As we’re headed into a new year, all eyes are on the housing market as it is showing signs of softening for the first time in a long time. Real estate investors waiting for the best time to buy an investment property or to sell one are looking for an answer to the question “Is the US housing market 2020 forecast to be a buyer’s or seller’s market?” Knowing who’s going to have the upper hand during real estate transactions is something investors consider before making an investment decision. In order to reach the answer, one must look at emerging housing market trends and data which will point toward which direction the real estate market is heading.

If you’ve been doing some research on the US real estate market over the past two years, you’ve probably noticed that the market has been leaning towards sellers. This was mainly due to declining housing inventory along with fast annual home-value appreciation. And according to Zillow, it’s still a seller’s market right now. However, based on the latest US housing market predictions, it seems that this trend might be changing sometime in 2020. Experts believe that a buyer’s market is actually not too far off and the turning point should happen sometime during the upcoming year. Here’s everything you need to know about this US housing market forecast.

What US Housing Market Experts Have to Say

In its Q3 2018 Home Price Expectations Survey, Zillow asked over 100 real estate economists and experts for their US housing market predictions for the next 5 years. When asked to provide their opinion on when they believed the real estate market will start to shift to favor buyers, the largest share of respondents (43%) said in 2020. Another 18% of surveyed experts said the market will shift in 2021, 9% said the market will not see any meaningful shift until sometime after 2022, and just 5% said they thought the US housing market was already a buyer’s market.

Remember:

- A Buyer’s Market is when there’s more supply than demand (i.e. more houses for sale than people looking to buy). Homes for sale often stay on the market longer than average and sellers will likely accept lower prices than the original listing price. This is the ideal situation for buyers because they can get great real estate investment deals.

- A Seller’s Market is when there’s more demand than supply (i.e. more people looking to buy than people listing their houses for sale). Homes in this market are sold faster than average and possibly for a higher price. This is the ideal situation for sellers because several buyers will compete for the limited inventory of properties, hence they can get a great price.

Furthermore, results from the survey were regarding when the shift will start on the regional level. Some respondents predict that home buyers in the Midwest real estate market will be in the driver’s seat sooner than buyers in other regions. In fact, the most frequently selected year for major cities in the Midwest to turn into buyer’s markets was 2019. Other regions (Northeast, South, and West) are expected to change before the end of 2020 along with the nation overall. But what are the market trends that are causing experts to have this housing market forecast?

Emerging US Housing Market Trends for 2020

Real estate investors study certain housing market trends to determine whether it’s a seller’s market or a buyer’s market. These trends include available housing inventory, home sales, home prices and price cuts, interest rates, and days on market (DOM). These trends shape experts’ opinions on what will happen to the real estate market. Below, we’ll go over them and how they’re affecting the US housing market predictions 2020 according to experts.

1- Housing Inventory Might Become Stable

The supply of homes for sale is key for buyers to get the upper hand in the housing market. More options allow you to take your time in your property search and puts you in a better position for negotiating. Zillow reported the housing inventory of homes available for sale has fallen YOY in each of the past 42 months. As a result, buyers had to compete for a limited pool of properties which, in effect, had helped in keeping upward pressure on house prices. Naturally, this had contributed to putting sellers in the driver’s seat for the past several years at the expense of a buyer’s market. However, the pace of inventory decline has slowed in 2019, suggesting that housing inventory may stabilize in the US housing market 2020.

But while overall inventory has started to creep up this year, there are still inventory challenges on the low-end price points. Homebuilders are simply not increasing the supply of these properties. “There is plentiful inventory on the upper-end market, so the housing shortage is really on the mid-priced and low ends,” said Lawrence Yun, Chief Economist at NAR. How come? Experts say builders are facing a number of obstacles to ramping up new construction. These include high land prices, labor barriers, material costs, besides the tedious process to obtain permits. All this puts pressure on profit margins so when builders construct new houses, they tend to be more on the luxury end.

This created a tale of two markets: sellers of entry-level homes for sale are still looking at a competitive seller’s market as housing inventory of these properties is declining. On the other hand, sellers of more expensive homes should adjust their expectations as the upper-end market appears to be generally softer. Of course, we shouldn’t forget that real estate is local and inventory levels differ from one market to another. For example, cities like Memphis, Pittsburgh and Oklahoma City saw double-digit declines in supply while San Jose, Seattle, and Boston were seeing inventory gains according to Redfin.

Searching for an investment property in a low-inventory real estate market? Use our Property Finder to find lucrative investment properties that match your criteria in a matter of minutes!

2- Home Price Growth & Appreciation Are Slowing

The next real estate market trends that’ll give us an answer to “is it a buyer’s or seller’s market?” are home prices and appreciation growth. For years, home prices and appreciation rates in major markets across the nation have been well above historical norms. Both have also been experiencing lengthy periods of acceleration. According to Zillow, home values in the US housing market appreciated at a faster pace in July 2018 than in July 2017. Add to this the year-over-year inventory fall and you’ll get why sellers had the upper hand in the previous two years.

2019, though, had experienced different real estate market trends. After 7 straight years of increases, the median price for newly built homes has finally moderated. Skylar Olsen, Director of Economic Research at Zillow, said that “for the first time in a long time, we’re starting to see prices correct”.

As for growth in appreciation rates, it’s also slowing in over half of the nation’s 35 largest metros. The US housing market forecast 2020 suggests the predicted appreciation rate for residential real estate will remain steady at 3.7% over the next year. This is another sign of a balanced market, with conditions starting to tilt back toward a buyer’s market.

But to be clear, home prices and real estate appreciation rates are still going up nationally – just at a more moderate rate. Even in cities where appreciation growth has slowed down, it remains above its historical average rate. Besides, there are certain housing markets experiencing different real estate trends according to a report from Veros Real Estate Solutions. This tells property investors that you can still find cities experiencing growing appreciation rates and expect a good return on investment.

3- Mortgage Interest Rates Are Dropping

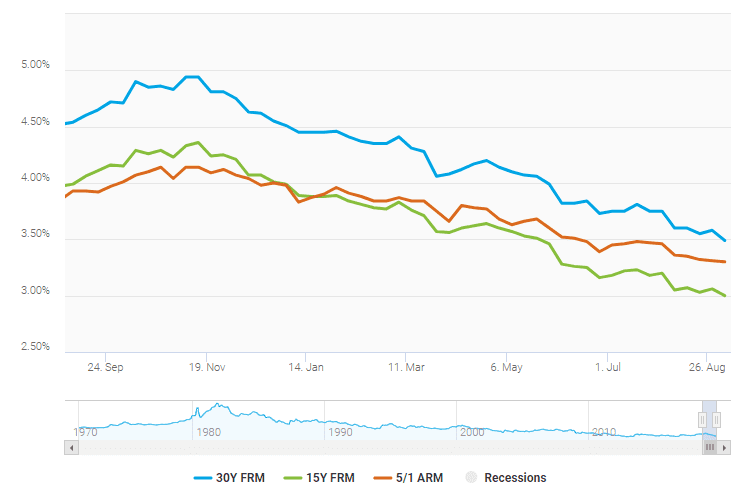

The final reason why experts predict 2020 to shift into a buyer’s market is due to falling mortgage rates. In the latest Primary Mortgage Market Survey, Freddie Mac reported that the interest rate for a 30-year fixed mortgage loan dropped (yet again!). As you can see from the chart below, interest rates of all types of mortgage loans have actually been following a downward trajectory for most of 2019. Rates began the year at 4.5% and have dropped to 3.49%. This is the lowest it has been since October 2016! Another interesting point worth mentioning is that Freddie Mac’s latest US housing market forecast shows that rates could be even lower in 2020 (on average) than they are right now! They predict the annual average mortgage rate will average out to 3.9% in 2019 before sinking to 3.7% in 2020.

Source: Freddie Mac PMMS

However, it seems that not many home buyers are taking advantage of lower interest rates. According to a survey by the National Association of Home Builders done in the second quarter of this year, only 12% of adults said they plan to buy a home in the coming year. That is down from 14% in 2018 and the third consecutive year-over-year decline in the share of adults thinking about buying a home in the US housing market. But why are people choosing to wait at the sideline despite lower mortgage rates? One reason is that a lower rate “doesn’t impact the down payment” said Olsen. “Just because mortgage rates dropped doesn’t mean I can suddenly re-enter the housing market.” This provides further evidence of a slowdown in the housing market.

For a real estate investor, this is the best time to take out a mortgage loan to buy a home to rent out! Fewer people planning to buy means the rental market is still strong in the US for 2020. This in addition to lower rates should give you an incentive to act sooner rather than later. Start searching for a profitable rental property in your market of choice using Mashvisor now!

So, Will It Be a Seller’s Market or Buyer’s Market in 2020?

Property sellers have held all the cards at the negotiating table for years. US housing market predictions 2020, however, suggest that conditions are starting to show signs of easing up. The above-mentioned real estate trends (improving inventory, slowing home price and appreciation growth, and dropping mortgage rates) lead us to believe that buyers could have the upper hand soon. However, experts say that while these trends are noticeable, it’s far too soon to call the US a buyer’s market. Meaning, the US housing market might be described as a seller’s market in 2020 – but not a traditional one.

Still, real estate experts remain optimistic about housing forecasts. This is mainly due to a huge wave of millennials reaching peak home-buying age. Consequently, this should put pressure on demand not only in 2020 but in the years to come. So if a recession does hit at some point, the real estate market will not see the same impact because it’s much healthier now. For now, we can consider the current softening in the US real estate market as a short-term correction.

Keep in mind that housing market trends and conditions vary from one city to another in the US. Some cities are still very much seller’s markets while others have already shifted to favor buyers. Hence, while it’s important to investigate national trends, it’s extremely important to research and understand regional and local trends for states and cities where you’re interested in buying or selling an investment property. This begs the questions: What are the best places to invest in real estate in 2020 for buyers and the best places for sellers?

Best Housing Markets for Buyers in the US

Are you looking to buy an investment property in 2020? Then, you should be looking for cities with affordable median home prices, common price cuts, longer days on market, low unemployment rate, and a strong demand for rental properties. An Airbnb calculator can be helpful if you’re searching for short term rental properties across the US housing market.

According to research and Mashvisor’s property data and real estate analytics, here are the best housing markets for buyers in the coming year:

San Antonio, Texas

- Median Property Price: $284,135

- Traditional Rental Income: $1,593

- Price to Rent Ratio: 15

- Days on Market: 70

Jacksonville, Florida

- Median Property Price: $285,322

- Traditional Rental Income: $1,310

- Price to Rent Ratio: 18

- Days on Market: 82

Albany, New York

- Median Property Price: $262,018

- Traditional Rental Income: $1,465

- Price to Rent Ratio: 15

- Days on Market: 99

Philadelphia, Pennsylvania

- Median Property Price: $388,987

- Traditional Rental Income: $1,349

- Price to Rent Ratio: 24

- Days on Market: 125

Tampa, Florida

- Median Property Price: $378,705

- Traditional Rental Income: $1,731

- Price to Rent Ratio: 18

- Days on Market: 77

Miami, Florida

- Median Property Price: $525,565

- Traditional Rental Income: $2,310

- Price to Rent Ratio: 19

- Days on Market: 170

Dallas, Texas

- Median Property Price: $405,282

- Traditional Rental Income: $1,899

- Price to Rent Ratio: 18

- Days on Market: 71

Start out your 7-day free trial with Mashvisor now to find & analyze the best investment opportunities in your city/neighborhood of choice in a matter of minutes!

What About Home Sellers in 2020?

Have you been waiting for the right time to sell your home? Experts say that now is the time to get it on the market for sale! Even though it’s expected to be a buyer’s market in the coming year, the switch won’t be immediate. The housing inventory in the US housing market is still relatively low right now. So, it may still hold as a seller’s market in some cities across the US. Selling your house while the supply of homes for sale is limited will give you a better chance of getting close to your asking price as more buyers will bid for your home. This is why we encourage sellers to close their deals before the end of 2019 and the beginning of 2020.

Are you looking to sell your house before the new year? List it for FREE and get more reach right here on Mashvisor!