A real estate investor has many different kinds of fees and costs to pay when buying an investment property. Sometimes, it can be overwhelming to even think about. Well, we’re here to help!

When a real estate investor is looking to finance an investment property from mortgage lenders, closing costs can sometimes come as a surprise, especially to beginners. Mortgage lenders will hand you a long list, and on top of your mortgage, interest rates, down payment, and keeping up with your amortization schedule, you’re responsible for all of the closing costs. So, let’s break it down:

- What are closing costs?

- What are the types of closing costs?

- Do I have to pay closing costs?

- How can Mashvisor help?

What are closing costs?

Investing in real estate is not as simple as just paying the price of the investment property. A real estate investor ends up paying a certain sum on top of this price. This is the closing costs. There are different expenses that fall under the title of closing costs. They mostly come from the fact that in order for mortgage lenders to close on your loan, there are certain services they have to complete for you. If you want mortgage lenders to finance your investment property and complete your loan application, you have to pay the closing costs.

Related: Is Taking a Mortgage for Rental Property a Good Idea?

Closing costs can vary when investing in real estate.

Do you prefer investing in real estate close to home? Or out of state? Well, don’t be surprised if the closing costs end up being different from state to state. Not only do prices differ, but some states require certain closing costs, while others do not. Keep this in mind and ask your mortgage lender for more information.

Just as down payment, interest rates, and amortization schedule can vary for different types of mortgages, so can the closing costs. For example, if a real estate investor wishes to finance an investment property with an FHA mortgage, closing costs can be less. This is because the FHA has different rules when it comes to how much parties (besides the buyer) can pay for closing costs. Conventional mortgages only allow up to 3% of the closing costs to be paid by other parties (real estate agents, sellers, and mortgage brokers). FHA mortgages allow them to pay up to 6%. This all boils down to your negotiating skills, but still closing costs can vary with the type of mortgage.

Certain expenses in closing costs vary because they don’t have a flat rate. These can include transfer taxes, title insurance, and mortgage insurance.

How much are the average closing costs?

Just because closing costs can vary, that doesn’t mean that a real estate investor can’t prepare for them. Generally, average closing costs fall in the range of 2-6% of the price of the investment property. When preparing a budget for investing in real estate, keep this range of closing costs in mind.

Three days after mortgage lenders receive a real estate investor’s mortgage application, they have to send a loan estimate. This is required by law. This loan estimate includes:

- Down payment

- Interest rates

- Mortgage term and monthly mortgage payment (to get an idea of your amortization schedule)

- Closing costs

The loan estimate gives a real estate investor an initial idea of what the closing costs will be. Three days before closing on the mortgage, mortgage lenders are also required to give a real estate investor a disclosure statement. This also includes the down payments, interest rates, and details for an amortization schedule as well as closing costs. However, it’s possible that the amount of closing costs changes from when a real estate investor received the loan estimate.

Related: Real Estate Investors Want to Know: How Much are Closing Costs?

What are the types of closing costs?

As mentioned, there are different expenses that fall under the name of closing costs. To make things simpler, closing costs can be divided into five different categories:

1. Title/Recording Fees and Transfer Taxes:

- Title Search

- Title Insurance

- Recording Fees

- Transfer/Sales Taxes

2. Prepaid and Escrow:

- Prepaid Days of Interest

- Prepaid Taxes and Interest

- Initial Escrow Deposit

3. Mortgage Insurance

4. Loan Related Fees:

- Origination

- Application

- Underwriting

- Credit Report

- Discount Points

5. Property Specific and Third Party Fees:

- Appraisal

- Termite

- Survey

- Attorney

- Home Inspection

Related: Breaking Down Real Estate Fees: What are the Types of Closing Costs of Investing?

Do I have to pay closing costs?

Real estate investors have the option of not paying closing costs. They will have to finance their investment property with a no-closing-cost mortgage. This kind of mortgage makes it so that a real estate investor can finance a real estate investment with less money upfront. While this is a benefit, it’s only felt short term.

The closing costs will end up being paid as part of the interest rates. When planning an amortization schedule for a no-closing-cost mortgage, you’ll have to take this into account in the form of higher interest rates.

Related: How to Save Money: Negotiating and Reducing Real Estate Closing Costs

How can Mashvisor help?

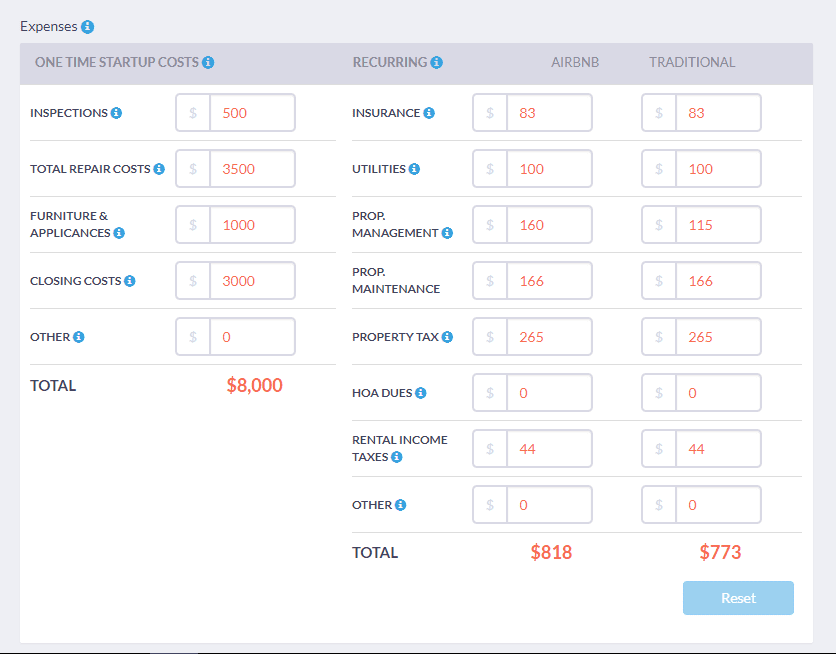

There are many tools to use which provide a closing cost calculator. These tools allow you to enter in each individual closing cost for an investment property, and then it is all added up. What Mashvisor provides you with is an investment property calculator that includes a kind of closing cost calculator.

The closing cost calculator starts you off with a rough estimate (based on the listing price and the location of the investment property). A real estate investor can then add up all of the individual closing costs and put them into the investment property calculator.

The advantage that Mashvisor’s investment property calculator has over typical closing cost calculators is that it allows you to take a look at how closing costs affect the bigger picture. Most closing cost calculators give only the final closing cost, and that’s it. With an investment property calculator, a real estate investor can see the total amount he/she will pay, including closing costs. This is a much more important value to have when budgeting for investing in real estate.

Related: Investment Property Calculator: Real Estate Investing

Related: Investment Property Calculator: Real Estate Investing

Don’t allow yourself to be surprised by closing costs from mortgage lenders. Prepare ahead of time by knowing the answer to “What are closing costs?” Use Mashvisor’s investment property calculator/closing cost calculator to give you an idea of what you’ll be paying for closing costs before you even begin investing in real estate.