As the coronavirus began to spread across the US and individuals were encouraged (or in many cases ordered) to stay at home, many real estate markets were affected as home sales dropped. According to an updated real estate market forecast by Realtor.com, existing-home sales in Q1 of 2020 were down by 15% and Q2 is expected to be worst (down by 25%). However, the company’s economists expect home sales to improve in the third quarter, mainly driven by demand from millennials and real estate transactions in the secondary market.

Surprising cities are attracting new residents at the expense of some of the most influential housing markets in the US. As the demand is shifting to these cities, they also become more attractive for real estate investment in 2020. Why though? Keep reading as we explain why people are moving to secondary housing markets and how this benefits real estate investors. Moreover, we also list down the best up-and-coming markets in the US where you’ll find profitable real estate investment opportunities according to Mashvisor’s real estate data and analytics.

What’s Driving the Demand in Secondary Markets?

The main driver of the growth that the secondary market will experience is affordability. First off, the supply of affordable homes simply isn’t keeping up with the demand in primary markets like New York City, San Francisco, and Boston. This real estate market trend isn’t new – residents have been priced out of these expensive cities for some time now. However, the COVID-19 pandemic has amplified this trend in the US housing market 2020. The pandemic led to millions of Americans losing their jobs and applying for unemployment benefits. Those with battered finances will want to save by turning to resilient secondary real estate markets, away from pandemic hot spots and in more affordable houses.

Besides affordability, today’s residents also search for space and quiet. They want to live in places where they can easily walk to work and local attractions found in downtown neighborhoods, but at the more affordable prices of the suburbs. Together, affordability and search for space explain why secondary housing markets will see more than normal demand in 2020. As a matter of fact, both secondary and suburban real estate are both heating up and experiencing growing demand due to the pandemic. Danielle Hale, Chief Economist at Realtor.com, said:

“The coronavirus pandemic has kept both buyers and sellers on the sidelines, preserving market balance, for now. As cities and states begin the slow process of reopening, we’re going to see a see-saw recovery with ups and downs that will favor the nation’s secondary market in the short-term…After experiencing life under quarantine, many buyers are searching for affordability and greater space, which is driving demand out of the nation’s largest metros and into surrounding smaller towns.”

Related: Suburban Real Estate Market Boom Due to COVID-19

What Does That Mean to Real Estate Investors?

As residents continue their search for affordability and additional space, real estate investors should also gravitate away from primary markets and towards the thriving secondary market in 2020. Why? First, secondary real estate markets have strong job growth that’s not limited to one industry and often includes an emerging tech sector. This attracts young, educated professionals and also helps these housing markets endure a recession. Continued unemployment, however, could pull first-time buyers out of the market. So the people who are moving to these areas will most probably rent.

In addition, investing in real estate secondary markets is affordable because the supply of housing is less constrained than in primary markets. You can easily find investment properties for sale in these cities that you can buy and rent out to long-term residents to start making rental income. What is more, experts predict that these secondary real estate markets will see faster rent prices growth in 2020 than urban markets – which are already nearing their ceilings for sustainable rent growth.

Related: 15 Cities Where Rental Prices are Growing in 2020

Investors can also benefit from other housing market predictions 2020 which are lower mortgage interest rates and home prices. Mortgage rates are expected to drop to new record lows – below 3% – by the end of 2020. Furthermore, home prices are predicted to flatten, slightly increasing by 1.1% for the whole year according to Realtor.com. This combination of affordable property prices and growing rental prices tells investors that they can find high cap rate properties for sale. In other words, buying investing in a fast-growing secondary market means you’ll enjoy a stronger rate of return on rental property than in a primary market.

Searching for profitable rental properties in a secondary market? Mashvisor helps you find the best one in 15 minutes!

The Best Secondary Real Estate Markets to Invest in

Before you start your investment property search, it’s important to first decide which market you want to invest in. There are hundreds of up-and-coming cities in the US housing market, but not all of them are good for real estate investing. To help you out, we list the 10 top secondary real estate markets for investing in rental properties in 2020 according to Buildium. Furthermore, we also provide data and analytics for each real estate secondary market that was estimated using Mashvisor. Our data includes property prices, rental income estimates, price to rent ratio, and more which will help you narrow down your options to the one that best fits your investment goals.

To learn more about us and how we’ll help you make faster and smarter real estate investment decisions, click here.

1) Boise, ID

- Median Property Price: $518,131

- Price per Square Foot: $239

- Monthly Rental Income: $1,437

- Price to Rent Ratio: 30

- Average Days on Market: 47

2) Austin, TX

- Median Property Price: $632,386

- Price per Square Foot: $315

- Monthly Rental Income: $1,998

- Price to Rent Ratio: 26

- Average Days on Market: 73

Read the complete Austin real estate market report!

3) Madison, WI

- Median Property Price: $364,329

- Price per Square Foot: $198

- Monthly Rental Income: $1,460

- Price to Rent Ratio: 21

- Average Days on Market: 41

4) Charlotte, NC

- Median Property Price: $424,533

- Price per Square Foot: $204

- Monthly Rental Income: $1,660

- Price to Rent Ratio: 21

- Average Days on Market: 71

5) Indianapolis, IN

- Median Property Price: $259,388

- Price per Square Foot: $123

- Monthly Rental Income: $1,239

- Price to Rent Ratio: 17

- Average Days on Market: 82

6) Denver, CO

- Median Property Price: $517,303

- Price per Square Foot: $346

- Monthly Rental Income: $2,015

- Price to Rent Ratio: 21

- Average Days on Market: 40

7) Jacksonville, FL

- Median Property Price: $273,735

- Price per Square Foot: $147

- Monthly Rental Income: $1,431

- Price to Rent Ratio: 16

- Average Days on Market: 85

8) Raleigh, NC

- Median Property Price: $456,323

- Price per Square Foot: $186

- Monthly Rental Income: $1,636

- Price to Rent Ratio: 23

- Average Days on Market: 72

9) Portland, OR

- Median Property Price: $590,780

- Price per Square Foot: $308

- Monthly Rental Income: $2,106

- Price to Rent Ratio: 23

- Average Days on Market: 68

10) Fort Worth, TX

- Median Property Price: $302,240

- Price per Square Foot: $142

- Monthly Rental Income: $1,724

- Price to Rent Ratio: 15

- Average Days on Market: 27

Still uncertain where to invest in real estate in 2020? Check out this ultimate guide on How to Choose a Real Estate Market to Invest In.

Next Step for Real Estate Investors

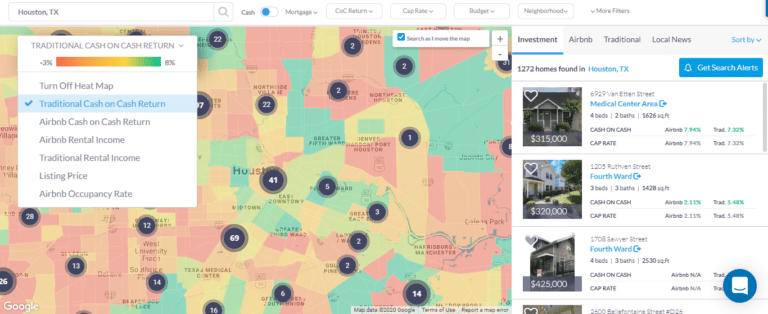

After determining which secondary market you want to invest in, it’s important for investors to study the different neighborhoods within the city as well. You want to find a neighborhood where prices of homes for sale fit your budget and rental properties can generate high rental income. To do so, you need an investment tool like Mashvisor’s Real Estate Heatmap. Simply select the filter “Traditional Rental Income” or “Listing Price” and the map will show you how the different areas are performing based on the real estate metric you’ve chosen.

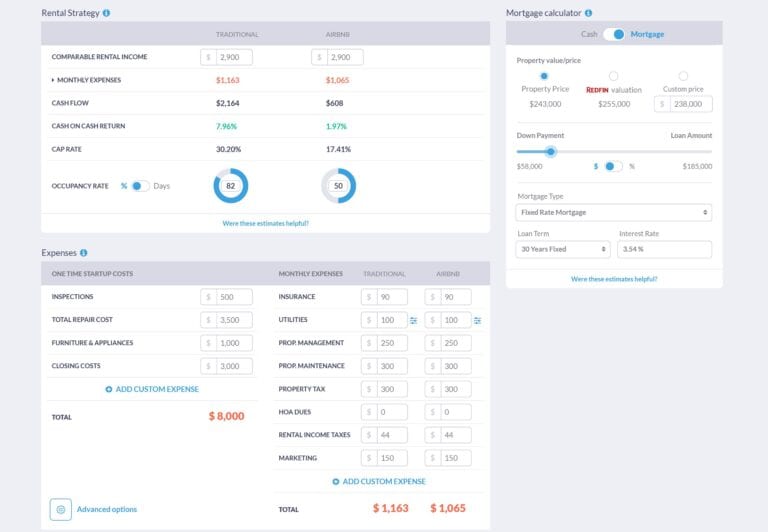

As you can see, on the right side of the Heatmap is a list of all properties for sale in this city as well as their cap rates. This metric is pre-estimated using Mashvisor’s Investment Property Calculator. If you’re interested in a certain property, just click on the listing to get access to this tool. There, you’ll find a readily available rental property analysis. Our calculator uses rental comps in the city or secondary market as well as predictive analytics to estimate the rental income, expenses, cash flow, cap rate, cash on cash return, occupancy rate, and more for every property.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.