Owning a home next to a beach or lake is something that most people dream of. Living near water offers unparalleled serenity and peace. Hearing the crashing waves and watching breathtaking sunrises and sunsets provides an incredible sense of calm. In addition, proximity to the water comes with exciting recreation options such as skimboarding, scuba diving, snorkeling, water skiing, fishing, boating, and surfing.

Purchasing a waterfront property is especially a great idea for anyone that wants to invest in Airbnb. Besides renting out the Airbnb investment, you can also stay in the home whenever you go on vacation, thus saving cash that you would have spent on accommodation.

Related: What Should You Know Before Buying a Beachfront Property?

However, before buying a waterfront property, you need to ask yourself ‘Is waterfront property a good investment?’ We will answer this question by looking at some of the pros and cons of buying a waterfront property.

Benefits of Investing in a Waterfront Property

- High demand – Any vacation rental investment located near water is usually highly sought-after, especially by Airbnb users. Since waterfront property is in high demand, you are likely to enjoy a high vacation rental occupancy rate. In addition, you can charge a relatively higher rental price due to the unique location of your rental property.

- High appreciation rate – Due to the high demand and limited supply, waterfront property rarely depreciates in value. Whenever you decide to sell the home, you are likely to enjoy a good return on investment.

- Save cash on vacation – As mentioned earlier, owning a waterfront house could save you lots of money whenever you want to go on vacation with your family or friends. Besides enjoying free accommodation, you will also have free or subsidized access to activities such as swimming, diving, boating, kayaking, or skiing.

Find a profitable waterfront property now.

Downsides of Investing in a Waterfront Property

- Waterfront properties are more expensive – There are always real estate investors and homebuyers looking to buy waterfront property. Due to the high competition, the price of such homes is usually very high. To get them, you have to outbid other potential buyers. Besides the cost of purchase, there are other additional costs that make owning a waterfront home expensive. For instance, you will be required to pay for different types of property insurance such as water insurance, wind insurance, and general hazard insurance. The homeowners association (HOA) fees for waterfront properties are also quite high.

- Risk of climate change – Waterfront property owners must live with the risk of rising sea levels. During severe hurricanes and storms, such homes are likely to experience flooding. This can cause significant damage and lower the value of your rental property. In addition, such climate changes could make your property inaccessible to potential guests.

- High maintenance – A waterfront property usually requires more maintenance compared to one located inland. The high humidity often results in rust, wood rot, and mold growth. In addition, the salt in the air could cause significant damage to different sections of your structure. This means that you might have to spend a lot of money on the maintenance of your rental property.

Related: The Ultimate Guide to Rental Property Maintenance

- Strict regulations – Some waterfront homes come with very stringent regulations on what you can and cannot do. For instance, you might not be able to renovate or increase the size of your rental property without permission. Or some recreational activities might not be allowed in the area. Breaking any of these rules could result in a hefty fine or even prosecution. Therefore, before signing on the dotted line, be sure to visit the local authority to find out what you are actually allowed to do.

- Lack of privacy – Vacationers are usually attracted to lakes and oceans. As a result, your waterfront investment is likely to be surrounded by beachgoers, especially during summer. Besides a lack of privacy, this influx of people could pose a security risk for your investment property.

4 Tips for Buying a Waterfront Property for Investment

For many real estate investors, the pros of buying a waterfront property far outweigh the cons. If this is true for you, get started today with these tips for buying a profitable waterfront property investment:

- Choose the right location – Here are some of the best cities to purchase waterfront property in the US housing market:

- Toledo, Ohio

- Aberdeen, Washington

- Buffalo, New York

- Hampton, Virginia

- Cleveland, Ohio

- Duluth, Minnesota

- Devils Lake, North Dakota

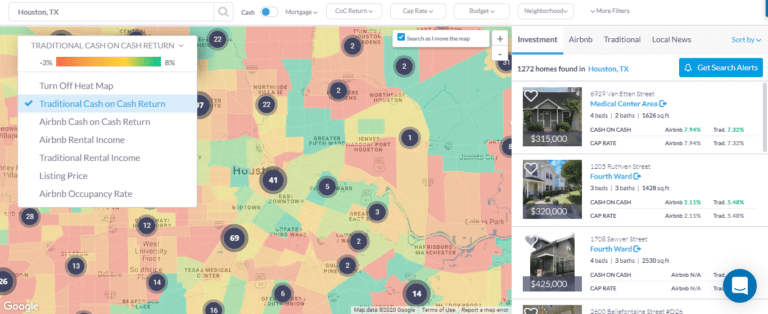

Before choosing a city, check out the neighborhood where the body of water is located. Mashvisor’s real estate heatmap will help you identify the best locations for buying a good real estate investment. You can analyze different areas using metrics such as Airbnb cash on cash return, Airbnb rental income, Airbnb occupancy rate, and listing price.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

- Analyze the Airbnb rental potential of the investment property for sale – Once you’ve found a great location, look for properties that fit your criteria. Use Mashvisor’s rental property calculator to assess the homes for sale based on Airbnb cash flow, Airbnb cash on cash return, and Airbnb cap rate.

- Work with an experienced agent – Your real estate agent should have experience dealing with waterfront property for sale in the location you are targeting. The agent should have extensive knowledge about the area and what owning a short-term rental entails. For instance, they should know if the bottom of the water is muddy, sandy, or rocky. In addition, the agent should be able to tell you what outdoor activities are allowed on the water.

- Inspect carefully – A waterfront home might look beautiful at first glance, but could have many underlying problems. This is why a professional home inspection is necessary to check for things like mold, corrosion, a damp basement, or rust. The inspection should also include water quality tests, surveys, and other water-based inspections that are not typically conducted on regular homes.

Related: The Ultimate Property Inspection Checklist for Real Estate Investors

- Make multiple visits – Be sure to visit the income property at different times of the day, both on weekends and weekdays. You might be surprised that the neighborhood that is serene and peaceful during the week is a place of loud parties on weekends. Making multiple visits will help you make a more informed decision.

Conclusion

‘Is waterfront property a good investment?’ There is no one-size-fits-all answer to this question. However, if you mind your due diligence, buying a waterfront home could be a great addition to your real estate portfolio.