How Much Will It Cost Ya’

In the real estate business, you want to know two things: how much money you’re going to make and how much it will cost you. Investment property costs could be anything at all.

You want to get an idea of what those costs could be and how much they amount to. There is where estimating your real estate investment costs comes in. One of the most common ways to estimate investment property costs is the 50% rule.

Here, we break down the 50% rule so you can judge whether it is a yay, or nay, to estimate your investment property costs.

Food for Thought

Something you have to keep in mind is that now every real estate investor operates the same. You may be the type to defer maintenance and neglect basic repairs. Or you may be the type to over-improve an investment property and end up with really high investment property costs.

To put in another turn of events, every single investment property differs from the other. You may find that your investment property requires less, or more, maintenance than other investment properties. Things like age, property type, and location all play a major part in your investing costs.

What we’re trying to say here is, this is just a rule of thumb. This is not a fortune telling tool that will predict every single investment property cost you may encounter. This is a base that you build off of, and try to get an overall idea from. It is useful if you utilize it correctly. Go do some real investment property analysis to get the real deal. In the meantime, you can use the 50% rule.

But Wait…

If you do want accurate, property predictions when it comes to your investment property, you can check out Mashvisor’s real estate analytics. You see an investment property you like and want to get to know the numbers a bit more. 5 clicks in and Mashvisor can provide you with the cap rate, cash on cash return, and projected rental income (Airbnb AND traditional).

This allows you to gain the confidence you need in your investment property. There are even more real estate goodies we can give, and for you to take full advantage of. We are pretty good fortune tellers if you ask us.

50% Rule, What Are You?

Broadly speaking, we like to think that the 50% rule is just one big assumption. The rule in its most simple state is just an assumption that 50% of your rental income will go solely to operating expenses.

Capital expenditures, principal, and interest payments are left out from the operating expenses category. However, most of the other expenses you will incur are actually included.

We know 50% may seem like a lot (or maybe it may not.) This is where we stress once again that this rule is just one big assumption. They really should’ve just named this that “50% assumption.” Seriously though, this may be accurate, or it may not. It all goes back to your investment property.

50% Rule, What Do You Include?

These are just some, and not all, of the investment property expenses this rule takes into consideration:

- Investment Property Taxes

- Real Estate Insurance

- Utilities

- Investment Property Management Expenses

- Maintenance Expenses

- Marketing/Rental Fees

- Rental Turnover Costs

- General Administration

- Payroll Expenses

- Capital Expenses

And Just How Much of Each?

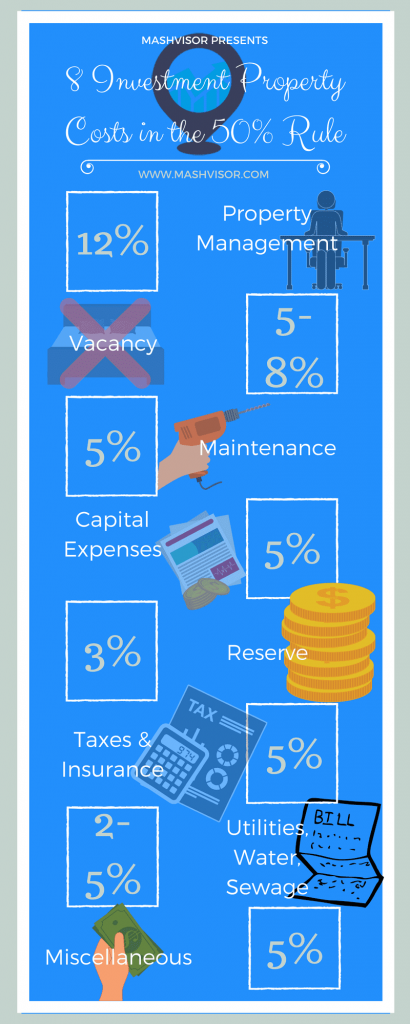

This is an overall estimate of just how much of a percentage expenses take up:

Note: You need to charge higher rent if water, sewage, and other utility expenses are taking up more than 2-5% of your investment property costs. Principal and interest payments are NOT included.

To Use, and When Not to Use

Remember, this is a screening rule that can help you get a very general idea of what your expenses will look like. DO NOT use this rule in place of actual expense history.

This rule can be useful if there is no expense history or experience in rental properties, as it can be a conservative estimate. In any case, always try to get the actual expense history of the income property you are looking at.

If you notice that their investment property costs are higher than 50% of their rent, you need to investigate why. This could range anywhere from rent being too low to major maintenance being recently done.

Noticing some exceedingly low investment property expenses could mean neglected maintenance that needs to be done, or the seller is just miscalculating their actual investment property costs.

Work to Reduce the Investment Property Costs

No matter the investment property expenses you may have, you always want to work on shrinking them. The last thing you want is to throw away rental income. Imagine throwing away every penny you receive into costs you could avoid. We want to share with you three simple ways you can make a big difference in your investment property expenses.

Increase Your Rental Rates While Still Maintaining the Same Costs

Increasing the money in lessens how much money is going out. Think about it. If you are able to maintain the same investment property costs but increase your rental income, you are making up for the expenses. This is best to utilize when you have fixed costs, like a roof repair every 20 years for $8,000.

Be Your Own Property Manager

We mentioned how rental property management was included in that 50% rule. Property management could make up a whole 12% of your investment property costs. So what if you were able to save the 12% and handle matters on your own?

You could be a real estate investor who has some extra time on your hands. Maybe a beginner in real estate who is able to put all their effort into this income generating asset. Or even a part-time real estate investor that wants to go full time. Whatever your case, if you are able to tie in being your own property manager, prepare yourself for the benefits.

Your investment property will become your little child. You made it, nurture it, and benefit from that little thing! Watch it grow into a prosperous “adult” investment property, save yourself 12% of a cost, and get the bragging rights of saying “that’s all me.” Sounds like a win-win-win situation to me.

Get a Competitive Edge with Mashvisor

In the real estate business, you always want to be 100 steps ahead of your real estate comps. How? With Mashvisor. Decent real estate investing tools can be hard to find these days, but the search has never been made easier than now. All of the best real estate investing tools in one place – Mashvisor. You want to save yourself as much money as possible, so getting to know how the numbers are looking for your investment property is necessary.

One tool you can utilize from Mashvisor is the property valuation tool. With this tool, you are able to check out:

- Average listing price of an investment property

- The average rate of return on investment property (rates like cash on cash return or cap rate)

- The average occupancy rate of income properties

- And your winner, the average rental income

You can call us a “screening” tool as well. Once you check out those numbers, you can get an idea of how the costs are going to play into how much you’re actually getting from the investment property. This could potentially save you thousands since you will be fully aware of what you’re getting yourself into. Why go in blind when you can start with full sight and plenty of angles?

You Know What to Do Now

As a real estate investor, you have the potential to make thousands and thousands of dollars. The main key here is to make sure you know what is going in, and out, of your pocket. Be your own security guard.

No one, and more importantly nothing, can snatch your rental income as they please. Instead, keep your numbers right. Consider the investment property costs, get to know the real estate investment analytics from Mashvisor, and practice the behavior of avoiding expenses.

Should the 50% rule be used? Sure, why not. The power of a real estate investing tool is not in the tool itself, but how you, the real estate investor, use it to your advantage. You give the tool the power, not the other way around. As long as you know the best way to take advantage of the tool, you are set to go. Now go out there and get the investment property of your dreams!