A rental property is one of the largest assets anyone can buy. However, for generations, rental property investments have been used to generate cash flow, diversify real estate portfolios, and achieve wealth for the long-term. But before you can enjoy these benefits and become a real estate investor, you need to first know the 10 steps to buying rental property for the first time.

While buying an investment property is similar to buying a primary residence, there are, of course, some unique differences that beginner investors need to be aware of. In this guide, we’ll walk you through the steps you need to take to successfully buy a rental property for the first time. We’ll also share some of the common challenges beginners face along with the best tips to make the process as smooth as possible.

For a rundown of the 10 crucial steps, check out the video below!

This video is made using InVideo.io.

Step 1: Set Investment Goals and Expectations

While starting a rental business is a great way to become rich, the journey is going to be a long one. One of the biggest mistakes beginner investors make is going into the industry without actually having an idea of what they want to achieve. So, it’s important that you set your goals and expectations before you get into real estate investing. Meaning, the first step to buying your first rental property is to sit down and write a real estate business plan.

This plan should be based on realistic expectations, your financial capabilities, and the investment strategy. It should also include how much money you plan on investing in rental properties, how many real estate investments you aim to own, and how to grow and diversify your portfolio to reduce risks and maximize returns. Having everything planned out from the start will help you stay focused on reaching your end goals and give you direction to keep you on track to succeed while just getting started.

Here’s a guide to Developing a Real Estate Investing Business Plan for Beginner Investors.

Step 2: Work Out Your Finances for Buying Rental Property

A big question for buying your first rental property is how to finance this purchase. For beginner investors, mortgage loans are the most common methods of financing an investment property, so consider exploring your options there. In this step, it’s important to consider how much money you need to save for a down payment. Ideally, you should have a 20% – 30% down payment saved up (based on your price range) before you even start looking for rental properties for sale.

Therefore, the next step is to figure out your finances. Check how much you have in your savings account, how much you expect to save up in the next few months, and how much you’ll be able to spend on a rental property in the coming years. In this way, you will set up your budget for real estate investing. If you’re buying your first rental property and you’re not familiar with qualification requirements, interest rates, loan availability, and terms, a good tip is to speak with a mortgage broker for advice.

Step 3: Get Pre-Approved for a Mortgage

Another common mistake that beginner investors make is searching for investment opportunities before securing financing. Getting pre-approved first is what allows you to make educated decisions about the investment property. Say, for example, you find the perfect property for sale after months of searching. Because you need to include a pre-approval letter in your offer, you’ll need to wait until you actually get one before making an offer. But by the time you get pre-approved, the investment property is most likely already under contract with another real estate investor.

As you can see, getting pre-approved early on is essential when buying your first rental property to have the ability to jump on a good deal right away. This will also help you further understand what types of investment properties you can afford to invest in. There are a few qualifications that must be met in order to get pre-qualified including:

- A credit score of at least 680 (an ideal score is 740 or higher)

- A 2-year job history at a US company. Self-employed individuals need to prove they had a monthly income and were financially stable for the past 3 – 5 years

- Have the cash needed for the down payment

- Have cash available that can cover at least 6 months of expenses

- Maintain a consistently low debt-to-income ratio

Step 4: Research Different Rental Markets

Now it’s time for you to do your due diligence and search for the best places to invest in real estate. Seeing as the investment location is crucial, you need to invest in a good location if you want to own a successful rental business. Many beginner investors consider buying rental properties in their local housing market to eliminate headaches. However, that’s not always the smartest decision. Successful investors are willing to invest in profitable investment properties even if they’re located in a different city and even a different state!

Therefore, the next step to buying your first rental property is to research, research, and research some more. Basically, you need to understand how to identify the best places to invest in real estate and see what markets meet this criterion. An essential indicator of a strong rental market is population growth. Generally, when more people flock to an area, the rental market is flooded – there’s a high demand for rental properties. This gives real estate investors the opportunity to capitalize on profitable opportunities.

Other trends and indicators to look for include job growth and unemployment rate, home prices, school ratings, crime rates, and walkability. Researching these trends in different rental markets allows investors to determine how desirable the market is for renters and, thus, makes for a good place for you to start a rental business. To give you a head start, check out these 10 Best Places to Invest in Real Estate in 2019.

Step 5: Conduct Real Estate Market Analysis

After narrowing down potential location choices for buying your first rental property, you need to dig a little deeper into them. In this step, investors conduct what we call a real estate market analysis. This step is important because it’ll help you figure out property prices, rental rates, the best type of rental property, best rental strategy, and much more! Having all of this information allows real estate investors to better understand the rental market and, thus, make smarter investment decisions.

A real estate market analysis is the process of evaluating investment opportunities to explore expected profit and risks. It provides investors with a comprehensive picture of the location, how properties are performing there, and the profit you can expect to earn from investing there. In essence, a real estate market analysis tells you whether buying your first rental property in this location makes financial sense and will bring you profits.

Step 6: Search for Potential Rental Properties

After doing all of the previous work from obtaining the pre-approval letter to analyzing the real estate market to ensure investing in the best location, now you can start your property search. There are many ways (both traditional and innovative) to search for rental properties for sale. For example, you can ask around your networks, check property listings in newspapers, or use real estate websites to find homes for sale. If you’re interested in the latter option, make sure to check the Top Real Estate Sites for Finding Investment Properties in 2018.

However, there are a few things to consider before you start your property search. First off, don’t forget to stick to your budget and expectations you’ve set for your rental property. Furthermore, focus on a certain type of property to narrow down your options. For example, beginners in real estate investing are often recommended to start with single-family homes as they’re easier to buy, manage, and are always in demand.

Looking for a fast way to find homes for sale for buying your first rental property? Mashvisor provides a number of investment tools–including traditional and Airbnb data–designed to help investors search for, find, and analyze investment properties in a matter of minutes!

Step 7: Do Investment Property Analysis

When doing a property search, you’ll probably have a few properties to choose from. How will you know which one has the highest potential for making money and generating a good return on investment? In this case, you’ll have to conduct an investment property analysis on each property to evaluate how good of an investment it is. While it might seem like a lot of work, this is a very important step, so don’t skip it!

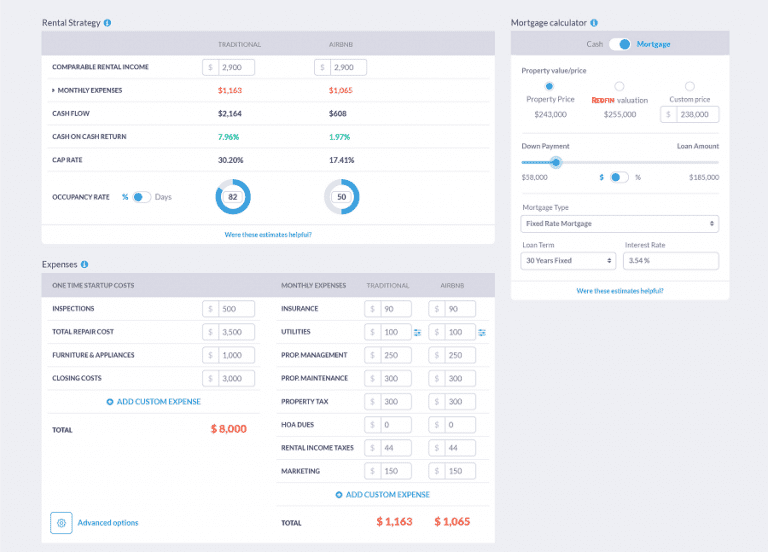

To conduct a property analysis, consider all the costs of owning a rental property. These include startup costs (like an appraisal, closing fees, agent fees, mortgage fees, repairs, etc.) and recurring costs (like mortgage payments, property tax, insurance, property management, etc.). Then, compare these costs to the rental income you expect the property to make. You want to make sure the numbers add up to a positive cash flow, good cap rate and/or cash on cash return.

We know it’ll take time to do an investment property analysis on each property you think has a potential for real estate investing. This is why you’ll need to use the Airbnb Calculator. This tool will provide you with projections on what ROI you can expect to earn in regards to the above metrics based on data and predictive analytics. You should use this tool when buying your first rental property to get the most accurate results in the most efficient manner!

Start out your 14-day free trial with Mashvisor now to access our Investment Property Calculator.

Step 8: Get a Home Inspection + Appraisal

Once you’ve decided on which property you want to invest in, you can go ahead and present an offer to the seller. If the terms of sale have been agreed upon, the next step is to schedule a home inspection. The purpose of this inspection is to point out any red flags or issues in the property that you didn’t notice and could end up costing you thousands of dollars on repairs after you’ve already closed the deal. Savvy real estate investors use the results of a home inspection during the negotiation phase to either reduce the price or ask the current owner to fix these issues before buying the property. Remember, if there are any major issues, you can back out of the deal and search for another property.

The next part of this step to buying your first rental property is the home appraisal. If you’re financing the purchase with a mortgage, the lender will typically order an appraisal. This helps the lender ensure lending the appropriate amount of money and that the purchase price and the appraisal price are similar. For example, the lender won’t give out a $200,000 loan for a property that has been appraised at $100,000. Moreover, an appraisal gives real estate investors the peace of mind to make sure they’re not paying more for the rental property than its actually worth.

Step 9: Hire a Real Estate Attorney

As a beginner real estate investor, you shouldn’t attempt to close the deal on your own. Not only is there lots of paperwork, but it takes certain skills that you may lack. To make sure the transaction process goes smoothly and the sale of the home is legal, it’s best to work with a professional real estate attorney. An attorney will provide you with guidance and help you negotiate the final terms to the contract like final price, closing costs, and closing date.

Step 10: Buying Your First Rental Property

After you receive funding and the lender issues the loan approval, the last step in this journey is to close the deal. Again, your real estate attorney will help you sign the final paperwork to have full ownership transferred from the seller to you so you can receive the key to your first investment property!

By following the above 10 steps, you’ll be well prepared for buying your first rental property. While there are many things to consider before buying investment properties, you should start by doing your research and due diligence. Look at property prices in your investment location of choice and start saving up for a down payment. When you’re ready to dive into the rental market, come back to Mashvisor to begin and end your property search and analysis using the best investment tools.

To learn more about how we’ll help you make faster and smarter real estate investment decisions, click here.