rent prices should be high enough that matching the rate would give you a minimum of 10% return on investment (ROI). And finally, a 3% or lower vacancy rate represents high rental demand, ensuring that you will find tenants quickly. These will also help you determine if the market is poised for growth in the next few years.

3. Property Condition

Assess the overall condition of the building, including the roof, foundation, plumbing, electrical systems, and common areas, and factor in any necessary repairs or renovations and their associated costs. Certain repairs can get very expensive, and doing several renovations can add up. You’d want to keep your costs low especially in the beginning to keep your potential profit and ROI as high as possible.

4. Unit Mix and Configuration

Evaluate the mix of unit sizes and configurations to ensure they align with the local rental market demand. If possible, a multi-family home with a mix of studio units, one bedroom, two bedrooms, and even three bedrooms would help you attract different groups of tenants. But if the property only has one type of unit, make sure that there is enough rental demand to keep all units occupied by tenants.

5. Rental Income and Expenses

Analyze the current rental income and potential for rent increases. When studying the local market trends, you will find out the typical rent price for the units in your prospective multi-family home. Take that number, multiply it by the number of units, and then deduct all operating expenses from the total, including property taxes, insurance, maintenance, and property management fees. This should help you determine the property’s net operating income (NOI).

6. Financing Options

If you can’t pay in cash, shop around for financing options and interest rates and understand how they will impact your cash flow and overall ROI. It’s best to go to at least three lenders first before making a decision on how to finance your purchase. If possible, consider working with lenders who are experienced in financing multi-family homes.

7. Regulatory Environment

At the same time that you choose a location, familiarize yourself with local zoning regulations, building codes, and any rent control ordinances that may affect your investment. This is especially crucial if you’re planning to build a new multifamily home instead of buying an existing one. Some zoning regulations restrict the type, size, or density of multifamily properties in an area, which could lower profit potential.

But you wouldn’t want to invest in a location with minimal or no regulations, either. Areas with lenient zoning rules tend to have overdevelopment and a lot of competition, which may result in lower rental rates and property values.

8. Tenant Quality and Lease Terms

If you’re looking into a multifamily property with existing tenants, it’s important to evaluate the current tenant quality and their lease terms. Minimizing your investment risks includes making sure that your would-be tenants pay their rent on time and that only a small portion are ending their lease soon. Check the building’s historical occupancy rates and tenant turnover to get a feel for the stability of rental income.

9. Cap Rate and Cash Flow

Finally, calculate the capitalization rate to assess the property’s potential return on investment. Many consider 4% to be a good cap rate for multi-family homes but try to aim for one that can give you 8% to 12%. This range is in the sweet spot of an investment that can provide high returns but relatively low risks.

You should also project the property’s cash flow before closing, and factor in both ongoing operating costs and potential financing costs. Knowing the property’s potential cash flow will help you identify which of your prospects is the most profitable.

By thoroughly examining these factors, you can make informed decisions and increase your chances of succeeding in multi-family home investing. Now that you know what to look for in multi-family homes for sale, how can you go about looking for them?

So, What Is the Best Way to Find Multi Unit Properties for Sale?

The best way how to find multi-unit properties for sale in the US housing market is by using online real estate investment tools. Such tools will help you perform a complete and thorough multi-family real estate investment analysis.

Because that’s what you really need as a multi-family real estate investor. You need a quick and easy way to analyze multi-family homes to determine if they make for a good real estate investment or not.

There are a few online real estate tools that every multi-family investor should be using instead of scouring the entire internet to learn how to find rental properties for sale:

- Real Estate Heatmap

- Rental Property Finder

- Multi-Family Investment Calculator

- Off Market Property Marketplace

Let’s take a look at these real estate investment tools and how to find multi unit properties for sale or rental properties for sale near me using each one.

Just one last note before you dive into these career-changing real estate investment tools.

Our focus today is on finding small multi-family homes for sale – those with 2-4 units. duplexes, triplexes, and fourplexes. Why? Because these multi family properties offer one clear advantage for the savvy real estate investor: They can be financed using FHA loans with a down payment as low as 3.5%. Of course, you would need to live in one unit and rent out the rest. This residential real estate investment strategy is known as house hacking.

Related: How to Buy Multi Family Property with No Money

While it may not sound appealing to the average person, those with a business mindset see a world of possibility – to live rent-free (and mortgage-free), save up money, buy multiple rental properties, and eventually move out after the allotted time.

But, if house hacking is not your strategy of choice, small multi-family homes for sale are still more affordable than larger multi unit apartment buildings and are just simply a great way to kick off your real estate career. Now, onto the tools that will help you do that.

Watch our video below to find out helpful real estate tax exclusions related to multi family properties:

The 4 Best Multi Family Investment Property Search Tools

Did you know that all of these tools can be found here at Mashvisor? Follow along with the steps on how to use each one by signing up now. That way, after this short read, you will have found the best multi unit property.

1. Real Estate Heatmap

Do you have a city in mind for multi family real estate investing?

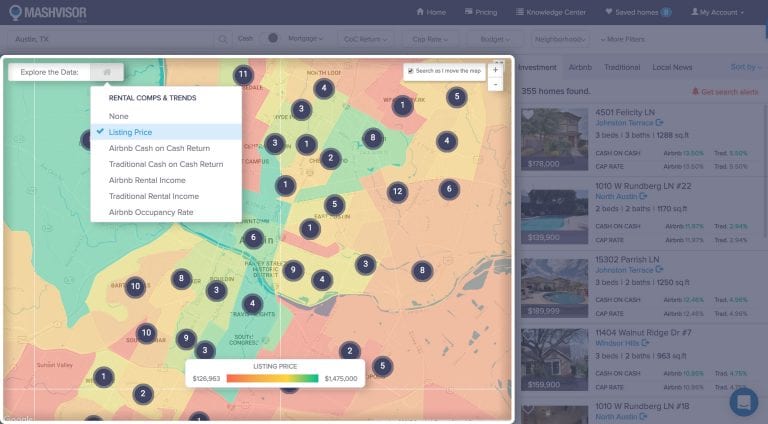

Well, that’s only step 1 of choosing a location for buying multi-family property or other rental properties for sale near me. Within that city, you need to know exactly where to find multi-unit properties for sale that are going to give you the highest return on investment. And that’s where the real estate heatmap comes in. Here’s how it works:

Type in the city of your choice and hit the Explore Data button in the top left corner of the map.

From there, you’ll be given the option to set 6 different investment property search filters:

- Listing Price

- Airbnb Cash on Cash Return

- Traditional Cash on Cash Return

- Airbnb Rental Income

- Traditional Rental Income

- Airbnb Occupancy Rate

Start with the Listing Price filter. It will highlight all of the neighborhoods in the city with investment properties for sale based on listing price. Those with affordable properties for sale will be colored in red and those on the more expensive side, green. Take note of the neighborhoods that fit your budget for buying multi family homes or other rental properties for sale.

Next, play around with the other search filters, one by one. For the rest, you’ll want to take note of neighborhoods that are highlighted in green. These will be the locations with the highest cash on cash return, rental income, and Airbnb occupancy rate.

With that, you will have found the best neighborhood to start your search for multi unit properties for sale! You will have completed the crucial first step of finding income properties (in minutes) and that’s a neighborhood analysis.

2. Rental Property Finder

I know what you really want when looking for investment property for sale and that’s high cap rate multi family real estate. While other factors come into play and a high cap rate isn’t always better, it is a good place to start.

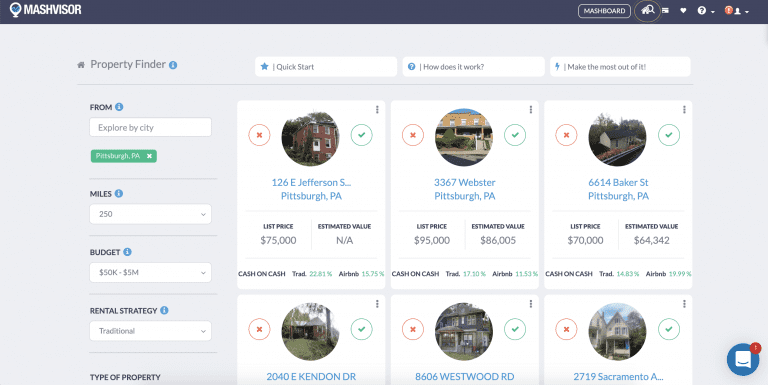

The best way to find high cap rate properties for sale is with a rental property finder. With this investment property search tool, you’ll have a set of filters to select including:

- Location (search in up to 5 cities at once)

- Miles from the city

- Budget

- Rental Strategy (Airbnb vs Traditional)

- Type of Investment Property for Sale (you’ll want to choose multi family home)

- Number of Bedrooms and Bathrooms

Once a multi family investor sets these filters, the AI works to bring back results. But these aren’t just multi family real estate listings – they are high cap rate properties for sale. They are the best-performing multi-family homes in that real estate market. The rental property finder basically hands you the best multi family real estate investments available on a platter with little to no effort on your part.

3. Multi-Family Investment Calculator

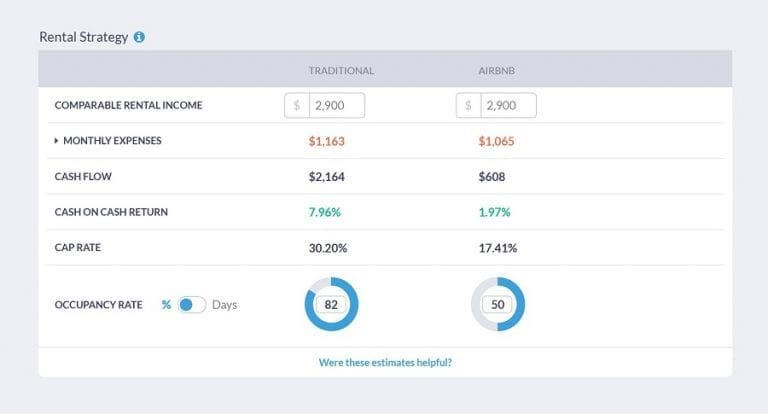

Once you do find an appealing multi family property, your search shouldn’t stop there. You do have to perform a multi family real estate investment analysis. For this, there is no better tool than the multi family investment calculator.

With this tool, you can analyze a number of multi unit properties for sale or rental properties for sale in a few minutes. Click on any listing on Mashvisor and you’ll be taken to the Property Analysis Page. While this page is full of neat stuff to help you make a good investment choice, the best part is the calculator, which also serves as an Airbnb calculator. It looks like this:

As you can see, the multi family investment calculator provides the following metrics that are key to analyzing multi unit properties for sale or rental properties for sale near me:

- Rental Income

- Monthly Expense Estimates

- Cash Flow

- Cash on Cash Return

- Cap Rate

- Occupancy Rate

These numbers are provided for both rental strategies for comparison and are based on real estate analytics and data of local rental comps in the area.

You also have a mortgage calculator to help you see your real estate cash on cash return based on your multi family financing. You can plug in your:

- Down Payment on Rental Property

- Loan Type

- Loan Amount

- Interest Rate

- Loan Term

And the return on investment will be adjusted to match these. This way, you can ensure you have the best multi family financing to get you the highest cash on cash return with that specific property.

Because the multi family investment calculator is interactive, you will also be able to adjust or even add any rental property expenses you see fit. This will change the cash flow projections for the multi family rental properties for sale or other types of rental properties for sale.

The tool will also provide multi family comps to help you ensure you pay the right price through comparative market analysis.

And just like that, multi family real estate investment analysis is complete. You can either get started with buying this multi unit property or keep looking for one that offers better returns.

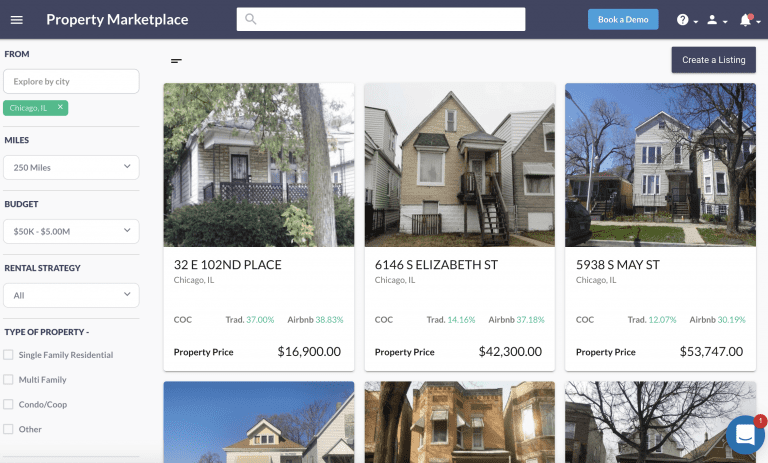

4. Off Market Property Marketplace

I haven’t met a beginner or experienced real estate investor who doesn’t covet off market properties. That’s why Mashvisor has created the Property Marketplace- a place where you can easily find and analyze off market properties for sale. The Marketplace gives you access to a large supply of off-market real estate listings from different sources, including foreclosures, short sales, and even tenant-occupied rental properties so you can start earning cash flow instantly.

All you have to do is set the filters:

- Location

- Distance from the Location

- Budget

- Rental Strategy

- Type of Property (select off-market multi-family for sale)

- Number of Bedrooms and Bathrooms

- Cash on Cash Return

- Cap Rate

- Listing Type (Non-MLS, Foreclosures, Needs Repair, Tenant Occupied)

Once you do that, the AI will return the best off market multi family for sale in the housing market of your choice. And with the Mashvisor Property Marketplace, you can access the multi family investment calculator to analyze the income property further. Buying multi unit properties for sale off market has never been so easy.

The Next Step in Investing in Multi Family Homes for Sale

At this point in your investment property search, you’ll have found the ideal rental income properties for sale for investing in multi unit rental properties for sale. Now, you’ll want to:

- Finalize your multi family financing

- Hire a real estate agent or realtor to help you close the multi family deal

- Make an offer to the seller

If you did your real estate market research well and chose one of the best multi family investment markets, you’ll find tenants in no time (with the right marketing strategy, of course). You’ll be well on your way to making money with multi family investing.

It all starts with the right real estate investment tools. Take the first step now and sign up for a 7-day free trial of Mashvisor, followed by 15% off for life.