One way that real estate investors choose the best places to buy investment property is to look at cap rates by city. Typically, if the average cap rate for rental property in a city is high, this location is considered to have a high potential for being profitable.

If you’re still undecided on where to invest in real estate in 2019, we can show you the cap rates by city across the US. This data is provided by Mashvisor’s Investment Property Calculator.

2019 Cap Rates by City

Note that the following cap rate data is specific to the performance of long-term rentals in each city. It encompasses all types of residential real estate from single family homes to condos to townhomes to multi family homes and more.

City Average Cap Rate

Camden, NJ 6%

Key West, FL 5%

Jackson, MS 4%

Lancaster, SC 4%

Santa Fe, NM 4%

Baltimore, MD 3%

Philadelphia, PA 3%

Scottsdale, AZ 3%

Dayton, OH 3%

Baton Rouge, LA 2.5%

Arlington, VA 2.5%

Indianapolis, IN 2%

Nashville, TN 2%

Pittsburgh, PA 2%

Orlando, FL 2%

Tampa, FL 2%

Atlanta, GA 2%

Virginia Beach, VA 2%

Denver, CO 2%

Las Vegas, NV 1.5%

Memphis, TN 1.5%

Columbus, OH 1.5%

Bakersfield, CA 1.5%

Fort Lauderdale, FL 1%

Grand Rapids, MI 1%

Seattle, WA 1%

Sacramento, CA 1%

Charlotte, NC 1%

Phoenix, AZ 1%

San Diego, CA 1%

Houston, TX 1%

New York City, NY 1%

Los Angeles, CA 1%

Chicago, IL 1%

Raleigh, NC 1%

San Francisco, CA 0.7%

Boston, MA 0.7%

Austin, TX 0.6%

Dallas, TX 0.5%

Miami, FL 0.4%

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

Why Are 2019 Cap Rates by City So Low?

Why are the real estate cap rates listed above so low? And what is a good cap rate for investing in real estate?

When we think of the ideal cap rate for rental property, it’s something that is above 8% at least. Anything higher is a good cap rate. However, when looking at cap rates by city, your “rule of thumb” needs to change. Because the cap rate relies on so many factors, the average real estate cap rates for cities are typically low. So the cap rate alone is not always the best indication of whether or not a place is the best city to invest in real estate.

Take the Dallas real estate market for example. It has been named the #1 best place to invest in real estate for 2019. That’s because the population is growing, there’s healthy economic and job growth, and 2019 will see new construction focused in this city. All of this means that the Dallas housing market is a great place to buy an investment property thanks to the growing housing demand.

Learn more: Dallas Real Estate Market: The Best Place to Invest for 2019

Yet, Dallas is really low on the list for cap rates by city. That’s because the average cap rate for rental property for a city includes all rental properties- both top-performing ones and ones that are performing poorly. And if we want to dive into why a rental property performs poorly, location can be one of the main contributors but that isn’t always the case. Sometimes, a rental property is mismanaged for example. It may not be producing as much cash flow from rental income as it could be in its location for various reasons.

Even if the investment location is the reason for the low cap rate, it could come down to a few bad neighborhoods in the city. Does that mean, for example, all Dallas neighborhoods are terrible for real estate investing? Absolutely not. It means that you need to perform a thorough neighborhood analysis when choosing the final location for your rental property. And even then, you need to perform an investment property analysis to make sure you buy one of the best real estate investments in that neighborhood that will perform well.

Cap Rates by Neighborhood

Cap rate data for neighborhoods used to be hard to come by, with the exception of seeking out a real estate agent and asking him/her to provide you with such data. But if you want a quick and easy way to find out cap rates for neighborhoods in any city in the US, you need an Airbnb calculator.

Using real estate data analytics, Mashvisor’s Investment Property Calculator can show you the cap rates for neighborhoods in the city of your choice. Not only that but with this real estate investment tool, you can perform a full neighborhood analysis. This is important as (just like with cap rates by city) the cap rates of neighborhoods can’t be the one-and-only deciding factor when choosing your next place for owning a rental property in 2019.

The neighborhood data provided by Mashvisor’s Investment Property Calculator includes:

- Median Price

- Rental Income for Airbnb and Traditional Rentals

- Cash on Cash Return and Cap Rate (the value is equal as investment property financing is not taken into consideration on the neighborhood level)

- Airbnb Occupancy Rate

- The Optimal Rental Strategy (Airbnb or Traditional)

- Rental Comps

- Mashmeter Score (which shows the overall investment potential for a neighborhood)

With all of this real estate data, why would you choose an investment location based solely on the capitalization rate?

To perform a neighborhood analysis for any city in the US, click here.

Cap Rates for Rental Property

At this point, you might start calculating cap rate manually for a few investment properties within your budget. Well, if you’re using Mashvisor’s Investment Property Calculator, you won’t have to. Our calculator includes a cap rate calculator. This tool will automatically display the cap rate for rental properties on the platform. With this, you can narrow down listings with a good cap rate for rental property.

From there, the cap rate calculator is interactive, allowing you to input any values for expenses like closing costs, renovations, property management, etc. That way, you are sure to end up with a rental property with a good cap rate and positive cash flow.

And just as you get a complete neighborhood analysis with Mashvisor, you also get a complete investment property analysis beyond just the cap rate.

Related: What Is a Cap Rate and How Do You Calculate It?

The Easiest Way to Find High Cap Rate Properties for Sale

So we know now that simply buying a rental property based on cap rates by city is not the right move. Looking at cap rates by city is just the first step in the long process.

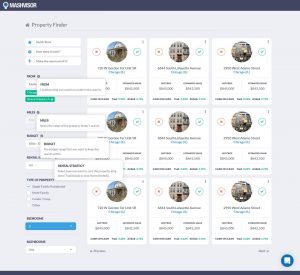

Did you know there is an easier way to find high cap rate properties for sale? It’s by using Mashvisor’s Property Finder Tool. With this real estate investment tool, you can select up to 5 cities. Set any other filters you’d like including:

- Budget

- Preferred Rental Strategy

- Type of Investment Property

- Number of Bedrooms and Bathrooms

From there, the Property Finder Tool will show you the highest cap rate properties for sale in your selected cities. After you find a few high cap rate properties for sale, you can use the investment property calculator to do a full analysis and make sure you’ll get a good ROI depending on your financing and any extra costs.

Start your 14-day free trial now to use Mashvisor’s tools.

Final Note on the Cap Rate

While cap rates by city aren’t a stand-alone indication of whether or not a place is the best city for real estate investment, that doesn’t mean you should neglect it altogether. It can be a great starting point in your investment property search for sure.

For example, looking at the cap rates by city above, the Camden real estate market would be one of the best places to invest in real estate in 2019 and since it’s actually an emerging market, this would be a good place to look for a rental property this year.

As long as you continue with all the proper steps for investing in rental properties right down to the investment property analysis, the cap rate can be a great guide along the way.