Generating a high return on investment (ROI) is the goal of every real estate investor. A good rate of return on investments is what allows you to expand your portfolio and build your wealth in a sustainable manner. While there is no set rule on what constitutes the ideal return, the consensus among experienced investors is that a highly profitable real estate property should yield around 20% return on investment. So how should you go about finding rental properties that can generate this kind of return? And what is the most effective way to ensure a 20% return on investment in the real estate market? This article will discuss the mechanisms of profitability in real estate and detail the process of finding the most profitable investment properties in any US housing market in 2020.

How to Ensure a 20% Return on Investment with the Rental Property Finder

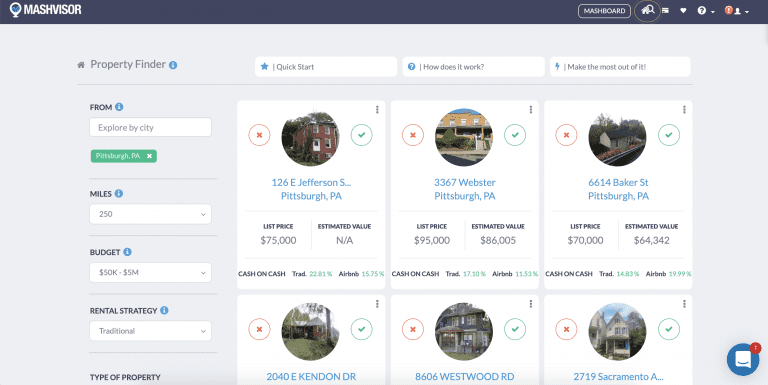

Making money in real estate is only possible if you manage to zero-in on profitable income properties. The most effective way to achieve this is by relying on advanced real estate investment tools that are specifically designed to identify good rental property investments. Mashvisor’s Rental Property Finder is without a doubt the most effective tool that you can use to this end. In fact, finding properties that can generate a 20% return on investment is easily achievable once you get a good understanding of how this investment property deal finder works.

Let’s take a look at some of the main features of the Rental Property Finder.

1- AI and Machine-Learning Algorithms

Like all Mashvisor tools, the Rental Property Finder boasts a wide array of unique features that set it apart from the competition. Chiefly among them is the advanced AI that it employs. Thanks to a set of high-end machine-learning algorithms, the Property Finder can rapidly sift through thousands of listings and unearth properties that match your preferences and have the highest return on investment in the location. Moreover, the AI factors in social and behavioral patterns when going through listings, resulting in accurate results that perfectly reflect what you are looking for.

2- The Filters

Another key element that makes the Rental Property Finder the perfect tool for getting a 20% return on investment is the multitude of filters that it comes with. Unlike other tools that rely on overly complicated parameters, the Mashvisor tool keeps it to the essential minimum. Here are the filters that you can use when you are aiming for a 20% return on investment:

- Location

- Distance from the location

- Type of investment property

- Preferred rental strategy (Traditional or Airbnb)

- Budget

- Number of bedrooms and bathrooms

The tool also boasts a simple interface that is easy to navigate, making it ideal for novice real estate investors.

3- Multiple Cities Search

Getting a 20% return on investment on rental property requires extensive search across several real estate markets. Needless to say, this can get fairly tedious if you have to conduct each search individually. But luckily, the Property Finder provides you with a simple solution to this. Thanks to the multiple cities function, real estate investors are able to find investment properties in up to 5 cities at once.

4- Investment Property Analysis

Finding investment properties for sale is not the only function that this tool offers. In fact, it can also help you when it comes to investment property analysis. Besides listing relevant investing metrics such as cash on cash return, the tool gives you access to an Airbnb calculator. Clicking on any investment property takes you to the Property Analysis page where you can view metrics such as rental income, cash flow, cap rate, and the occupancy rate. This saves you the hassle of juggling between multiple platforms when looking for the ideal rate of return on a rental property.

Now that you have grasped the basics of how to find investment property with the Property Finder, let’s take a look at some of the factors that affect your return on investment.

Factors that Affect Your Return on Investment in Real Estate

While finding rental properties that can yield a good return on investment is feasible, getting there depends on many factors. At the end of the day, property search is only half of the equation as the average return on investment can still be affected by mismanagement, poor financial planning, and unforeseen market factors. Here are some of the most significant variables that you need to be aware of when aiming for a 20% return on investment.

1- Investment Property Financing

Getting good mortgage rates is critical when investing in real estate. Favorable loan terms can save you thousands of dollars in yearly expenses. Real estate investors who rush through the financing process will invariably incur extra costs that will gradually eat away at their ROI. To get good loan terms, make sure to tidy up your finances to appease mortgage lenders and shop around before committing to any financing option.

2- Rental Property Management

Rental property management can be the difference between generating a 20% return on your money and barely breaking even. Operating an investment property comes with several expenses that can escalate quickly if not handled properly. This is especially the case for small, recurring costs that go unnoticed but slowly morph into a sizable expenditure. This is why it is essential to maintain tight bookkeeping and retain the services of professional property management.

3- Housing Market Factors

Any type of investing comes with some level of risk. Regardless of how thorough your planning and implementation are, variables that are out of your control can still affect your return on investment. Examples include major shifts in market dynamics, economic deterioration in the area, the introduction of new restrictive laws, etc.

The Bottom Line

A 20% return on investment might seem fanciful to some, but the reality is that it is easily doable if you take the right approach to property investing. Using Mashvisor’s Rental Property Finder should be your first step towards achieving this objective.

To learn more valuable real estate investing tips, check out our blog and make sure to subscribe to Mashvisor!